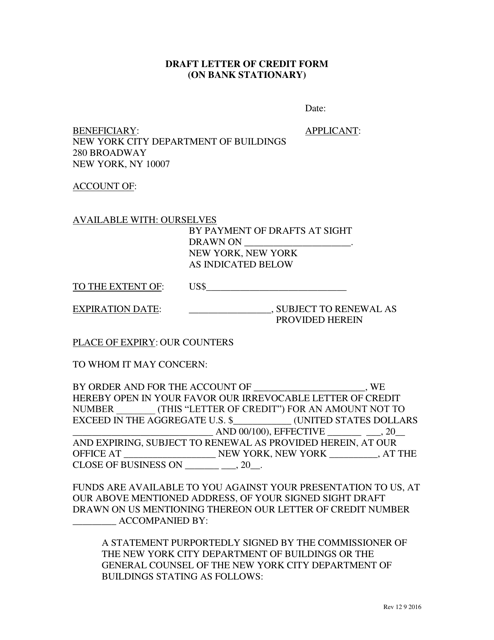

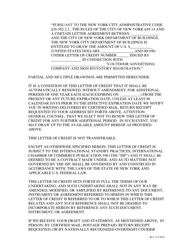

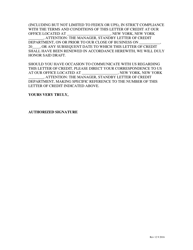

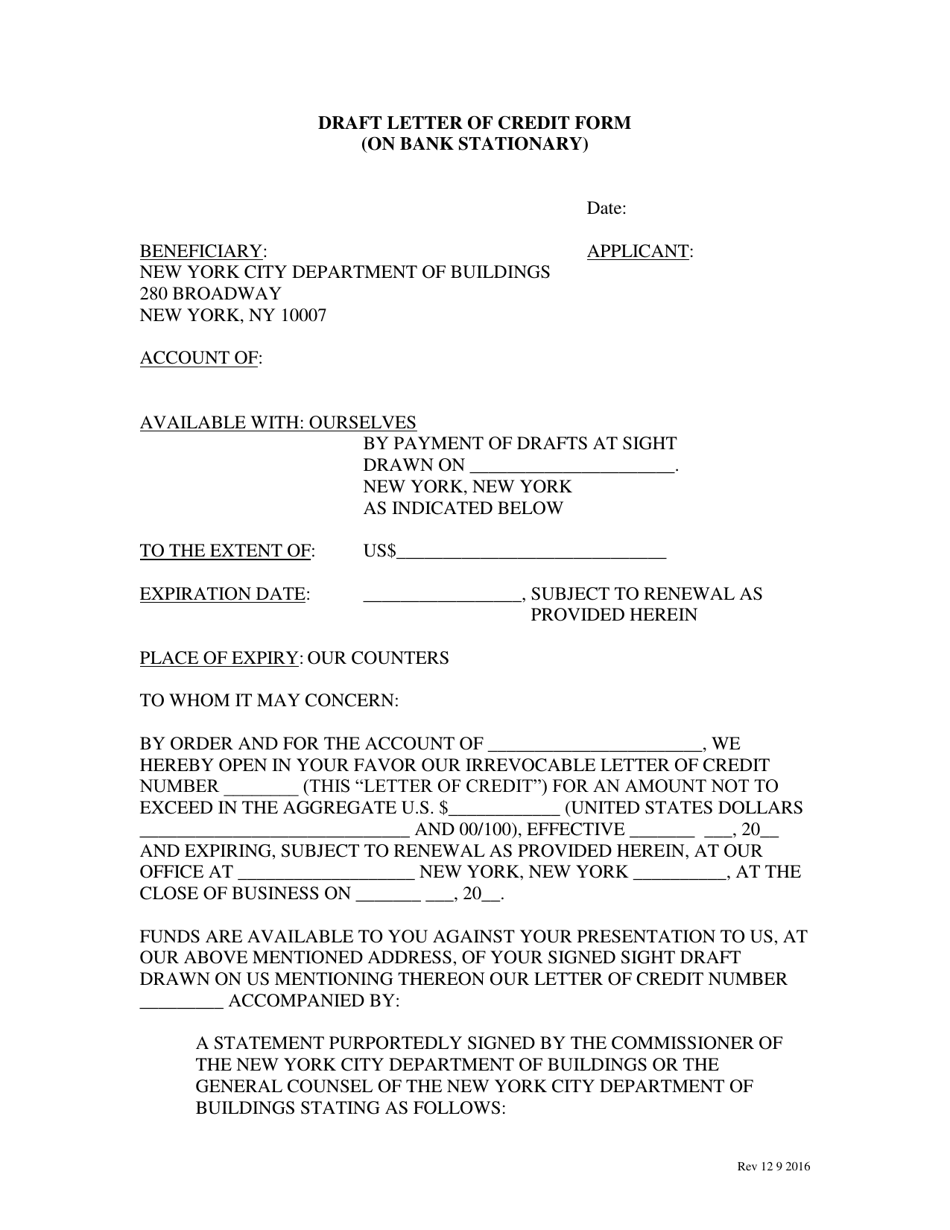

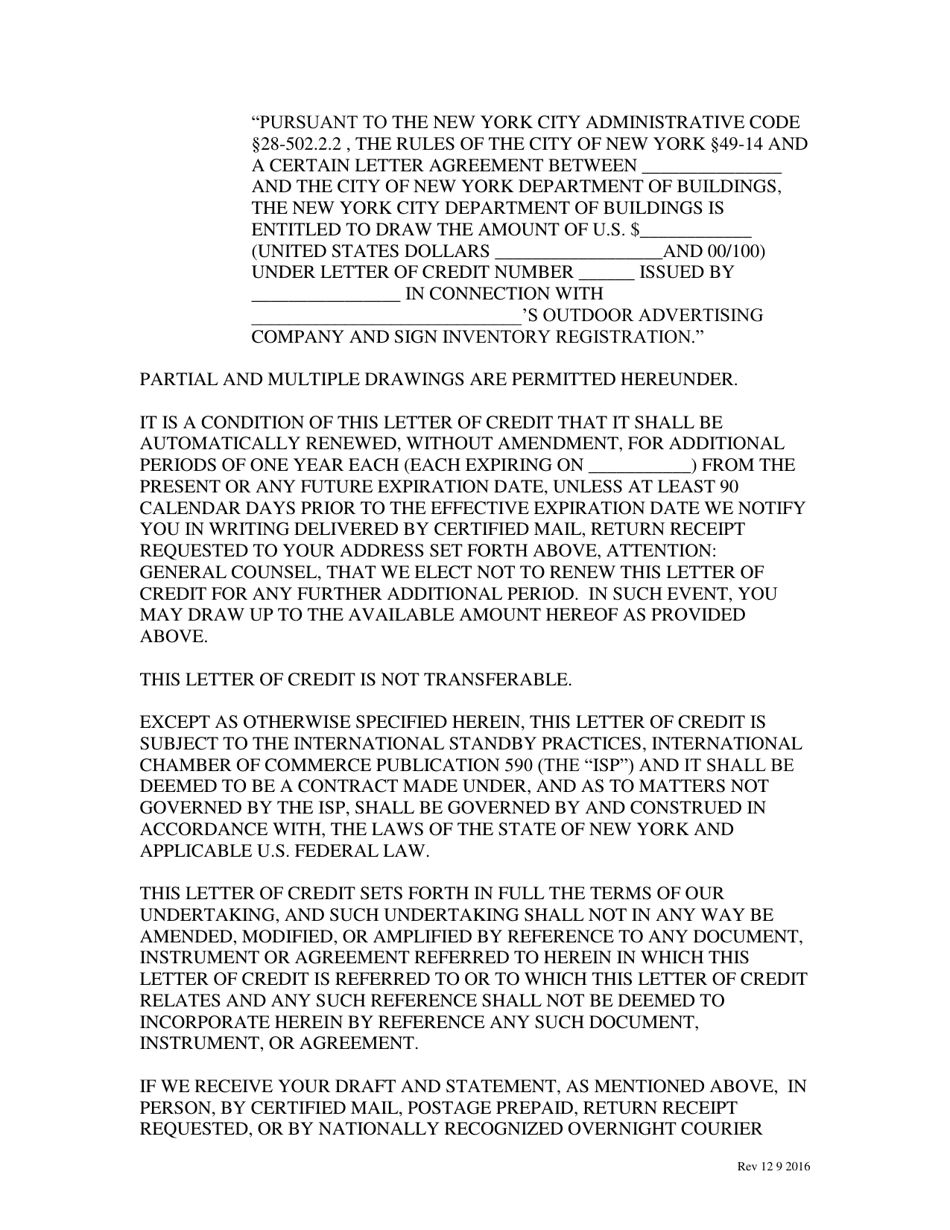

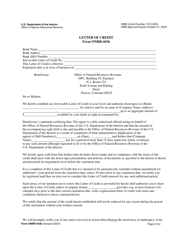

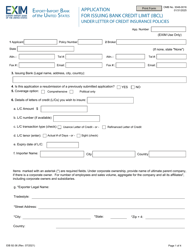

Draft Letter of Credit Form (On Bank Stationary) - New York City

Draft Letter of Credit Form (On Bank Stationary) is a legal document that was released by the New York City Department of Buildings - a government authority operating within New York City.

FAQ

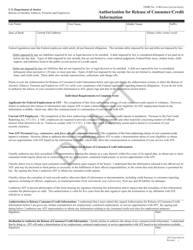

Q: What is a Letter of Credit?

A: A Letter of Credit is a document issued by a bank that guarantees payment to a seller when certain conditions are met.

Q: Why is a Letter of Credit important?

A: A Letter of Credit provides security for both the buyer and the seller in international trade transactions.

Q: Who issues a Letter of Credit?

A: A bank issues a Letter of Credit on behalf of the buyer.

Q: What are the conditions that must be met for payment under a Letter of Credit?

A: The conditions for payment include submission of required documents and compliance with specified terms and conditions.

Q: What is the role of a bank in a Letter of Credit?

A: The bank acts as an intermediary between the buyer and the seller, providing assurance of payment.

Q: What should be included in a Letter of Credit form?

A: A Letter of Credit form should include details of the buyer, seller, payment terms, shipping documents required, and any other specific conditions.

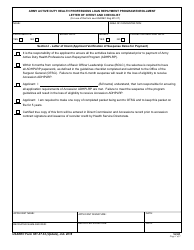

Q: Can a Letter of Credit be amended?

A: Yes, a Letter of Credit can be amended if both parties agree to the changes.

Q: Is a Letter of Credit legally binding?

A: Yes, a Letter of Credit is a legally binding document that outlines the obligations of the buyer, seller, and the bank.

Q: Are Letter of Credit forms specific to a particular city?

A: No, the format of a Letter of Credit form may vary, but it is not specific to a particular city.

Form Details:

- Released on December 9, 2016;

- The latest edition currently provided by the New York City Department of Buildings;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Buildings.