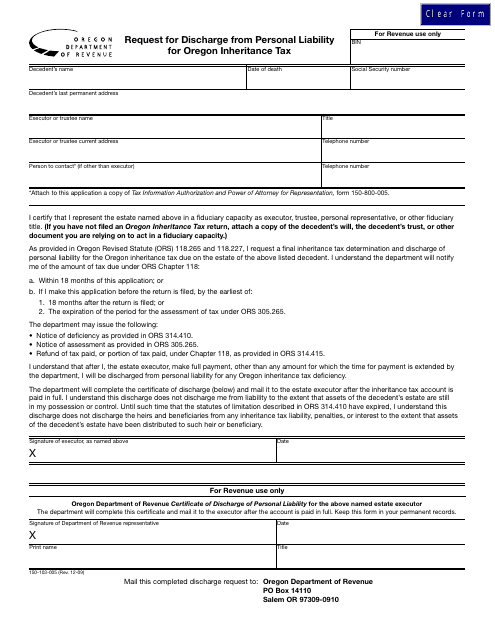

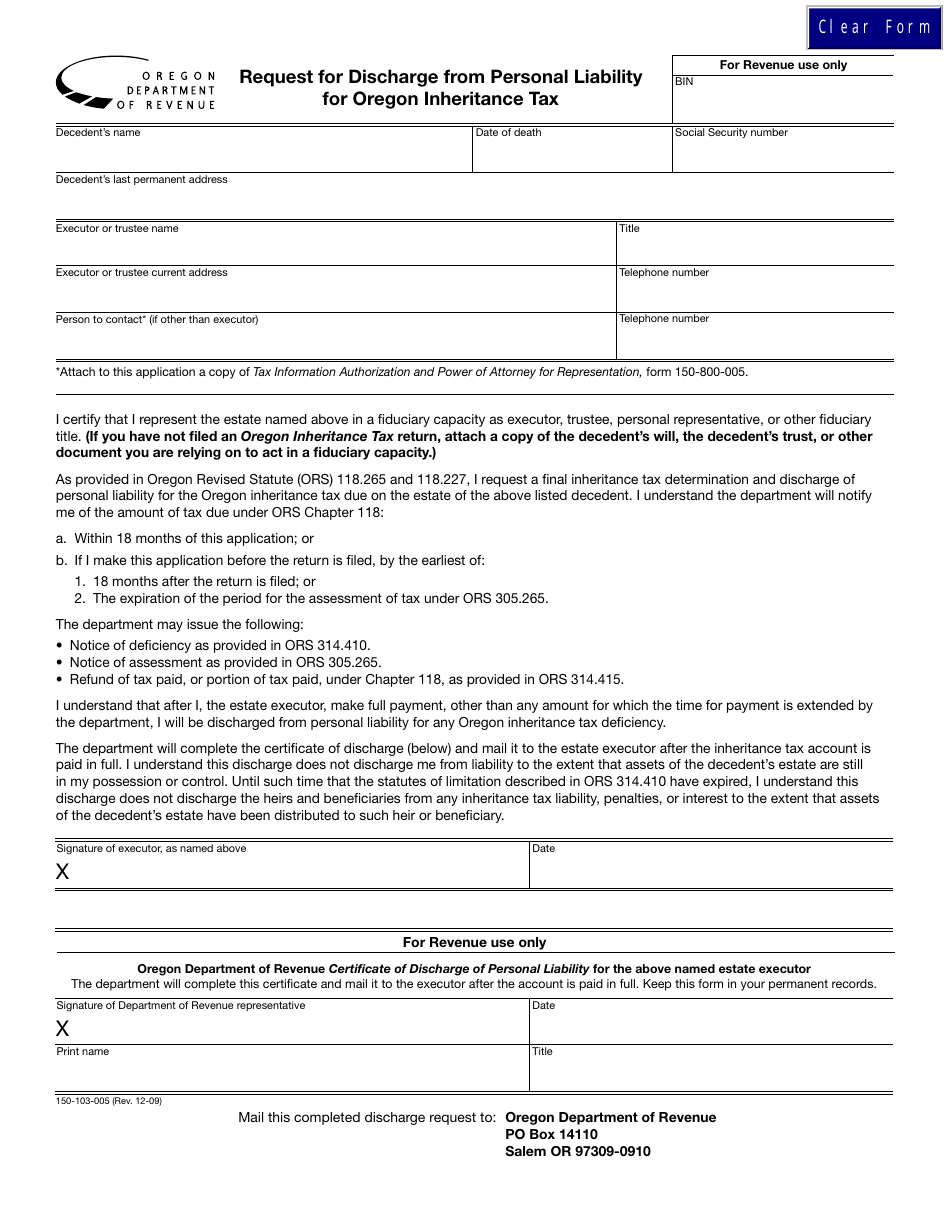

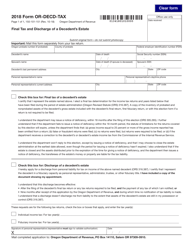

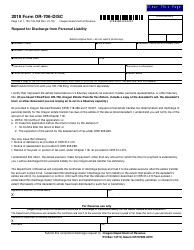

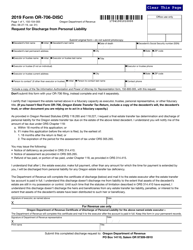

Form 150-103-005 Request for Discharge From Personal Liability for Oregon Inheritance Tax - Oregon

What Is Form 150-103-005?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-103-005?

A: Form 150-103-005 is a request for discharge from personal liability for Oregon inheritance tax in Oregon.

Q: Who can use Form 150-103-005?

A: Any individual who is seeking to be discharged from personal liability for Oregon inheritance tax can use this form.

Q: What is the purpose of Form 150-103-005?

A: The purpose of Form 150-103-005 is to request discharge from personal liability for Oregon inheritance tax.

Q: Is there a fee for filing Form 150-103-005?

A: There is no fee for filing Form 150-103-005.

Q: What information is required on Form 150-103-005?

A: Form 150-103-005 requires information such as the decedent's name, date of death, the personal representative's name, and details about the inheritance tax liability.

Q: What should I do after completing Form 150-103-005?

A: After completing Form 150-103-005, you should submit it to the Oregon Department of Revenue for processing.

Q: When should I file Form 150-103-005?

A: Form 150-103-005 should be filed within nine months from the date of the decedent's death.

Q: What if I have questions or need assistance with Form 150-103-005?

A: If you have questions or need assistance with Form 150-103-005, you can contact the Oregon Department of Revenue for guidance.

Form Details:

- Released on December 1, 2009;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-103-005 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.