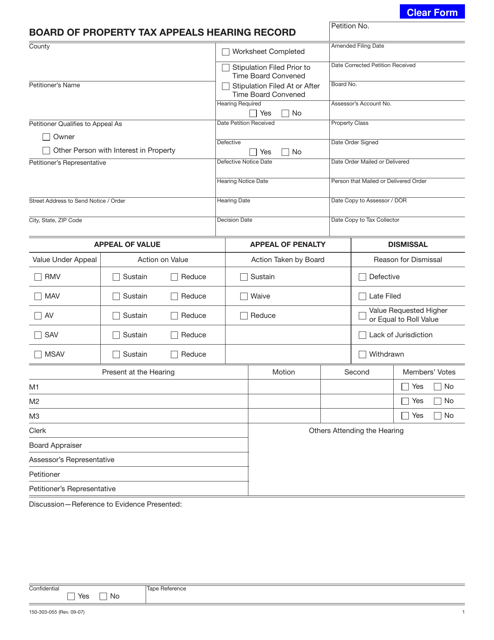

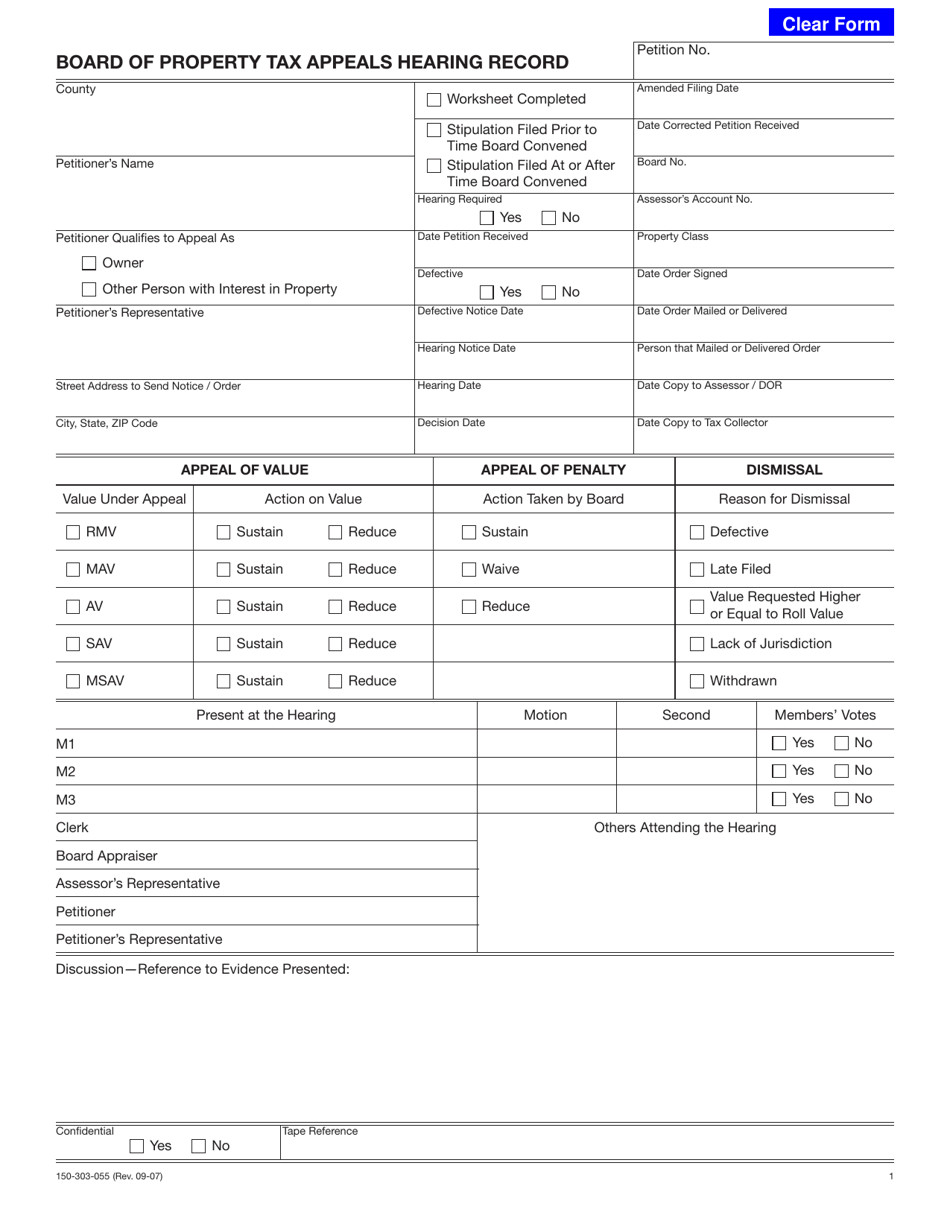

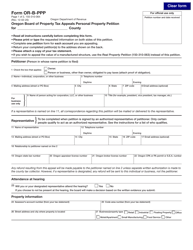

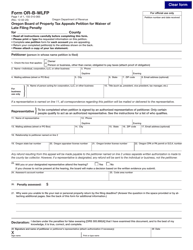

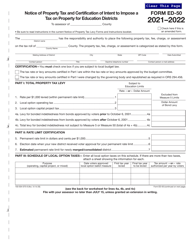

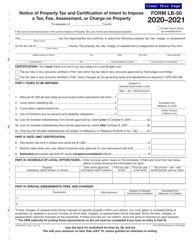

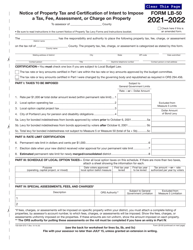

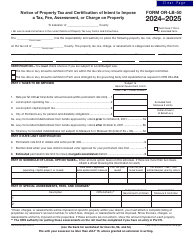

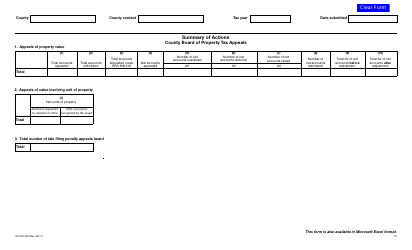

Form 150-303-055-1 Board of Property Tax Appeals Hearing Record - Oregon

What Is Form 150-303-055-1?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-303-055-1?

A: Form 150-303-055-1 is the Board of Property Tax Appeals Hearing Record in Oregon.

Q: What is the purpose of this form?

A: The purpose of this form is to document the proceedings and evidence presented during a property tax appeals hearing.

Q: Who uses this form?

A: This form is used by the Board of Property Tax Appeals in Oregon.

Q: What information is included in this form?

A: This form includes details about the property being appealed, the parties involved, the hearing date and location, as well as space to record the hearing proceedings and the evidence presented.

Q: Is this form mandatory for property tax appeals in Oregon?

A: Yes, this form is mandatory for property tax appeals in Oregon and must be completed and submitted to the Board of Property Tax Appeals.

Q: Are there any fees associated with filing this form?

A: There are no fees associated with filing Form 150-303-055-1, Board of Property Tax Appeals Hearing Record.

Q: Can I appeal a property tax assessment without using this form?

A: No, in order to appeal a property tax assessment in Oregon, you must complete and submit Form 150-303-055-1, Board of Property Tax Appeals Hearing Record.

Q: What should I do if I need assistance with filling out this form?

A: If you need assistance with filling out this form, you can contact the Oregon Department of Revenue or consult with a tax professional for guidance.

Form Details:

- Released on September 1, 2007;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

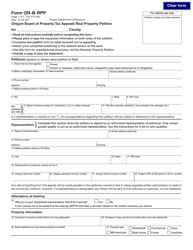

Download a fillable version of Form 150-303-055-1 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.