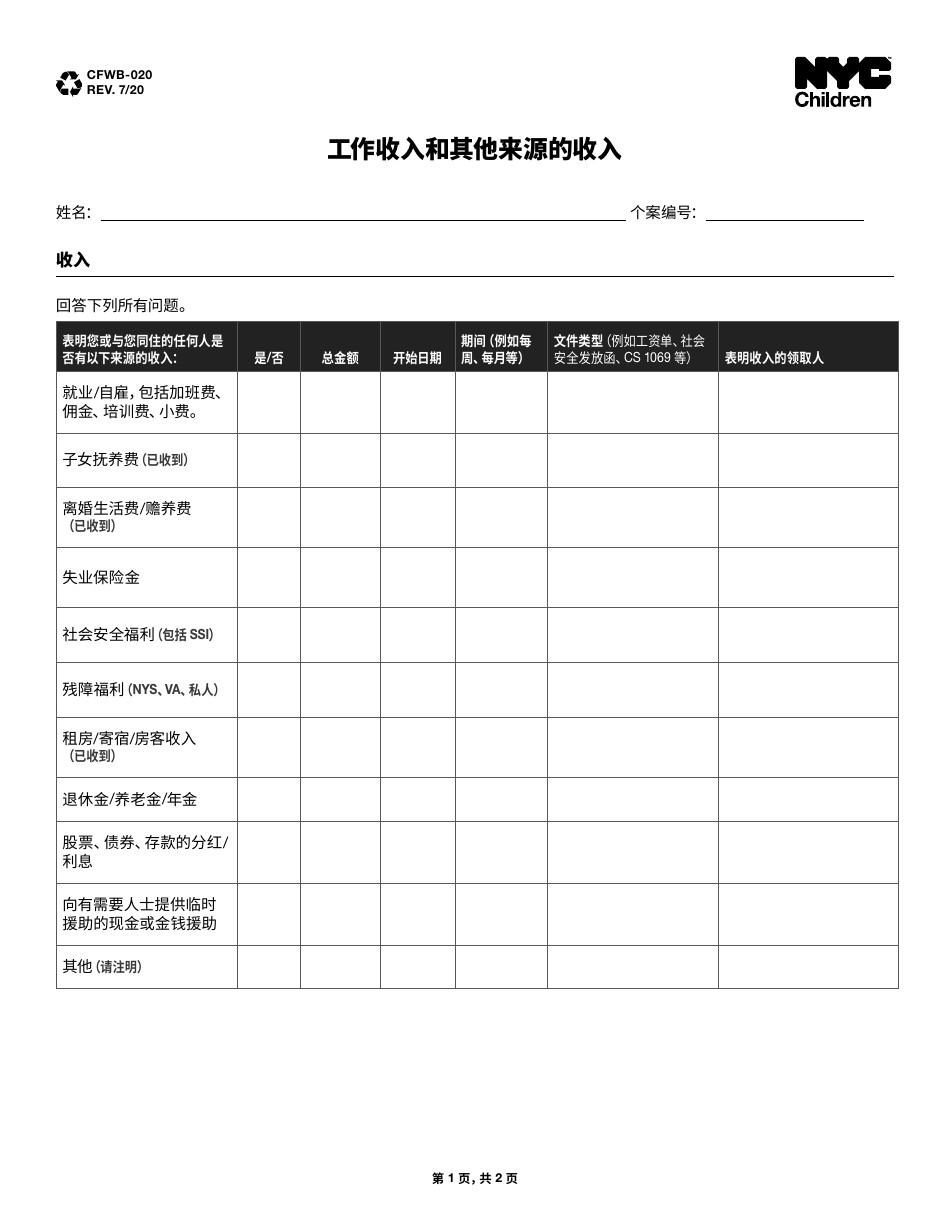

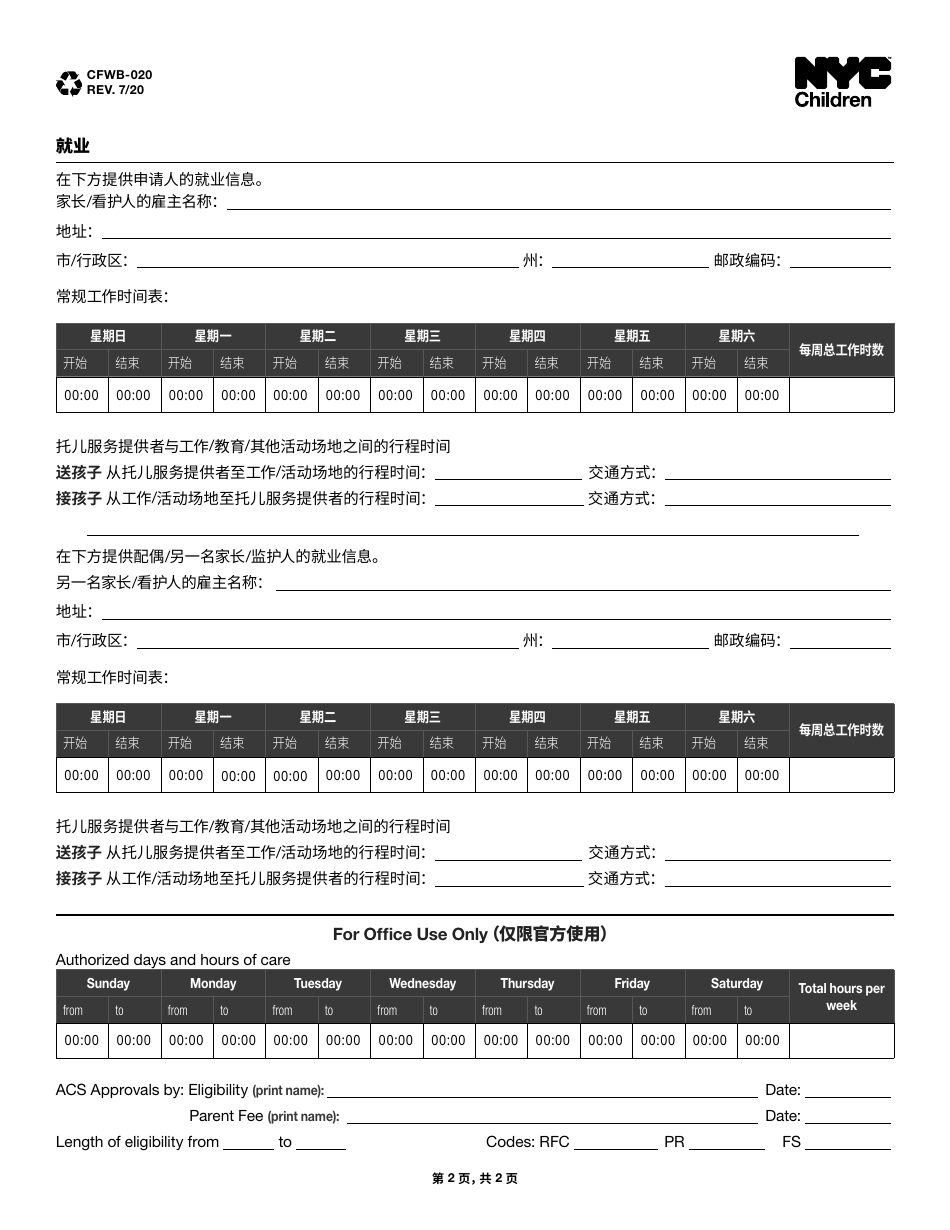

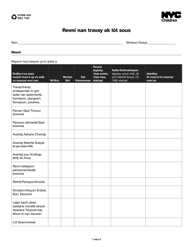

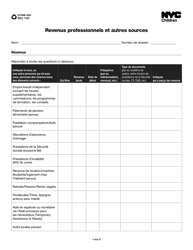

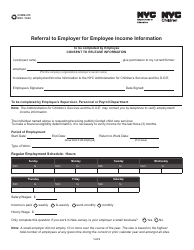

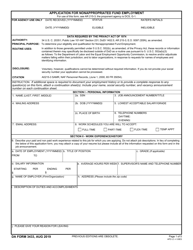

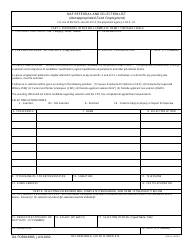

Form CFWB-020 Income From Employment and Other Sources - New York City (Chinese Simplified)

This is a legal form that was released by the New York City Administration for Children’s Services - a government authority operating within New York City.

The document is provided in Chinese Simplified. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

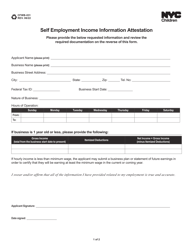

Q: What is Form CFWB-020?

A: Form CFWB-020 is a tax form for reporting income from employment and other sources in New York City.

Q: Who needs to file Form CFWB-020?

A: Individuals who have income from employment and other sources in New York City need to file Form CFWB-020.

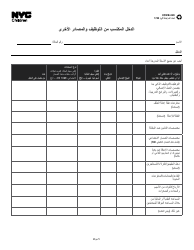

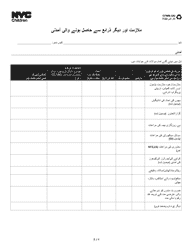

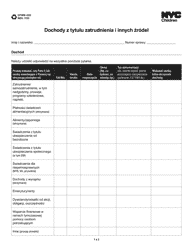

Q: What types of income should be reported on Form CFWB-020?

A: Form CFWB-020 should be used to report income from employment and other sources such as rental income, self-employment income, and dividends.

Q: When is the deadline to file Form CFWB-020?

A: The deadline to file Form CFWB-020 is usually April 15th, unless an extension has been granted.

Q: Are there any penalties for late filing of Form CFWB-020?

A: Yes, there may be penalties for late filing of Form CFWB-020, including possible fines and interest charges.

Q: Do I need to file Form CFWB-020 if I don't have any income from employment or other sources in New York City?

A: No, you do not need to file Form CFWB-020 if you have no income from employment or other sources in New York City.

Q: Do I need to include supporting documents when filing Form CFWB-020?

A: It is recommended to keep supporting documents, such as wage statements and receipts, for your records in case of an audit.

Q: Is there a separate form for New York City income tax filing?

A: Yes, in addition to Form CFWB-020, individuals may need to file a separate form for New York City income tax filing, such as Form NYC-210 or Form NYC-204.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the New York City Administration for Children’s Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

Download a fillable version of Form CFWB-020 by clicking the link below or browse more documents and templates provided by the New York City Administration for Children’s Services.