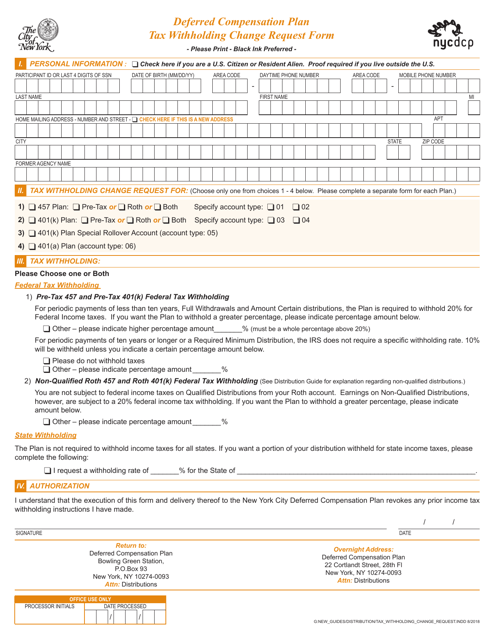

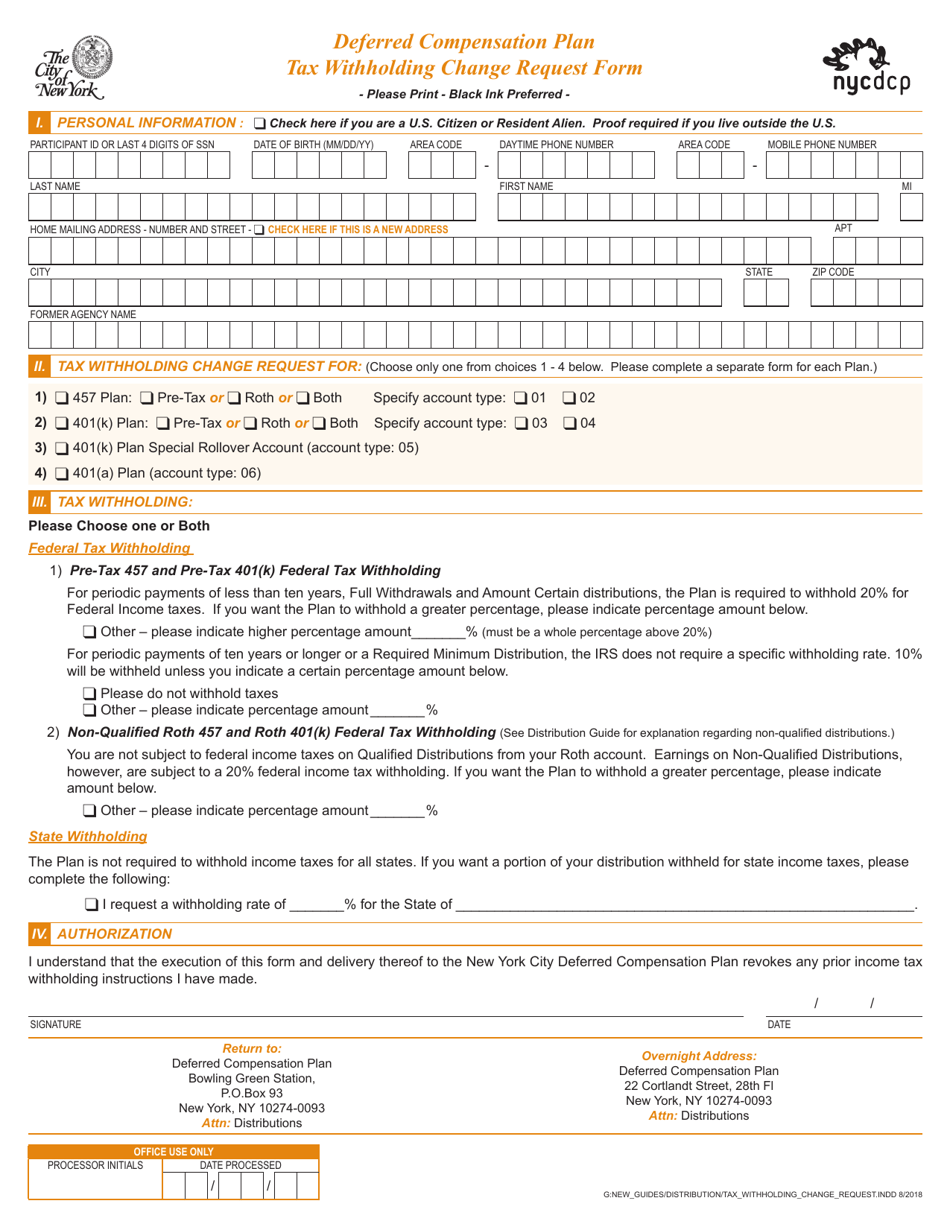

Deferred Compensation Plan Tax Withholding Change Request Form - New York

Deferred Tax Withholding Change Request Form is a legal document that was released by the New York State Office of Labor Relations - a government authority operating within New York.

FAQ

Q: What is a Deferred Compensation Plan?

A: A Deferred Compensation Plan is a retirement savings plan that allows employees to defer a portion of their salary to be paid at a later date, usually during retirement.

Q: Why would I need to change the tax withholding on my Deferred Compensation Plan?

A: You may need to change the tax withholding on your Deferred Compensation Plan if you want to adjust the amount of taxes that are withheld from your deferred compensation distributions.

Q: How do I request a change to my tax withholding on the Deferred Compensation Plan?

A: To request a change to your tax withholding on the Deferred Compensation Plan, you can use the Tax Withholding Change Request Form provided by the plan administrator.

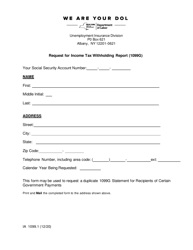

Q: What information do I need to provide on the Tax Withholding Change Request Form?

A: You will need to provide your personal information, such as your name, employee ID, and contact information, as well as details about your current tax withholding and the changes you wish to make.

Q: Are there any deadlines for submitting the Tax Withholding Change Request Form?

A: It is important to check with the plan administrator for any specific deadlines for submitting the Tax Withholding Change Request Form, as they may vary depending on the plan.

Q: Will my tax withholding change request be automatically approved?

A: The approval of your tax withholding change request will depend on the plan administrator and the policies of the Deferred Compensation Plan. It is advisable to review the plan's guidelines or contact the plan administrator for more information.

Q: How long does it take for the tax withholding change to take effect?

A: The time it takes for the tax withholding change to take effect will depend on the processing time of the plan administrator. It is best to inquire with the plan administrator for an estimated timeline.

Q: Can I make multiple tax withholding change requests throughout the year?

A: In most cases, you can make multiple tax withholding change requests throughout the year. However, it is important to review the plan's guidelines or consult with the plan administrator for any restrictions or limitations.

Q: Will changing my tax withholding affect my overall tax liability?

A: Changing your tax withholding on the Deferred Compensation Plan may have an impact on your overall tax liability. It is recommended to consult with a tax professional or financial advisor to understand the potential tax implications.

Form Details:

- Released on August 1, 2018;

- The latest edition currently provided by the New York State Office of Labor Relations;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York State Office of Labor Relations.