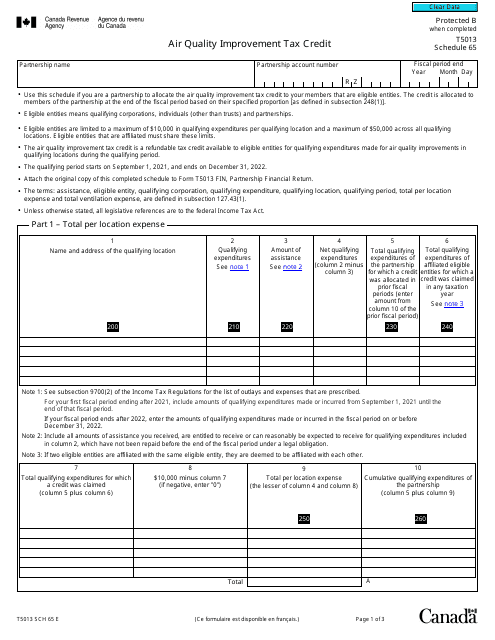

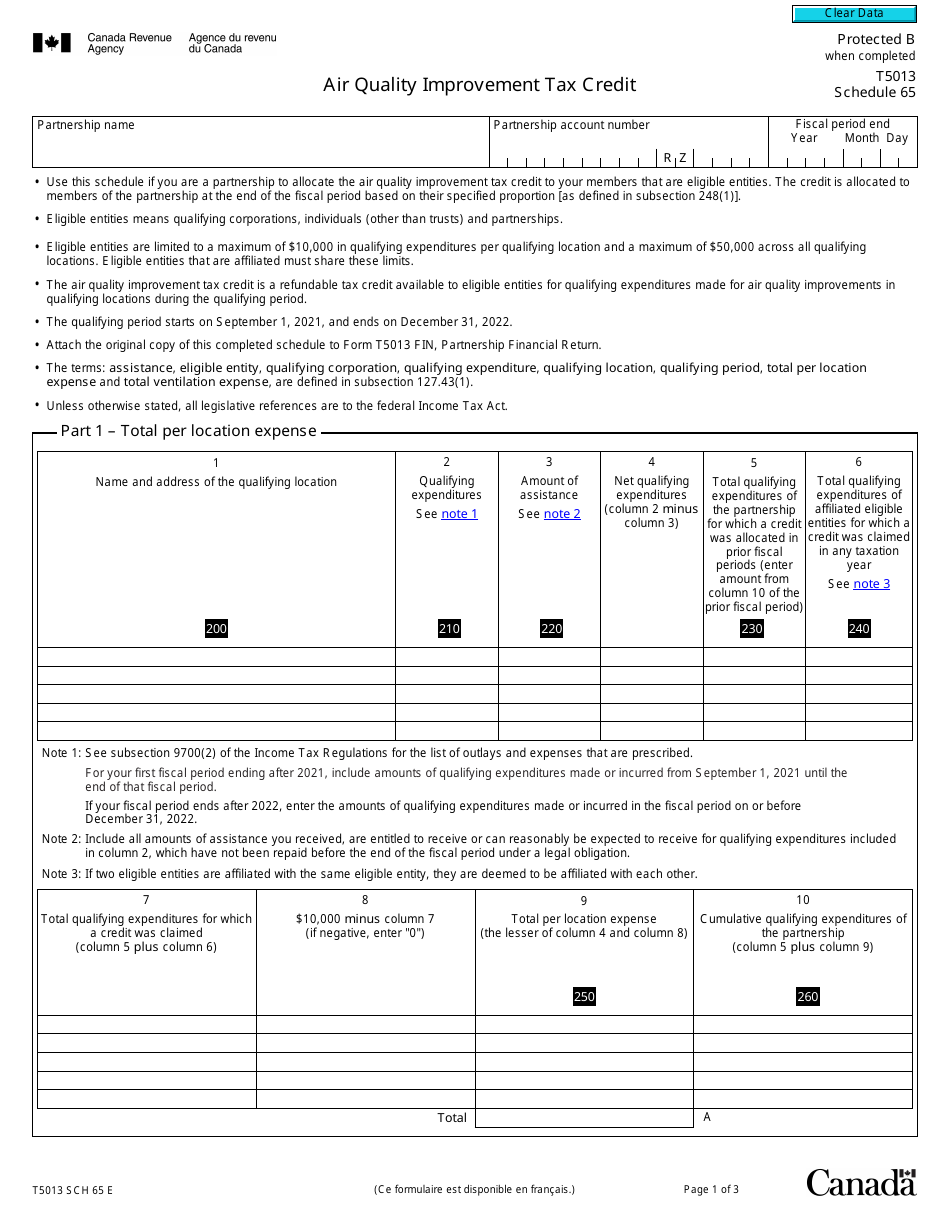

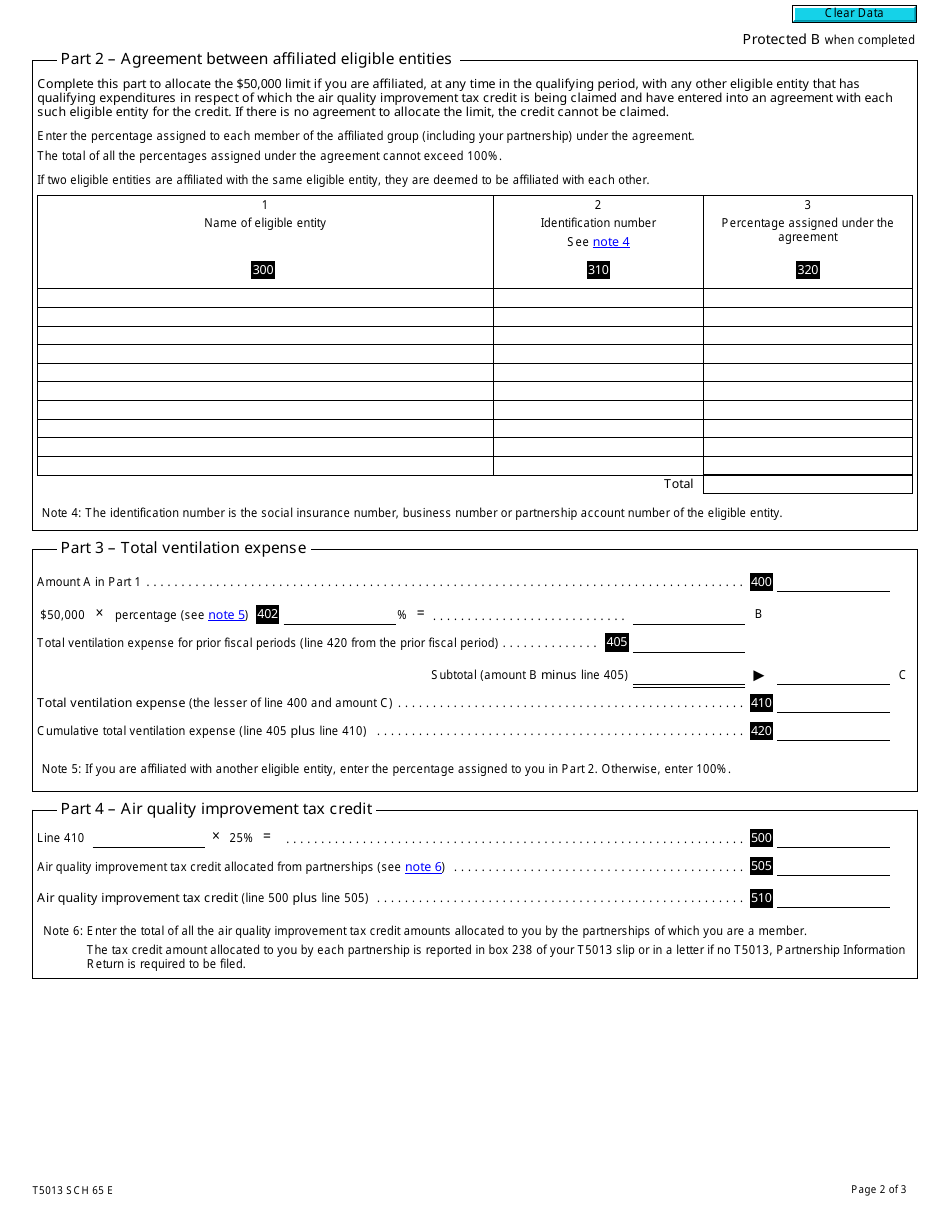

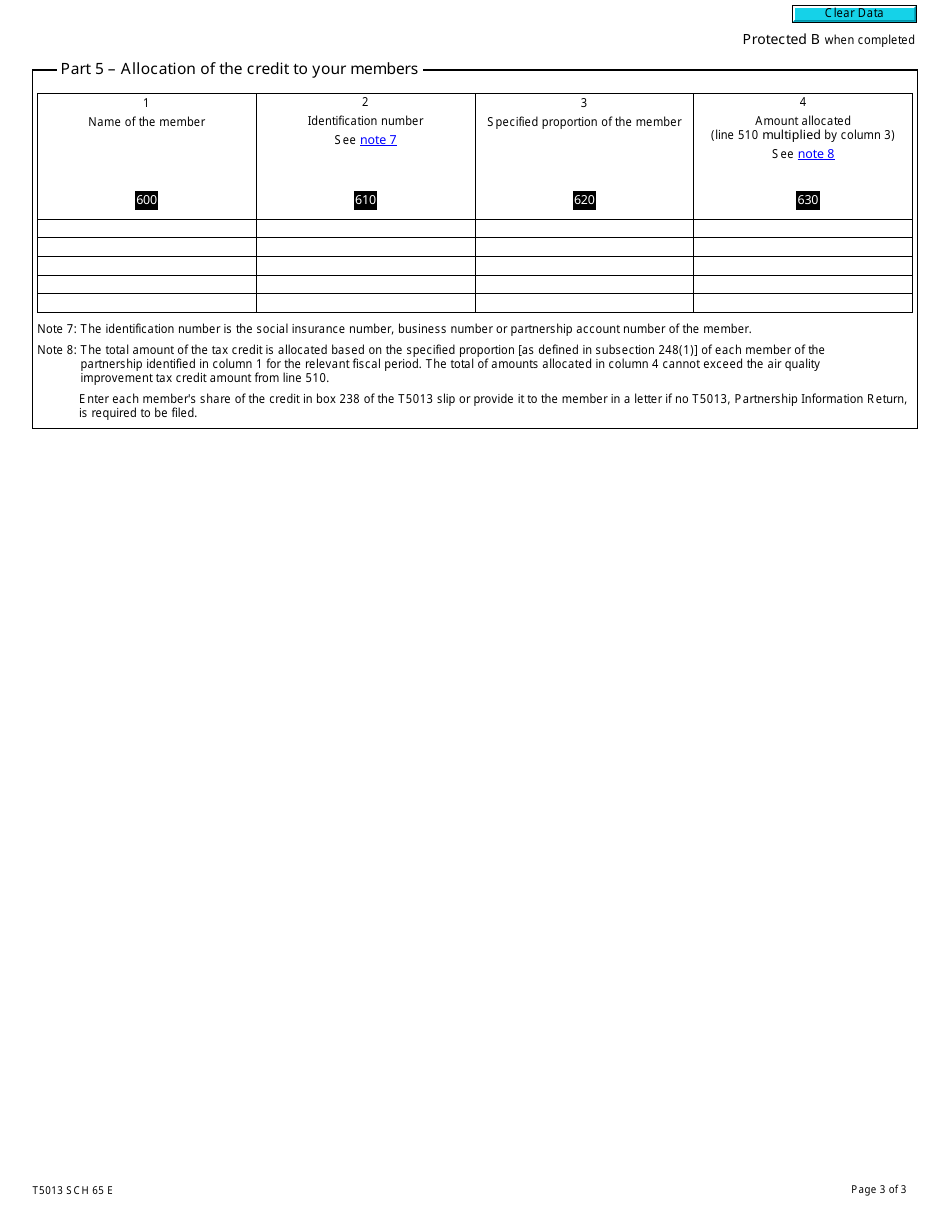

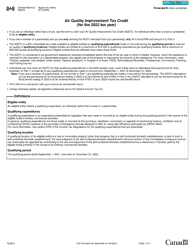

Form T5013 Schedule 65 Air Quality Improvement Tax Credit - Canada

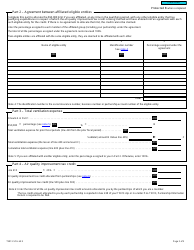

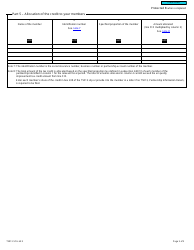

Form T5013 Schedule 65 Air Quality Improvement Tax Credit in Canada is used for claiming tax credits related to air quality improvement activities. It is a part of the T5013 Partnership Information Return.

The Form T5013 Schedule 65 Air Quality Improvement Tax Credit in Canada is filed by corporations that qualify for this tax credit.

FAQ

Q: What is the Form T5013 Schedule 65?

A: Form T5013 Schedule 65 is a tax form used in Canada to claim the Air Quality Improvement Tax Credit.

Q: What is the Air Quality Improvement Tax Credit?

A: The Air Quality Improvement Tax Credit is a tax credit in Canada designed to incentivize businesses to invest in projects that improve air quality.

Q: Who is eligible to claim the Air Quality Improvement Tax Credit?

A: Businesses in Canada that have made eligible investments in projects that improve air quality are eligible to claim this tax credit.

Q: What type of projects qualify for the Air Quality Improvement Tax Credit?

A: Projects that reduce greenhouse gas emissions, improve air quality, or develop clean energy sources may qualify for this tax credit.

Q: How much is the Air Quality Improvement Tax Credit?

A: The tax credit amount is based on the eligible expenditures made on qualifying projects, subject to certain criteria and limits.