This version of the form is not currently in use and is provided for reference only. Download this version of

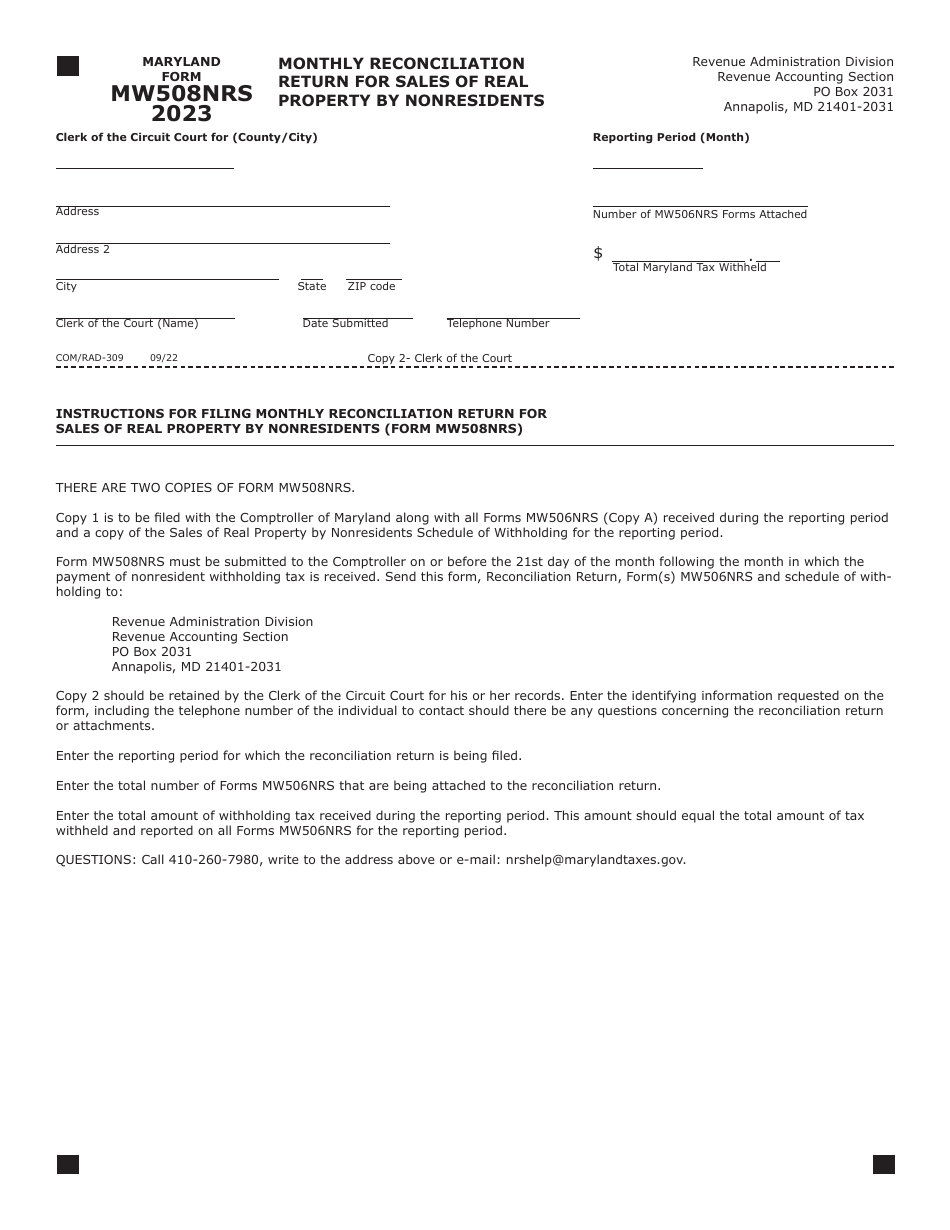

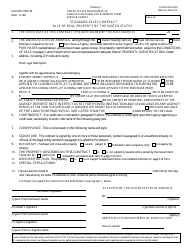

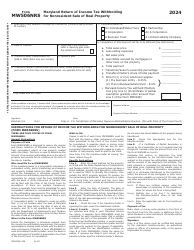

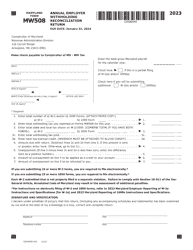

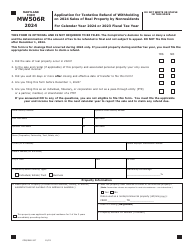

Maryland Form MW508NRS (COM/RAD-309)

for the current year.

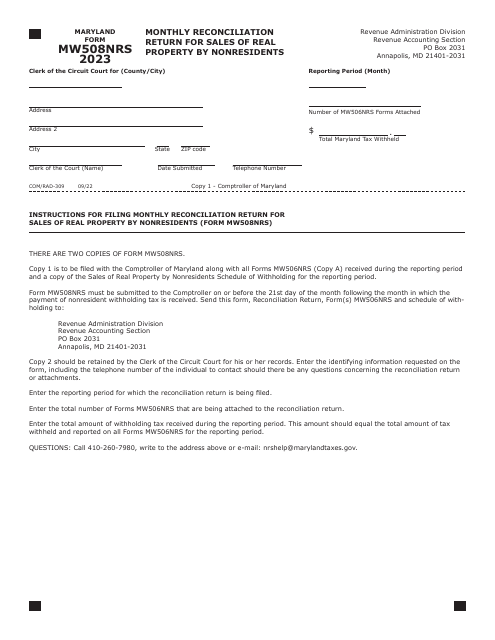

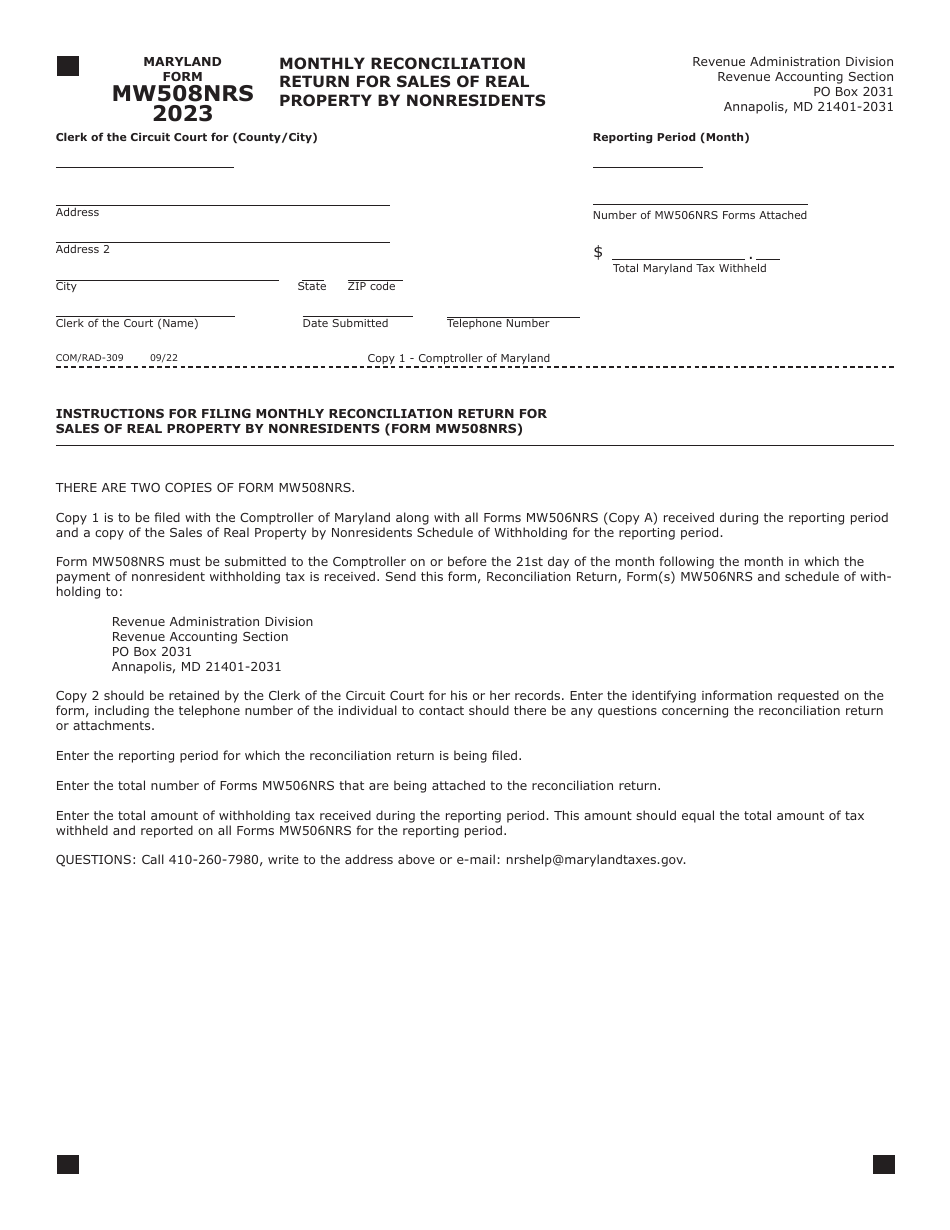

Maryland Form MW508NRS (COM / RAD-309) Monthly Reconciliation Return for Sales of Real Property by Nonresidents - Maryland

What Is Maryland Form MW508NRS (COM/RAD-309)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MW508NRS?

A: Form MW508NRS is the Monthly Reconciliation Return for Sales of Real Property by Nonresidents in Maryland.

Q: Who needs to file Form MW508NRS?

A: Nonresidents who have sold real property in Maryland need to file Form MW508NRS.

Q: What is the purpose of Form MW508NRS?

A: The purpose of Form MW508NRS is to reconcile the sales of real property by nonresidents in Maryland.

Q: When is Form MW508NRS due?

A: Form MW508NRS is due on a monthly basis, with the due date being the 15th day of the month following the month of the sale.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form MW508NRS (COM/RAD-309) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.