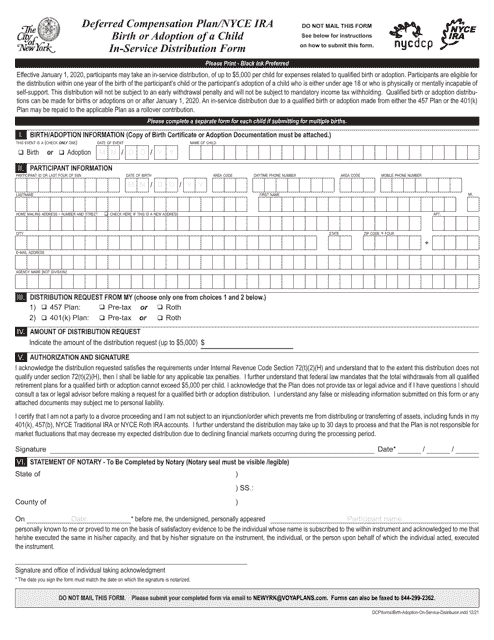

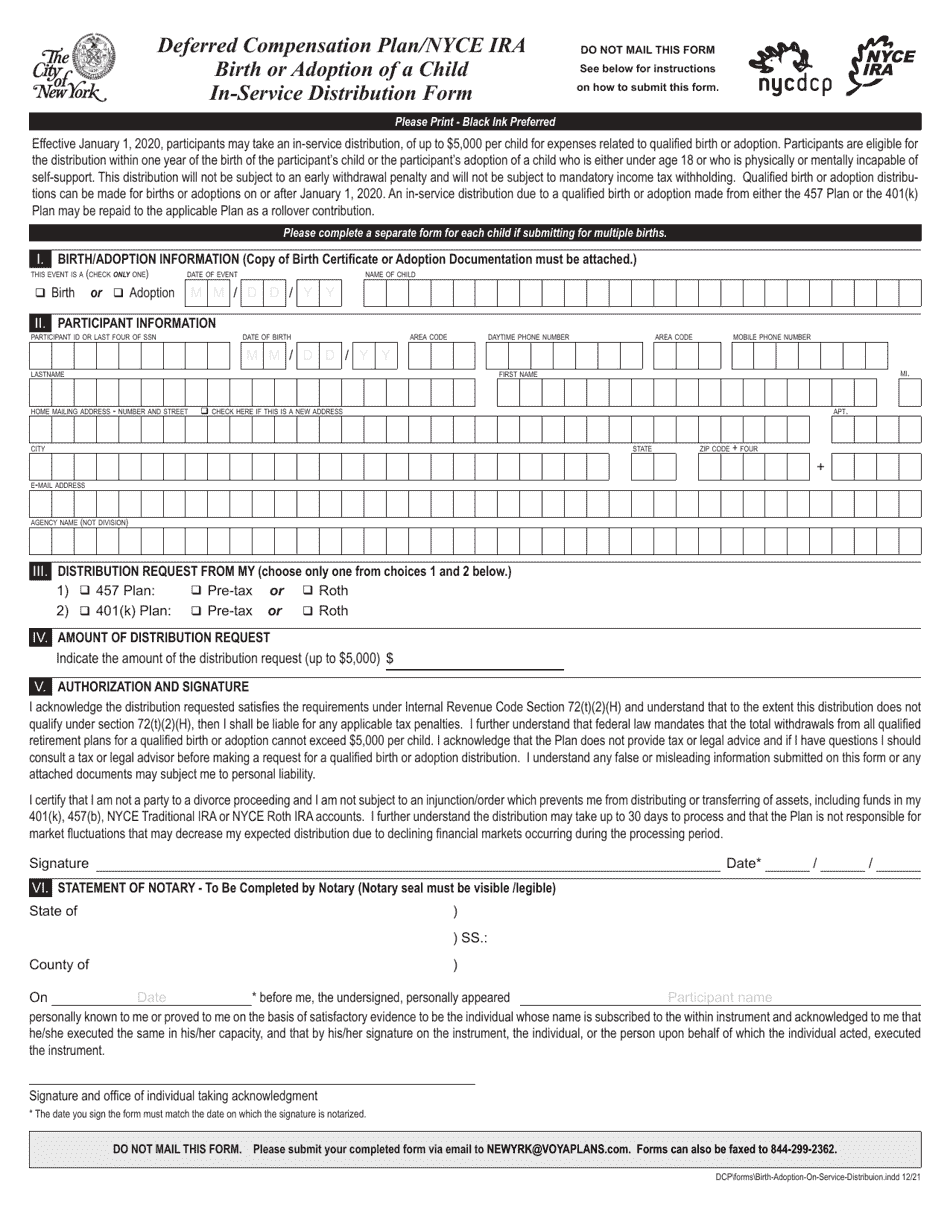

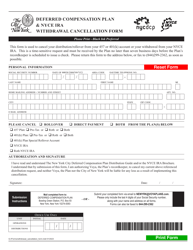

Deferred Compensation Plan / Nyce Ira Birth or Adoption of a Child In-Service Distribution Form - New York City

Deferred Compensation Plan/Nyce Ira Birth or Adoption of a Child In-Service Distribution Form is a legal document that was released by the New York City Office of Labor Relations - a government authority operating within New York City.

FAQ

Q: What is a Deferred Compensation Plan/Nyce Ira Birth or Adoption of a Child In-Service Distribution Form?

A: The Deferred Compensation Plan/Nyce Ira Birth or Adoption of a Child In-Service Distribution Form is a document related to the distribution of funds from a Deferred Compensation Plan or NYCE IRA for the birth or adoption of a child.

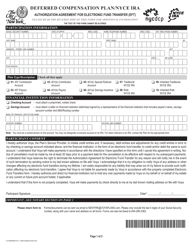

Q: What is a Deferred Compensation Plan?

A: A Deferred Compensation Plan is a retirement savings plan that allows employees to contribute a portion of their income on a pre-tax basis.

Q: What is a NYCE IRA?

A: NYCE IRA stands for New York City Employee Individual Retirement Account. It is a retirement savings account specifically for employees of the City of New York.

Q: What is a Birth or Adoption of a Child In-Service Distribution Form?

A: The Birth or Adoption of a Child In-Service Distribution Form is a form that allows employees to request a distribution of funds from their Deferred Compensation Plan or NYCE IRA for the purpose of covering expenses related to the birth or adoption of a child.

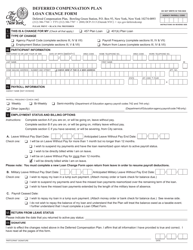

Q: Who can use the Deferred Compensation Plan/Nyce Ira Birth or Adoption of a Child In-Service Distribution Form?

A: This form can be used by employees who have a Deferred Compensation Plan or NYCE IRA and have experienced the birth or adoption of a child.

Q: What expenses can be covered by the funds distributed through this form?

A: The funds distributed through this form can be used to cover expenses related to the birth or adoption of a child, such as medical expenses, child care expenses, and other associated costs.

Q: Are there any restrictions or limitations on the use of the funds?

A: There may be restrictions or limitations on the use of the funds, depending on the specific rules and regulations of the Deferred Compensation Plan or NYCE IRA. It is recommended to review the plan documents or consult with a financial advisor for more information.

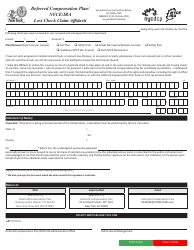

Q: What should I do once I have completed the form?

A: Once you have completed the form, you should submit it to the appropriate department or person designated by your employer for processing.

Q: Are there any tax implications for taking a distribution from a Deferred Compensation Plan or NYCE IRA for the birth or adoption of a child?

A: Yes, there may be tax implications for taking a distribution from a Deferred Compensation Plan or NYCE IRA. It is recommended to consult with a tax professional or financial advisor to understand the specific tax consequences in your situation.

Form Details:

- Released on December 1, 2021;

- The latest edition currently provided by the New York City Office of Labor Relations;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Office of Labor Relations.