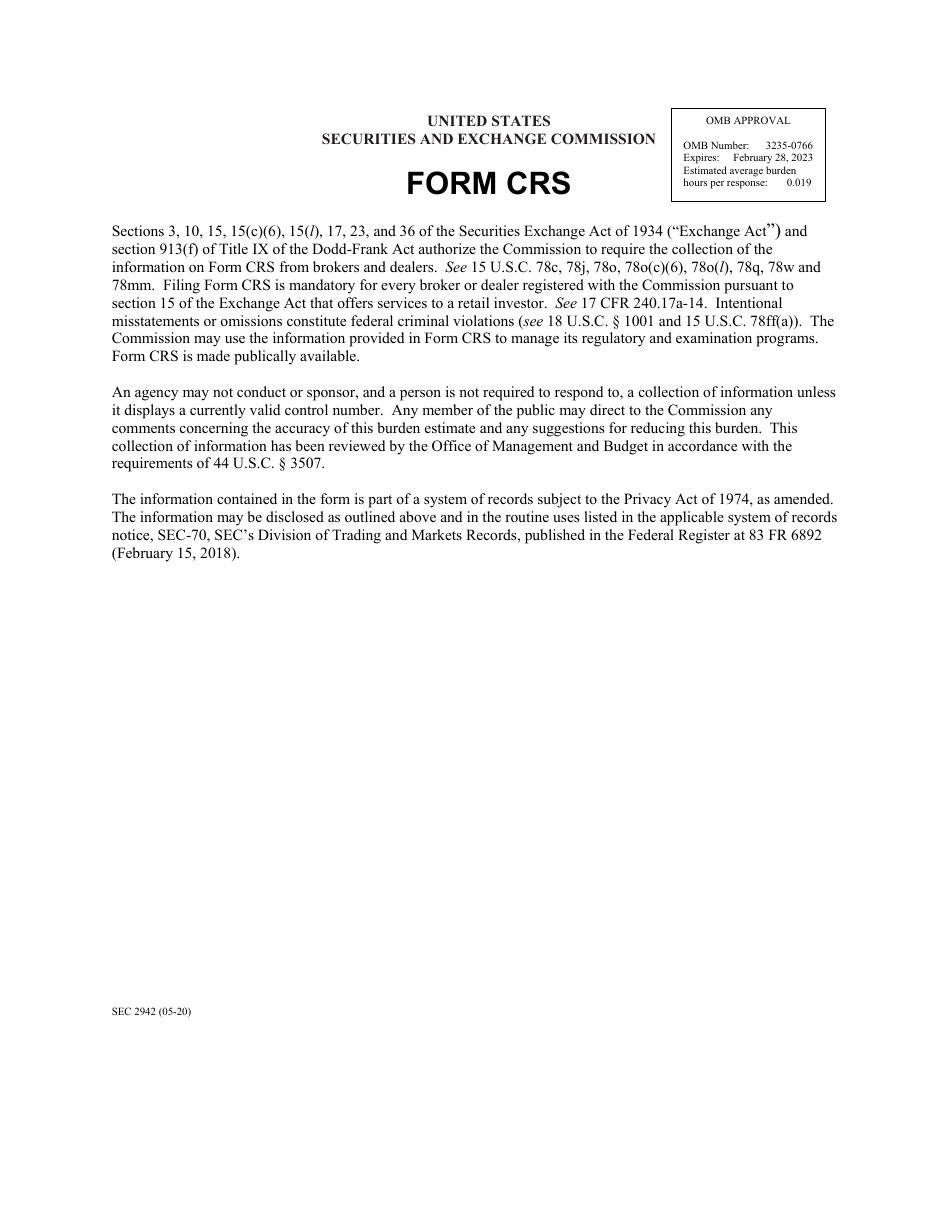

Form CRS (SEC Form 2942) Customer Relationship Summary

What Is Form CRS (SEC Form 2942)?

This is a legal form that was released by the U.S. Securities and Exchange Commission on May 1, 2020 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CRS?

A: Form CRS is the Customer Relationship Summary form.

Q: Who uses Form CRS?

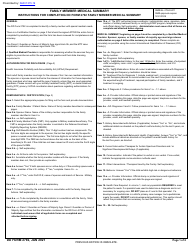

A: Financial firms use Form CRS to provide information to their clients about the services they offer, fees, costs, potential conflicts of interest, and disciplinary history.

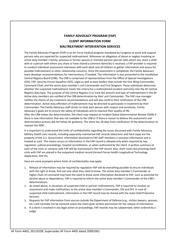

Q: What is the purpose of Form CRS?

A: The purpose of Form CRS is to help clients make informed decisions about their financial relationships with a firm.

Q: What information does Form CRS provide?

A: Form CRS provides information about the firm's services, fees, conflicts of interest, the legal standard of conduct that applies to the firm, and where to find additional information.

Q: What should clients do with Form CRS?

A: Clients should read and understand Form CRS before deciding to enter into a relationship with a financial firm.

Q: Is there a specific format for Form CRS?

A: Yes, Form CRS has a required format and specific content that must be included.

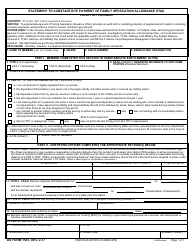

Form Details:

- Released on May 1, 2020;

- The latest available edition released by the U.S. Securities and Exchange Commission;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CRS (SEC Form 2942) by clicking the link below or browse more documents and templates provided by the U.S. Securities and Exchange Commission.