Payment Voucher Worksheet for Estimated Tax and Extension Payments (Pvw) - Maryland

Payment Voucher Worksheet for Estimated Tax and Extension Payments (Pvw) is a legal document that was released by the Maryland Taxes - a government authority operating within Maryland.

FAQ

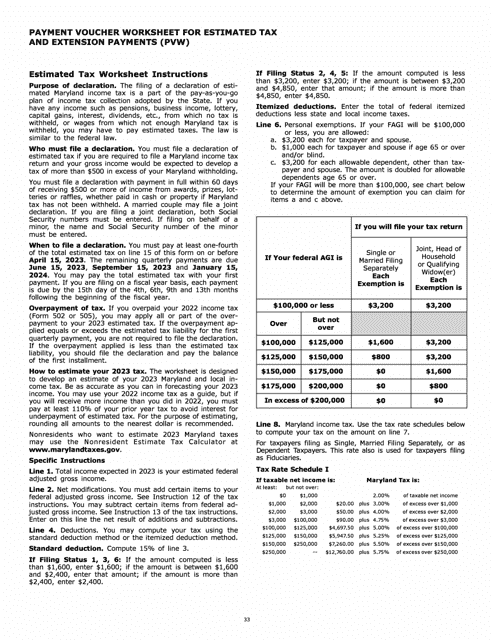

Q: What is a Payment Voucher Worksheet?

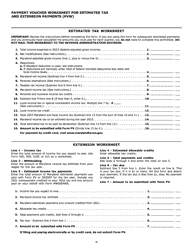

A: A Payment Voucher Worksheet is a form used to calculate and record estimated tax and extension payments.

Q: What is the purpose of a Payment Voucher Worksheet?

A: The purpose of a Payment Voucher Worksheet is to help individuals and businesses accurately calculate and record their estimated tax and extension payments.

Q: Why would I need to make estimated tax payments?

A: You may need to make estimated tax payments if you have income that is not subject to withholding, such as self-employment income.

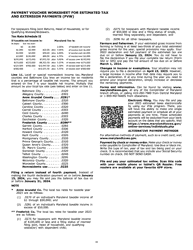

Q: What is an extension payment?

A: An extension payment is a payment made to the tax authorities to request additional time to file your tax return.

Q: When should I use the Payment Voucher Worksheet?

A: You should use the Payment Voucher Worksheet when making estimated tax payments or extension payments for your Maryland state taxes.

Q: Are there penalties for not making estimated tax payments?

A: Yes, there may be penalties for not making estimated tax payments, so it is important to stay up-to-date with your tax obligations.

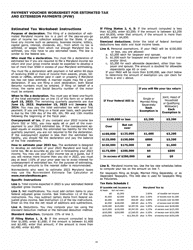

Q: How do I know how much to pay for estimated taxes?

A: You can calculate your estimated tax payments using the Payment Voucher Worksheet or consult a tax professional for assistance.

Q: What if I can't pay the full amount of my estimated taxes?

A: If you are unable to pay the full amount of your estimated taxes, it is still important to make partial payments to avoid penalties and interest charges.

Form Details:

- The latest edition currently provided by the Maryland Taxes;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Taxes.