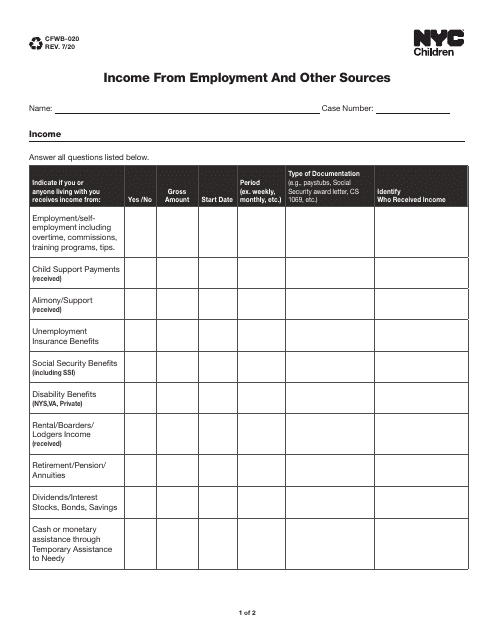

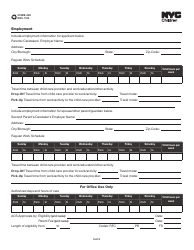

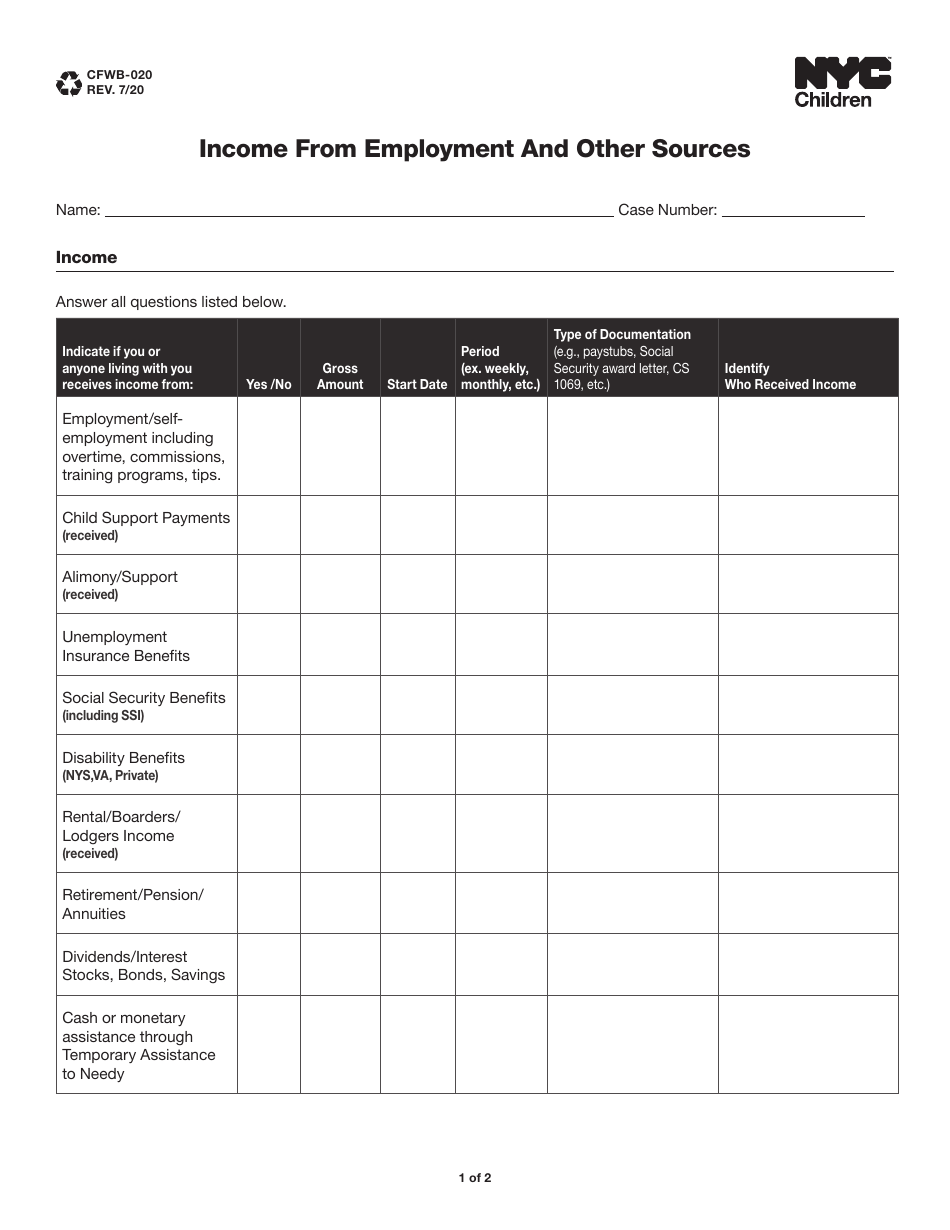

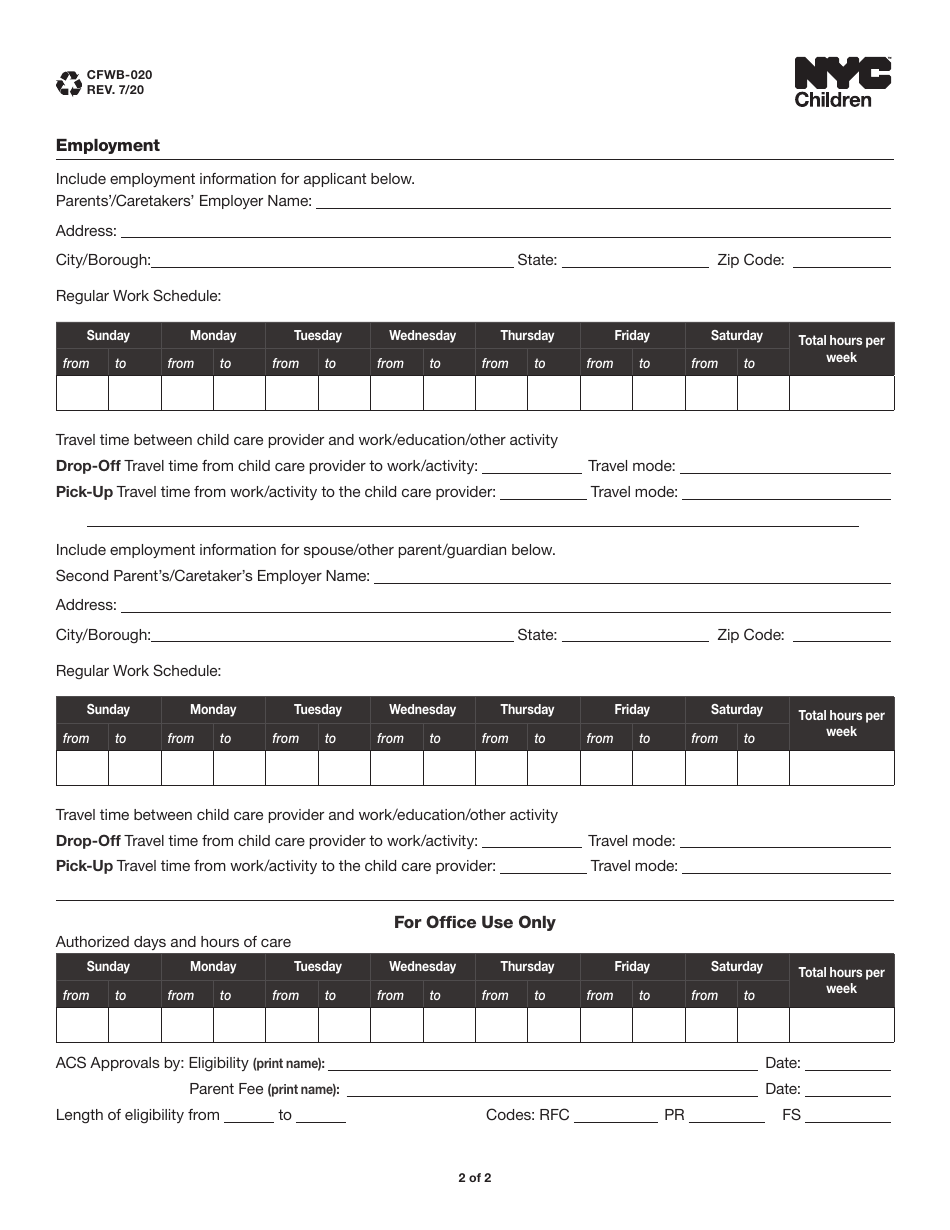

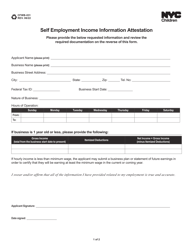

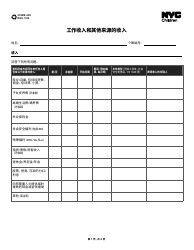

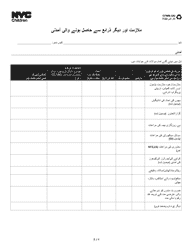

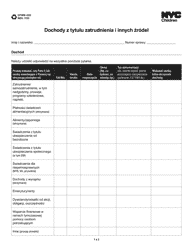

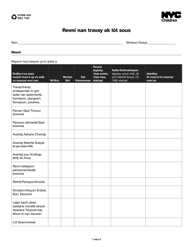

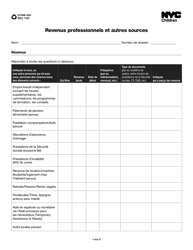

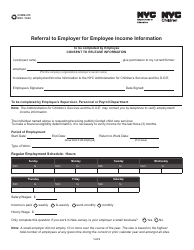

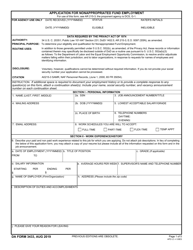

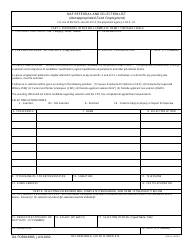

Form CFWB-020 Income From Employment and Other Sources - New York City

What Is Form CFWB-020?

This is a legal form that was released by the New York City Administration for Children’s Services - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CFWB-020?

A: Form CFWB-020 is a tax form used to report income from employment and other sources in New York City.

Q: Who needs to file Form CFWB-020?

A: Residents of New York City who have income from employment and other sources need to file Form CFWB-020.

Q: What kind of income should be reported on Form CFWB-020?

A: All income from employment and other sources, including wages, salaries, tips, commissions, self-employment income, rental income, and investment income, should be reported on Form CFWB-020.

Q: When is the deadline for filing Form CFWB-020?

A: The deadline for filing Form CFWB-020 is usually April 15th, but it may vary depending on the tax year.

Q: Do I need to file Form CFWB-020 if I don't have any income from employment or other sources?

A: No, if you don't have any income from employment or other sources, you don't need to file Form CFWB-020.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the New York City Administration for Children’s Services;

- Easy to use and ready to print;

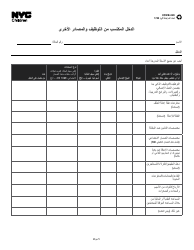

- Available in Arabic;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CFWB-020 by clicking the link below or browse more documents and templates provided by the New York City Administration for Children’s Services.