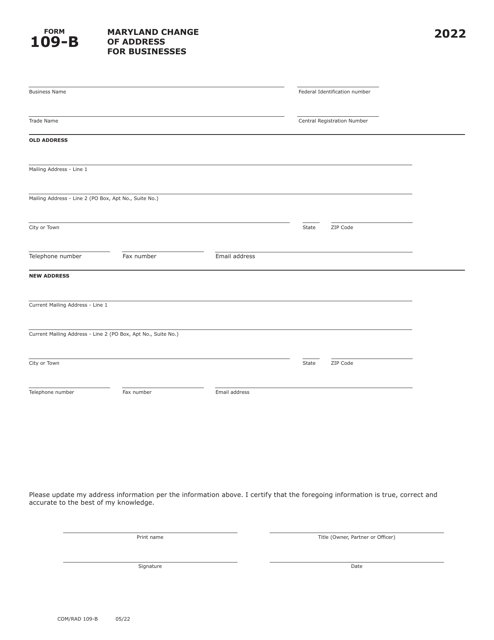

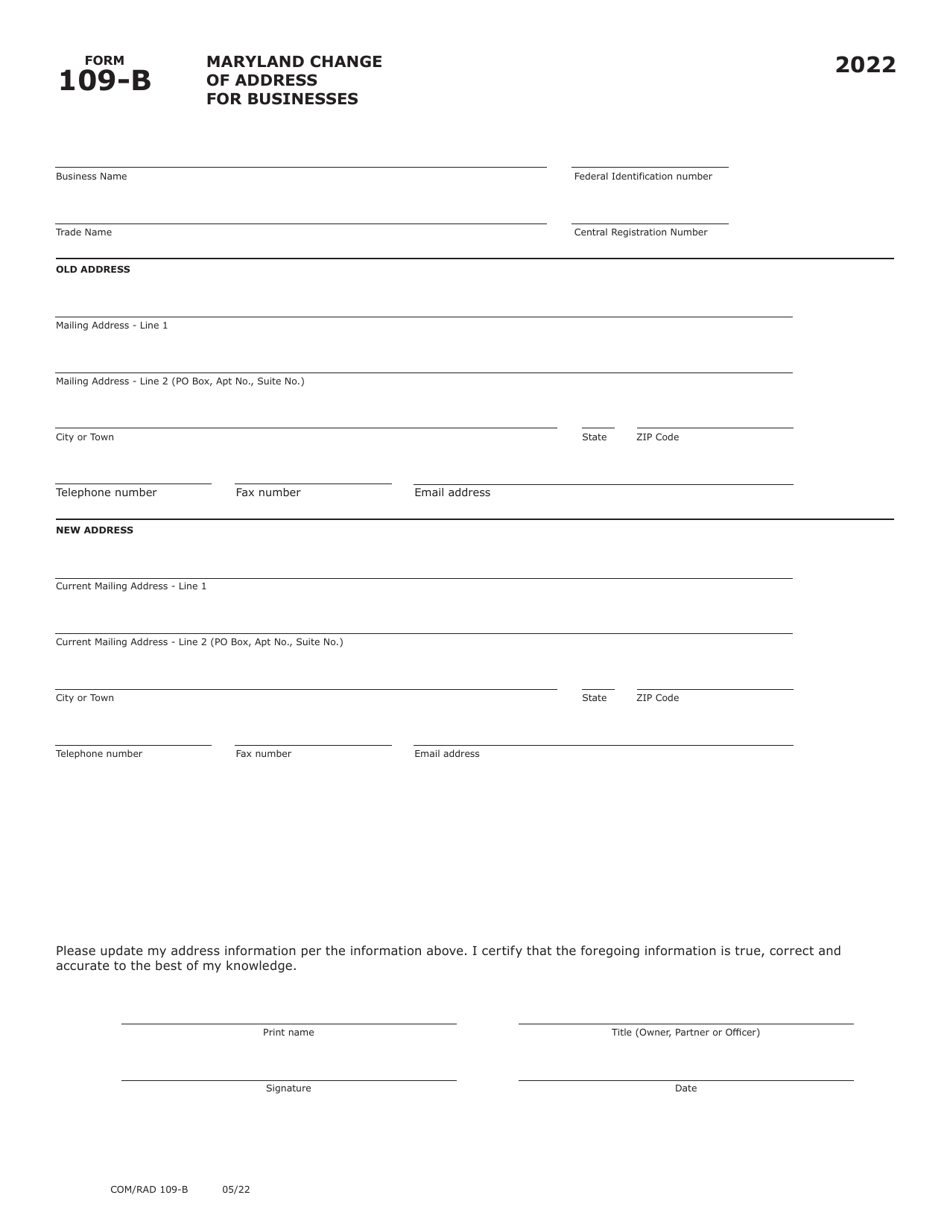

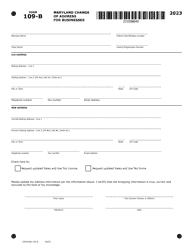

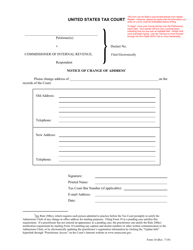

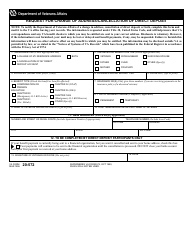

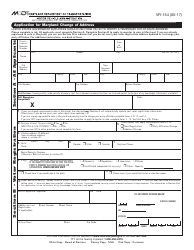

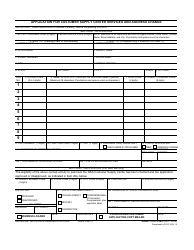

Maryland Form 109-B (COM / RAD109-B) Maryland Change of Address for Businesses - Maryland

What Is Maryland Form 109-B (COM/RAD109-B)?

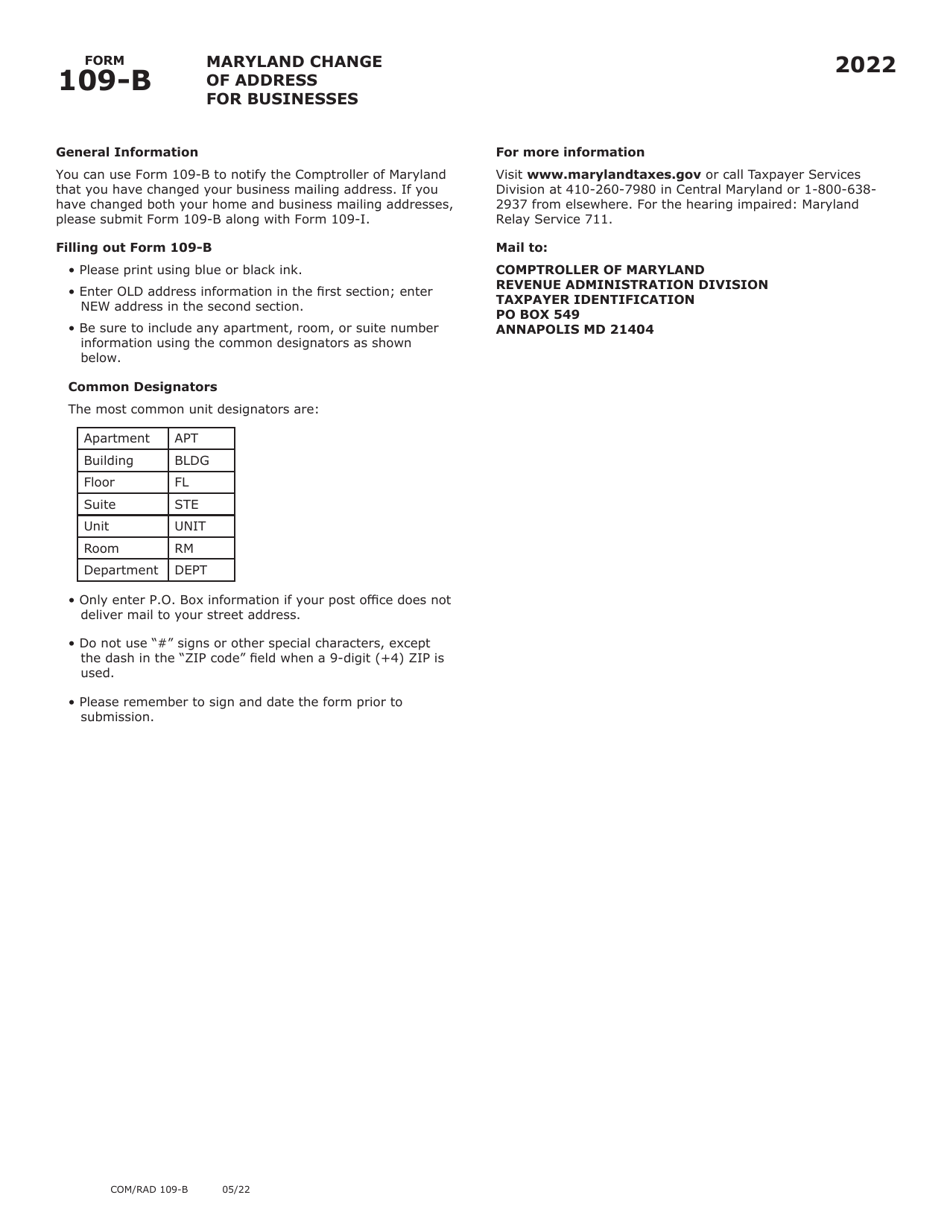

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Maryland Form 109-B?

A: Maryland Form 109-B is the form used to report a change of address for businesses in Maryland.

Q: What is the purpose of Maryland Form 109-B?

A: The purpose of Maryland Form 109-B is to notify the state of Maryland of a change in address for a business.

Q: Who needs to file Maryland Form 109-B?

A: Any business operating in Maryland that has a change of address needs to file Maryland Form 109-B.

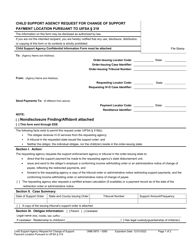

Q: What information is required on Maryland Form 109-B?

A: Maryland Form 109-B requires the business name, old address, new address, and other identifying information.

Q: Is there a fee to file Maryland Form 109-B?

A: No, there is no fee to file Maryland Form 109-B.

Q: What happens after I file Maryland Form 109-B?

A: After filing Maryland Form 109-B, the state of Maryland will update their records with the new address for the business.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Maryland Form 109-B (COM/RAD109-B) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.