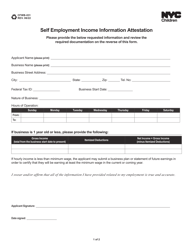

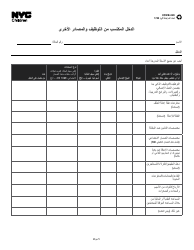

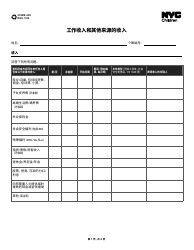

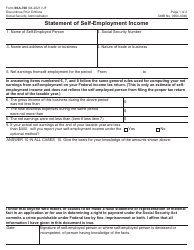

Form CFWB-031 Self Employment Income Information Attestation - New York City

What Is Form CFWB-031?

This is a legal form that was released by the New York City Administration for Children’s Services - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CFWB-031?

A: Form CFWB-031 is the Self Employment Income Information Attestation form used in New York City.

Q: Who needs to complete Form CFWB-031?

A: Individuals who are self-employed and have income to report in New York City.

Q: What is the purpose of Form CFWB-031?

A: The purpose of Form CFWB-031 is to report self-employment income accurately for tax purposes.

Q: Is Form CFWB-031 required for all self-employed individuals in New York City?

A: Yes, all self-employed individuals in New York City are required to complete Form CFWB-031.

Q: Are there any penalties for not completing Form CFWB-031?

A: Yes, failure to complete Form CFWB-031 accurately and on time may result in penalties or legal consequences.

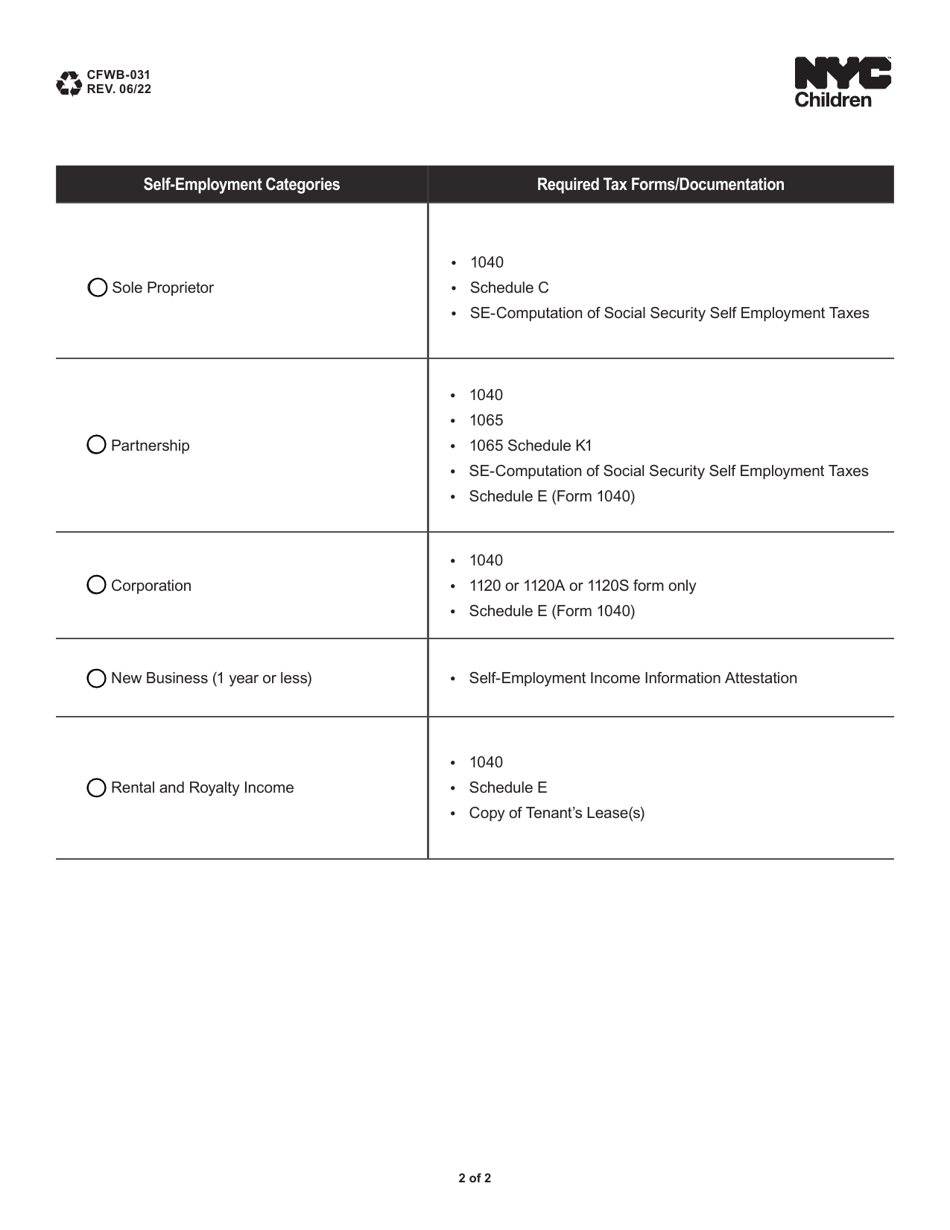

Q: What information do I need to provide on Form CFWB-031?

A: You need to provide your personal information, details about your self-employment income, and any supporting documentation, if required.

Q: When is the deadline for submitting Form CFWB-031?

A: The deadline for submitting Form CFWB-031 is usually April 15th of the following year, unless otherwise specified by the New York City Department of Finance.

Q: Who can I contact for assistance with Form CFWB-031?

A: You can contact the New York City Department of Finance or seek assistance from a tax professional for any questions or concerns regarding Form CFWB-031.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the New York City Administration for Children’s Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CFWB-031 by clicking the link below or browse more documents and templates provided by the New York City Administration for Children’s Services.