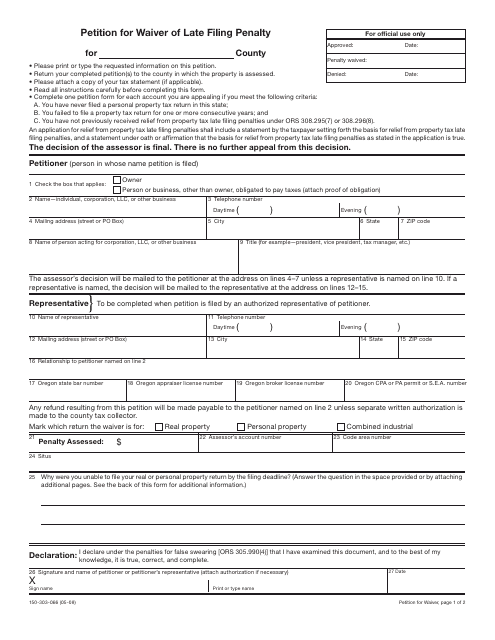

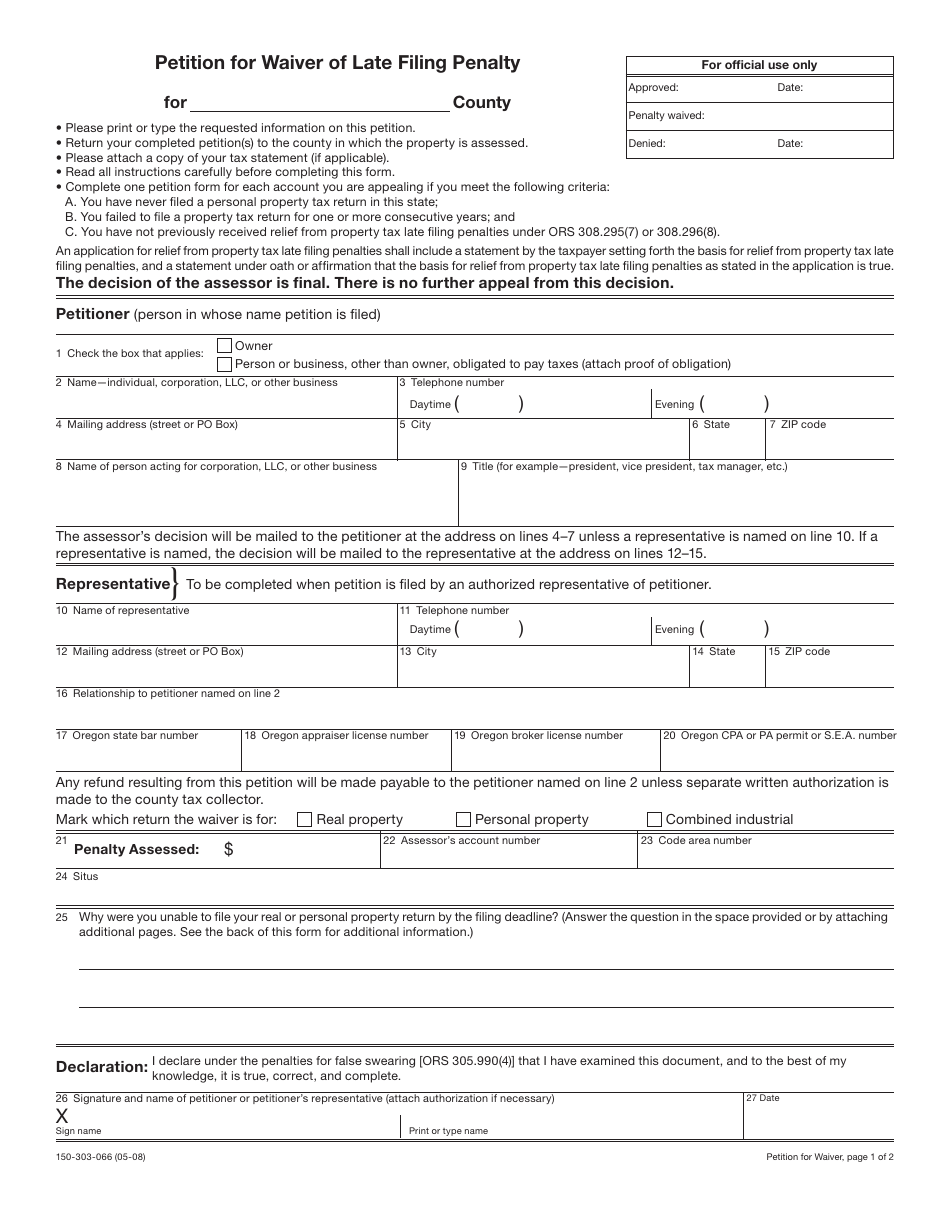

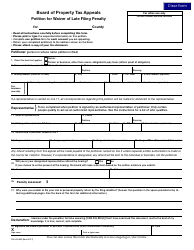

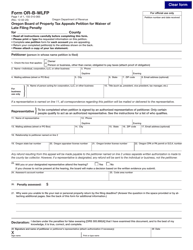

Form 150-303-066 Petition for Waiver of Late Filing Penalty - Oregon

What Is Form 150-303-066?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 150-303-066?

A: Form 150-303-066 is the Petition for Waiver of Late Filing Penalty in Oregon.

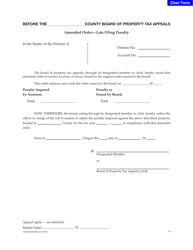

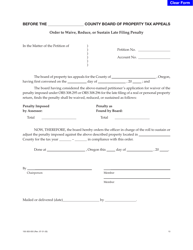

Q: What is the purpose of form 150-303-066?

A: The purpose of form 150-303-066 is to request a waiver of the late filing penalty in Oregon.

Q: When should I use form 150-303-066?

A: You should use form 150-303-066 if you are requesting a waiver of the late filing penalty in Oregon.

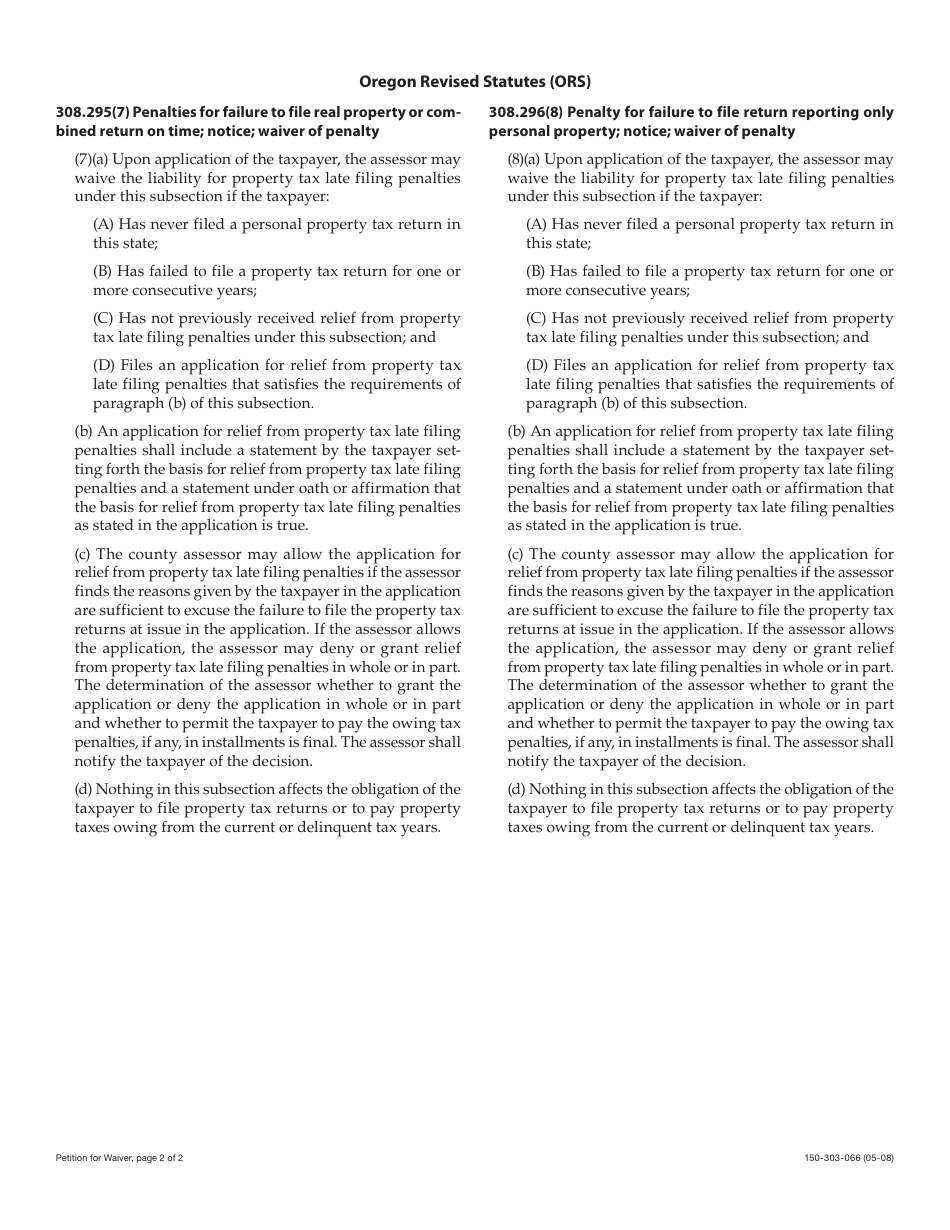

Q: Are there any eligibility requirements to use form 150-303-066?

A: Yes, there are eligibility requirements to use form 150-303-066. You must meet certain criteria to be eligible for a waiver of the late filing penalty.

Q: Is there a deadline for submitting form 150-303-066?

A: Yes, there is a deadline for submitting form 150-303-066. It should be submitted within a specific timeframe.

Q: What happens after I submit form 150-303-066?

A: After you submit form 150-303-066, the Oregon Department of Revenue will review your request for a waiver of the late filing penalty.

Q: Can I appeal if my request for a waiver is denied?

A: Yes, you can appeal if your request for a waiver of the late filing penalty is denied. There is a process for appealing the decision.

Q: Are there any fees associated with using form 150-303-066?

A: There may be fees associated with using form 150-303-066. You should check the instructions on the form or contact the Oregon Department of Revenue for more information.

Form Details:

- Released on May 1, 2008;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 150-303-066 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.