This version of the form is not currently in use and is provided for reference only. Download this version of

Form ARB-COTA4

for the current year.

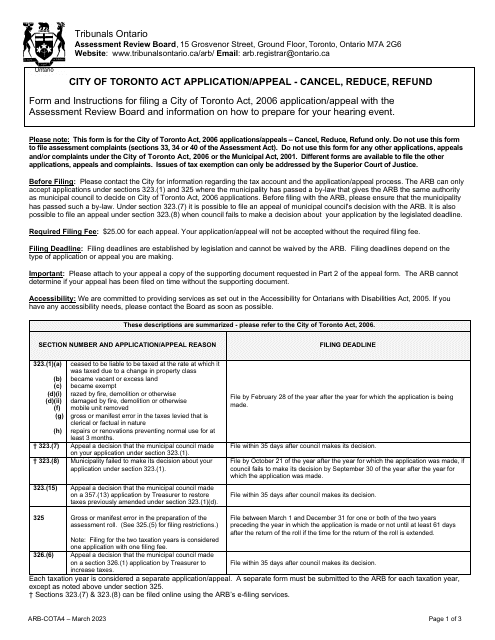

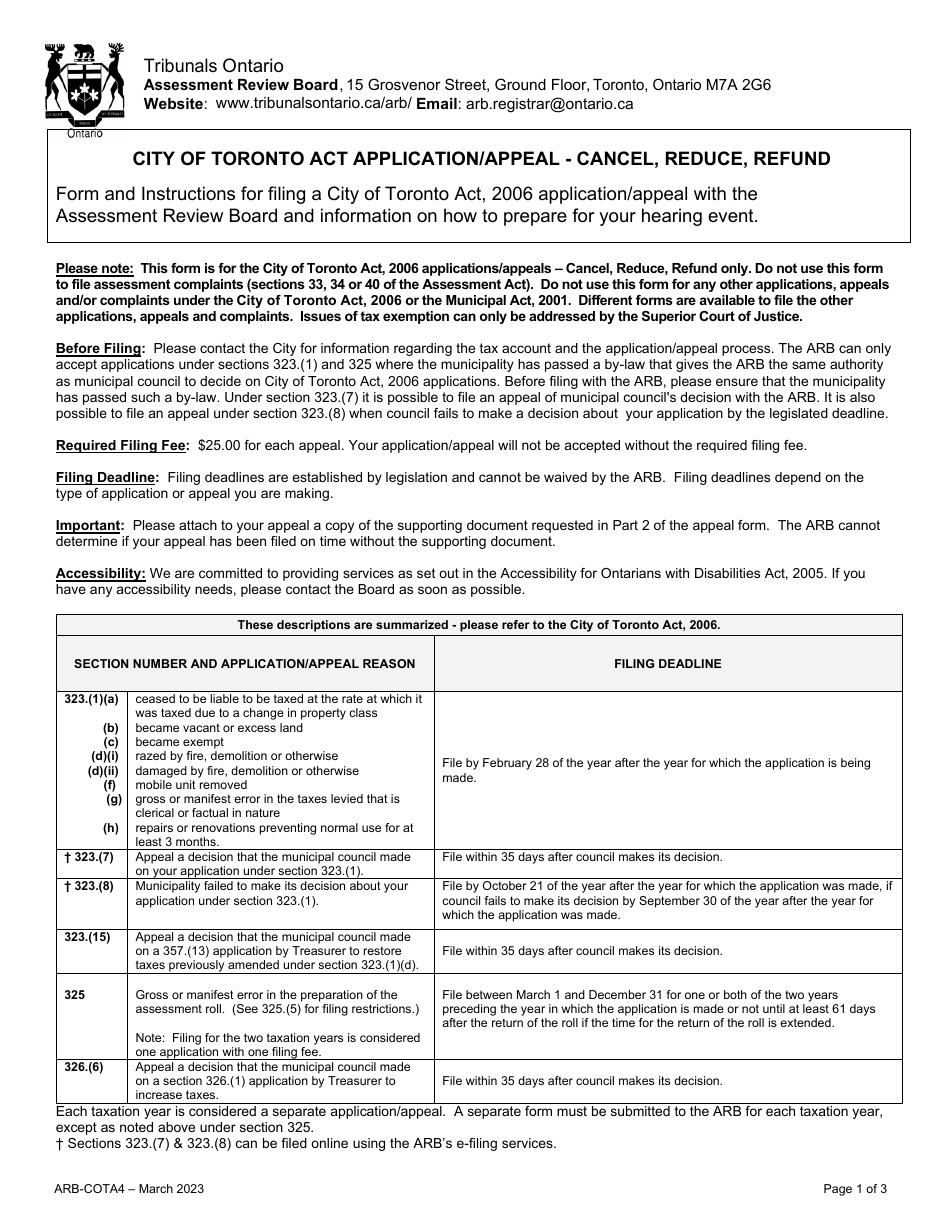

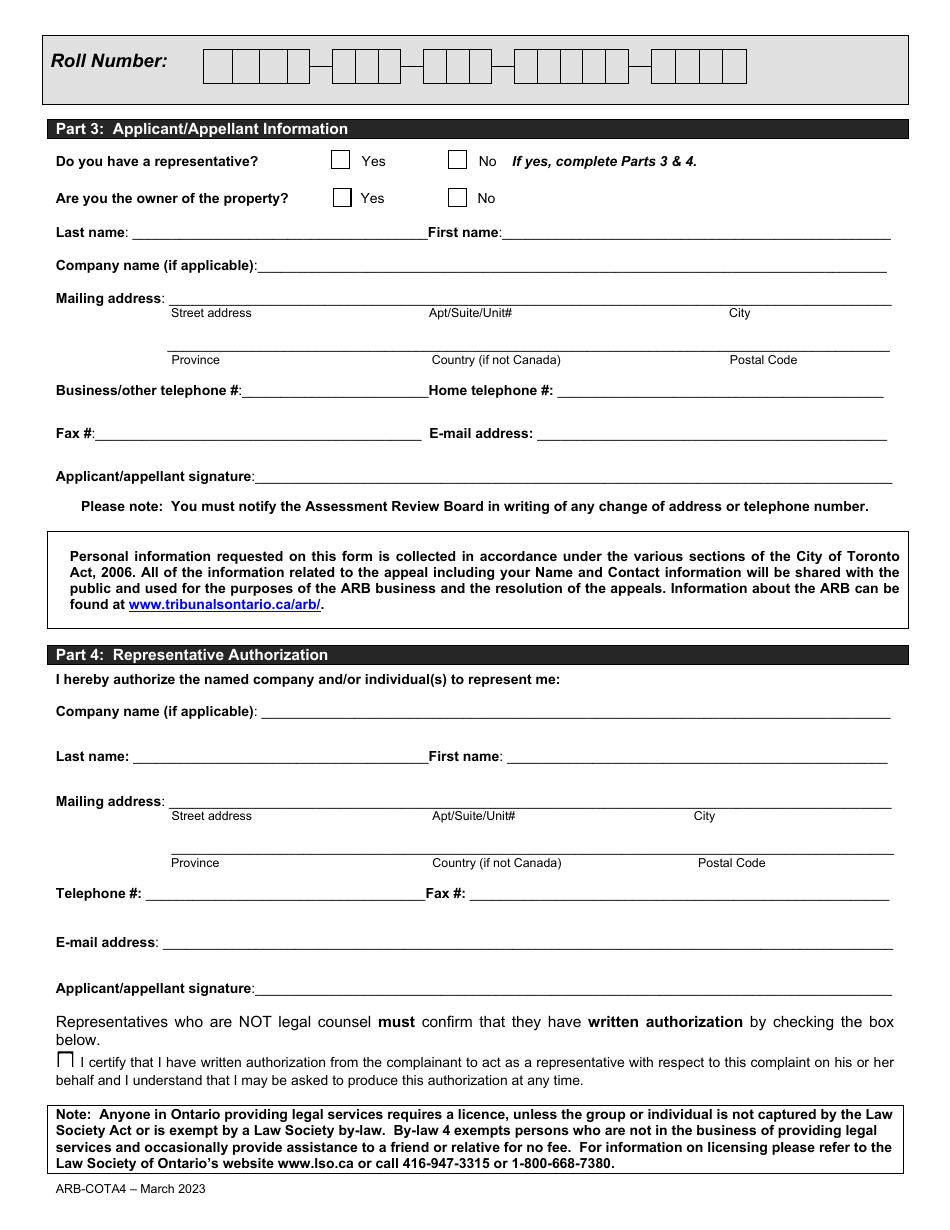

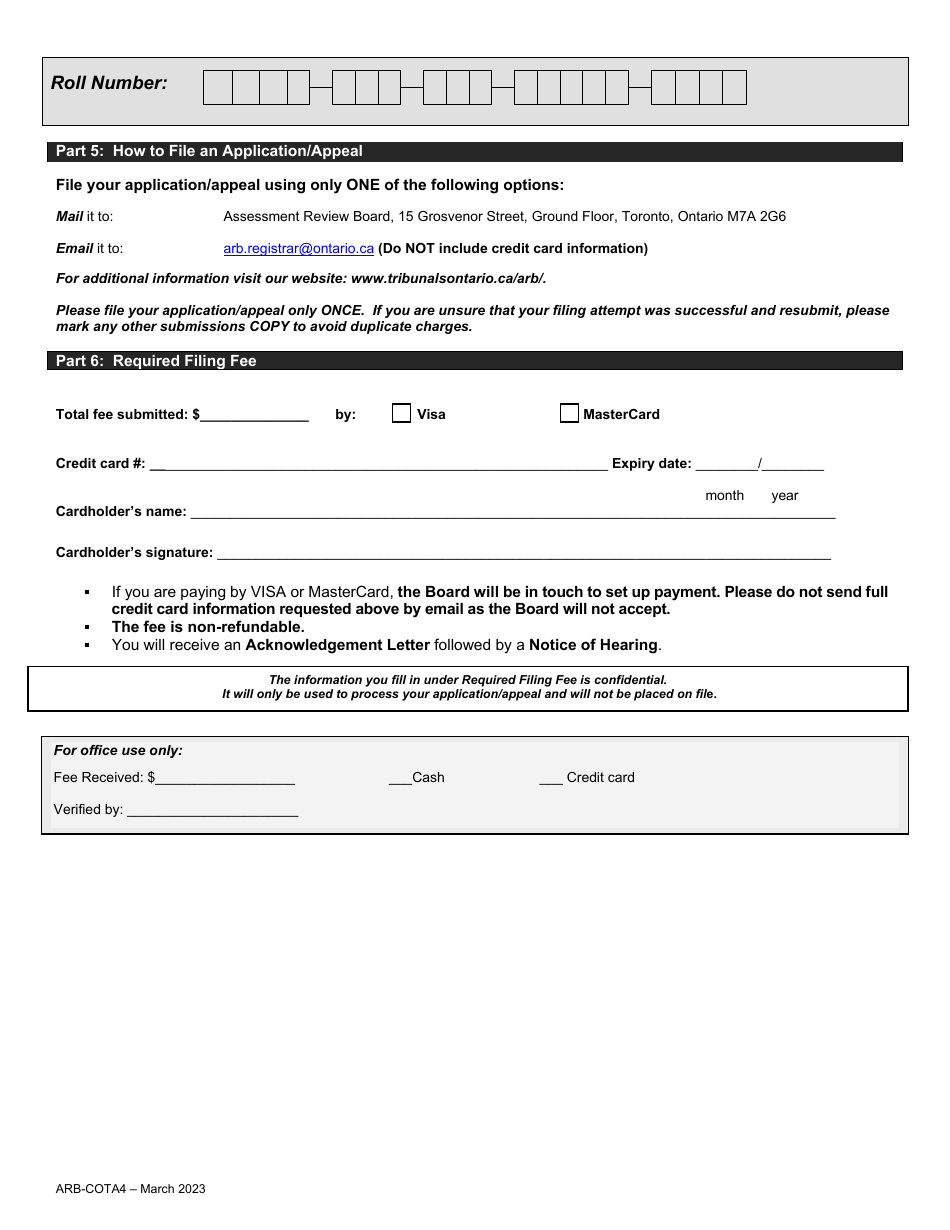

Form ARB-COTA4 City of Toronto Act Application / Appeal - Cancel, Reduce, Refund - Ontario, Canada

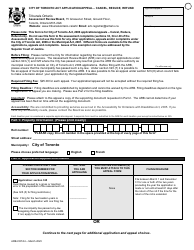

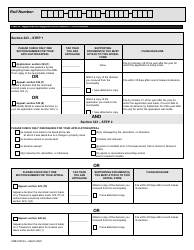

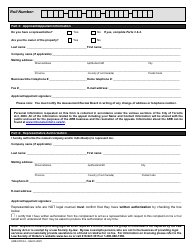

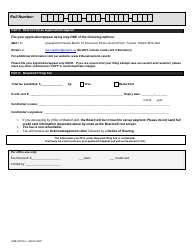

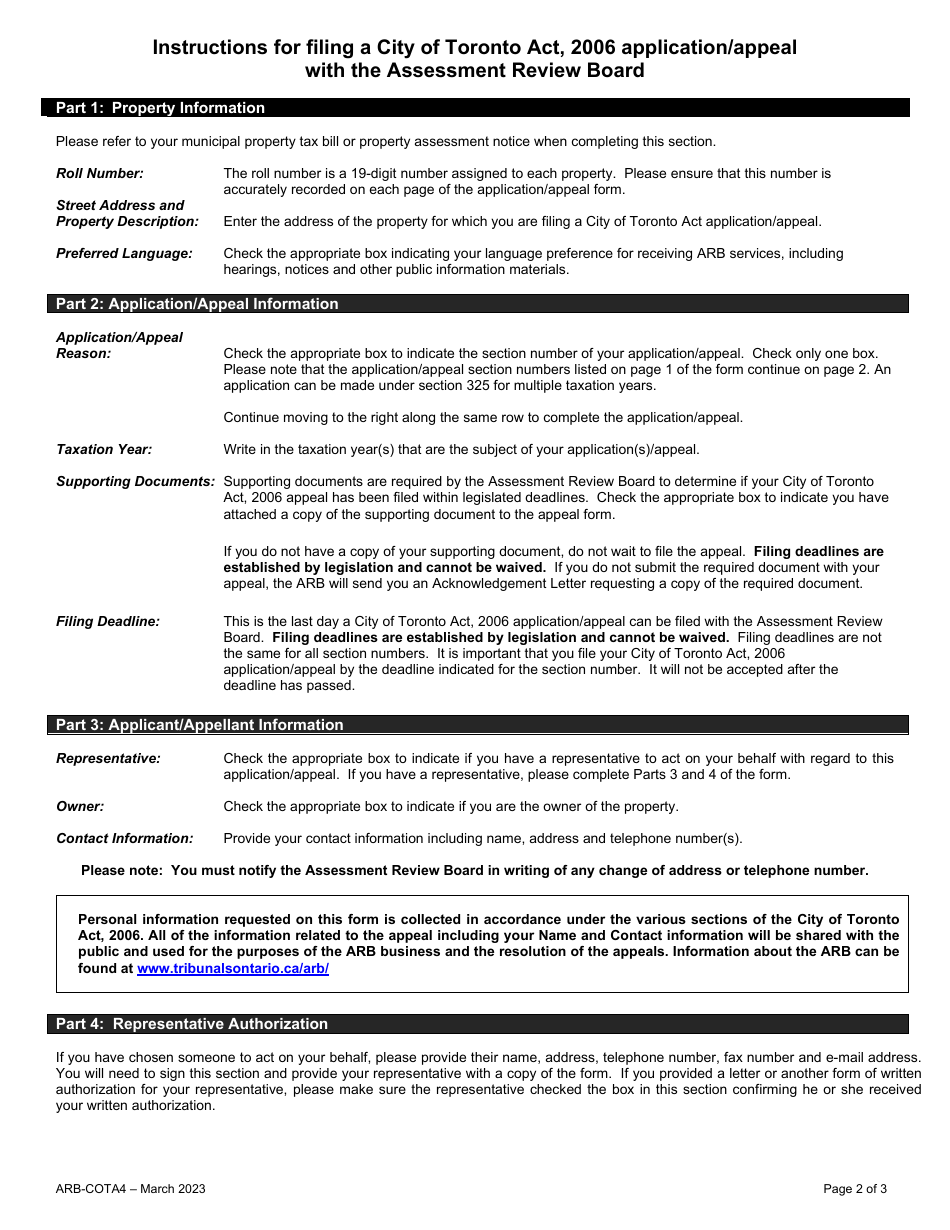

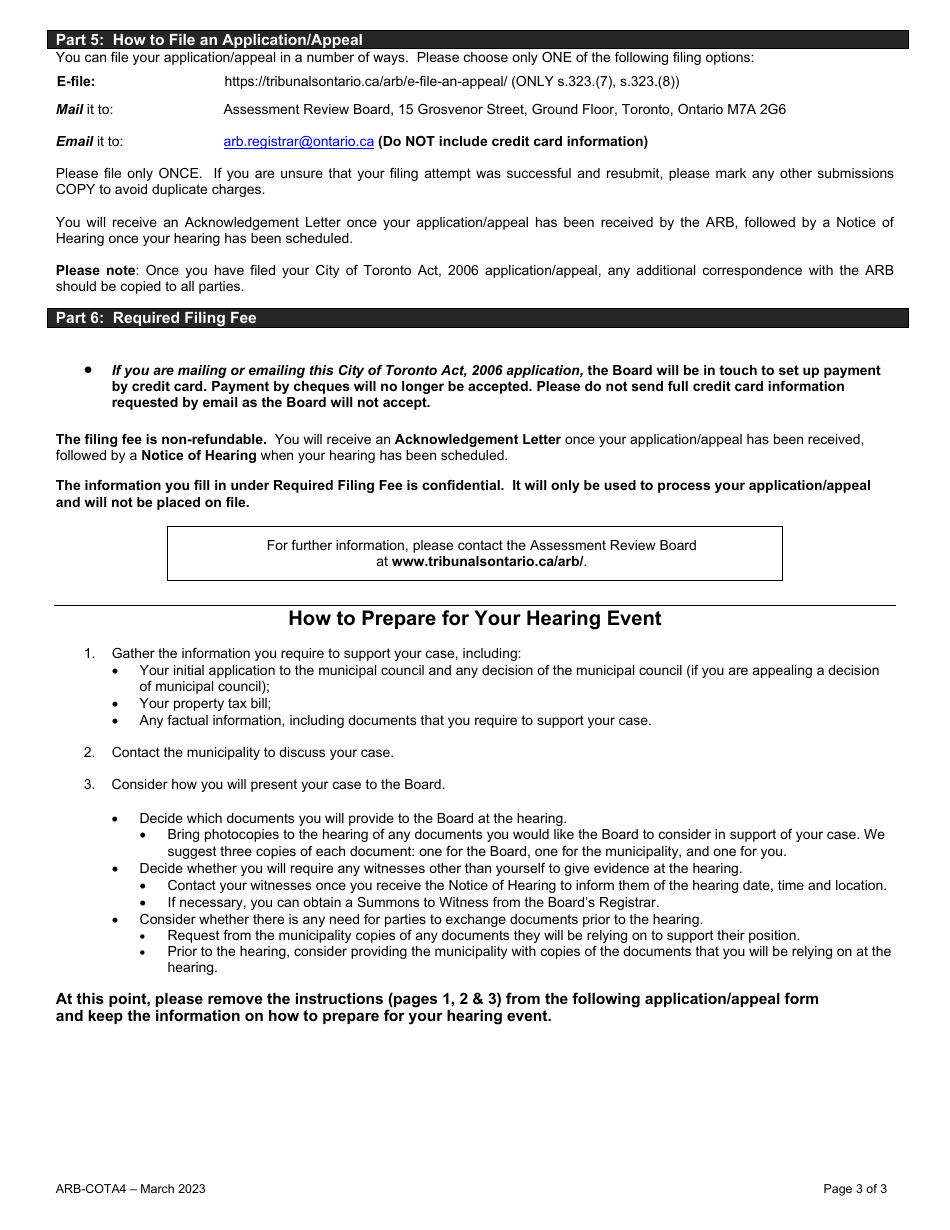

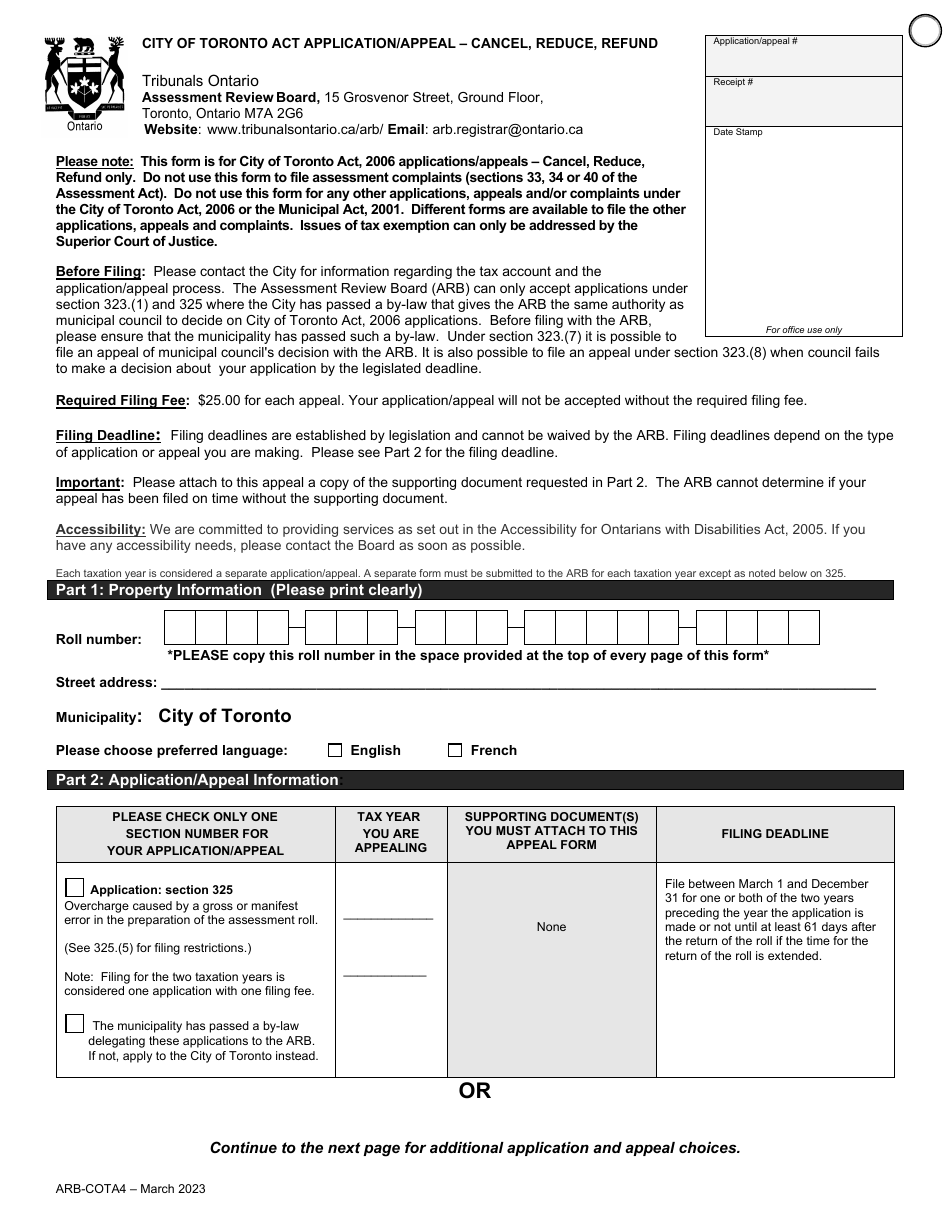

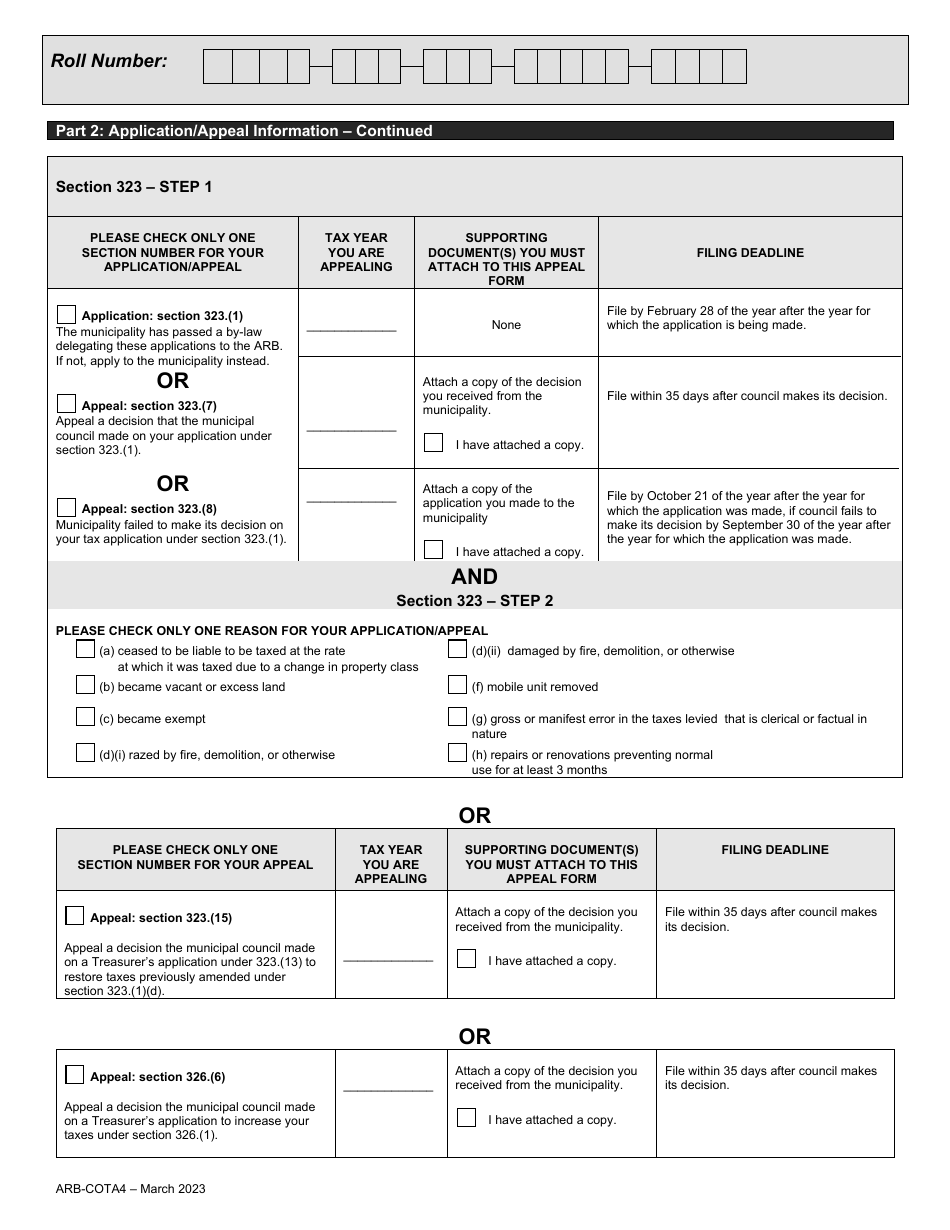

Form ARB-COTA4 is used for application or appeal under the City of Toronto Act in Ontario, Canada. It is specifically for requesting cancellation, reduction, or refund of certain taxes or fees imposed by the City of Toronto.

The form ARB-COTA4 for the City of Toronto Act application/appeal in Ontario, Canada, can be filed by individuals or businesses who want to cancel, reduce, or request a refund for certain municipal fees or charges.

FAQ

Q: What is ARB-COTA4?

A: ARB-COTA4 refers to the City of Toronto Act Application/Appeal process for cancelling, reducing, or refunding taxes in Ontario, Canada.

Q: What is the City of Toronto Act?

A: The City of Toronto Act is legislation in Ontario, Canada that grants additional powers to the City of Toronto.

Q: What can I apply for through ARB-COTA4?

A: Through ARB-COTA4, you can apply or appeal for the cancellation, reduction, or refund of taxes in the City of Toronto.

Q: Who can apply for ARB-COTA4?

A: Any individual or entity in the City of Toronto can apply for ARB-COTA4.

Q: What is the process for ARB-COTA4?

A: The ARB-COTA4 process involves submitting an application or appeal, providing supporting documentation, and attending a hearing if required.

Q: What are the grounds for application/appeal through ARB-COTA4?

A: The grounds for application or appeal through ARB-COTA4 can vary, but generally include hardship or error in assessment.

Q: How long does the ARB-COTA4 process take?

A: The length of the ARB-COTA4 process can vary depending on factors such as the complexity of the case and the availability of hearing dates.