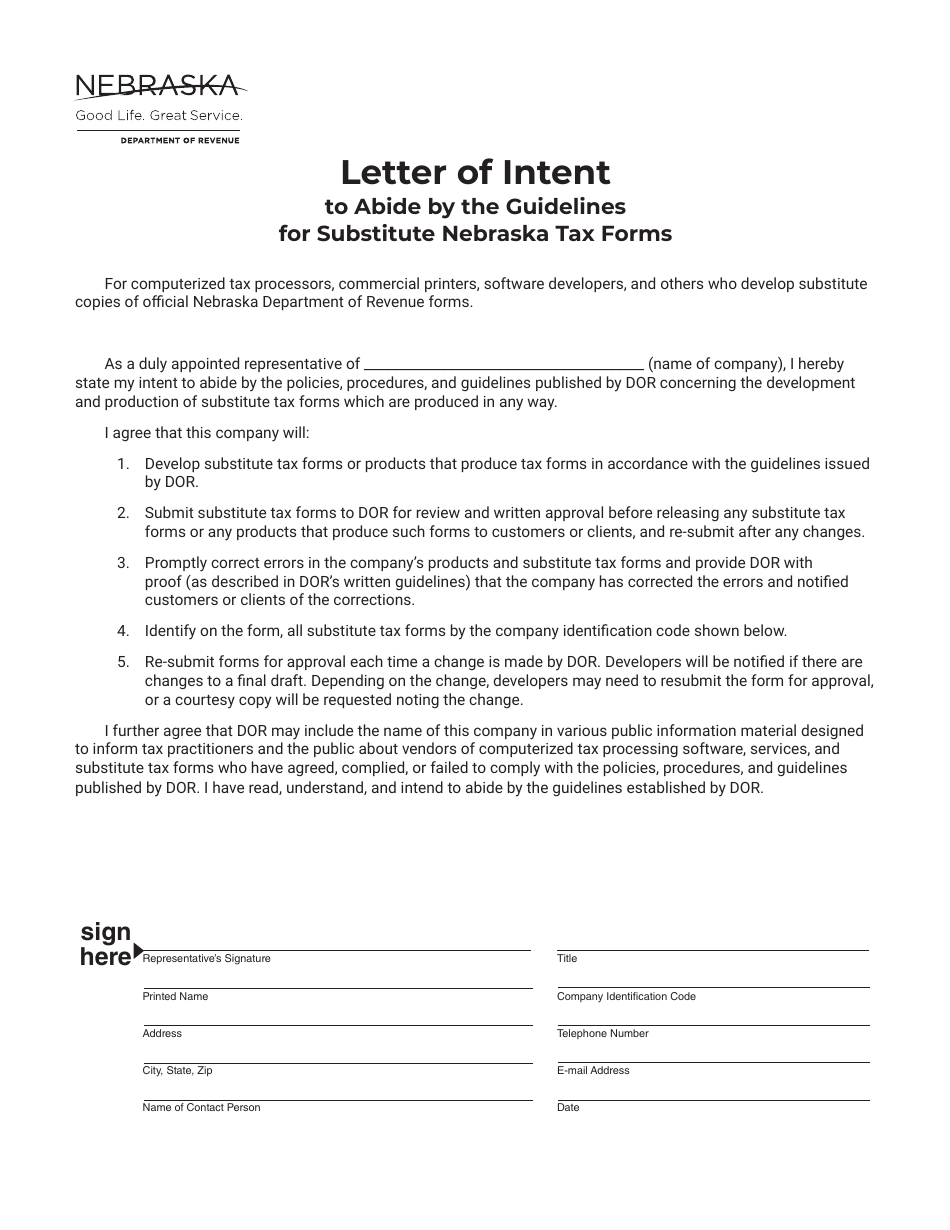

Letter of Intent to Abide by the Guidelines for Substitute Nebraska Tax Forms - Nebraska

Letter of Intent to Abide by the Guidelines for Substitute Nebraska Tax Forms is a legal document that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.

FAQ

Q: What is the Letter of Intent to Abide by the Guidelines for Substitute Nebraska Tax Forms?

A: The Letter of Intent is a document that signifies an individual or business's commitment to follow the guidelines for using substitute Nebraska tax forms.

Q: Why is the Letter of Intent important?

A: The Letter of Intent is important because it ensures compliance with the guidelines for using substitute Nebraska tax forms, which helps maintain accuracy and consistency in tax reporting.

Q: Who needs to submit a Letter of Intent?

A: Any individual or business that plans to use substitute Nebraska tax forms needs to submit a Letter of Intent.

Q: When do I need to submit the Letter of Intent?

A: The Letter of Intent should be submitted prior to using substitute Nebraska tax forms.

Q: Are there any penalties for not submitting a Letter of Intent?

A: Failure to submit a Letter of Intent may result in penalties or consequences as determined by the Nebraska Department of Revenue.

Q: Can I submit the Letter of Intent electronically?

A: Yes, the Letter of Intent can be submitted electronically.

Q: Is there a fee for submitting the Letter of Intent?

A: No, there is no fee for submitting the Letter of Intent.

Q: Can I use substitute Nebraska tax forms without submitting a Letter of Intent?

A: No, individuals or businesses must submit a Letter of Intent before using substitute Nebraska tax forms.

Form Details:

- Released on December 16, 2022;

- The latest edition currently provided by the Nebraska Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.