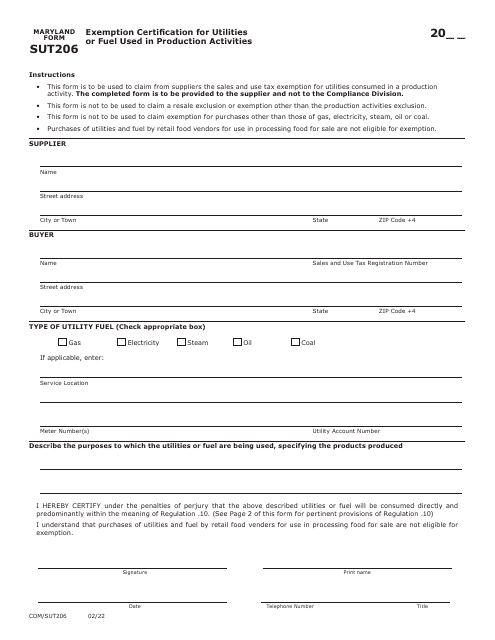

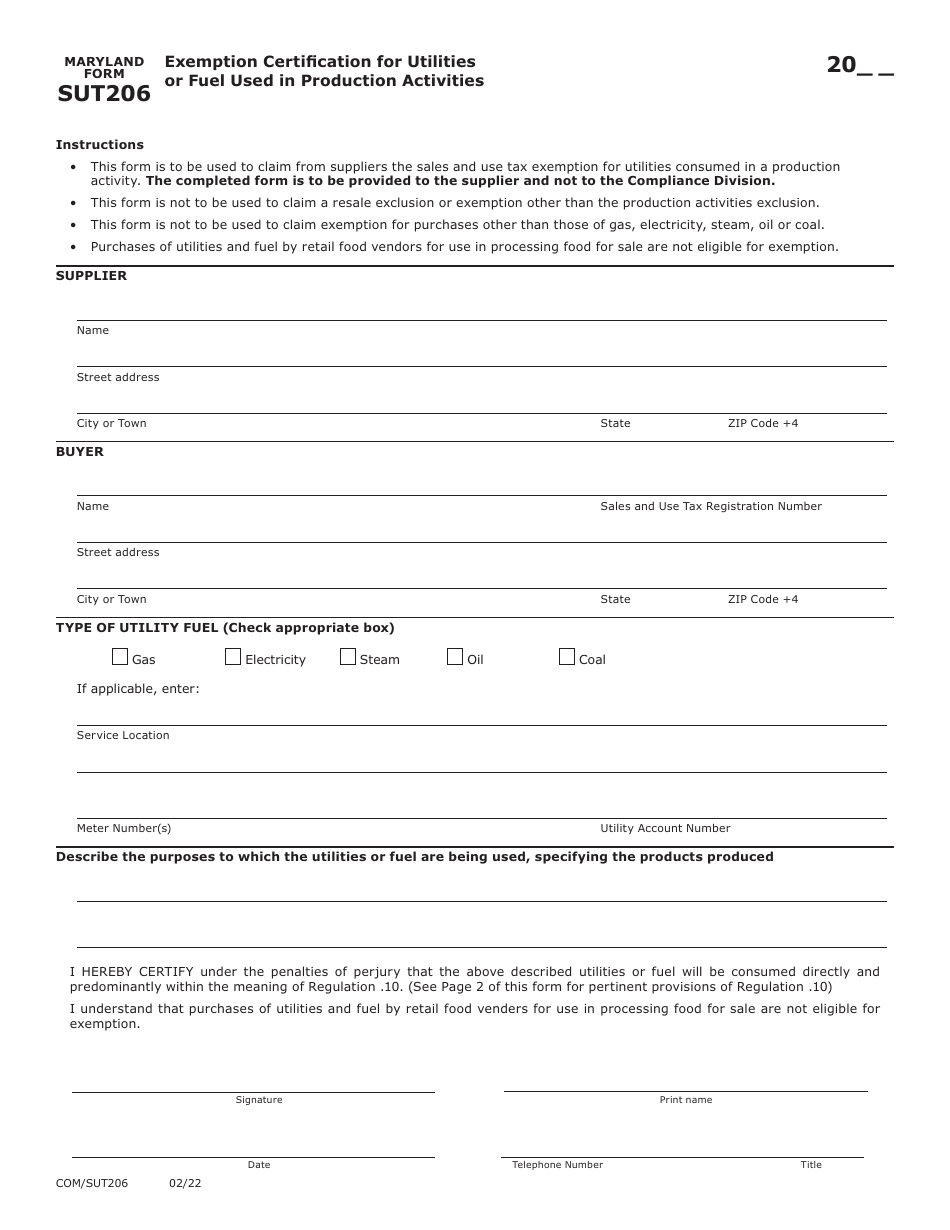

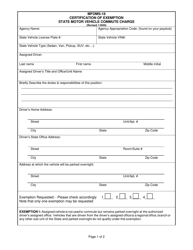

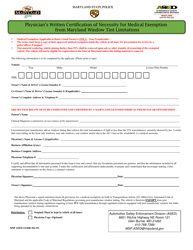

Maryland Form SUT206 (COM / SUT206) Exemption Certification for Utilities or Fuel Used in Production Activities - Maryland

What Is Maryland Form SUT206 (COM/SUT206)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Maryland Form SUT206?

A: Maryland Form SUT206 is the Exemption Certification for Utilities or Fuel Used in Production Activities in Maryland.

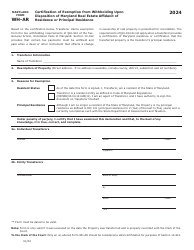

Q: What is the purpose of Form SUT206?

A: The purpose of Form SUT206 is to certify that utilities or fuel used in production activities in Maryland are exempt from sales and use tax.

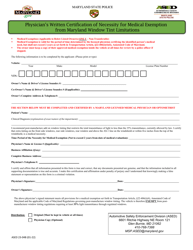

Q: Who needs to use Form SUT206?

A: Form SUT206 is used by businesses in Maryland that are engaged in production activities and want to claim an exemption for utilities or fuel used in those activities.

Q: What are production activities?

A: Production activities refer to the activities involved in manufacturing, processing, assembling, or refining products.

Q: What is the benefit of using Form SUT206?

A: Using Form SUT206 allows businesses to exempt utilities or fuel used in production activities from sales and use tax, reducing their tax liability.

Q: How do I fill out Form SUT206?

A: Form SUT206 requires you to provide information about your business, the utilities or fuel being used, and the production activities they are used for.

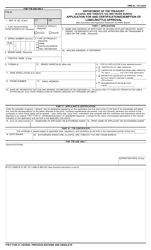

Q: When should I submit Form SUT206?

A: Form SUT206 should be submitted to the Maryland Comptroller's office before the end of the month following the reporting period.

Q: What happens after I submit Form SUT206?

A: After submitting Form SUT206, the Maryland Comptroller's office will review your application and notify you of the approval or denial of the exemption.

Q: Can I claim exemption for all utilities or fuel used in production activities?

A: No, certain utilities or fuel may not be eligible for the exemption. It is important to review the instructions and regulations pertaining to Form SUT206 to determine what qualifies for exemption.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form SUT206 (COM/SUT206) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.