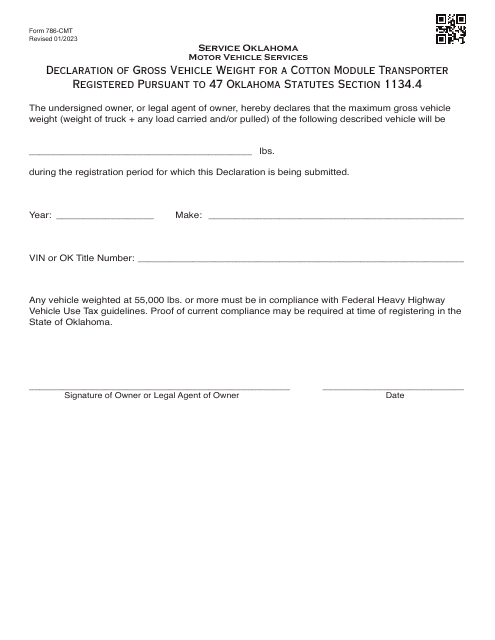

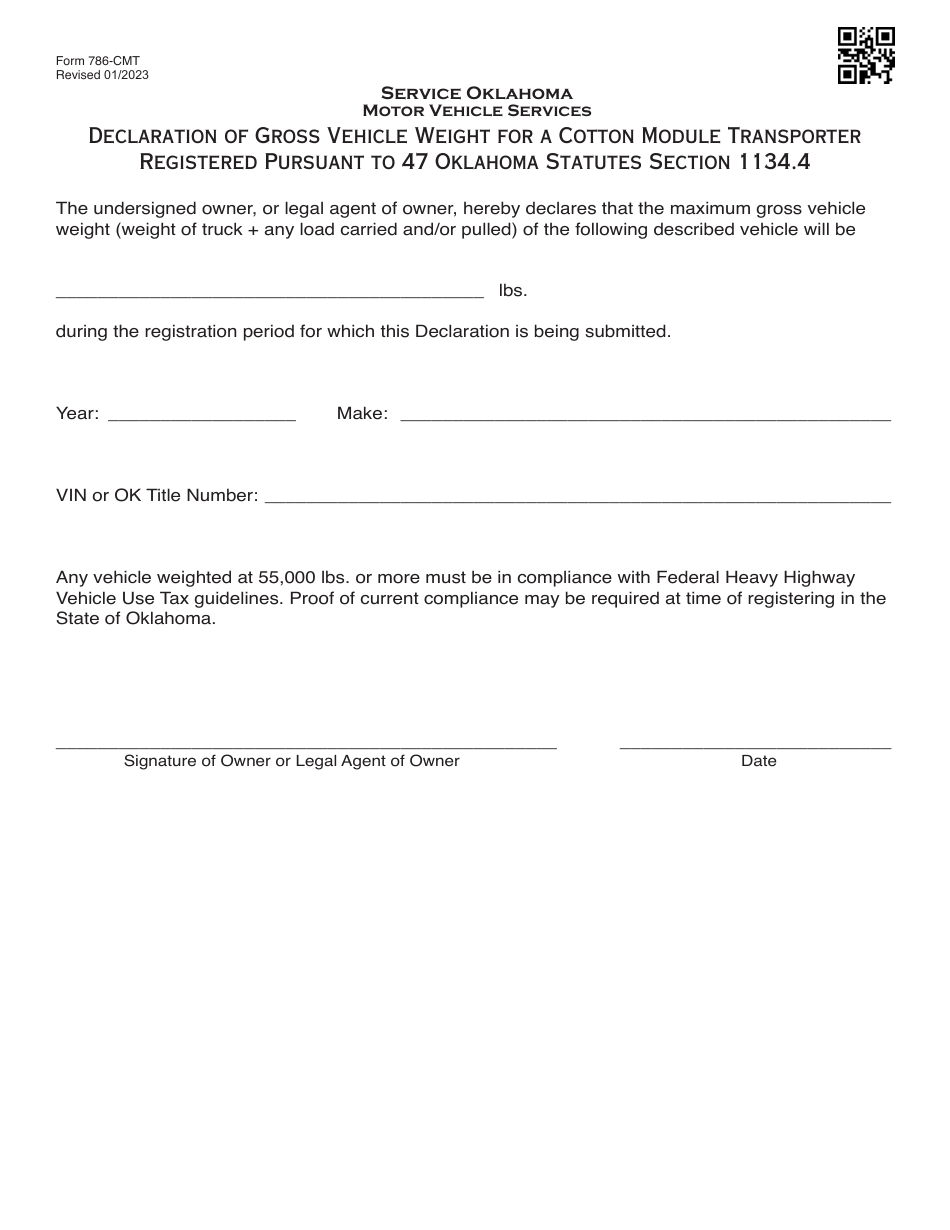

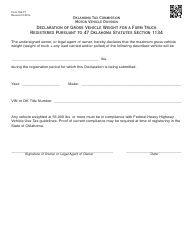

Form 786-CMT Declaration of Gross Vehicle Weight for a Cotton Module Transporter - Oklahoma

What Is Form 786-CMT?

This is a legal form that was released by the Oklahoma Office of Management and Enterprise Services - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 786-CMT?

A: Form 786-CMT is a declaration of gross vehicle weight for a Cotton Module Transporter.

Q: Who needs to fill out Form 786-CMT?

A: Anyone who operates a Cotton Module Transporter in Oklahoma needs to fill out this form.

Q: What is the purpose of Form 786-CMT?

A: The purpose of this form is to declare the gross vehicle weight of a Cotton Module Transporter, which is used to transport cotton modules.

Q: When do I need to submit Form 786-CMT?

A: You need to submit this form within 30 days of purchasing a Cotton Module Transporter or within 30 days of moving to Oklahoma with a Cotton Module Transporter.

Q: Are there any fees associated with Form 786-CMT?

A: Yes, there is a fee of $25 for filing this form.

Q: What happens if I don't submit Form 786-CMT?

A: Failure to submit this form can result in penalties and fines.

Q: Are there any additional requirements for operating a Cotton Module Transporter in Oklahoma?

A: Yes, you must also have a Cotton Module Transporter Permit and comply with other regulations set by the Oklahoma Tax Commission.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Oklahoma Office of Management and Enterprise Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 786-CMT by clicking the link below or browse more documents and templates provided by the Oklahoma Office of Management and Enterprise Services.