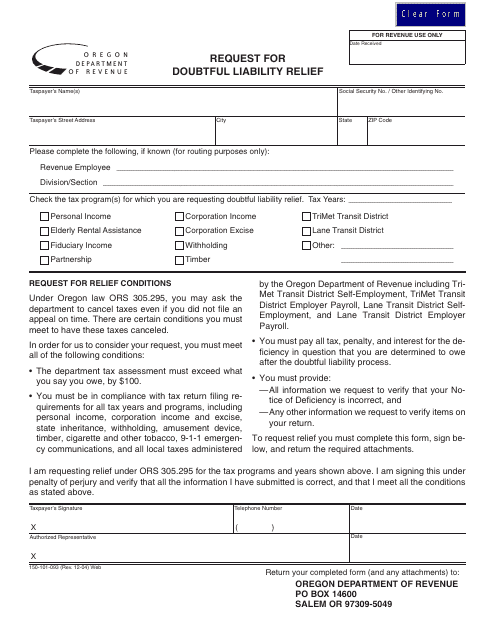

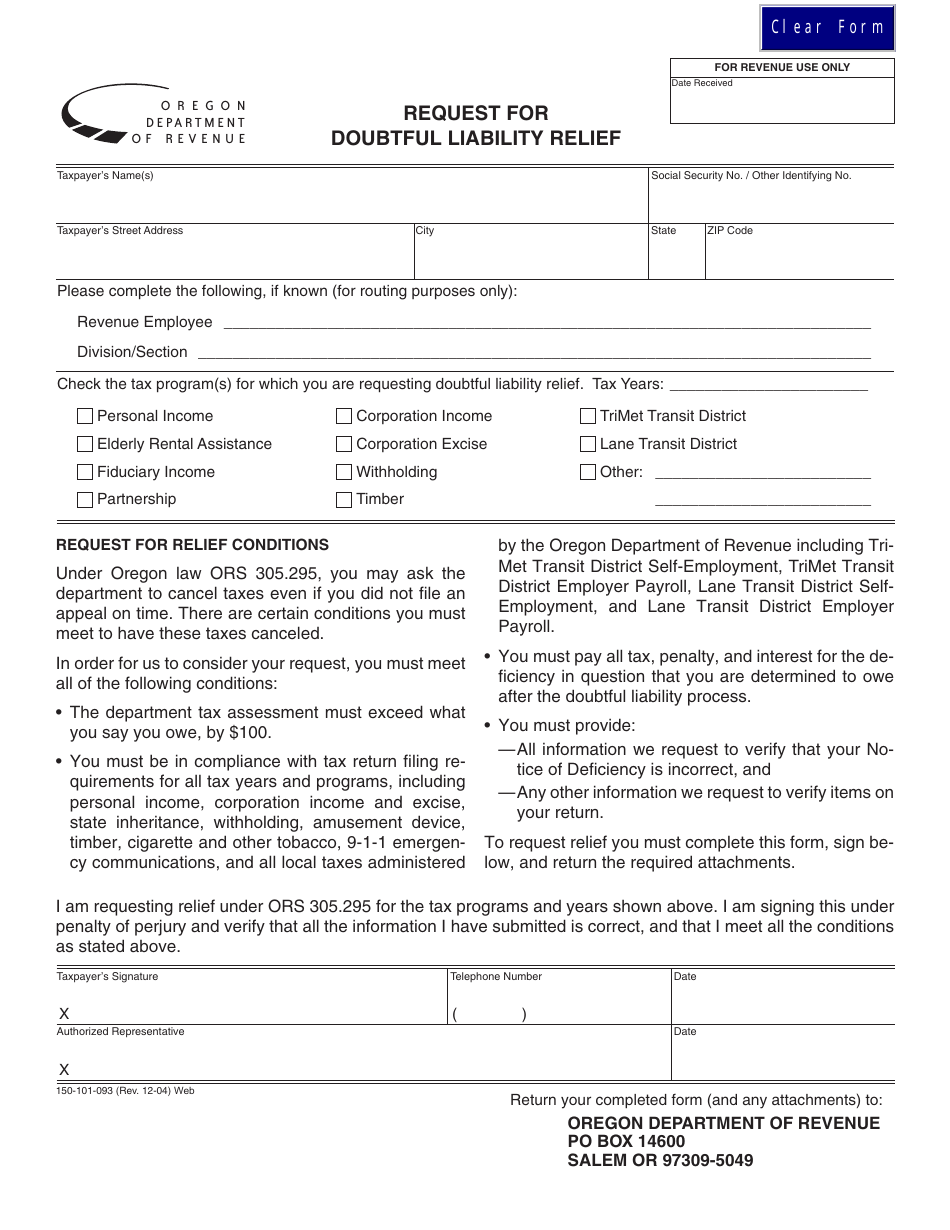

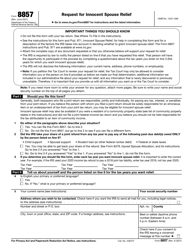

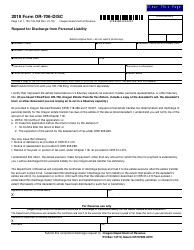

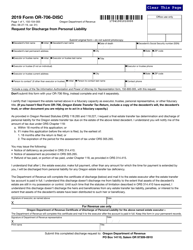

Form 150-101-093 Request for Doubtful Liability Relief - Oregon

What Is Form 150-101-093?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-093?

A: Form 150-101-093 is a request form for Doubtful Liability Relief in Oregon.

Q: Who can use Form 150-101-093?

A: This form can be used by taxpayers in Oregon who are seeking relief for doubtful liabilities.

Q: What is Doubtful Liability Relief?

A: Doubtful Liability Relief is a program in Oregon that provides relief to taxpayers who have liabilities that they are uncertain they can pay in full.

Q: How do I fill out Form 150-101-093?

A: You need to provide your taxpayer information, details of the liability, explanation of why it is doubtful, and any supporting documentation with the form.

Form Details:

- Released on December 1, 2004;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-093 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.