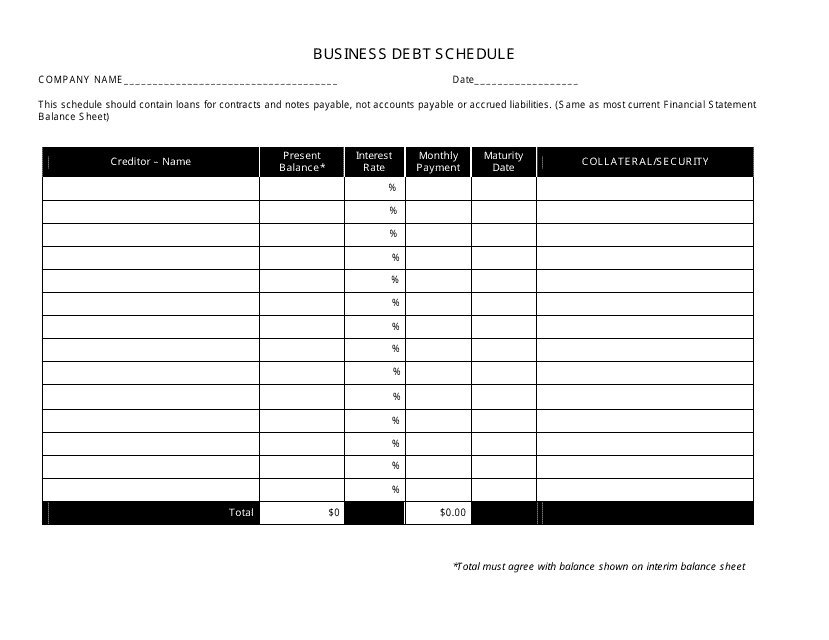

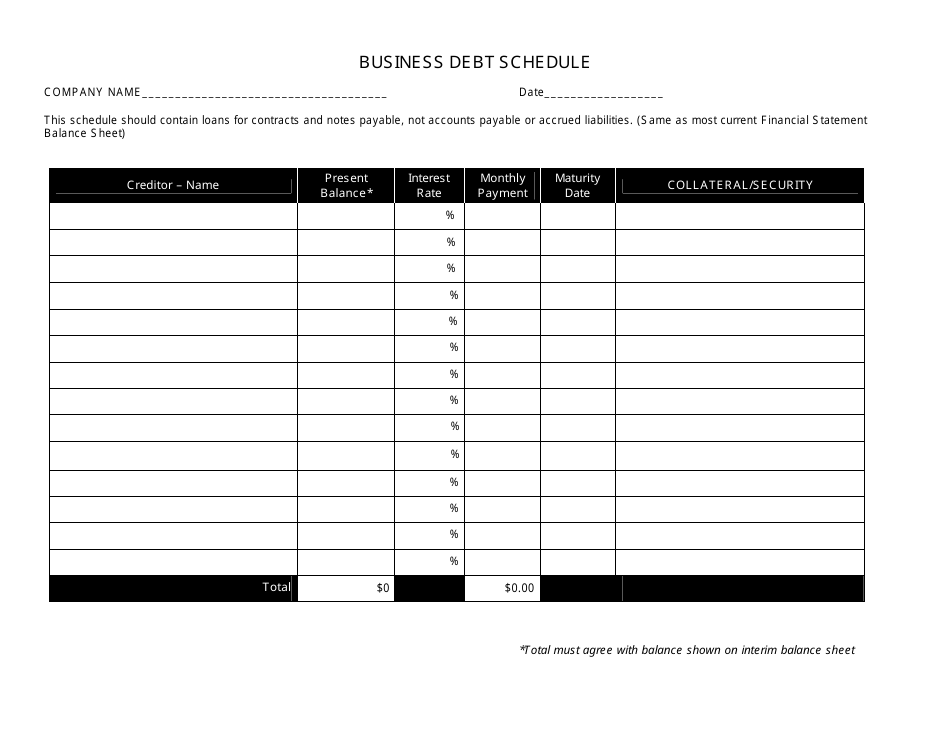

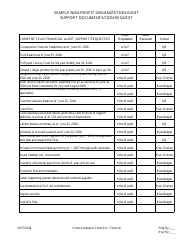

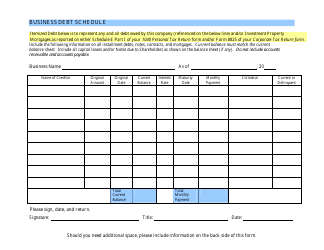

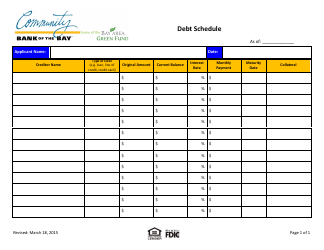

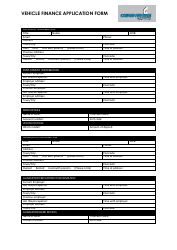

Business Debt Schedule Template - Black and White

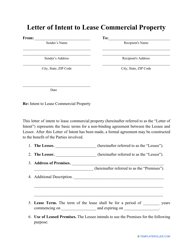

The Business Debt Schedule Template - Black and White is used to track and manage the debt obligations of a business. It helps to provide a clear overview of the debt structure, repayment terms, and outstanding balances of the business.

FAQ

Q: What is a business debt schedule?

A: A business debt schedule is a document that lists all the outstanding debts and liabilities of a business.

Q: Why is a business debt schedule important?

A: A business debt schedule is important because it helps businesses keep track of their debts, understand their financial obligations, and plan for repayment.

Q: What information is typically included in a business debt schedule?

A: A business debt schedule typically includes the name of the creditor, the amount of debt outstanding, the interest rate, the payment terms, and the due dates.

Q: How can I create a business debt schedule?

A: You can create a business debt schedule by listing all your outstanding debts and liabilities in a spreadsheet or using a pre-made template like the Black and White Business Debt Schedule Template.

Q: Are business debt schedules only for large businesses?

A: No, business debt schedules are useful for businesses of all sizes, from small startups to large corporations.

Q: How often should I update my business debt schedule?

A: It is recommended to update your business debt schedule regularly, such as monthly or quarterly, to keep it accurate and up-to-date.

Q: Can a business debt schedule help with financial planning?

A: Yes, a business debt schedule can help with financial planning by providing a clear overview of your debts and liabilities, allowing you to make informed decisions and manage your cash flow effectively.