This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

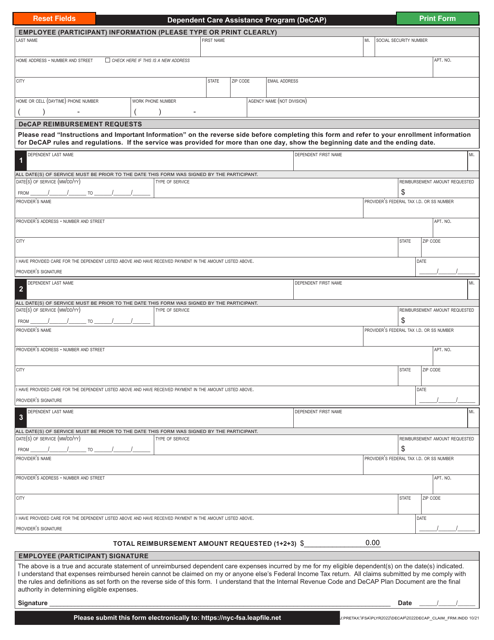

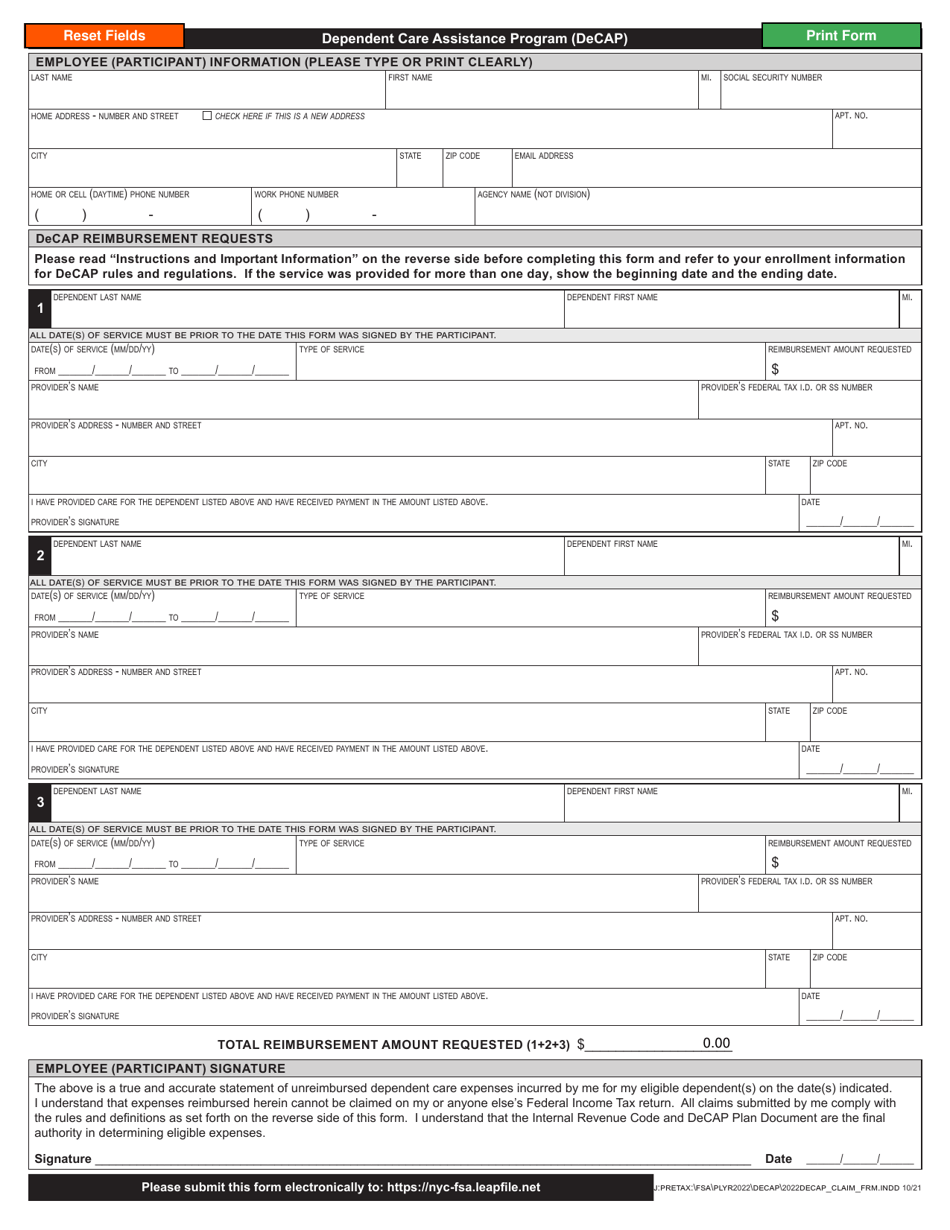

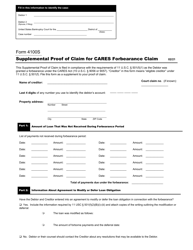

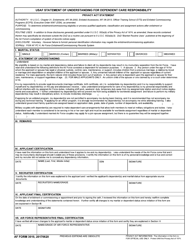

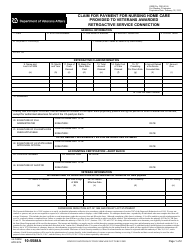

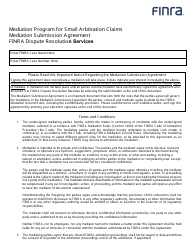

Claims Form - Dependent Care Assistance Program (Decap) - New York City

Claims Form - Dependent Care Assistance Program (Decap) is a legal document that was released by the New York City Office of Labor Relations - a government authority operating within New York City.

FAQ

Q: What is the Dependent Care Assistance Program (DECAP)?

A: The Dependent Care Assistance Program (DECAP) is a program that helps employees pay for eligible dependent care expenses.

Q: Who is eligible for the Dependent Care Assistance Program (DECAP)?

A: Employees of participating employers in New York City who have eligible dependent care expenses are usually eligible for DECAP.

Q: What expenses are covered under the Dependent Care Assistance Program (DECAP)?

A: Eligible expenses may include child care centers, day camps, before and after school programs, and in-home child care.

Q: How does the Dependent Care Assistance Program (DECAP) work?

A: Through DECAP, employees can set aside pre-tax dollars from their paycheck to pay for eligible dependent care expenses.

Q: Are there any limits on the amount of money I can contribute to the Dependent Care Assistance Program (DECAP)?

A: Yes, there are limits on the amount of money you can contribute to DECAP. It is subject to IRS regulations and the plan guidelines.

Q: Can I use the Dependent Care Assistance Program (DECAP) to pay for expenses for an elderly dependent?

A: No, DECAP is generally limited to expenses for dependent children under the age of 13.

Q: How do I participate in the Dependent Care Assistance Program (DECAP)?

A: To participate in DECAP, you need to enroll during your employer's open enrollment period or when you become a new employee.

Q: What documentation do I need to submit for the Dependent Care Assistance Program (DECAP)?

A: You may need to submit documentation such as receipts or invoices showing the details of your eligible dependent care expenses.

Q: Can I change my Dependent Care Assistance Program (DECAP) contribution amount during the year?

A: Changes to your DECAP contribution amount may be allowed during certain qualifying life events or during your employer's open enrollment period.

Q: What happens if I don't use all the money I contribute to the Dependent Care Assistance Program (DECAP)?

A: Unused amounts in your DECAP account generally cannot be refunded or carried over to future years. However, you should review your plan guidelines for specific details.

Form Details:

- Released on October 1, 2021;

- The latest edition currently provided by the New York City Office of Labor Relations;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New York City Office of Labor Relations.