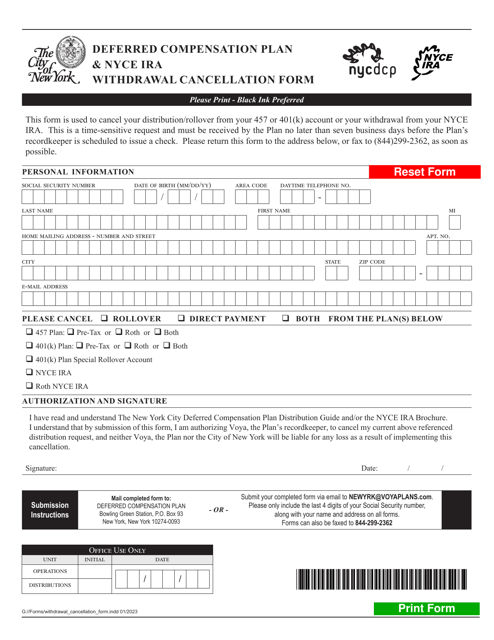

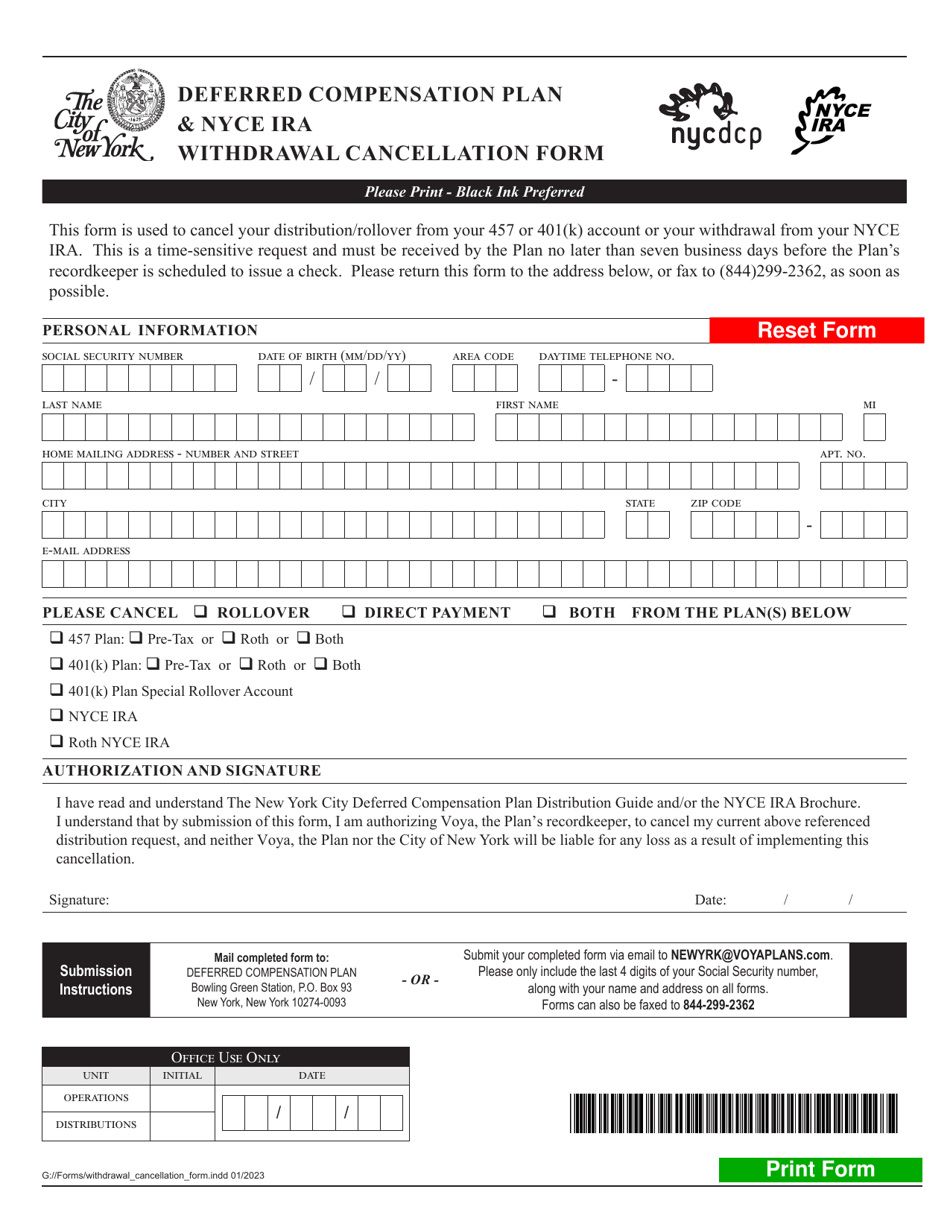

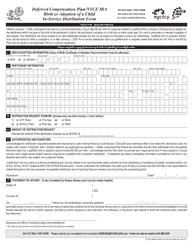

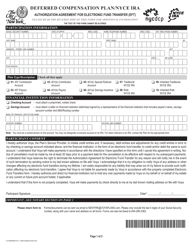

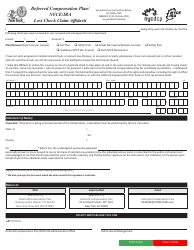

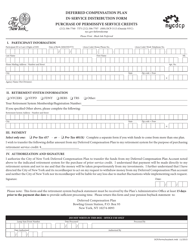

Deferred Compensation Plan & Nyce Ira Withdrawal Cancellation Form - New York City

Deferred Nyce Ira Withdrawal Cancellation Form is a legal document that was released by the New York City Office of Labor Relations - a government authority operating within New York City.

FAQ

Q: What is deferred compensation?

A: Deferred compensation is a type of employee benefit plan that allows employees to defer a portion of their income until a later date, typically retirement.

Q: How does a deferred compensation plan work?

A: In a deferred compensation plan, a portion of an employee's income is set aside and invested, often with tax advantages. The employee receives the deferred amount, along with any investment earnings, at a specified future date, usually during retirement.

Q: What is the Nyce IRA Withdrawal Cancellation Form?

A: The Nyce IRA Withdrawal Cancellation Form is a document used in New York City to cancel or modify a previously requested withdrawal from an Individual Retirement Account (IRA) held under the New York City Employee Deferred Compensation Plan.

Q: Why would someone need to cancel or modify an IRA withdrawal?

A: There are various reasons why someone might need to cancel or modify an IRA withdrawal, such as changes in financial circumstances, tax planning, or reevaluating retirement income needs.

Q: Are there any penalties for canceling or modifying an IRA withdrawal?

A: Penalties or fees may apply depending on the terms of the specific deferred compensation plan and the reason for canceling or modifying the withdrawal. It is recommended to consult the plan administrator or a financial advisor for guidance on any potential penalties.

Form Details:

- Released on January 1, 2023;

- The latest edition currently provided by the New York City Office of Labor Relations;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New York City Office of Labor Relations.