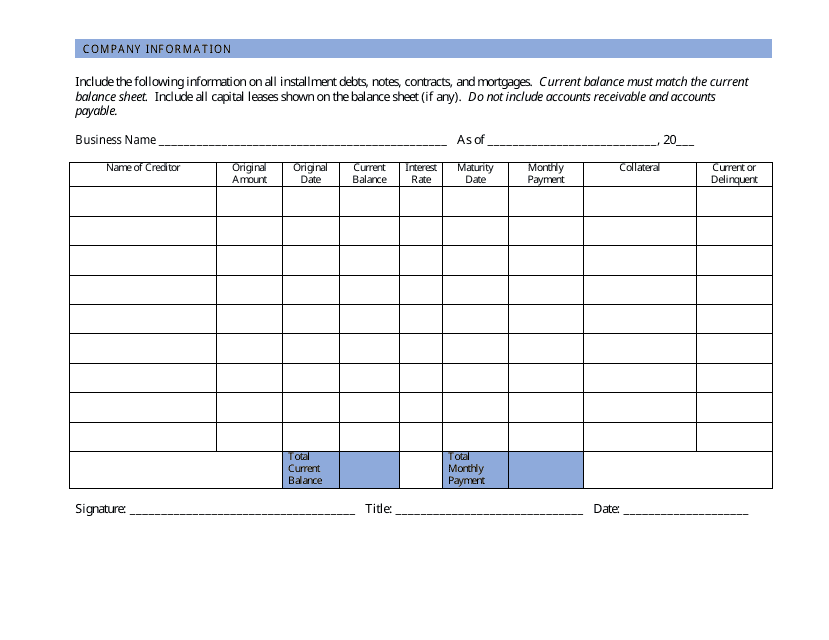

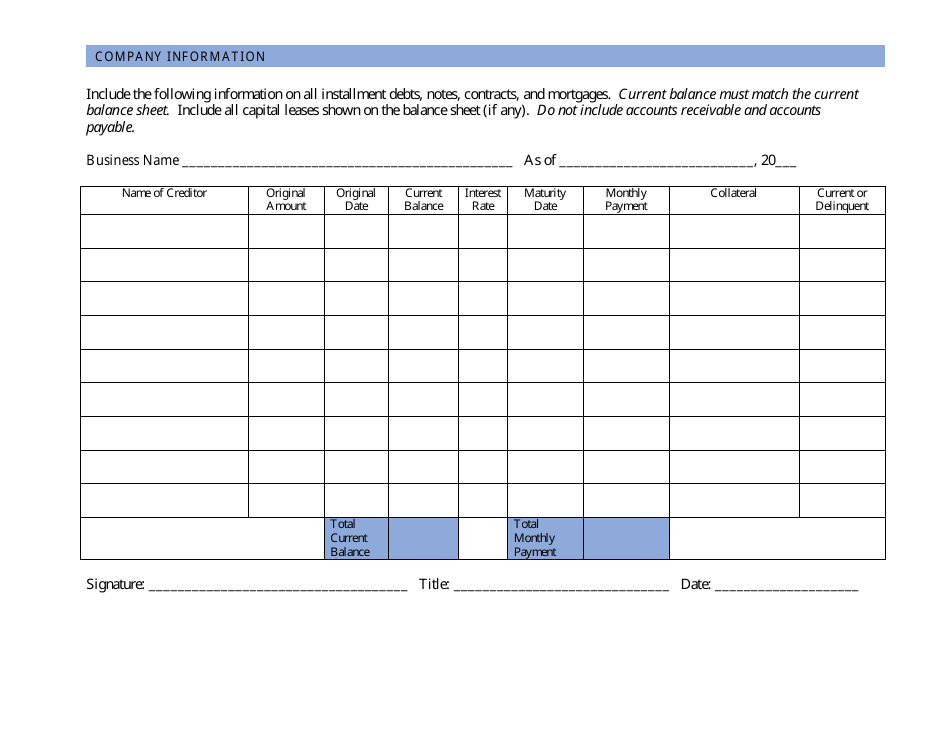

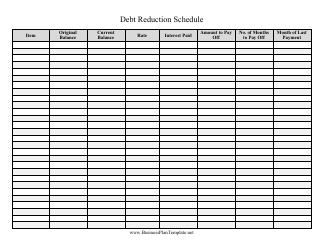

Company Debt Schedule Template

A Company Debt Schedule Template is used to keep track of a company's outstanding debts. It helps organize and manage information about loans, bonds, and other forms of debt that the company owes to lenders or creditors.

The company's finance department typically files the company debt schedule template.

FAQ

Q: What is a company debt schedule template?

A: A company debt schedule template is a tool used to track and manage a company's debt obligations.

Q: Why is a debt schedule template important for a company?

A: A debt schedule template helps a company keep track of their debts, including repayment schedules, interest rates, and total outstanding balances. It helps in managing and planning for debt payments.

Q: How can a company debt schedule template be useful?

A: A debt schedule template helps a company analyze its debt situation, make informed financial decisions, and ensure timely repayment of debts.

Q: What information is typically included in a company debt schedule template?

A: A company debt schedule template usually includes details such as the name and type of debt, interest rate, term, payment schedule, outstanding balance, and any other relevant information.

Q: How do I use a company debt schedule template?

A: To use a company debt schedule template, enter the relevant information about each debt, such as the amount, interest rate, and payment schedule. The template will automatically calculate the total outstanding balance and any other required information.

Q: Can a company debt schedule template be customized?

A: Yes, a company debt schedule template can be customized to fit the specific needs and requirements of a company. You can add or remove columns, adjust formulas, and tailor it to your company's debt structure.

Q: Is it important to regularly update the company debt schedule template?

A: Yes, it is important to regularly update the company debt schedule template to ensure accuracy and reflect any changes in debts, such as principal payments, interest rate changes, or new debts incurred.

Q: What are the benefits of using a company debt schedule template?

A: Using a company debt schedule template helps in organizing and visualizing all debt-related information in one place, enabling better financial decision-making and ensuring timely debt payments.

Q: Can a company debt schedule template help in analyzing debt trends and ratios?

A: Yes, a company debt schedule template can help in analyzing debt trends and ratios by providing an overview of the company's debt structure and the ability to calculate important ratios like debt to equity ratio or interest coverage ratio.