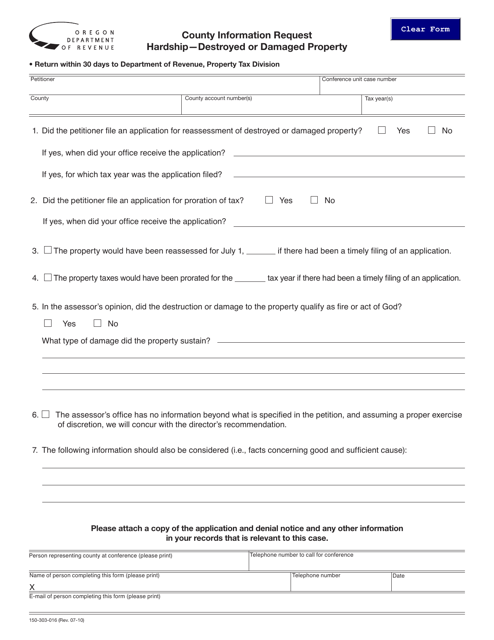

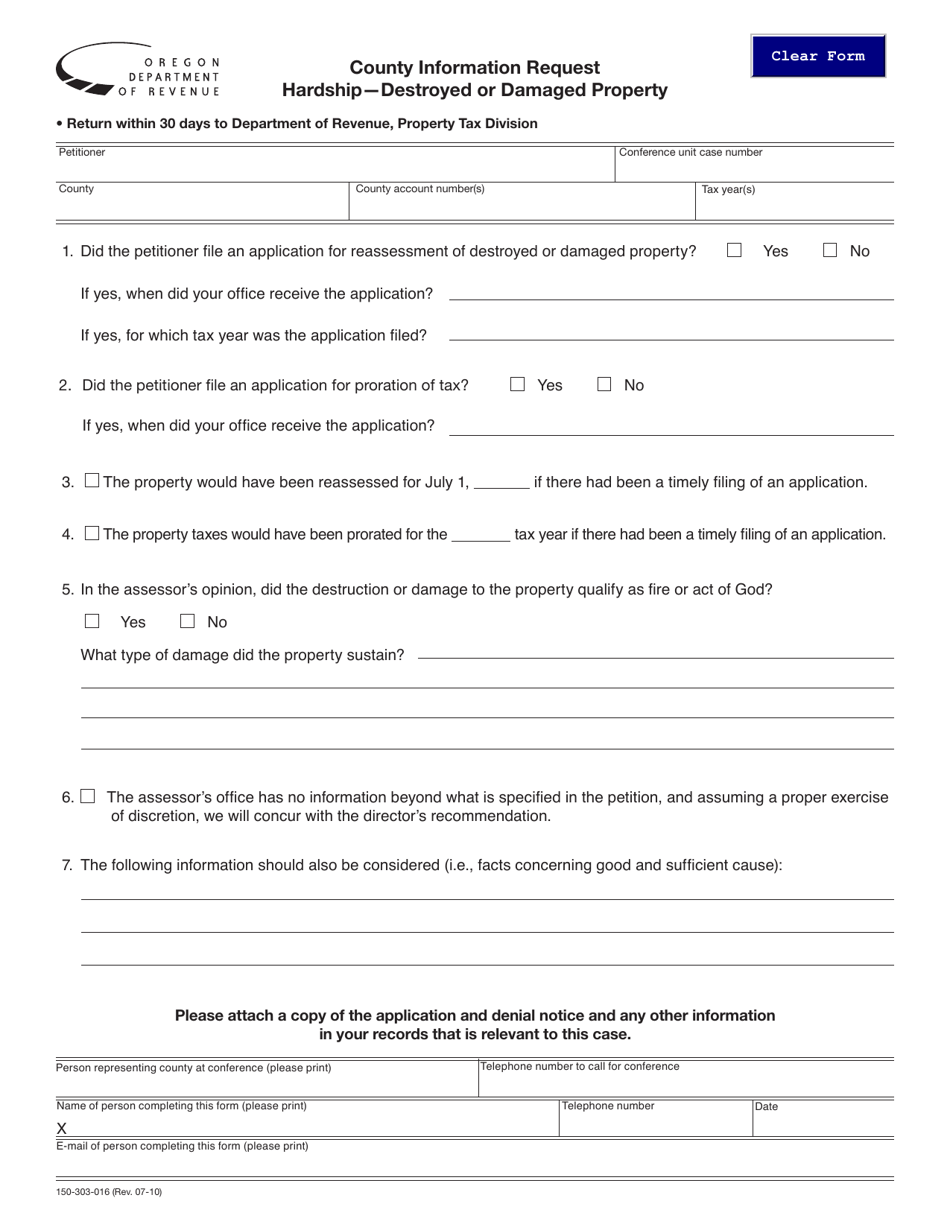

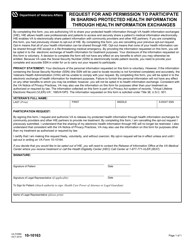

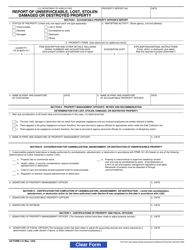

Form 150-303-016 County Information Request - Hardship - Destroyed or Damaged Property - Oregon

What Is Form 150-303-016?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-303-016?

A: Form 150-303-016 is the County Information Request form for reporting hardship due to destroyed or damaged property in Oregon.

Q: When should I use Form 150-303-016?

A: You should use Form 150-303-016 if you have experienced hardship due to the destruction or damage of your property in Oregon.

Q: What is the purpose of Form 150-303-016?

A: The purpose of Form 150-303-016 is to gather information about the hardship caused by the destruction or damage of property in Oregon.

Q: Do I need to submit any supporting documents with Form 150-303-016?

A: Yes, you may need to submit supporting documents such as photographs, repair estimates, or insurance claim information to substantiate your hardship claim.

Q: Who is eligible to use Form 150-303-016?

A: Any individual or household that has suffered hardship due to the destruction or damage of their property in Oregon may be eligible to use Form 150-303-016.

Q: Are there any deadlines for submitting Form 150-303-016?

A: The deadline for submitting Form 150-303-016 may vary depending on the specific instructions provided by your county assessor's office. It is recommended to contact them directly for the deadline.

Q: What happens after I submit Form 150-303-016?

A: After you submit Form 150-303-016, the county assessor's office will review your application and supporting documents. They will determine the eligibility and amount of any property tax relief you may receive.

Q: Can I appeal the decision made based on my Form 150-303-016?

A: Yes, if you disagree with the decision made based on your Form 150-303-016, you have the right to appeal the decision. Contact your county assessor's office for more information on the appeals process.

Q: Is there any cost associated with submitting Form 150-303-016?

A: There is no cost associated with submitting Form 150-303-016. However, you may incur expenses for obtaining necessary supporting documents or other related costs.

Form Details:

- Released on July 1, 2010;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-303-016 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.