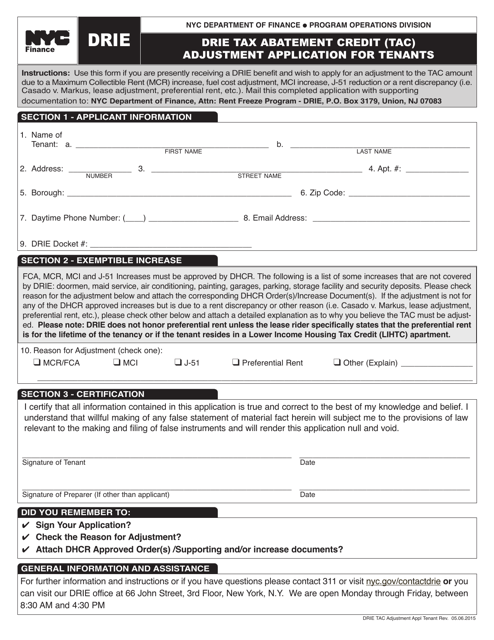

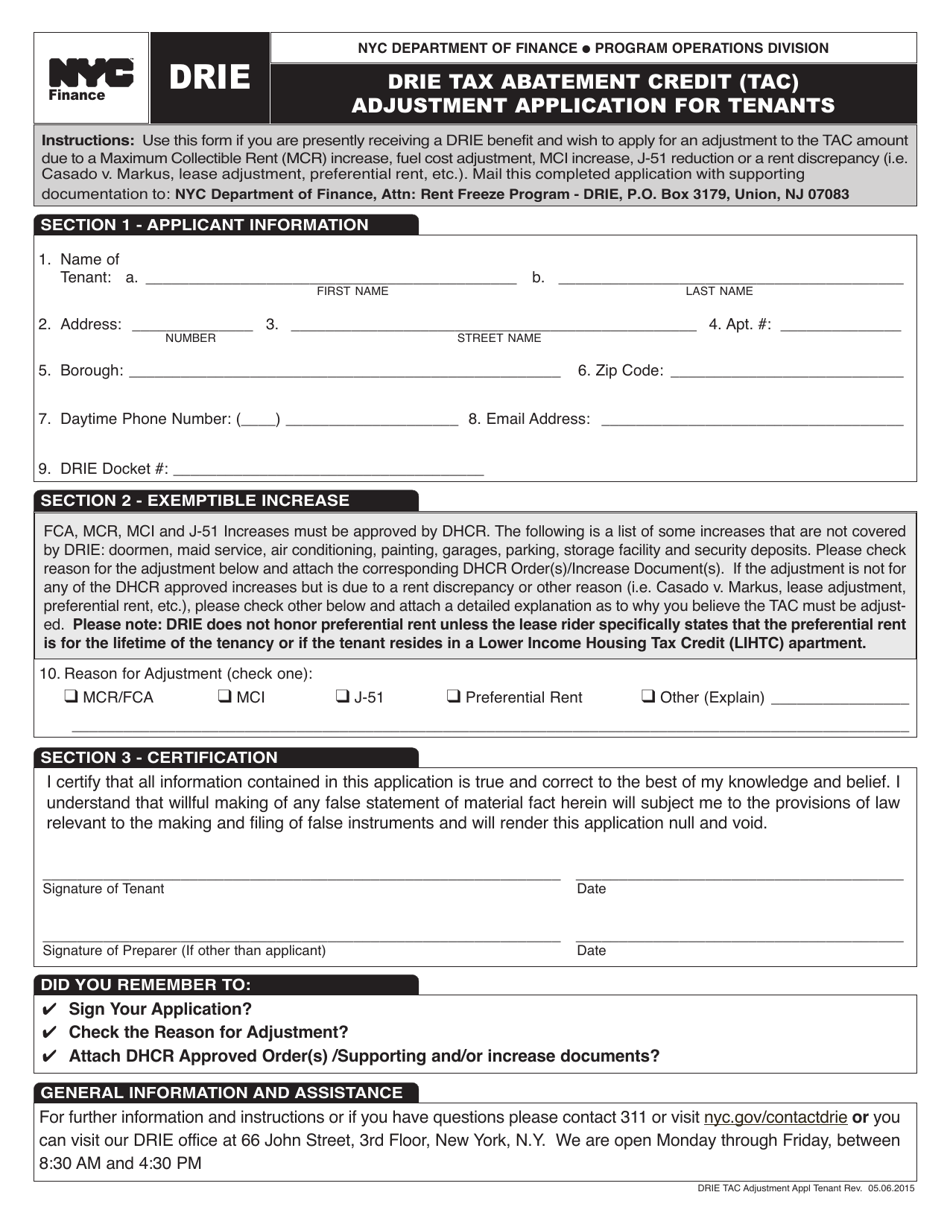

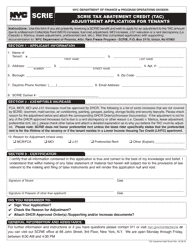

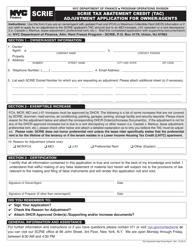

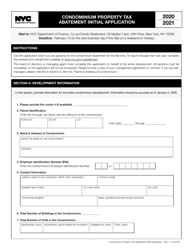

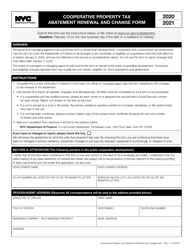

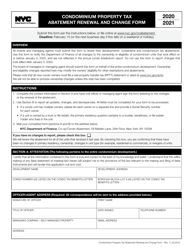

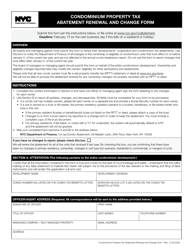

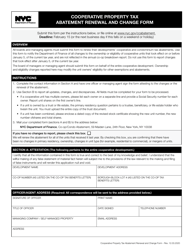

Drie Tax Abatement Credit (Tac) Adjustment Application for Tenants - New York City

Drie Tax Abatement Credit (Tac) Adjustment Application for Tenants is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

FAQ

Q: What is the Tax Abatement Credit (TAC) Adjustment Application for Tenants?

A: The Tax Abatement Credit (TAC) Adjustment Application for Tenants is a form used in New York City.

Q: What is the purpose of the TAC Adjustment Application?

A: The purpose of the TAC Adjustment Application is to apply for a tax abatement credit for eligible tenants in New York City.

Q: Who is eligible to apply for the TAC Adjustment?

A: Eligible tenants in New York City can apply for the TAC Adjustment.

Q: What is the benefit of the TAC Adjustment?

A: The TAC Adjustment allows eligible tenants to receive a tax abatement credit, reducing their property tax liability.

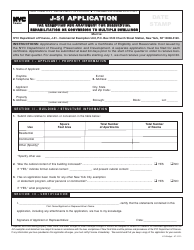

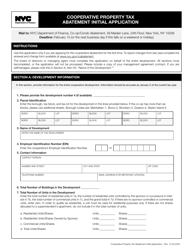

Form Details:

- Released on May 6, 2015;

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.