This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

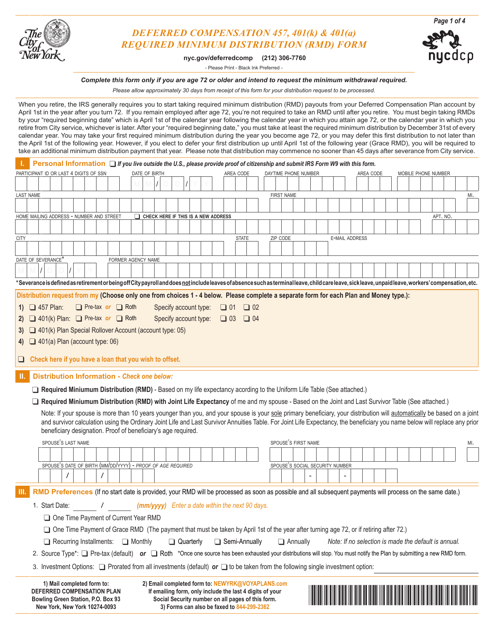

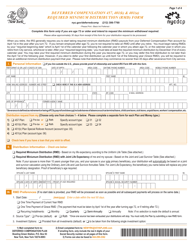

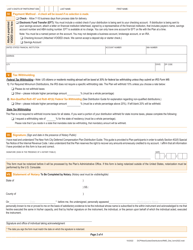

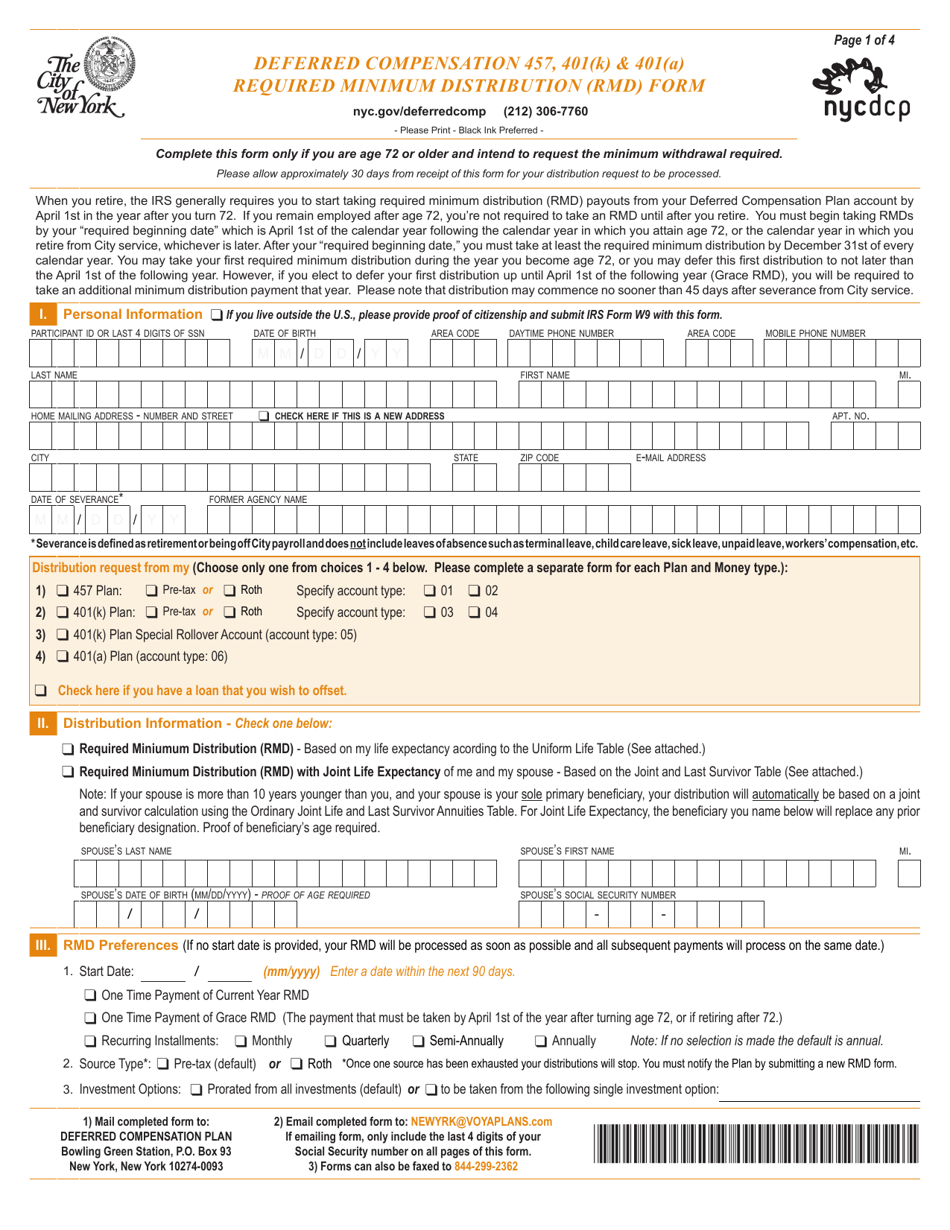

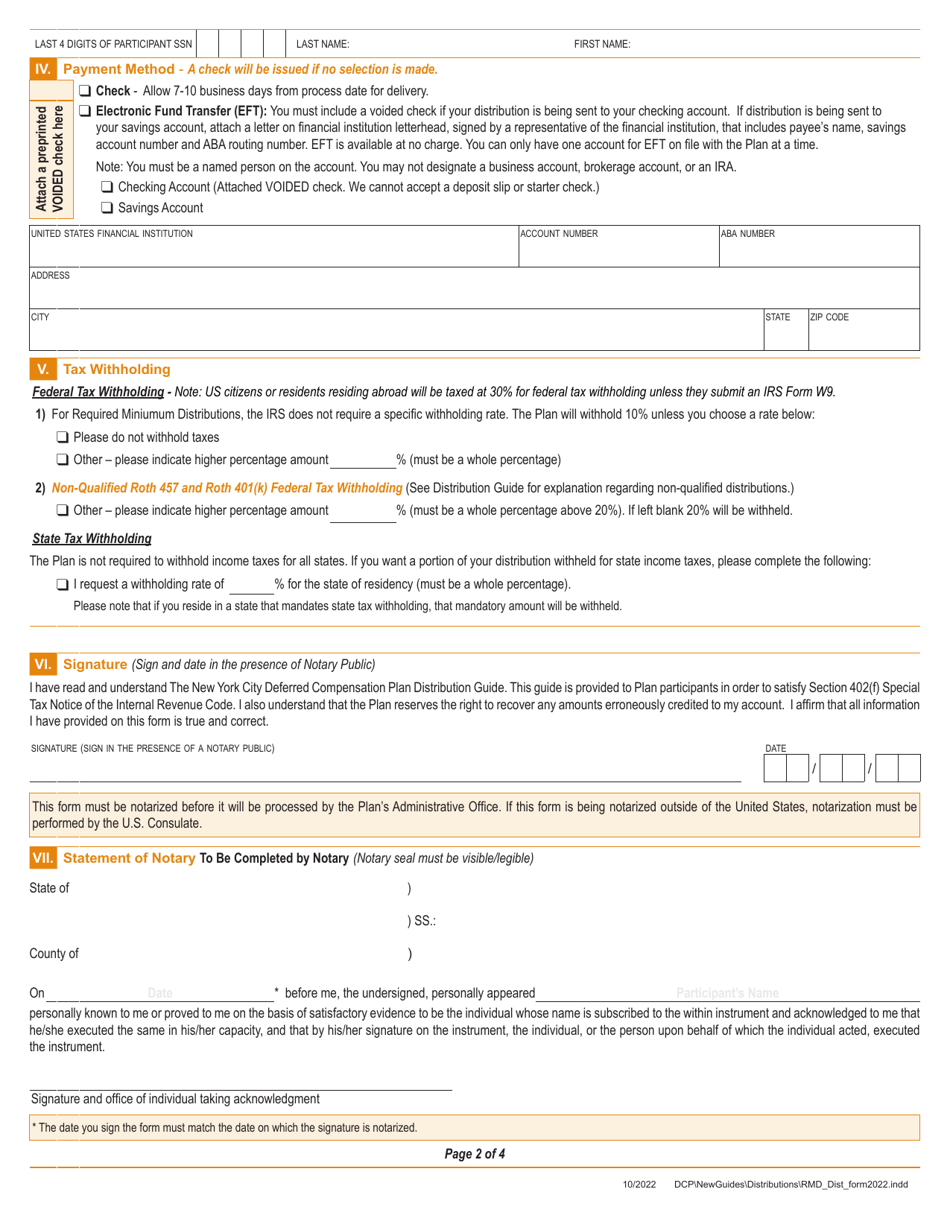

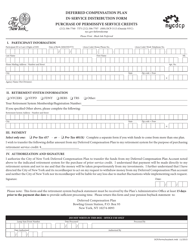

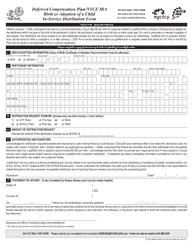

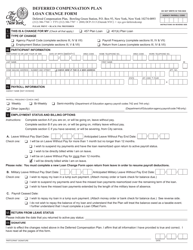

Deferred Compensation 457, 401(K) & 401(A) Required Minimum Distribution (Rmd) Form - New York City

Deferred Compensation 457, 401(K) & 401(A) Required Minimum Distribution (Rmd) Form is a legal document that was released by the New York City Office of Labor Relations - a government authority operating within New York City.

FAQ

Q: What is a Deferred Compensation 457 plan?

A: A Deferred Compensation 457 plan is a retirement plan offered by employers to their employees, allowing them to contribute a portion of their salary on a pre-tax basis for retirement savings.

Q: What is a 401(K) plan?

A: A 401(K) plan is a retirement savings plan sponsored by employers, where employees can contribute a portion of their salary on a pre-tax basis to save for retirement.

Q: What is a 401(A) plan?

A: A 401(A) plan is a retirement plan typically offered by government employers or educational institutions, where contributions are made by the employer on behalf of the employee.

Q: What is a Required Minimum Distribution (RMD) form?

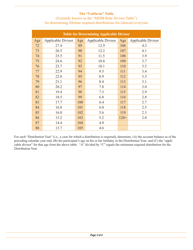

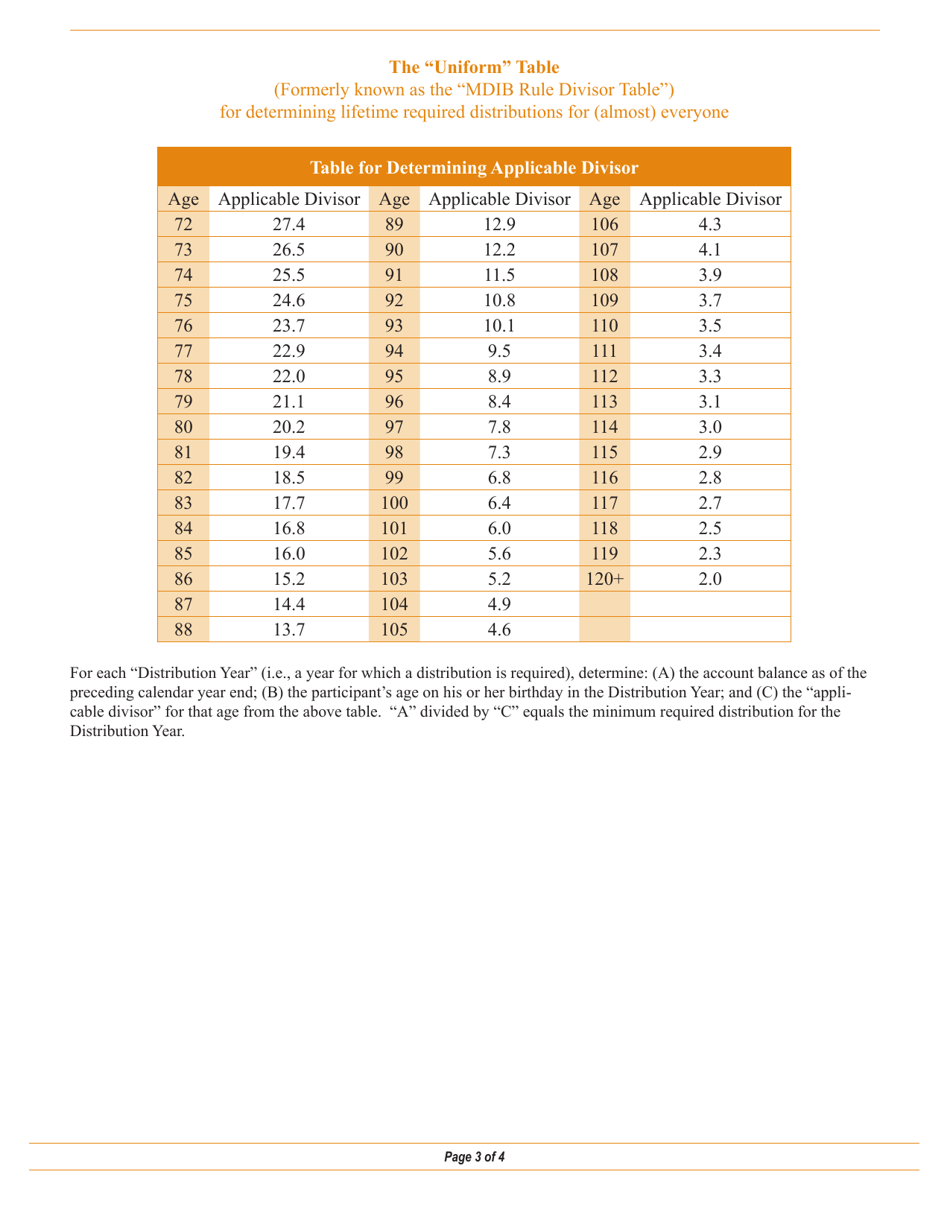

A: A Required Minimum Distribution (RMD) form is a document that retirees need to submit to the IRS to report and withdraw the minimum amount required from their retirement accounts each year once they reach a certain age.

Form Details:

- Released on October 1, 2022;

- The latest edition currently provided by the New York City Office of Labor Relations;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Office of Labor Relations.