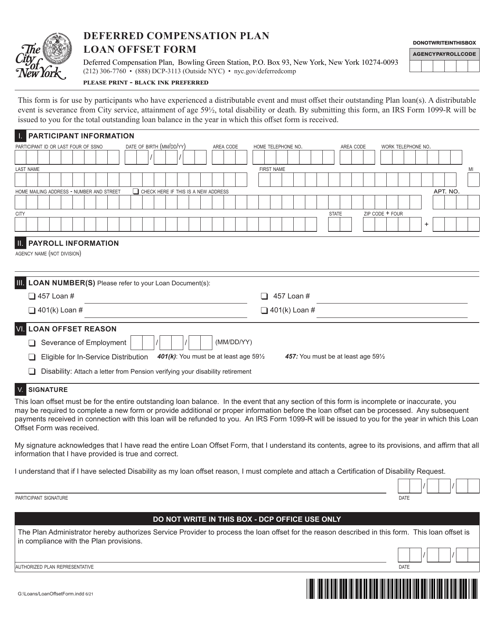

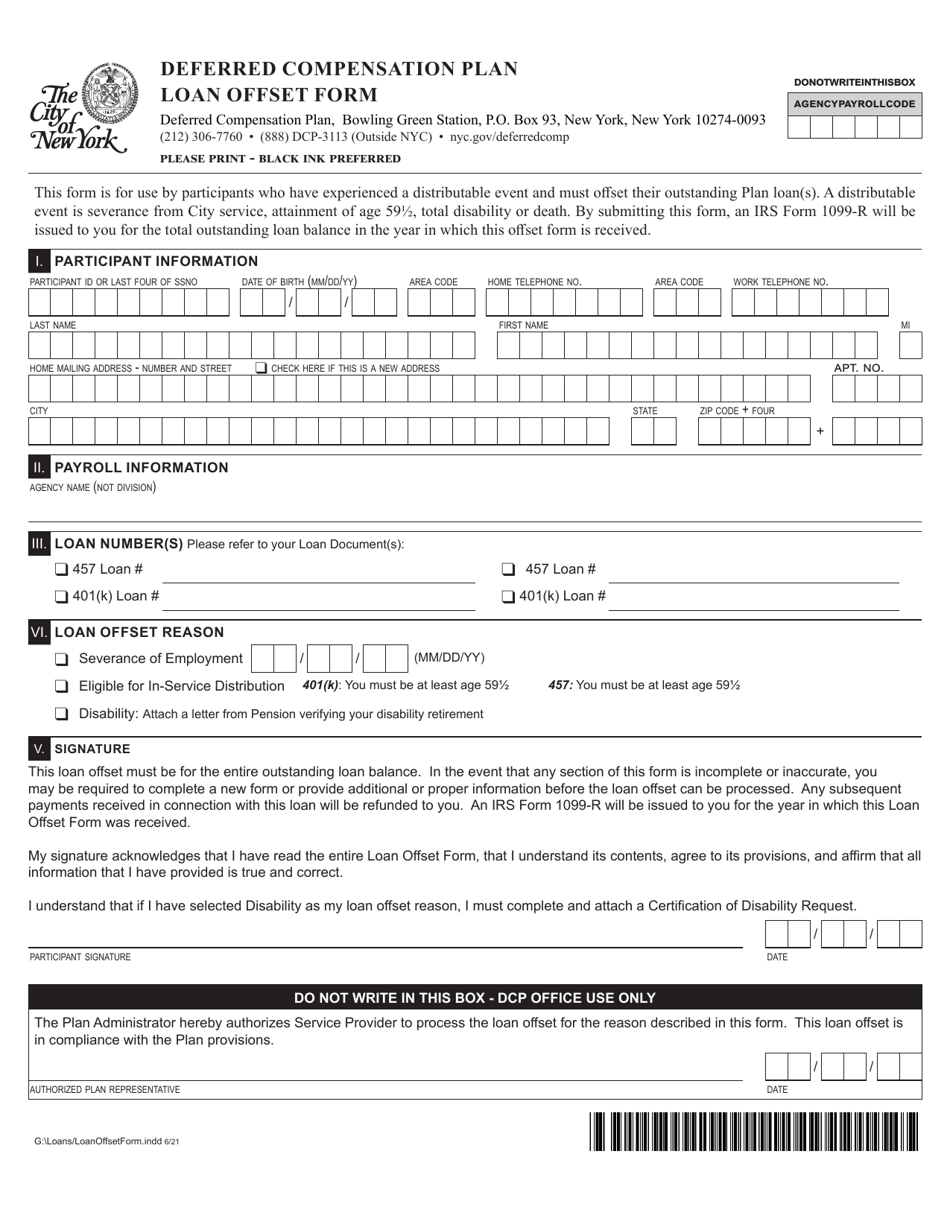

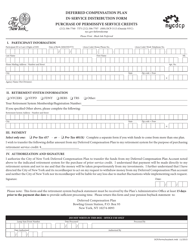

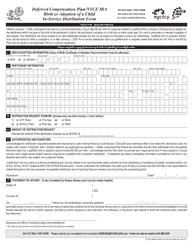

Deferred Compensation Plan Loan Offset Form - New York City

Deferred Compensation Plan Loan Offset Form is a legal document that was released by the New York City Office of Labor Relations - a government authority operating within New York City.

FAQ

Q: What is a Deferred Compensation Plan Loan Offset Form?

A: A Deferred Compensation Plan Loan Offset Form is a document used in New York City to offset a loan from an employee's deferred compensation plan.

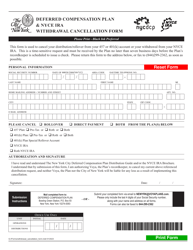

Q: What is a Deferred Compensation Plan?

A: A Deferred Compensation Plan is a retirement savings plan that allows employees to set aside a portion of their income for retirement on a pre-tax basis.

Q: What is a loan offset?

A: A loan offset is when a portion of an employee's retirement savings or deferred compensation plan is used to pay off an outstanding loan.

Q: Why would someone need to use a Deferred Compensation Plan Loan Offset Form?

A: Someone would need to use a Deferred Compensation Plan Loan Offset Form if they have an outstanding loan that they want to pay off using funds from their deferred compensation plan.

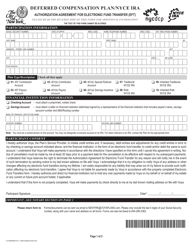

Q: Is the Deferred Compensation Plan Loan Offset Form specific to New York City?

A: Yes, the Deferred Compensation Plan Loan Offset Form is specific to New York City.

Q: Are there any restrictions or limitations on using the Deferred Compensation Plan Loan Offset Form?

A: There may be restrictions or limitations on using the Deferred Compensation Plan Loan Offset Form, so it is advisable to consult the official guidelines or contact the New York City Deferred Compensation Plan for more information.

Q: Can I use a Deferred Compensation Plan Loan Offset Form to pay off any loan?

A: No, a Deferred Compensation Plan Loan Offset Form can only be used to offset loans from an employee's deferred compensation plan.

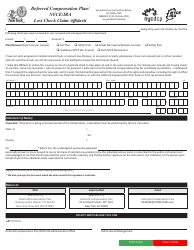

Form Details:

- Released on June 1, 2021;

- The latest edition currently provided by the New York City Office of Labor Relations;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Office of Labor Relations.