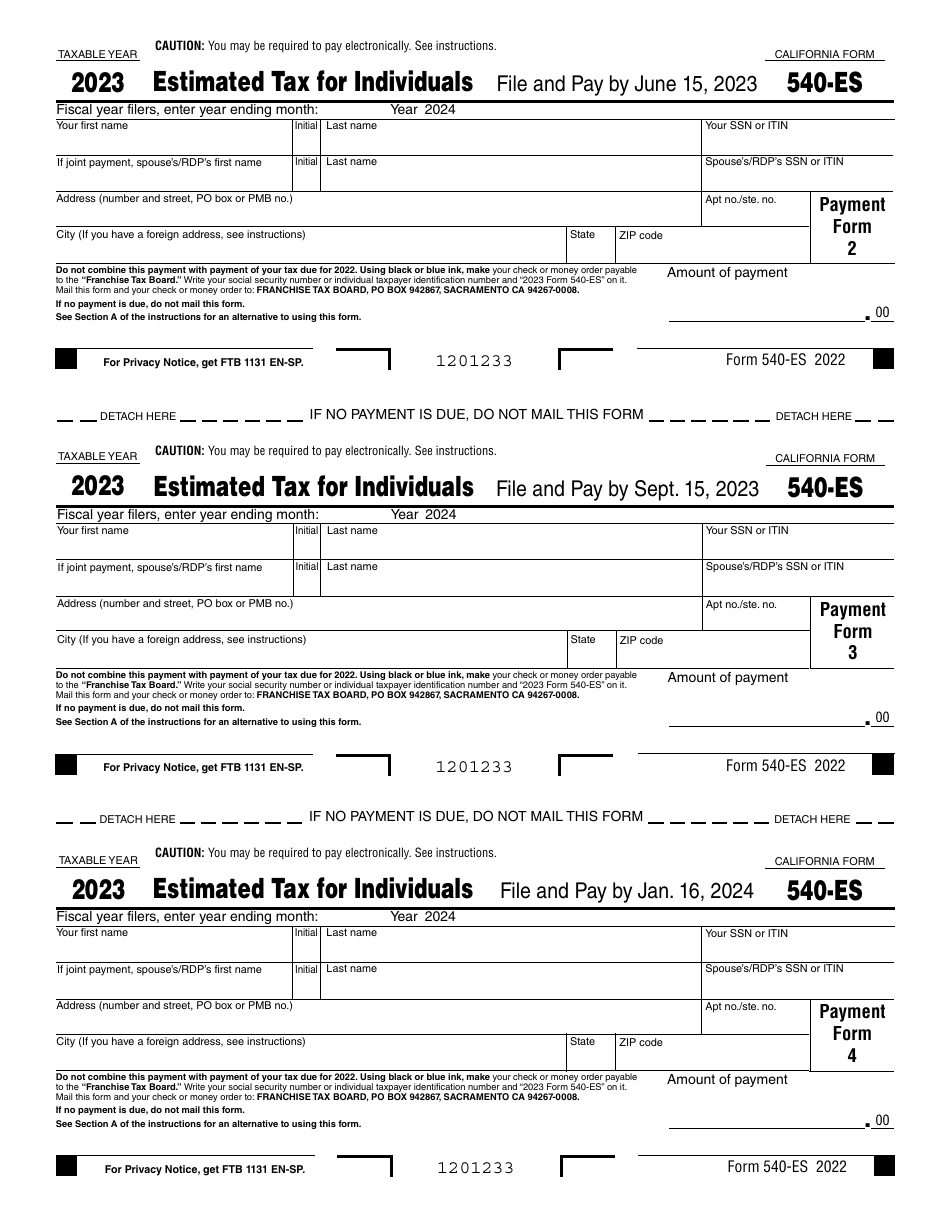

This version of the form is not currently in use and is provided for reference only. Download this version of

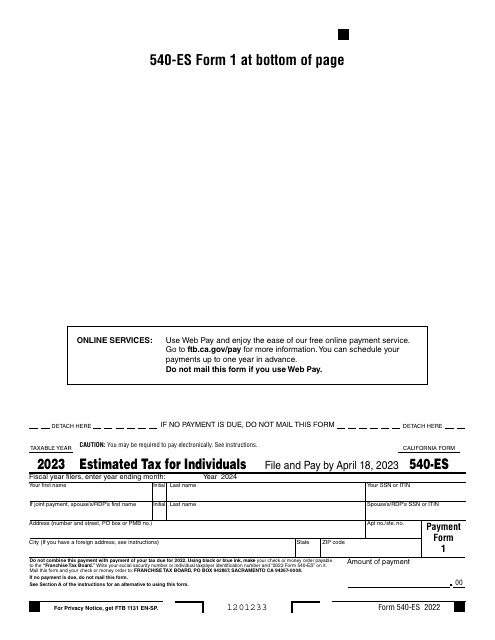

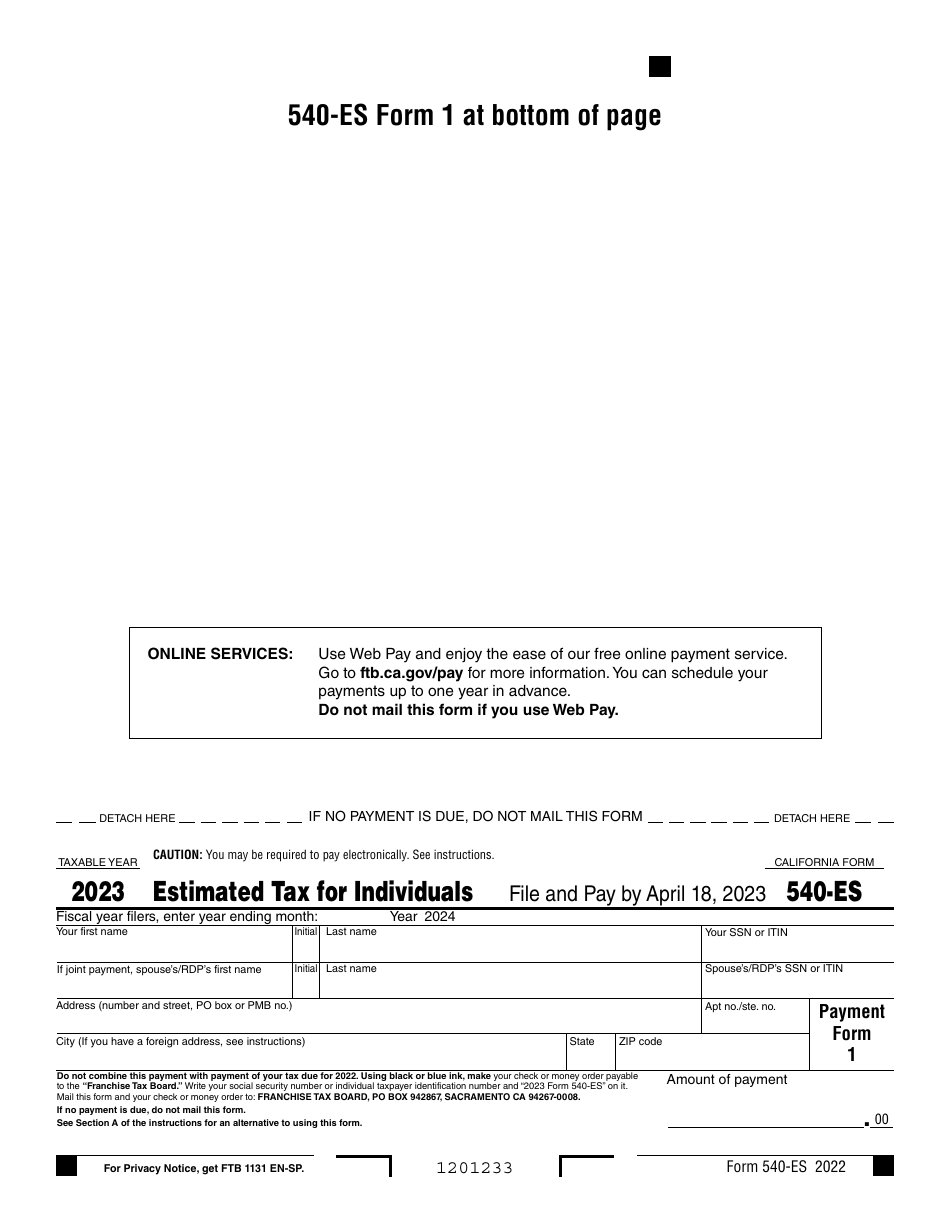

Form 540-ES

for the current year.

Form 540-ES Estimated Tax for Individuals - California

What Is Form 540-ES?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 540-ES?

A: Form 540-ES is a tax form used by individuals in California to make estimated tax payments.

Q: Who needs to file Form 540-ES?

A: Individuals who expect to owe more than $500 in California income tax for the year must file Form 540-ES and make quarterly estimated tax payments.

Q: How often do I need to file Form 540-ES?

A: Form 540-ES is filed quarterly, with payment due dates in April, June, September, and January of the following year.

Q: What information do I need to complete Form 540-ES?

A: You will need your estimated income, deductions, credits, and tax liability for the year to complete Form 540-ES.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 540-ES by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.