This version of the form is not currently in use and is provided for reference only. Download this version of

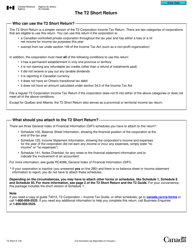

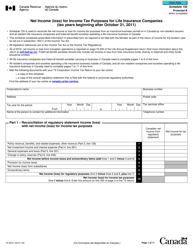

Form T3 Schedule 4

for the current year.

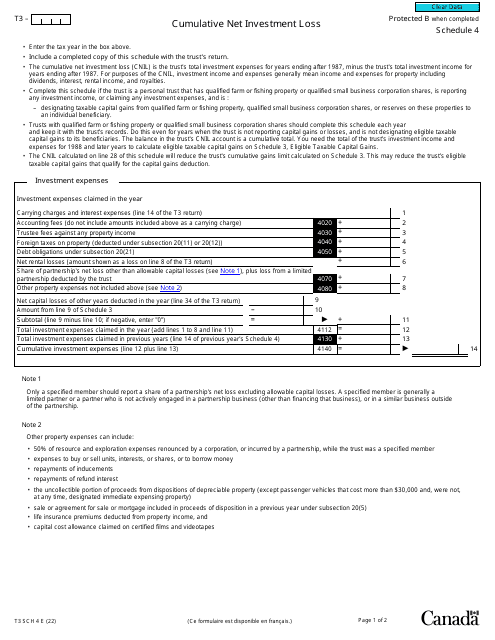

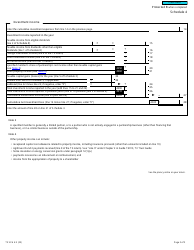

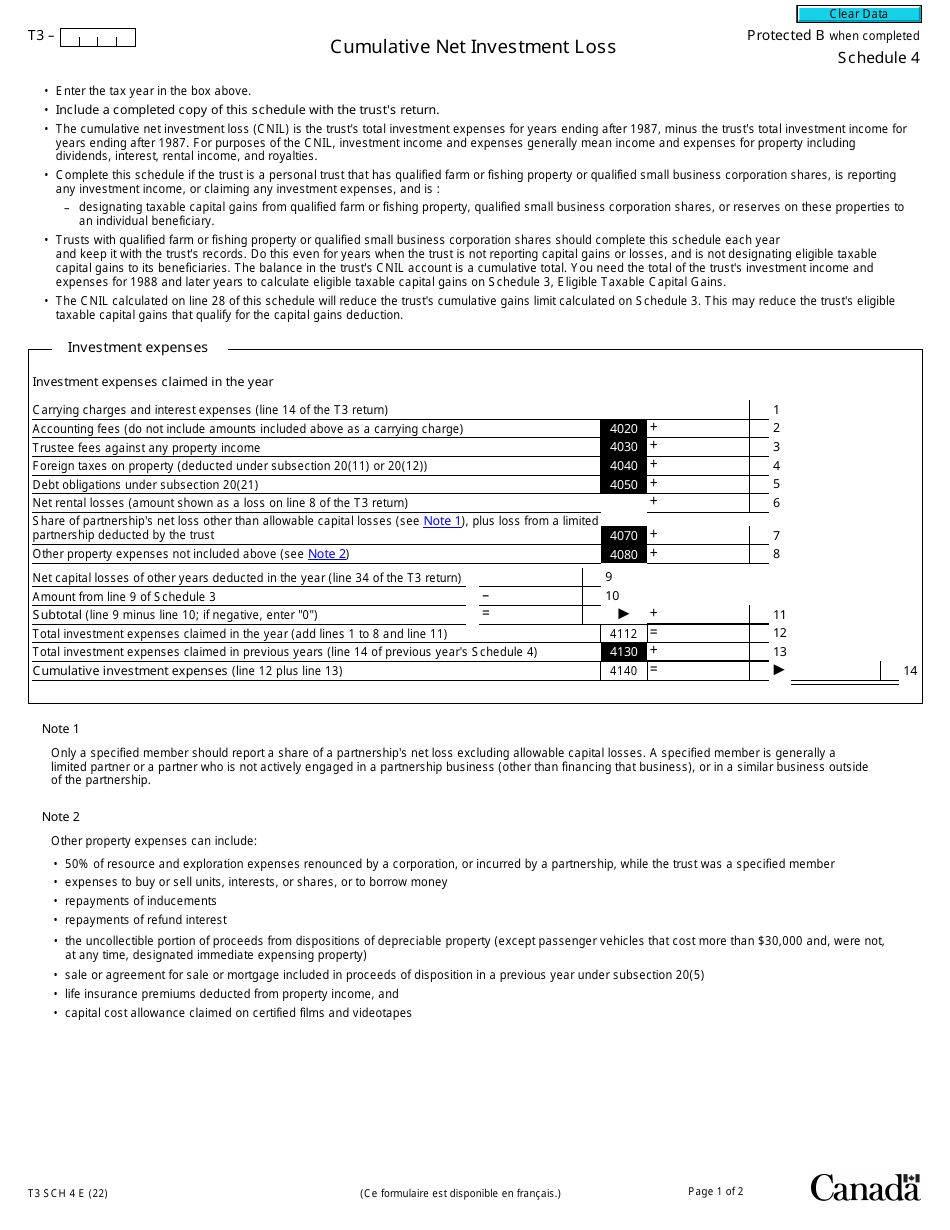

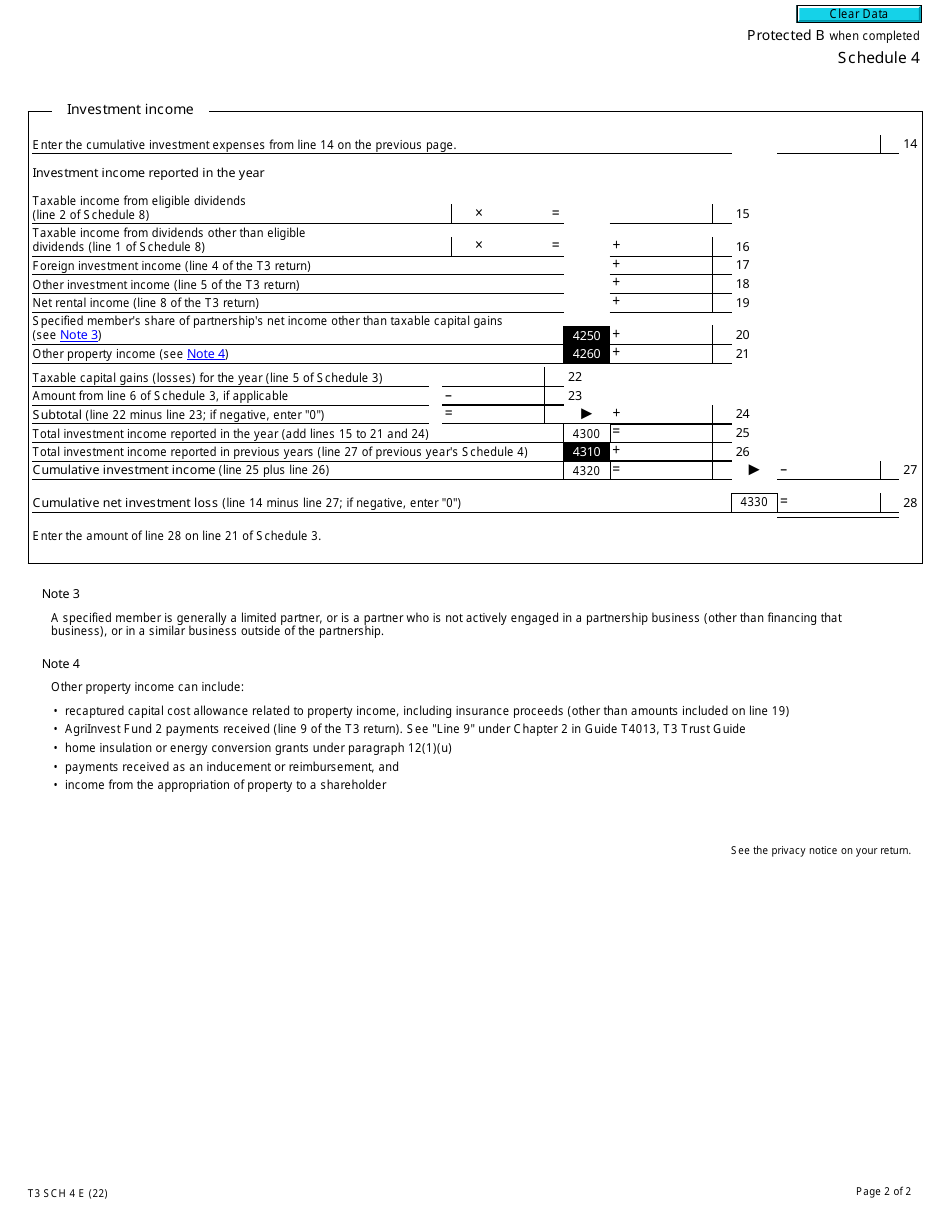

Form T3 Schedule 4 Cumulative Net Investment Loss - Canada

Form T3 Schedule 4 Cumulative Net Investment Loss is used in Canada to calculate and report any net investment losses that have accumulated over the years. It is typically filed by trusts to determine the amount of loss available to carry forward to future years for potential offset against future investment income.

The Form T3 Schedule 4 Cumulative Net Investment Loss in Canada is filed by individuals or corporations who have a net investment loss for the year.

FAQ

Q: What is Form T3 Schedule 4?

A: Form T3 Schedule 4 is a tax form used in Canada to calculate and report a cumulative net investment loss.

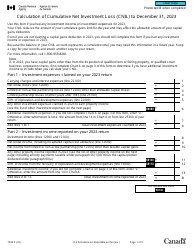

Q: What is a cumulative net investment loss?

A: A cumulative net investment loss refers to the total amount of investment losses that have been incurred by an individual or entity over a period of time.

Q: Who needs to file Form T3 Schedule 4?

A: Individuals or entities in Canada who have incurred a cumulative net investment loss need to file Form T3 Schedule 4.

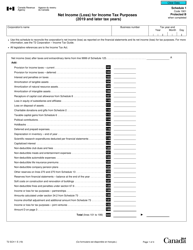

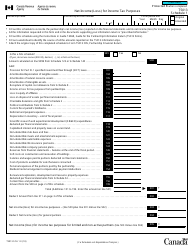

Q: What information is required to complete Form T3 Schedule 4?

A: To complete Form T3 Schedule 4, you will need to provide information about your investment losses, including the type of investment, the amount of the loss, and any previous carryovers.

Q: When is the deadline to file Form T3 Schedule 4?

A: The deadline to file Form T3 Schedule 4 is generally the same as the deadline for filing your income tax return in Canada, which is April 30th for most individuals.

Q: Are there any penalties for not filing Form T3 Schedule 4?

A: Yes, if you are required to file Form T3 Schedule 4 and fail to do so, you may be subject to penalties and interest charges by the Canada Revenue Agency.

Q: Can I carry forward a net investment loss to future years?

A: Yes, you can carry forward a net investment loss to future years to offset against any future investment income.

Q: Do I need to attach any supporting documents with Form T3 Schedule 4?

A: You may be required to attach supporting documents, such as statements or receipts, to substantiate the investment losses reported on Form T3 Schedule 4.

Q: Can I claim a refund for my cumulative net investment loss?

A: No, a cumulative net investment loss cannot be claimed as a refund. It can only be used to offset future investment income.