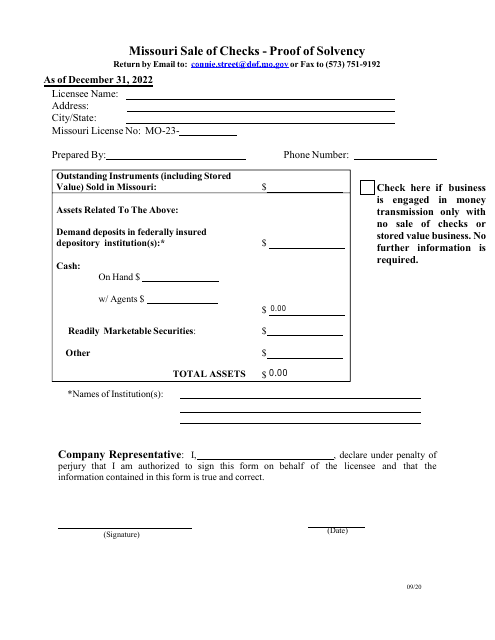

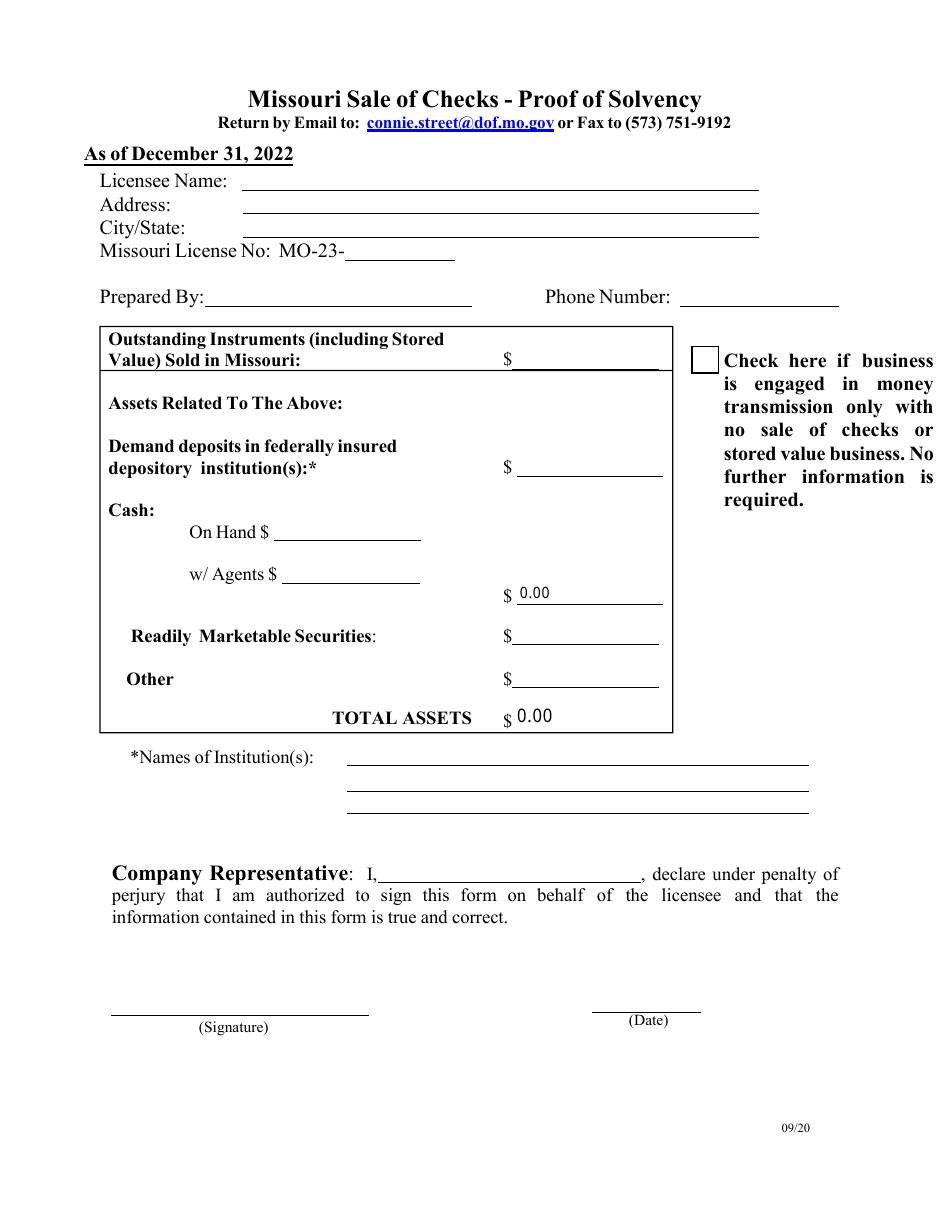

Missouri Sale of Checks - Proof of Solvency - Missouri

Missouri Sale of Checks - Proof of Solvency is a legal document that was released by the Missouri Division of Finance - a government authority operating within Missouri.

FAQ

Q: What is the Missouri Sale of Checks - Proof of Solvency law?

A: The Missouri Sale of Checks - Proof of Solvency law requires businesses to provide proof that they have enough funds to cover the value of the checks they sell.

Q: Who does the Missouri Sale of Checks - Proof of Solvency law apply to?

A: The law applies to businesses that sell checks or provide money transmission services in Missouri.

Q: Why is proof of solvency required for businesses selling checks in Missouri?

A: Proof of solvency is required to protect consumers from purchasing checks that may bounce or be unable to be cashed.

Q: How can businesses comply with the Missouri Sale of Checks - Proof of Solvency law?

A: Businesses can comply by providing financial statements or obtaining a surety bond to demonstrate their solvency.

Q: What happens if a business fails to provide proof of solvency in Missouri?

A: Failure to provide proof of solvency can result in penalties, including license suspension or revocation.

Form Details:

- Released on September 1, 2020;

- The latest edition currently provided by the Missouri Division of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Missouri Division of Finance.