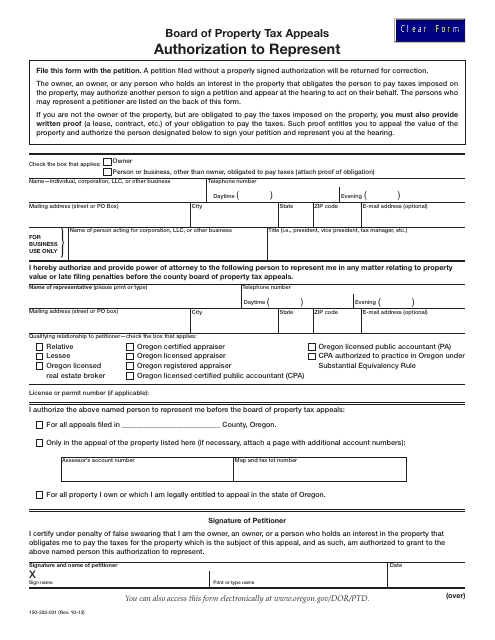

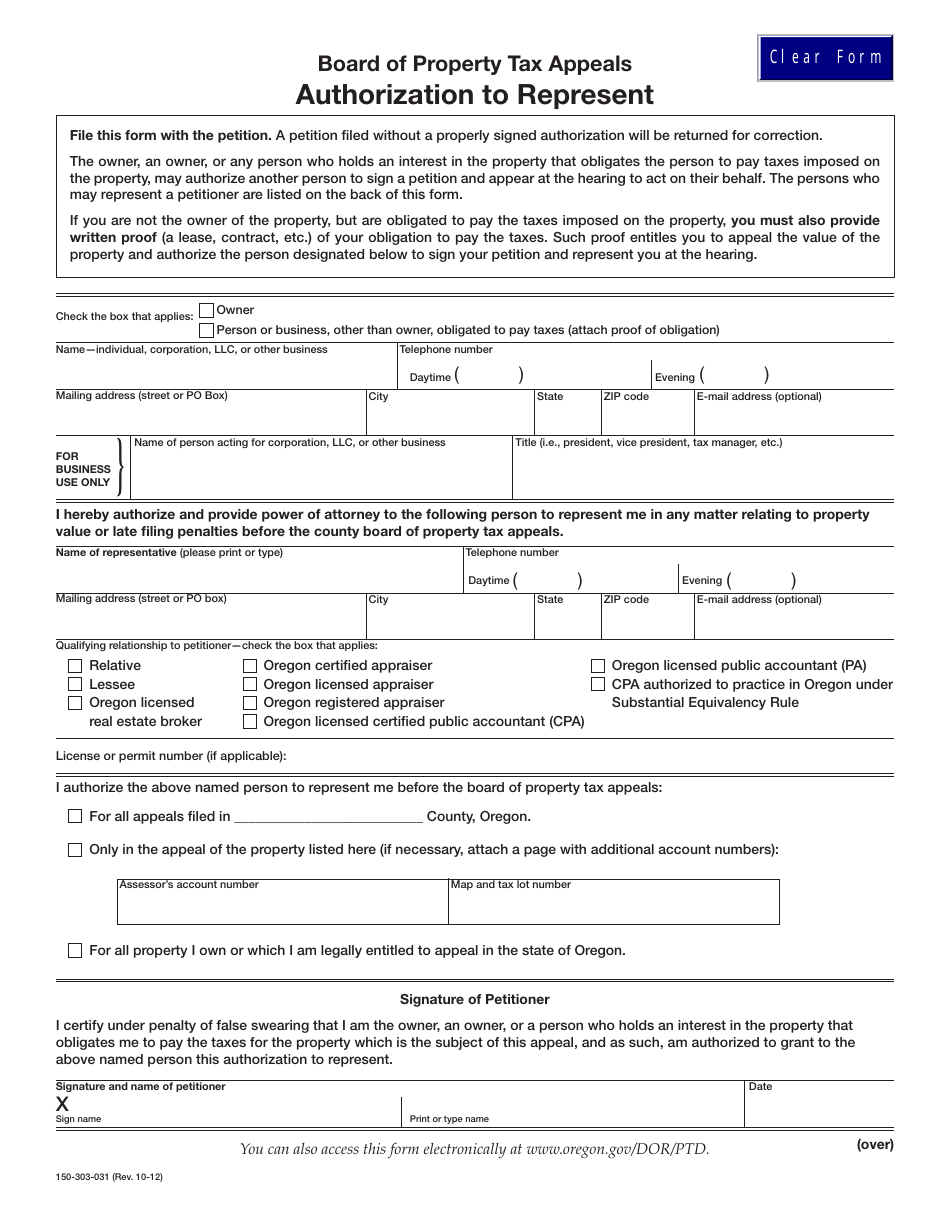

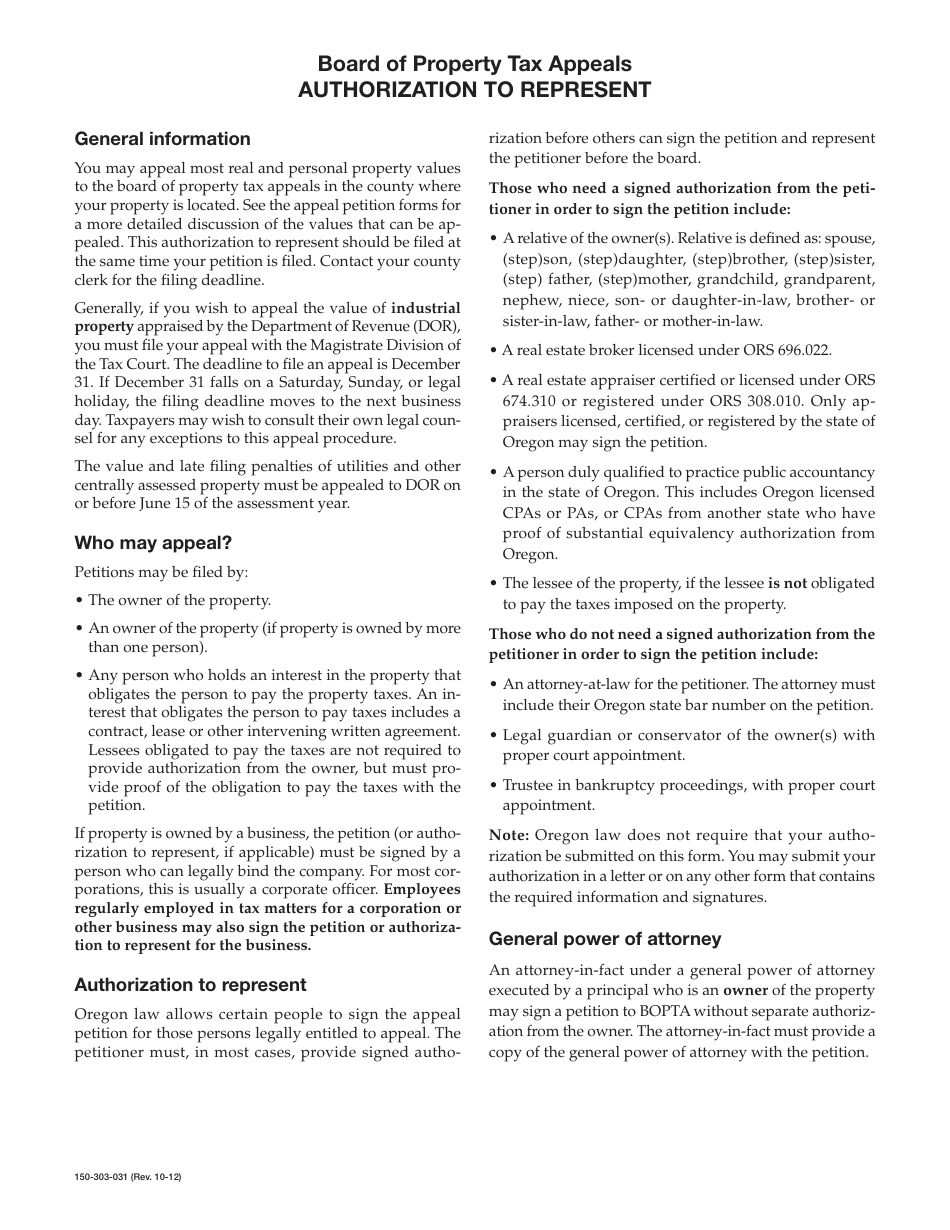

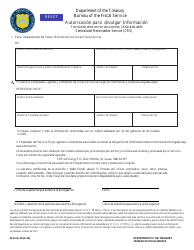

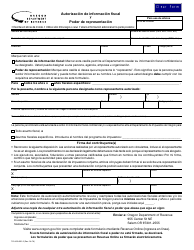

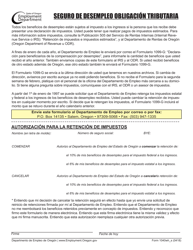

Form 150-303-031 Authorization to Represent - Oregon

What Is Form 150-303-031?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-303-031?

A: Form 150-303-031 is the Authorization to Represent form used in Oregon.

Q: What is the purpose of Form 150-303-031?

A: The purpose of Form 150-303-031 is to authorize someone to represent you in tax matters in Oregon.

Q: Who needs to fill out Form 150-303-031?

A: You need to fill out Form 150-303-031 if you want to authorize someone to represent you in tax matters in Oregon.

Q: Is there a deadline for filing Form 150-303-031?

A: There is no specific deadline for filing Form 150-303-031, but it's recommended to submit it as soon as you want to authorize someone to represent you.

Form Details:

- Released on October 1, 2012;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-303-031 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.