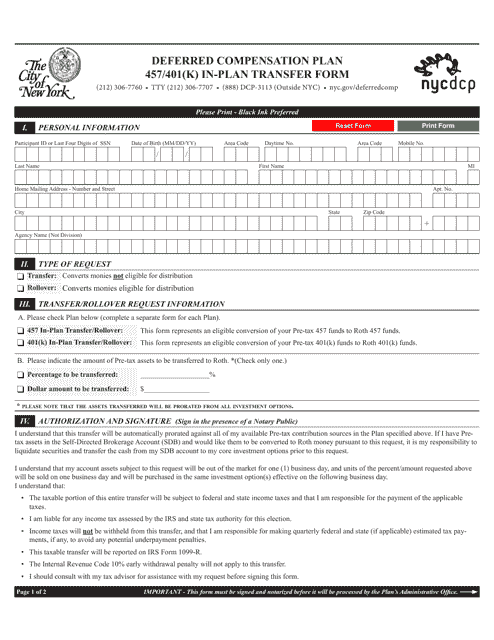

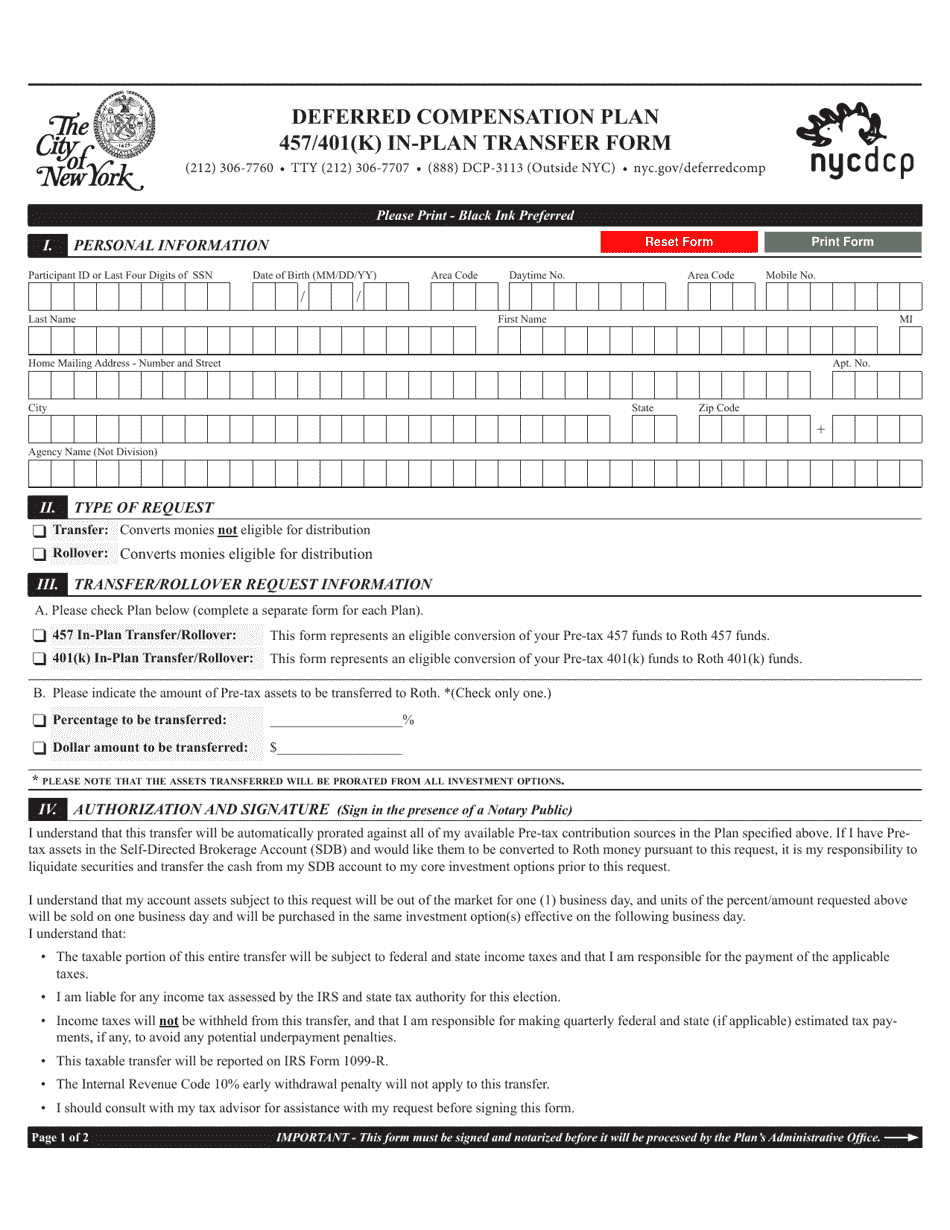

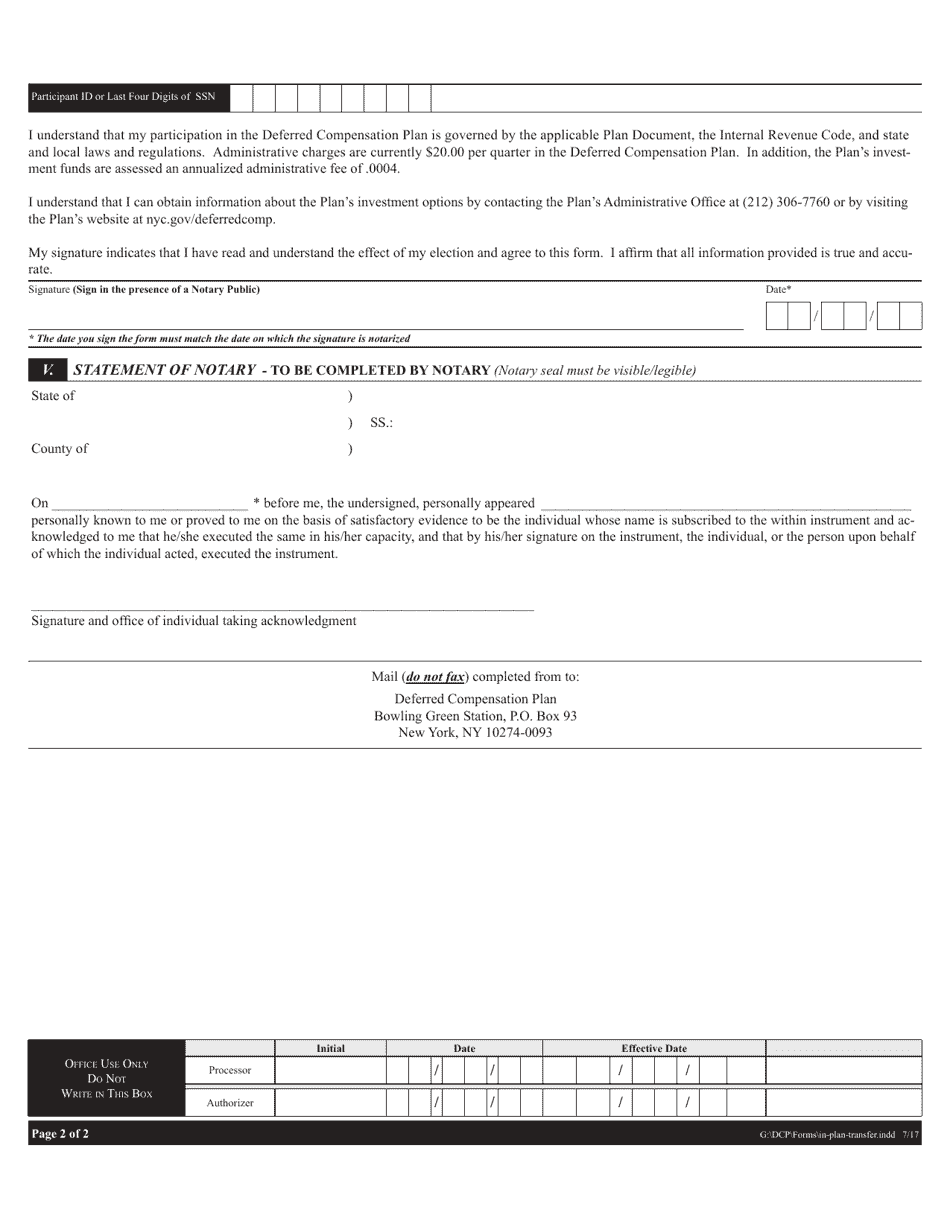

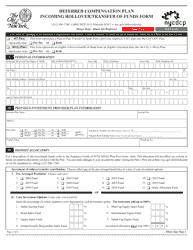

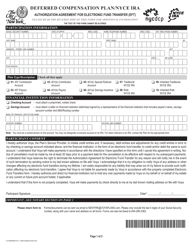

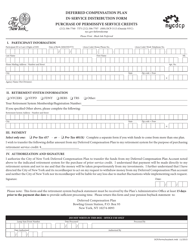

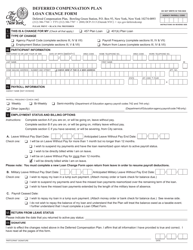

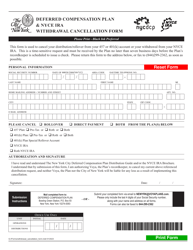

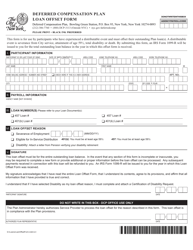

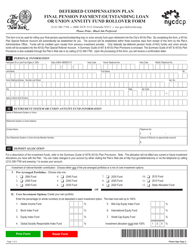

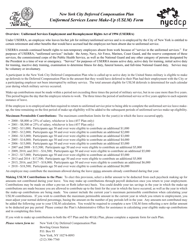

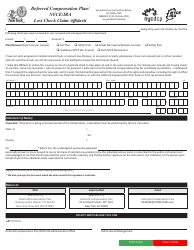

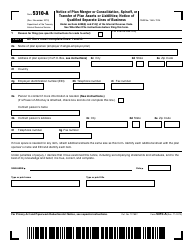

Deferred Compensation Plan 457 / 401(K) in-Plan Transfer Form - New York City

Deferred Compensation Plan 457/401(K) in-Plan Transfer Form is a legal document that was released by the New York City Office of Labor Relations - a government authority operating within New York City.

FAQ

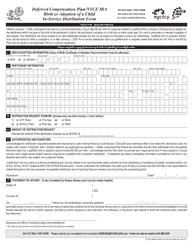

Q: What is a Deferred Compensation Plan 457?

A: A Deferred Compensation Plan 457 is a retirement savings plan offered by many public employers, including New York City, that allows employees to contribute a portion of their salary on a pre-tax basis and defer taxes on the contributions and any earnings until withdrawn.

Q: What is a 401(k) plan?

A: A 401(k) plan is a retirement savings plan offered by private employers that allows employees to contribute a portion of their salary on a pre-tax basis and defer taxes on the contributions and any earnings until withdrawn.

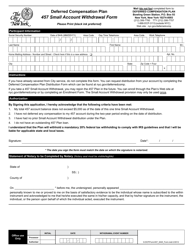

Q: What is an in-plan transfer?

A: An in-plan transfer is a process that allows participants to move funds from one investment option to another within the same retirement plan, such as a Deferred Compensation Plan 457 or a 401(k) plan.

Q: Why would someone want to do an in-plan transfer?

A: There are several reasons why someone may want to do an in-plan transfer, including changing investment strategies, rebalancing their portfolio, or taking advantage of better-performing investment options within the plan.

Q: How can I request an in-plan transfer?

A: To request an in-plan transfer, you will need to complete an in-plan transfer form provided by your employer or plan administrator. This form is specific to your retirement plan and should include instructions on where to submit it.

Q: Can I do an in-plan transfer between a Deferred Compensation Plan 457 and a 401(k) plan?

A: No, in general, you cannot do an in-plan transfer between a Deferred Compensation Plan 457 and a 401(k) plan. However, there may be exceptions depending on the specific rules of your employer's retirement plans.

Q: Is there a fee for doing an in-plan transfer?

A: The fees associated with an in-plan transfer vary depending on the retirement plan and investment options involved. You should review your plan's documentation or contact your plan administrator for information on any fees that may apply.

Form Details:

- Released on July 1, 2017;

- The latest edition currently provided by the New York City Office of Labor Relations;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New York City Office of Labor Relations.