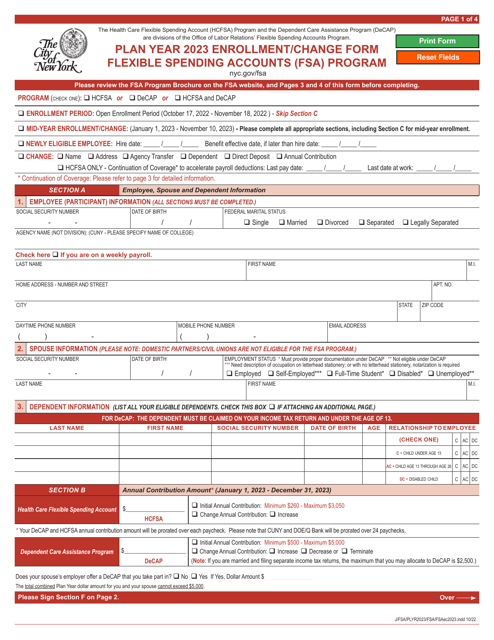

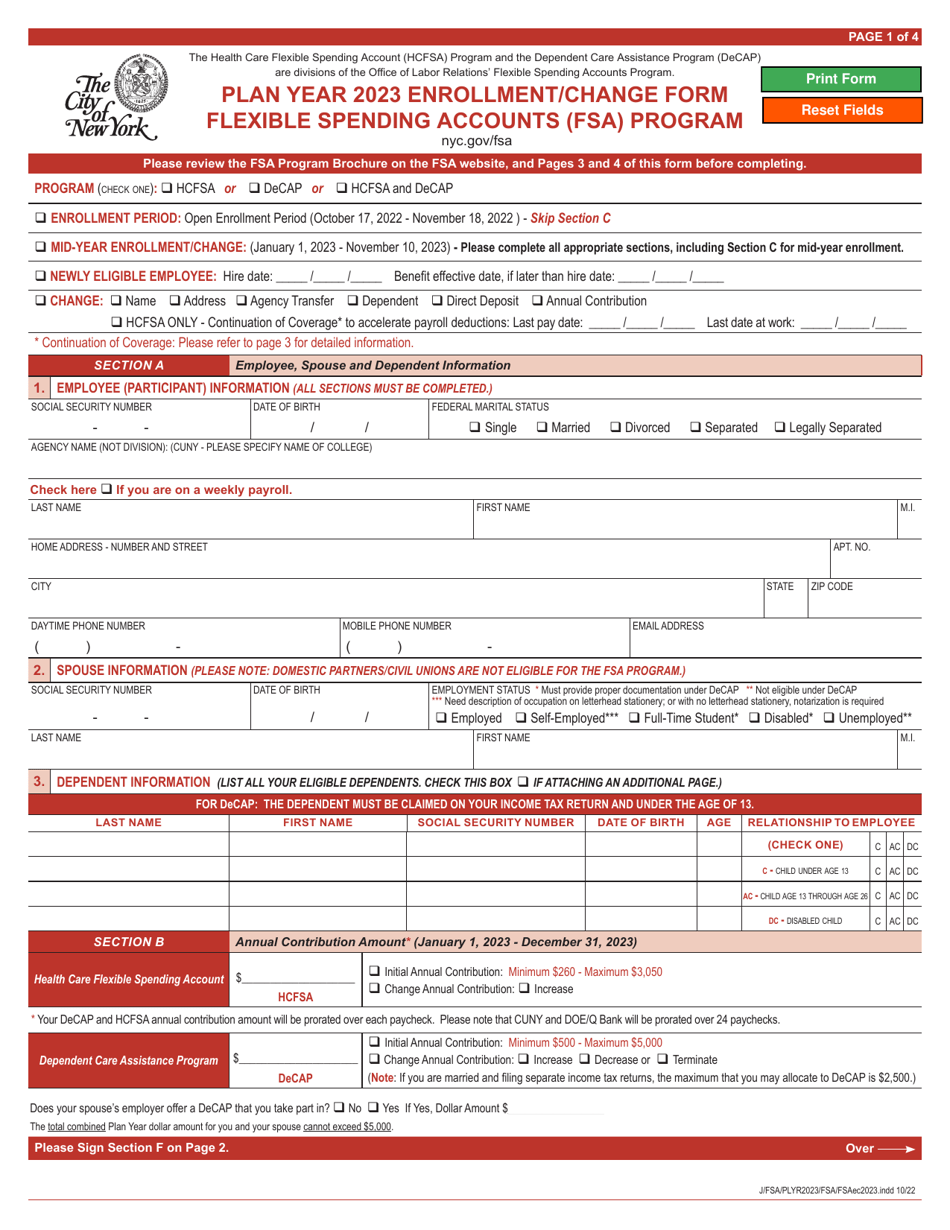

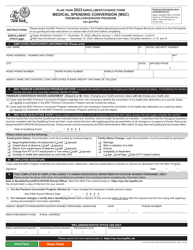

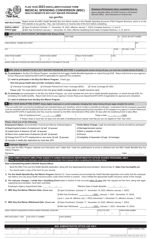

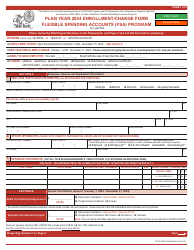

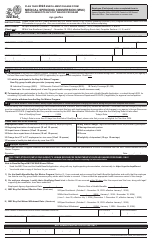

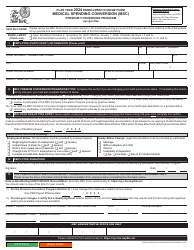

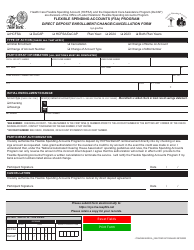

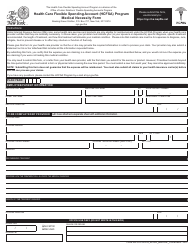

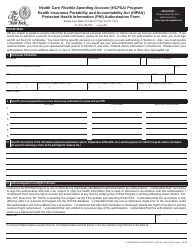

Plan Year Enrollment / Change Form - Flexible Spending Accounts (FSA) Program - New York City

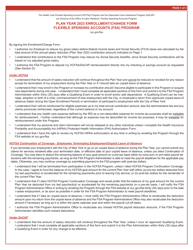

Plan Year Enrollment/Change Form - Flexible Spending Accounts (FSA) Program is a legal document that was released by the New York City Office of Labor Relations - a government authority operating within New York City.

FAQ

Q: What is the Plan Year Enrollment/Change Form?

A: The Plan Year Enrollment/Change Form is a document used to enroll or make changes to your Flexible Spending Accounts (FSA) Program in New York City.

Q: What is the Flexible Spending Accounts (FSA) Program?

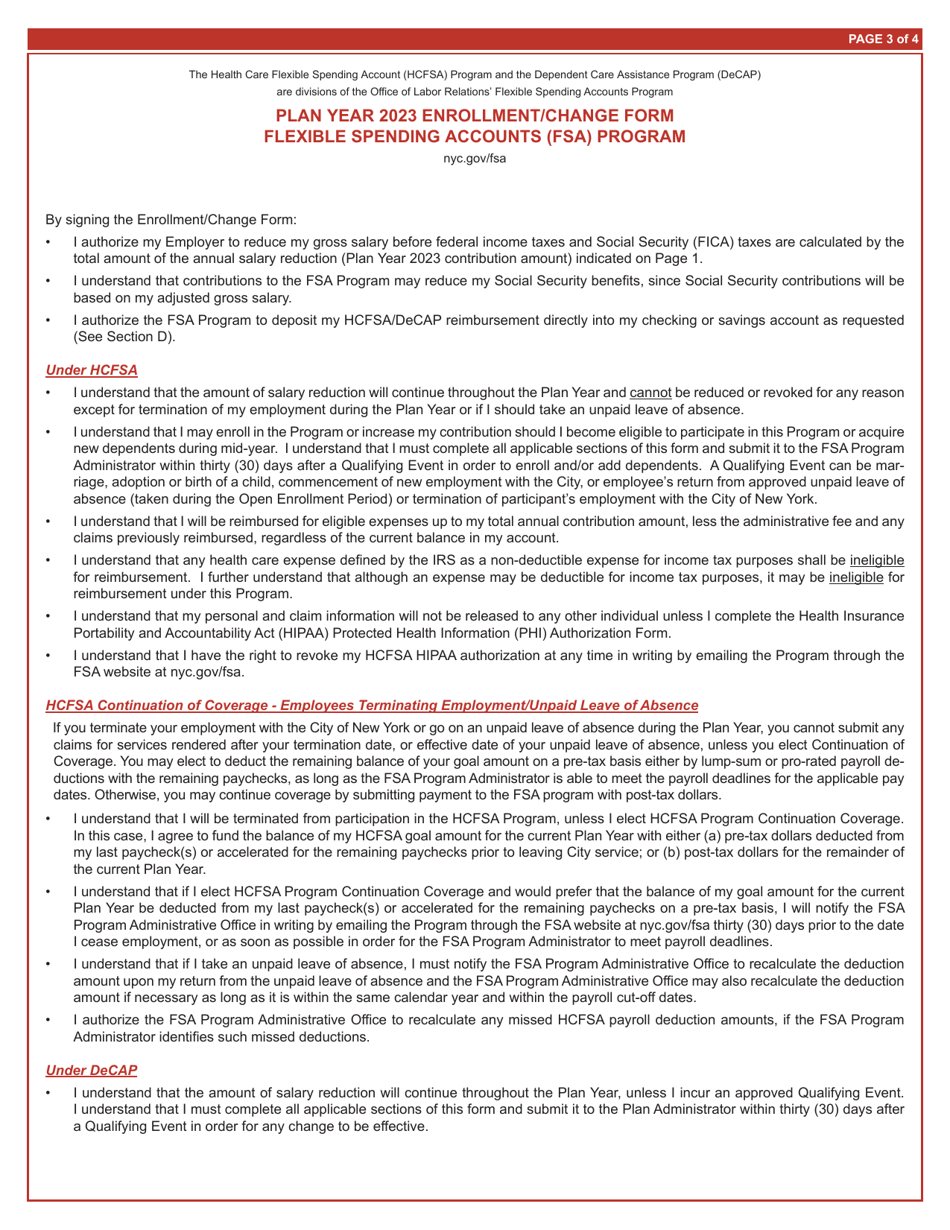

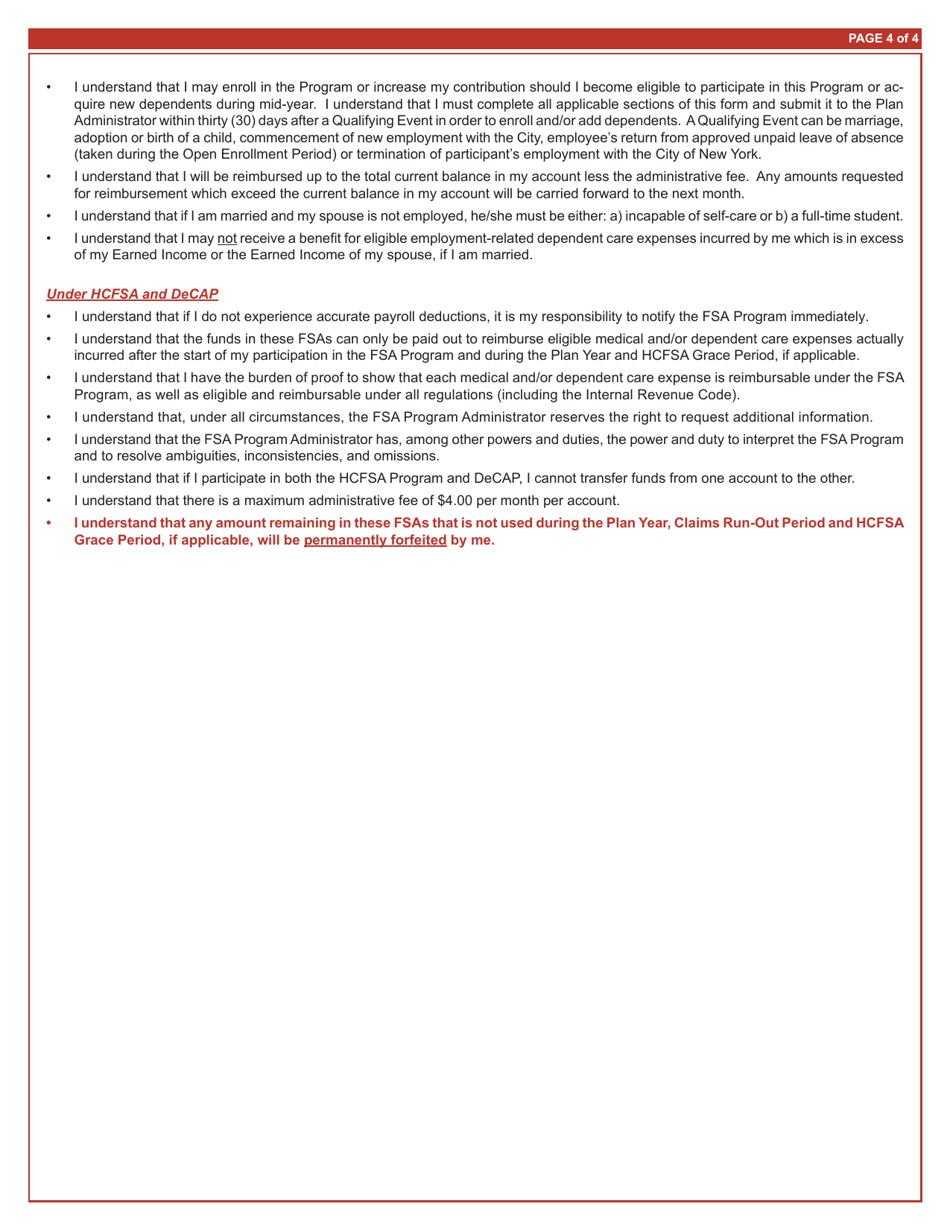

A: The Flexible Spending Accounts (FSA) Program is a benefit program offered in New York City that allows employees to set aside pre-tax dollars to pay for eligible healthcare and dependent care expenses.

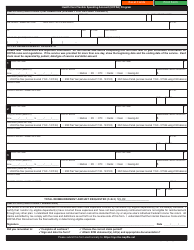

Q: Who is eligible for the Flexible Spending Accounts (FSA) Program?

A: Employees of participating employers in New York City are eligible for the Flexible Spending Accounts (FSA) Program.

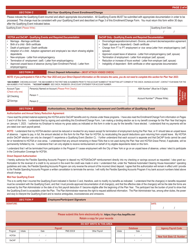

Q: What can the funds in the Flexible Spending Accounts (FSA) be used for?

A: The funds in the Flexible Spending Accounts (FSA) can be used to pay for eligible healthcare and dependent care expenses, such as doctor's visits, prescription medications, and childcare expenses.

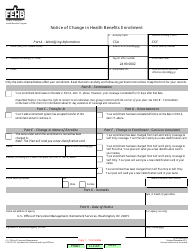

Q: What is the Plan Year?

A: The Plan Year refers to the annual period during which you can participate in the Flexible Spending Accounts (FSA) Program.

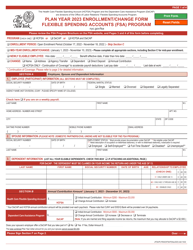

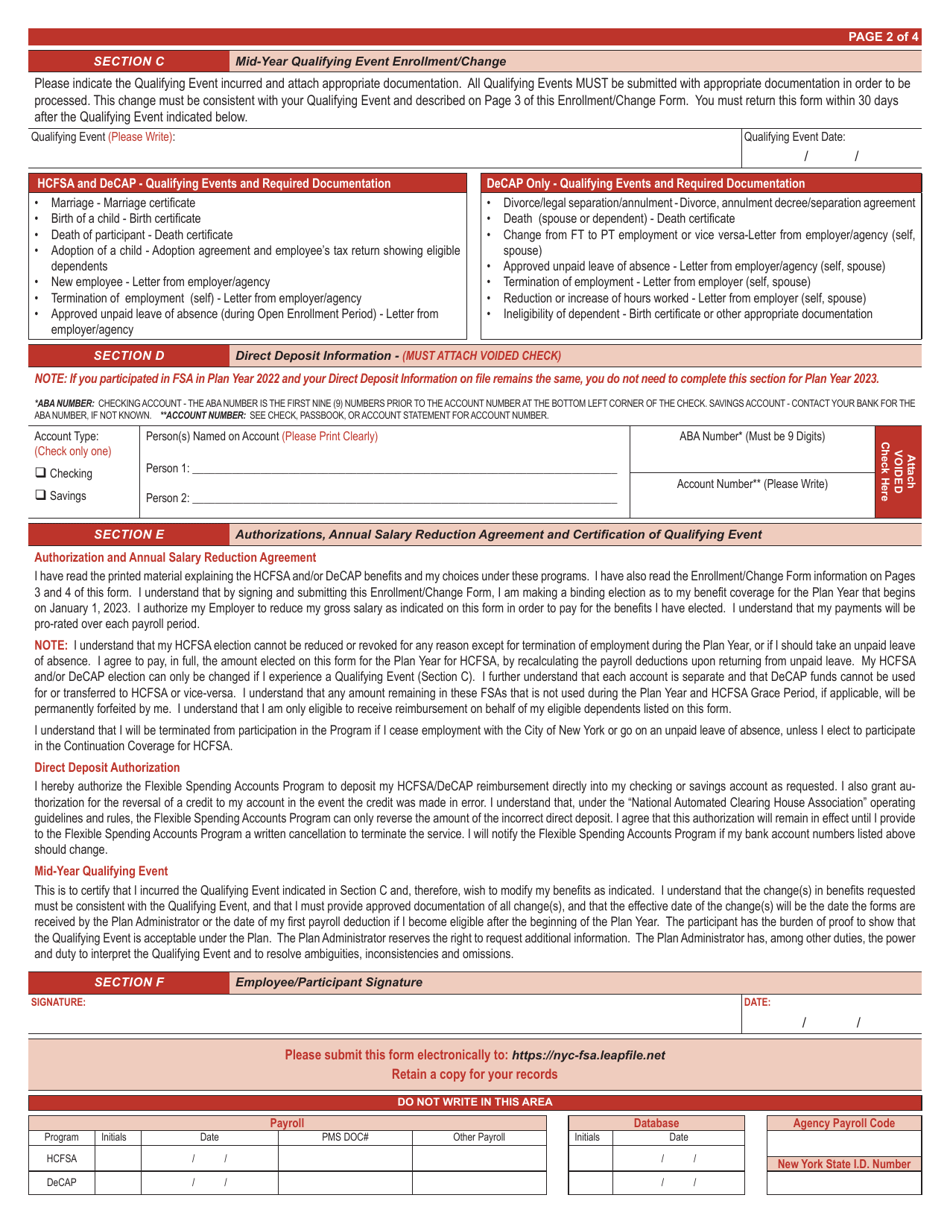

Q: Can I make changes to my Flexible Spending Accounts (FSA) during the Plan Year?

A: No, you can only make changes to your Flexible Spending Accounts (FSA) during the designated enrollment period, unless you experience a qualified life event.

Q: What is a qualified life event?

A: A qualified life event is a significant change in your circumstances, such as marriage, divorce, birth/adoption of a child, or a change in employment status, that allows you to make changes to your Flexible Spending Accounts (FSA) outside of the regular enrollment period.

Form Details:

- Released on October 1, 2022;

- The latest edition currently provided by the New York City Office of Labor Relations;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New York City Office of Labor Relations.