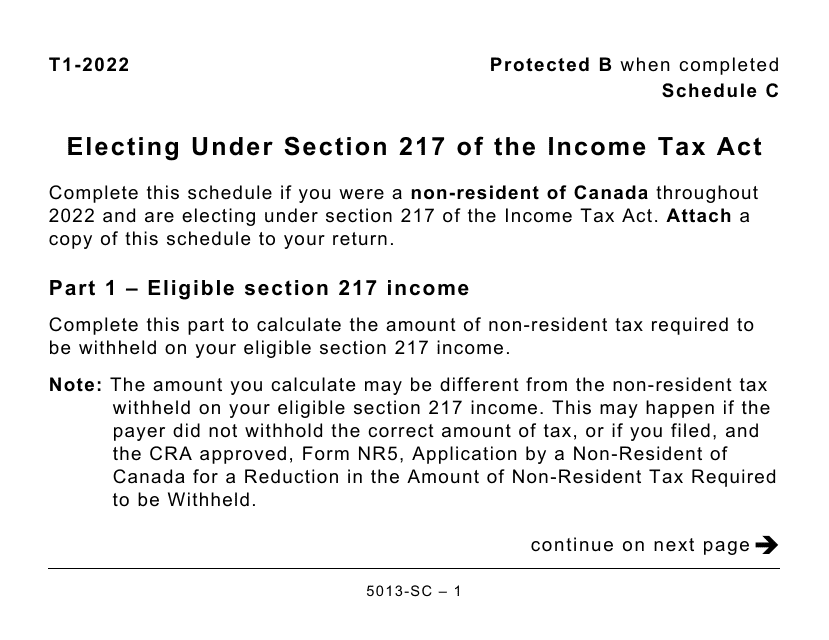

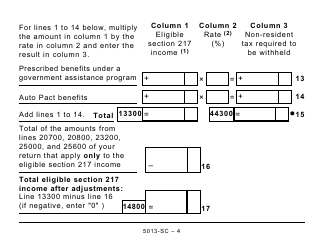

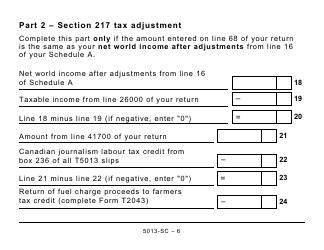

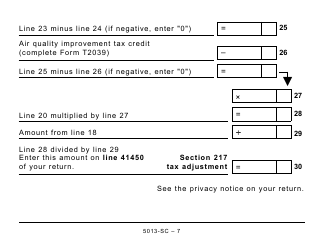

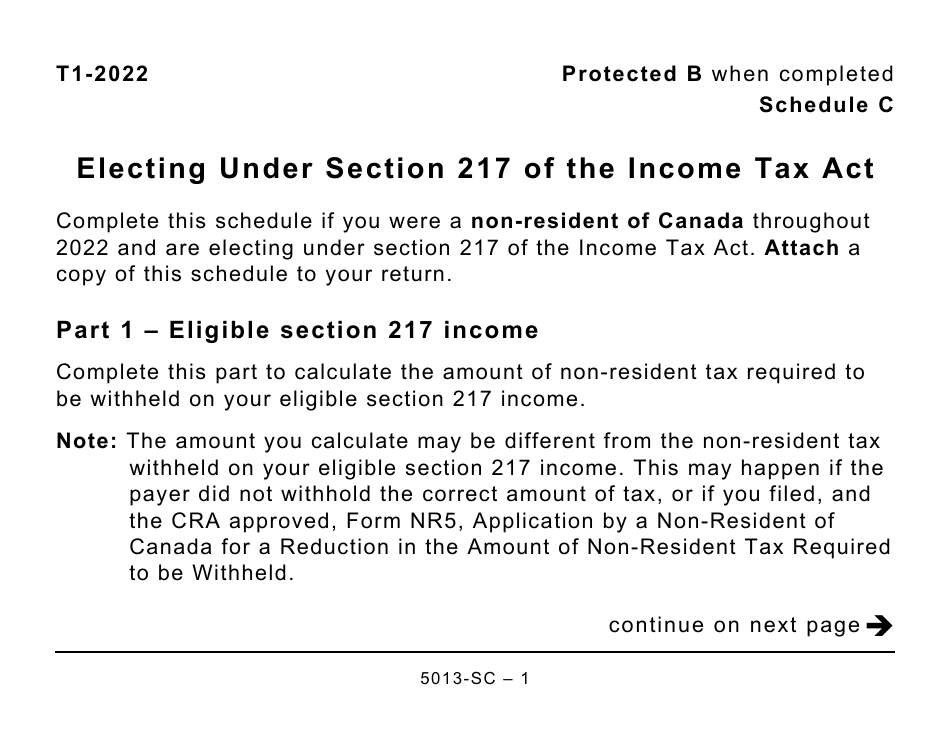

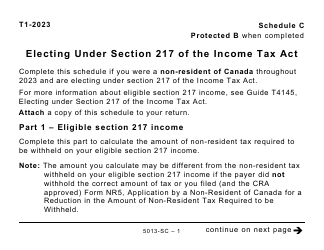

Form 5013-SC Schedule C Electing Under Section 217 of the Income Tax Act - Large Print - Canada

Form 5013-SC Schedule C Electing Under Section 217 of the Income Tax Act - Large Print is used in Canada for electing to claim deductions related to foreign employment income under Section 217 of the Income Tax Act.

The person who files the Form 5013-SC Schedule C Electing Under Section 217 of the Income Tax Act - Large Print in Canada is an individual taxpayer.

FAQ

Q: What is Form 5013-SC?

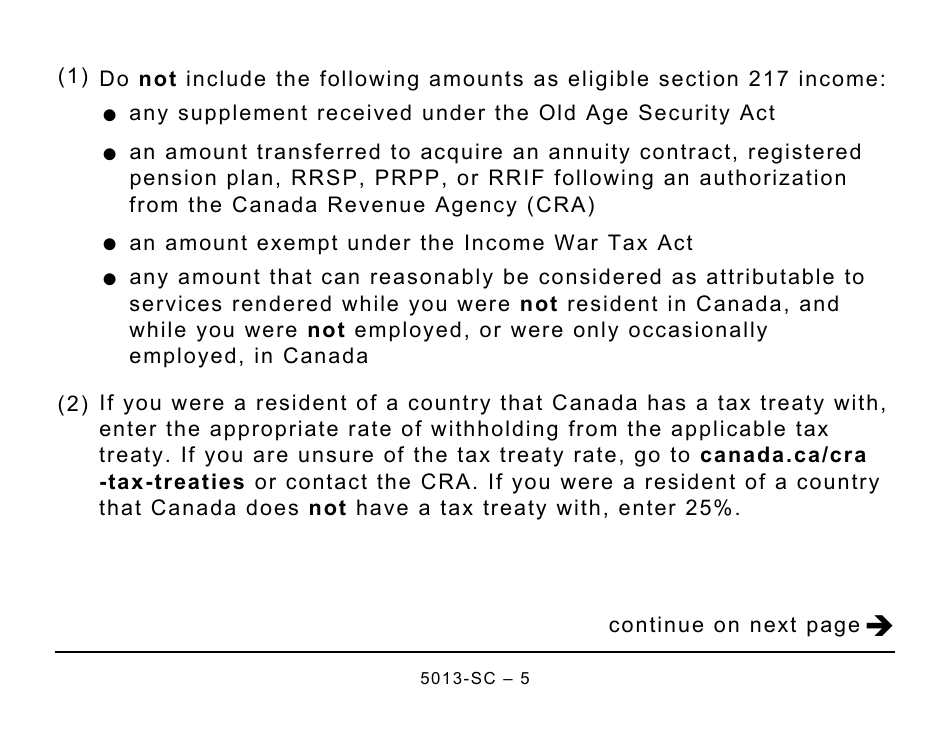

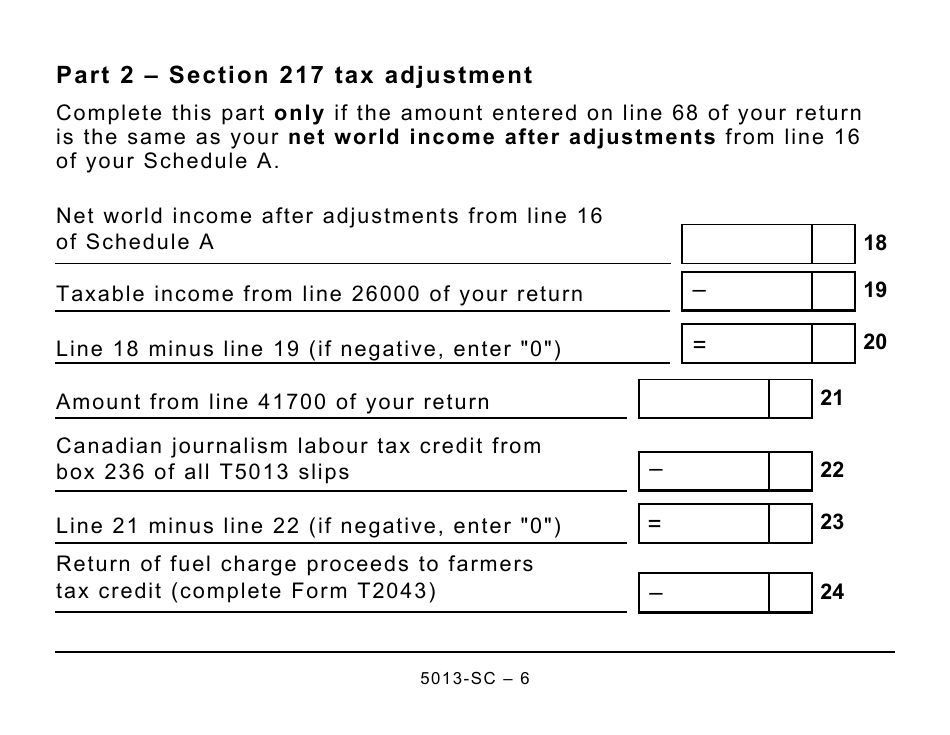

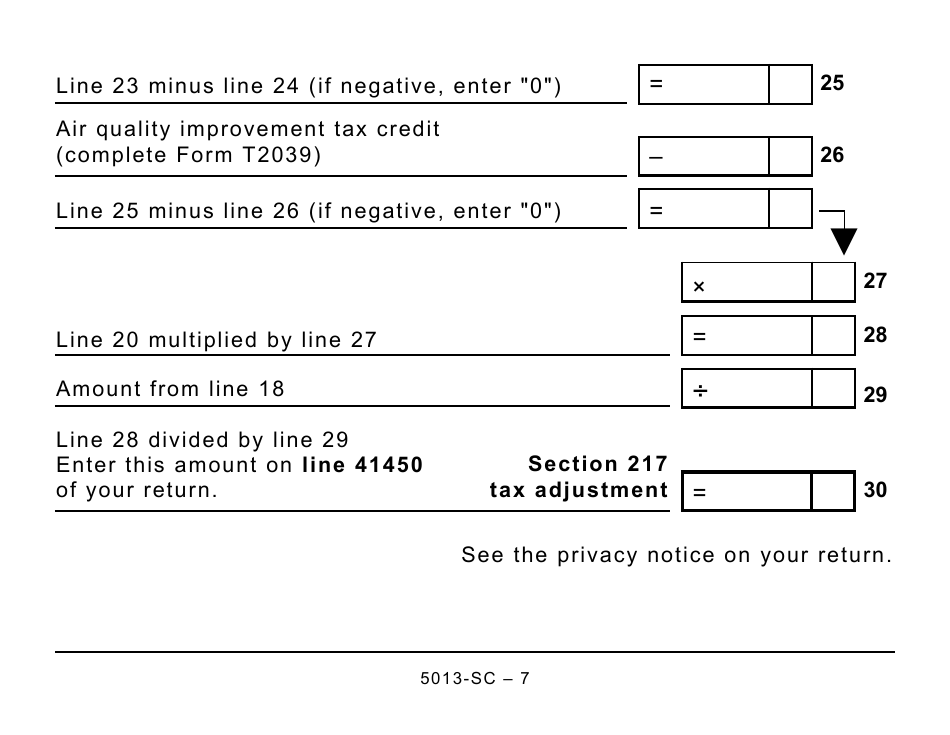

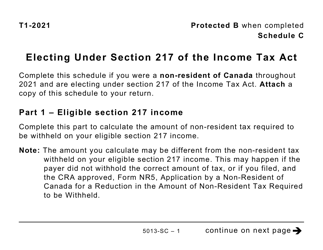

A: Form 5013-SC is a schedule for electing under Section 217 of the Income Tax Act in Canada.

Q: What is the purpose of Form 5013-SC?

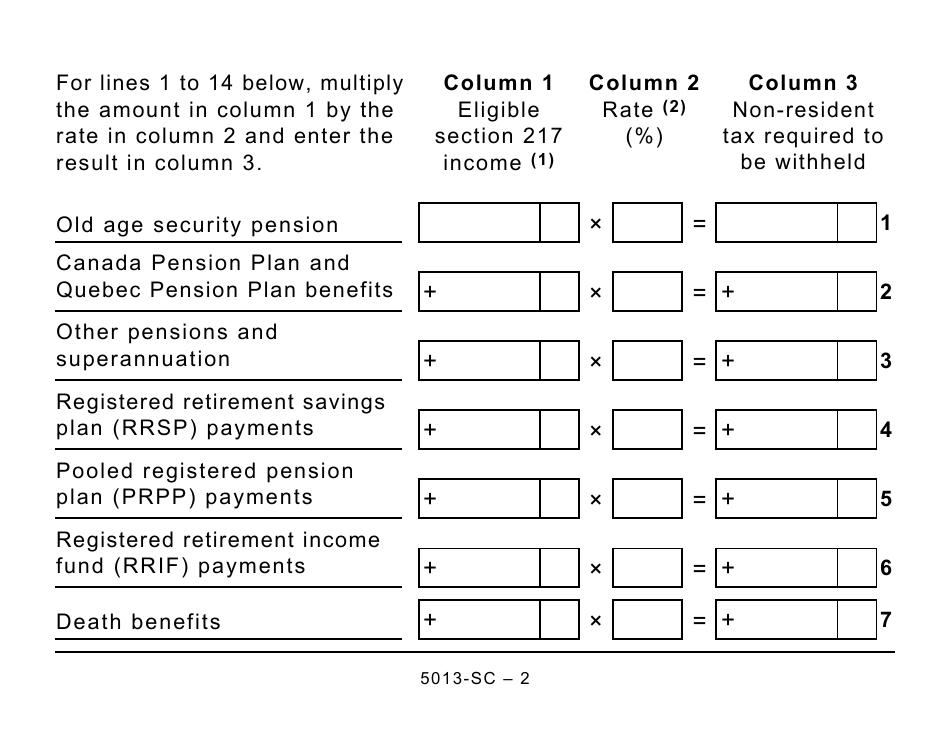

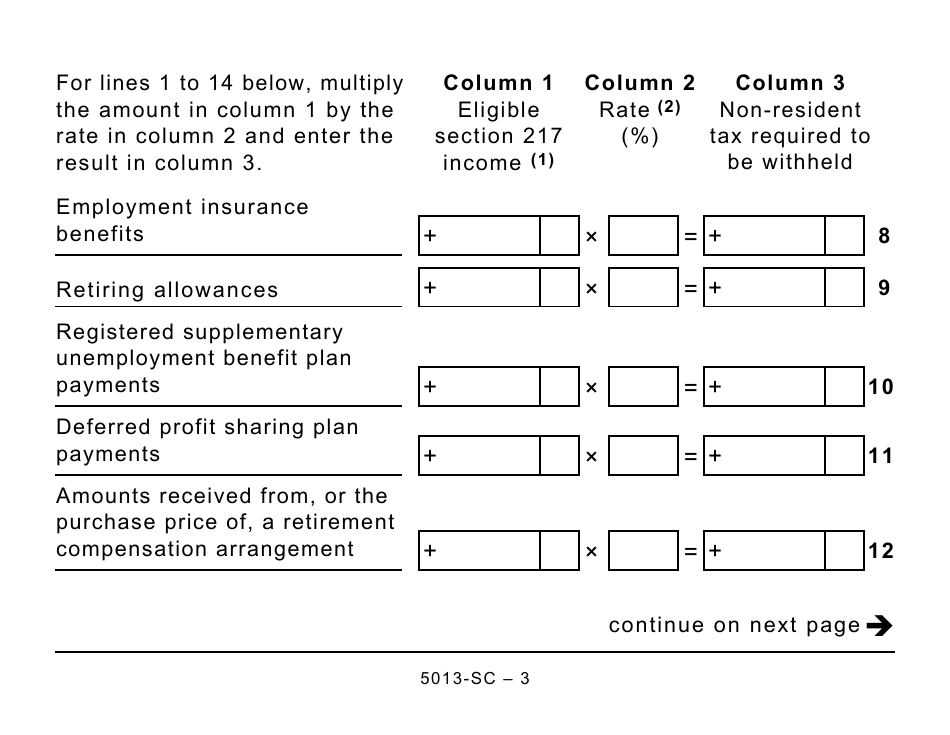

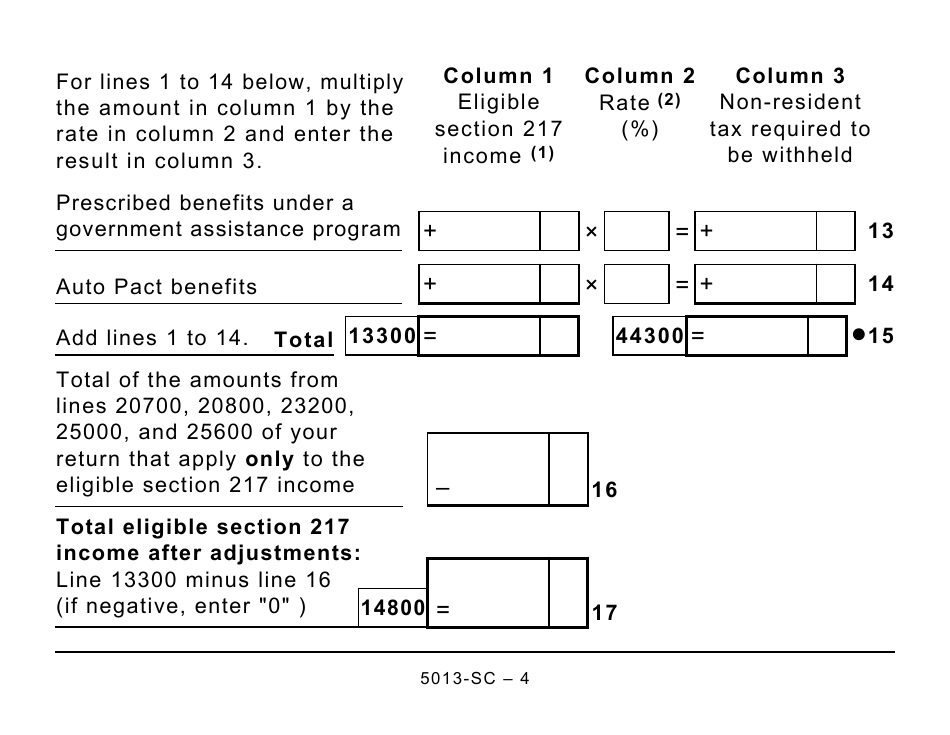

A: The purpose of Form 5013-SC is to elect to claim deductions in a specified manner when reporting foreign employment income.

Q: Who is required to use Form 5013-SC?

A: Individuals who have foreign employment income and want to claim deductions under Section 217 of the Income Tax Act in Canada.

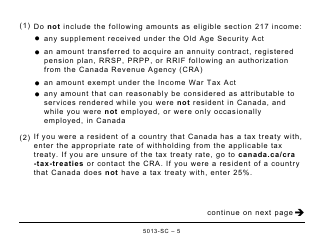

Q: What does electing under Section 217 mean?

A: Electing under Section 217 means choosing to report foreign employment income and claim deductions in a specific way.

Q: Is Form 5013-SC available in large print?

A: Yes, Form 5013-SC is available in large print for individuals who require it.