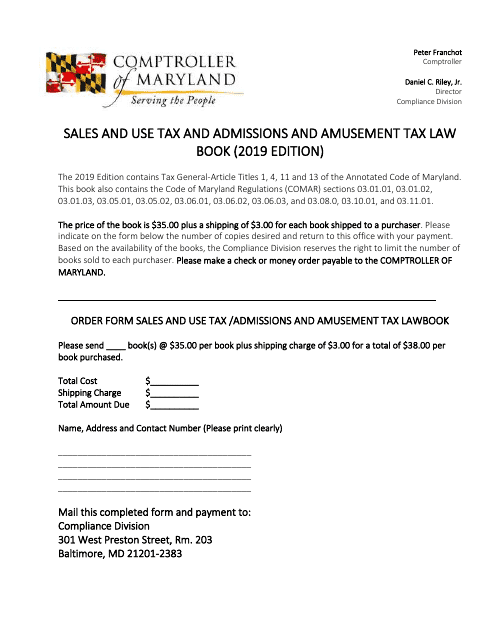

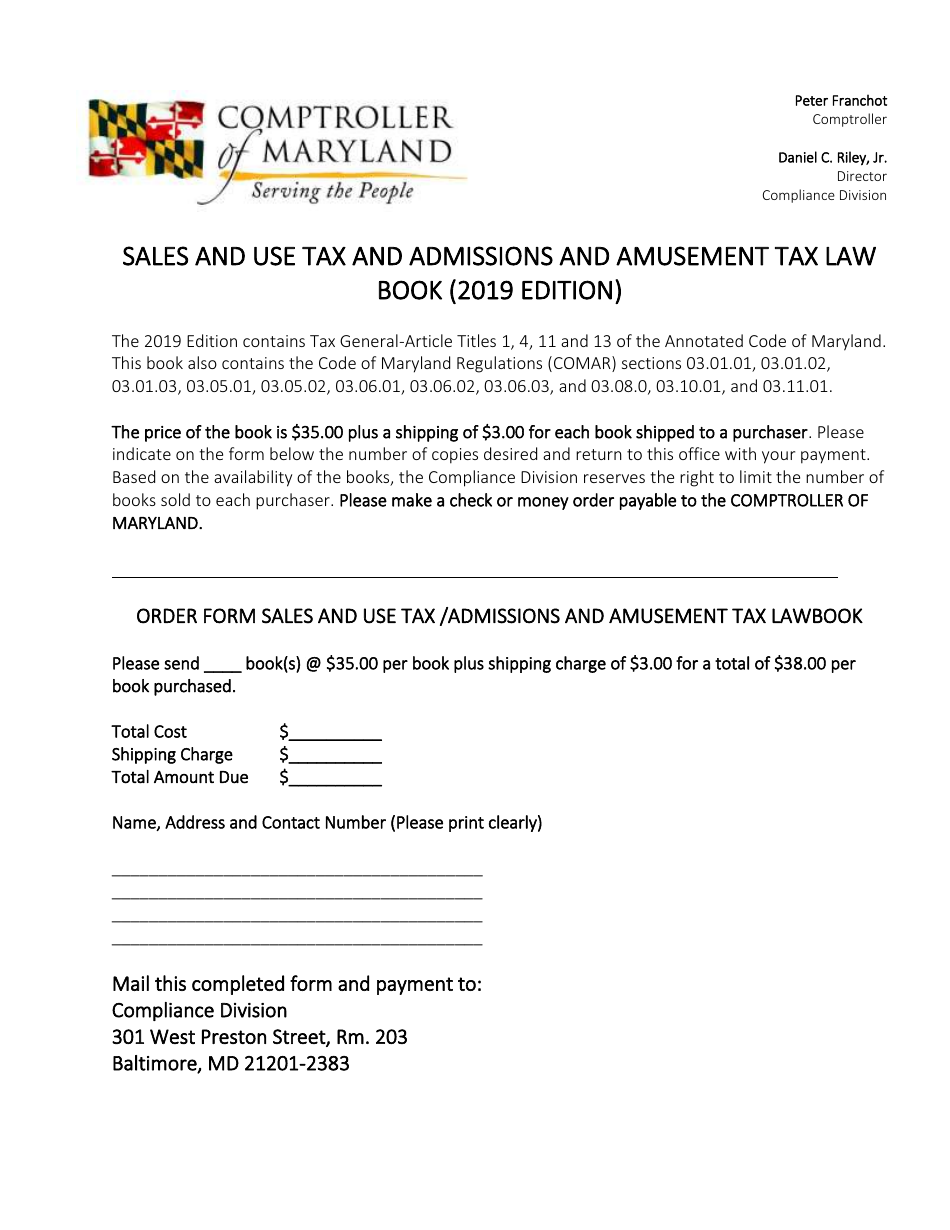

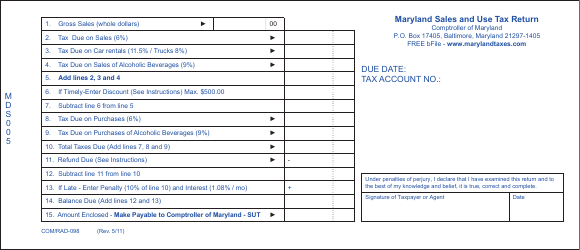

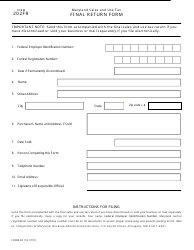

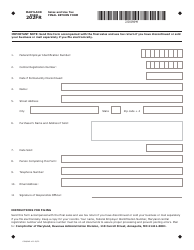

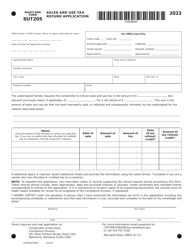

Sales and Use Tax and Admissions and Amusement Tax Law Book (2019 Edition) - Maryland

Sales and Law Book (2019 Edition) is a legal document that was released by the Maryland Taxes - a government authority operating within Maryland.

FAQ

Q: What is the Sales and Use Tax?

A: Sales and Use Tax is a tax on the sale, rental, or use of tangible personal property in Maryland.

Q: What is the Admissions and Amusement Tax?

A: The Admissions and Amusement Tax is a tax on the admission or fees charged for attending or participating in amusements, shows, or entertainment in Maryland.

Q: Who is responsible for paying the Sales and Use Tax?

A: The seller is responsible for collecting and remitting the Sales and Use Tax to the state of Maryland.

Q: Who is responsible for paying the Admissions and Amusement Tax?

A: The individual or business that operates the amusement or entertainment event is responsible for collecting and remitting the Admissions and Amusement Tax to the state.

Q: What is the purpose of these taxes?

A: The purpose of these taxes is to generate revenue for the state of Maryland to fund essential services and programs.

Q: Are there any exemptions or exclusions from these taxes?

A: Yes, there are certain exemptions and exclusions from both the Sales and Use Tax and the Admissions and Amusement Tax. These exemptions and exclusions are outlined in detail in the Maryland tax laws.

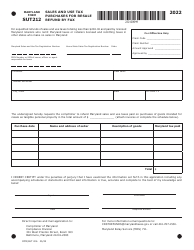

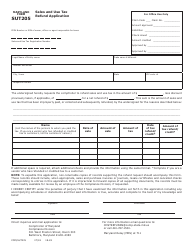

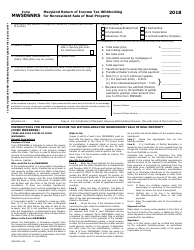

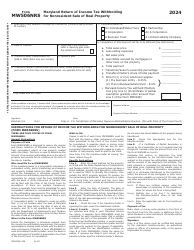

Form Details:

- The latest edition currently provided by the Maryland Taxes;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Taxes.