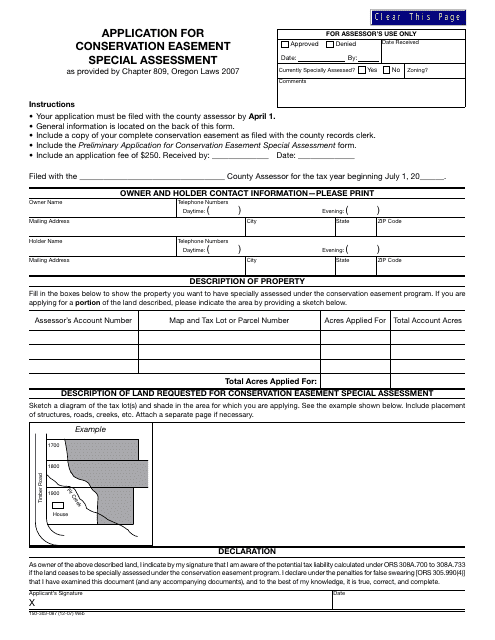

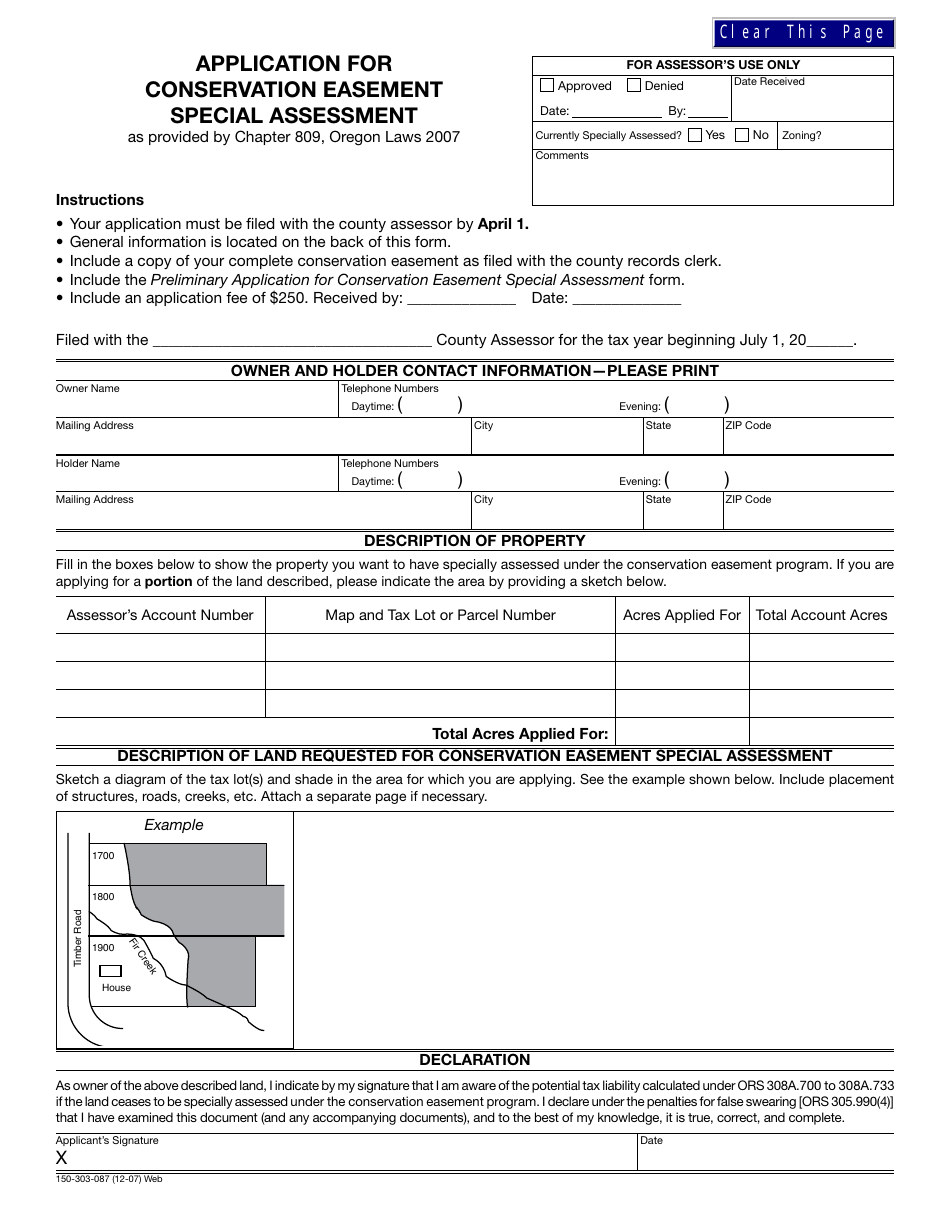

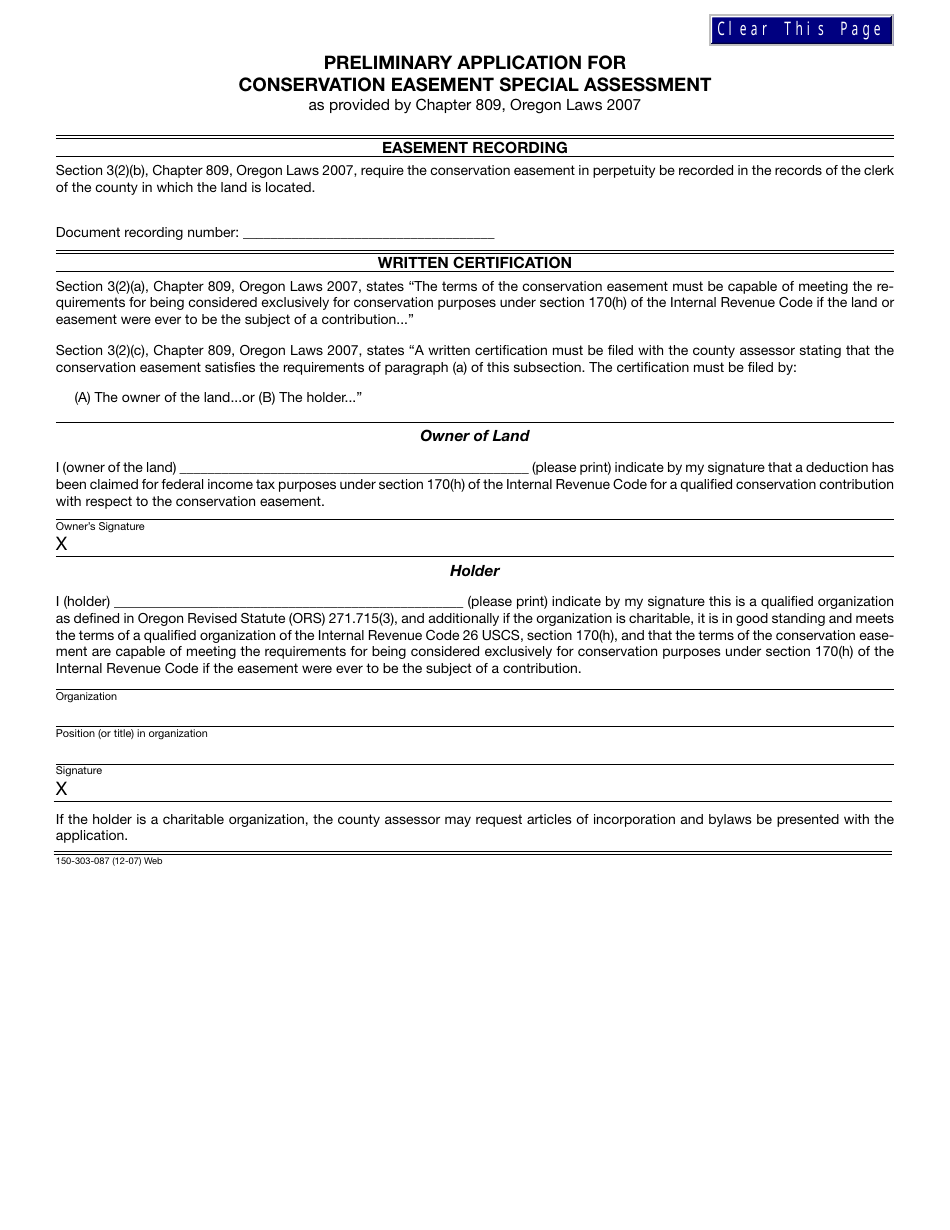

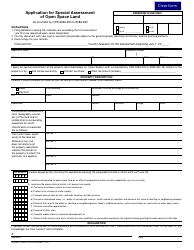

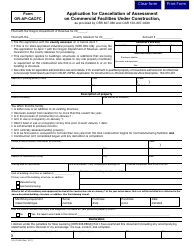

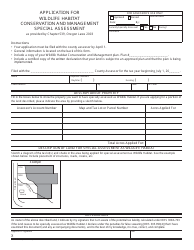

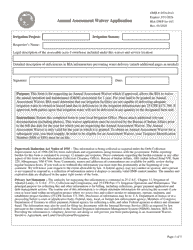

Form 150-303-087 Application for Conservation Easement Special Assessment - Oregon

What Is Form 150-303-087?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-303-087?

A: Form 150-303-087 is an application for Conservation EasementSpecial Assessment in Oregon.

Q: What is a Conservation Easement?

A: A Conservation Easement is a voluntary legal agreement that limits certain uses or development of a property to protect its natural, historical, or cultural resources.

Q: What is the Special Assessment for Conservation Easement?

A: The Special Assessment for Conservation Easement is a property tax program in Oregon that provides eligible landowners with a reduced property tax assessment on land subject to a qualifying Conservation Easement.

Q: Who is eligible to apply for the Special Assessment?

A: Landowners in Oregon who have a qualifying Conservation Easement on their property may be eligible to apply for the Special Assessment.

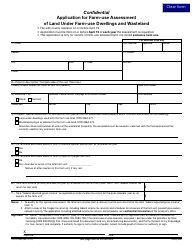

Q: What information is required on the application form?

A: The application form requires information about the landowner, the property with the Conservation Easement, and details about the easement itself.

Q: Are there any deadlines for submitting the application form?

A: Yes, the application form must be submitted to the Oregon Department of Revenue by April 1st of each year to be considered for the Special Assessment.

Q: What benefits does the Special Assessment provide?

A: The Special Assessment provides eligible landowners with a reduced property tax assessment, which can result in significant cost savings.

Q: Are there any restrictions or obligations for participating in the Special Assessment program?

A: Yes, landowners participating in the Special Assessment program must fulfill certain obligations, such as the continued maintenance and adherence to the terms of the Conservation Easement.

Form Details:

- Released on December 1, 2007;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-303-087 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.