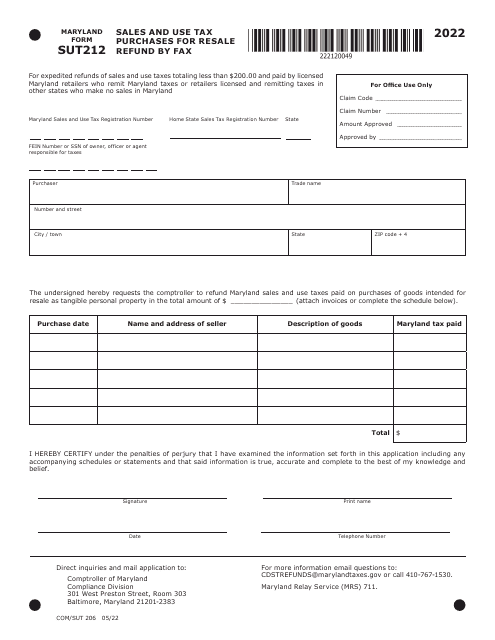

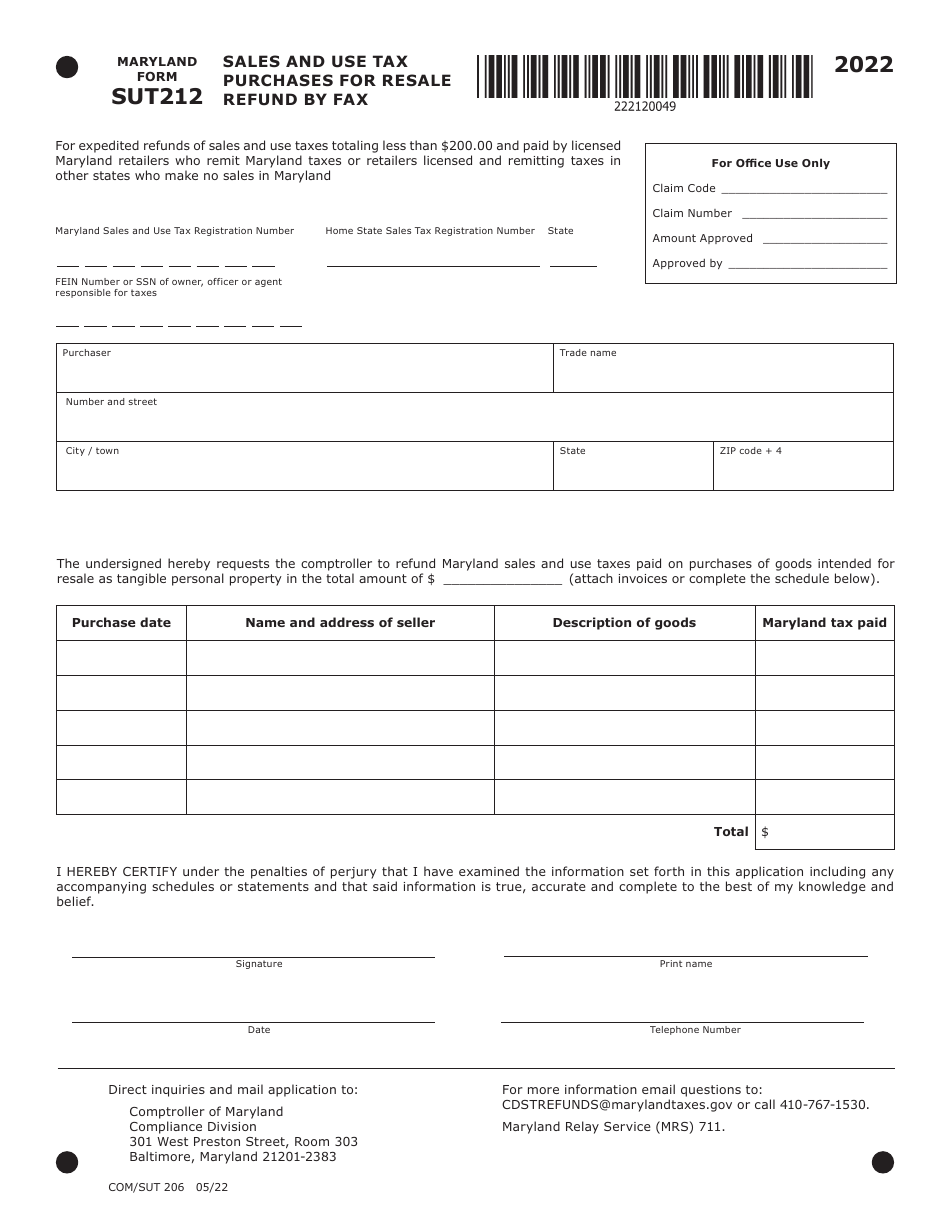

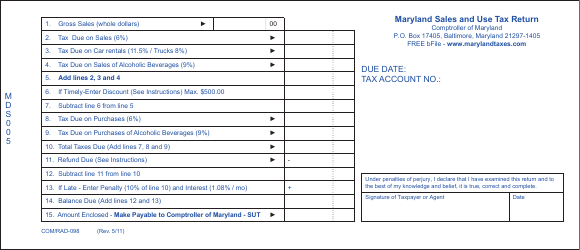

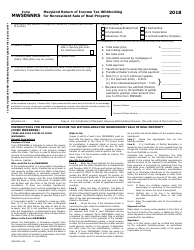

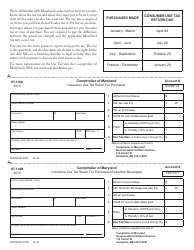

Maryland Form SUT212 (COM / SUT206) Sales and Use Tax Purchases for Resale Refund by Fax - Maryland

What Is Maryland Form SUT212 (COM/SUT206)?

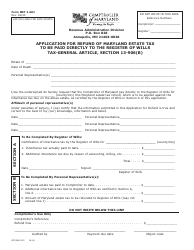

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Maryland Form SUT212?

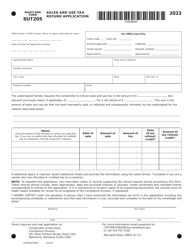

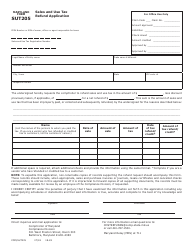

A: Maryland Form SUT212 is a form for requesting a refund of sales and use tax paid on purchases for resale.

Q: Who can use Maryland Form SUT212?

A: The form can be used by businesses in Maryland that have made tax-exempt purchases for resale.

Q: What is the purpose of Maryland Form SUT212?

A: The purpose of the form is to request a refund of sales and use tax paid on qualifying purchases for resale.

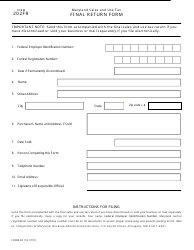

Q: How can I submit Maryland Form SUT212?

A: Maryland Form SUT212 can be submitted by fax.

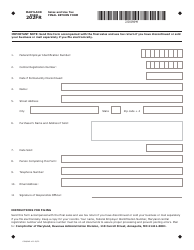

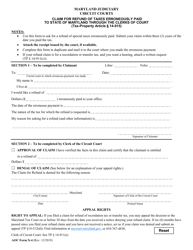

Q: What information is required on Maryland Form SUT212?

A: The form requires information such as the taxpayer's name, address, and tax identification number, as well as details about the purchases for resale.

Q: Is there a deadline for submitting Maryland Form SUT212?

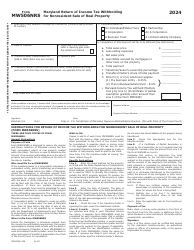

A: Yes, the form must be submitted within four years from the date the tax was paid or within four years of the due date of the return, whichever is later.

Q: Are there any supporting documents required with Maryland Form SUT212?

A: Yes, supporting documentation such as purchase invoices and resale certificates must be attached to the form.

Q: How long does it take to process a refund request with Maryland Form SUT212?

A: The processing time for a refund request varies, but it generally takes around six to eight weeks.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form SUT212 (COM/SUT206) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.