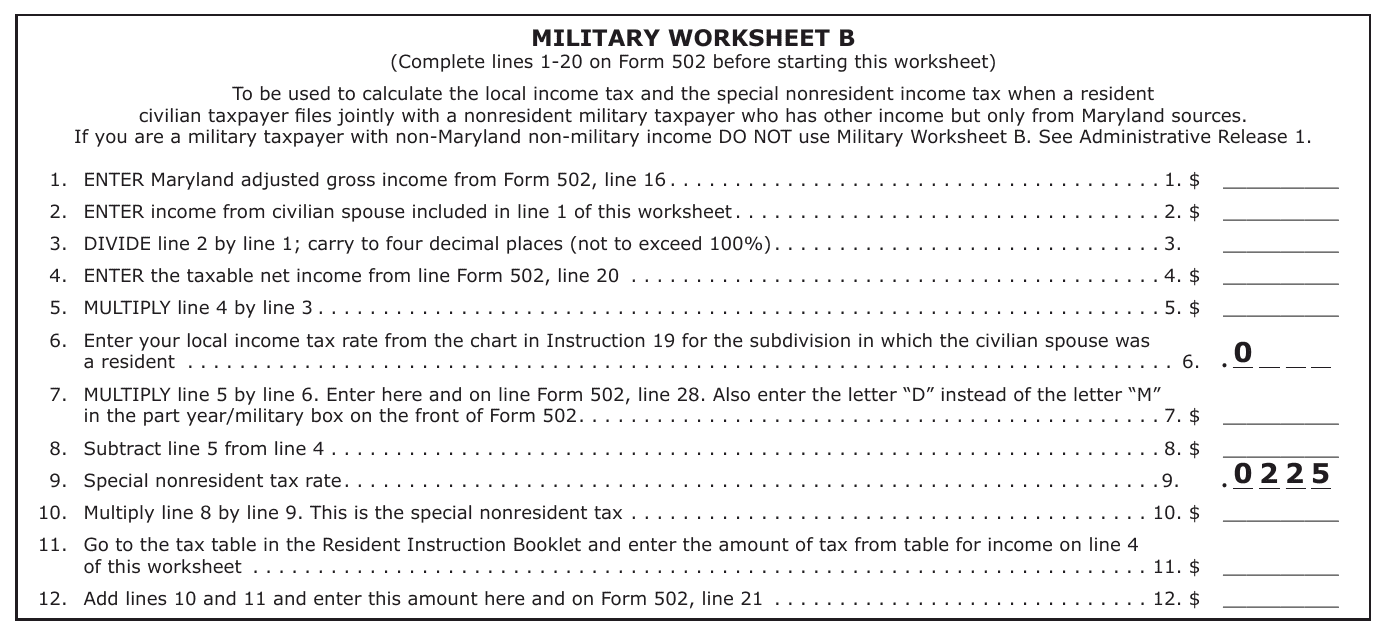

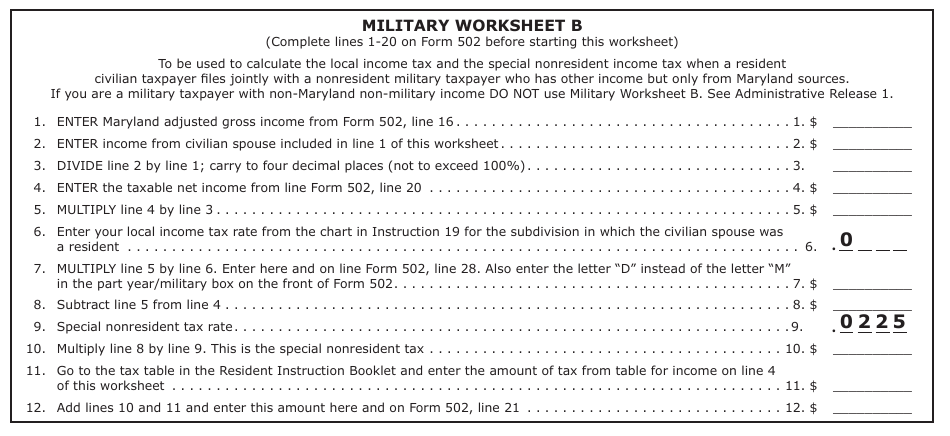

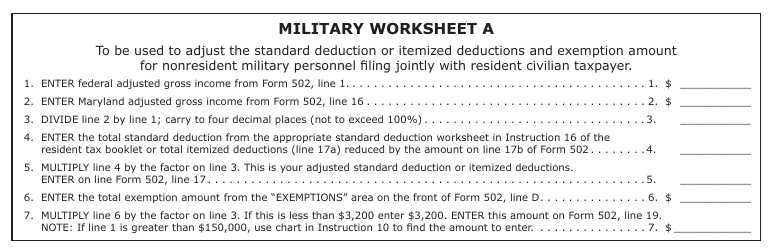

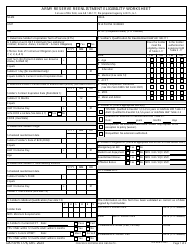

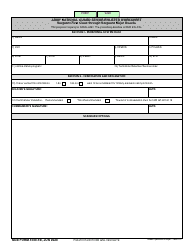

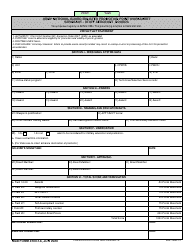

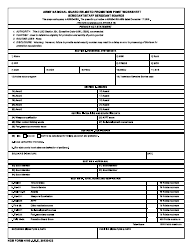

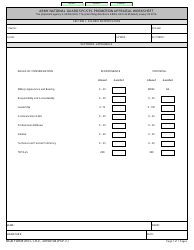

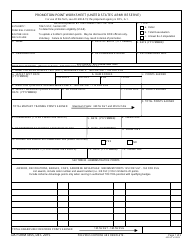

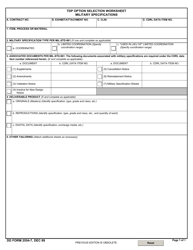

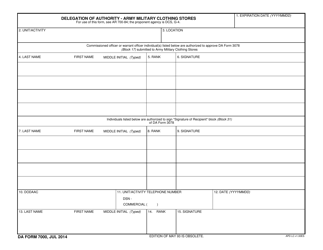

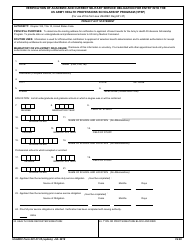

Worksheet B Military - Maryland

What Is Worksheet B?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Worksheet B Military in Maryland?

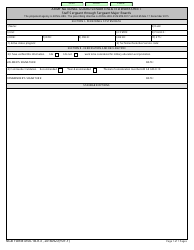

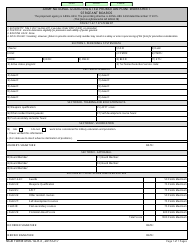

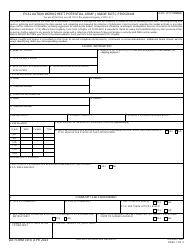

A: Worksheet B Military is a form used by military personnel in Maryland to report their military income, deductions, and adjustments for tax purposes.

Q: Who needs to fill out Worksheet B Military in Maryland?

A: Military personnel who are residents of Maryland and earn income from military sources need to fill out Worksheet B Military.

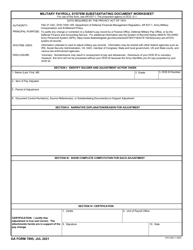

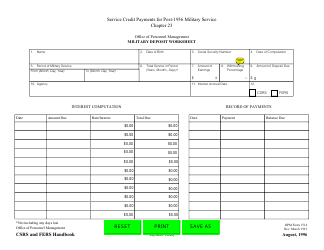

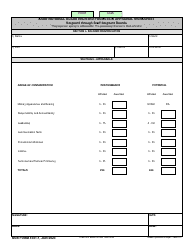

Q: What information is required on Worksheet B Military in Maryland?

A: Worksheet B Military requires military personnel to provide details of their military income, deductions, and adjustments, including details of combat pay, housing allowances, and other military benefits.

Q: When is the deadline to file Worksheet B Military in Maryland?

A: Worksheet B Military, along with the Maryland tax return, is generally due by April 15th of each year, unless an extension has been granted.

Q: Can military spouses use Worksheet B Military in Maryland?

A: No, Worksheet B Military is specifically for military personnel. Military spouses should use the regular Maryland tax forms and follow the applicable instructions for their situation.

Q: Do military personnel stationed in Maryland pay state taxes?

A: Yes, military personnel stationed in Maryland are generally required to pay state taxes on their military income, unless they have established legal residency in another state.

Q: Is Worksheet B Military used for both active-duty and reserve military personnel?

A: Yes, Worksheet B Military is used for both active-duty and reserve military personnel in Maryland, as long as they earn income from military sources.

Q: What happens if I fail to file Worksheet B Military in Maryland?

A: If you fail to file Worksheet B Military or any required tax forms in Maryland, you may be subject to penalties and interest on any unpaid taxes. It is important to timely and accurately file your tax returns to avoid these consequences.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Worksheet B by clicking the link below or browse more documents and templates provided by the Maryland Taxes.