This version of the form is not currently in use and is provided for reference only. Download this version of

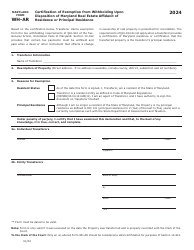

Maryland Form MW507M (COM/RAD048)

for the current year.

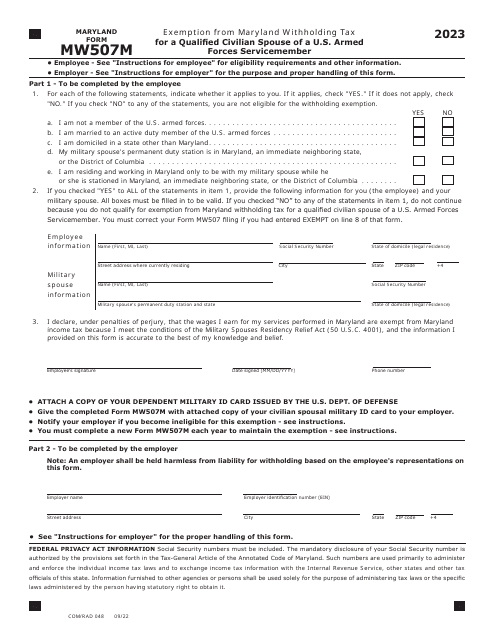

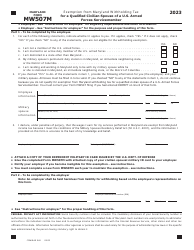

Maryland Form MW507M (COM / RAD048) Exemption From Maryland Withholding Tax for a Qualified Civilian Spouse of a U.S. Armed Forces Servicemember - Maryland

What Is Maryland Form MW507M (COM/RAD048)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

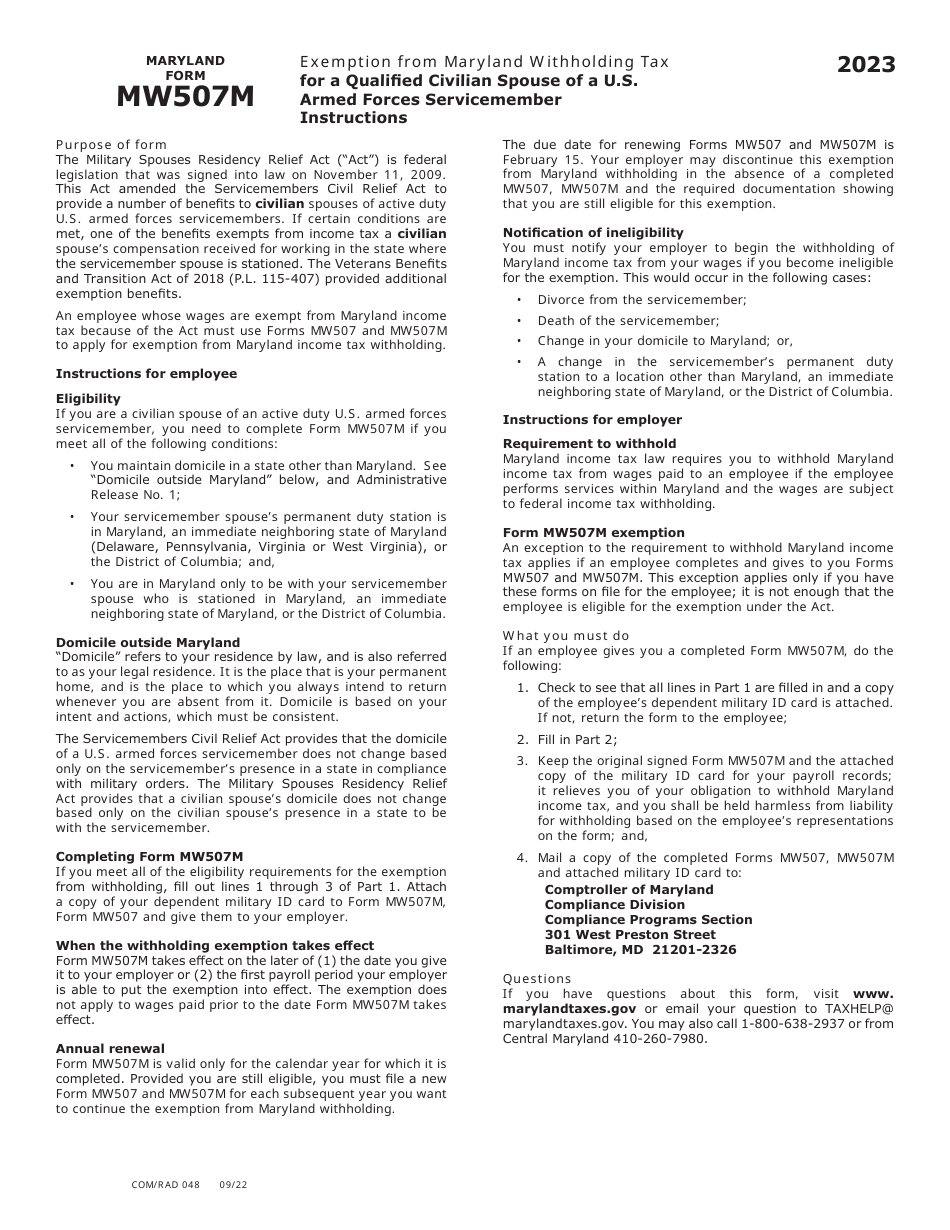

Q: What is the purpose of Maryland Form MW507M?

A: The purpose of Maryland Form MW507M is to claim exemption from Maryland withholding tax for a qualified civilian spouse of a U.S. Armed Forces servicemember.

Q: Who is eligible to use Maryland Form MW507M?

A: Only qualified civilian spouses of U.S. Armed Forces servicemembers are eligible to use Maryland Form MW507M.

Q: What does it mean to be a qualified civilian spouse?

A: A qualified civilian spouse is a spouse of a U.S. Armed Forces servicemember who resides with the servicemember in Maryland and has income from a source outside of Maryland.

Q: What is the purpose of claiming exemption from Maryland withholding tax?

A: Claiming exemption from Maryland withholding tax means that no Maryland state income tax will be withheld from the qualified civilian spouse's wages.

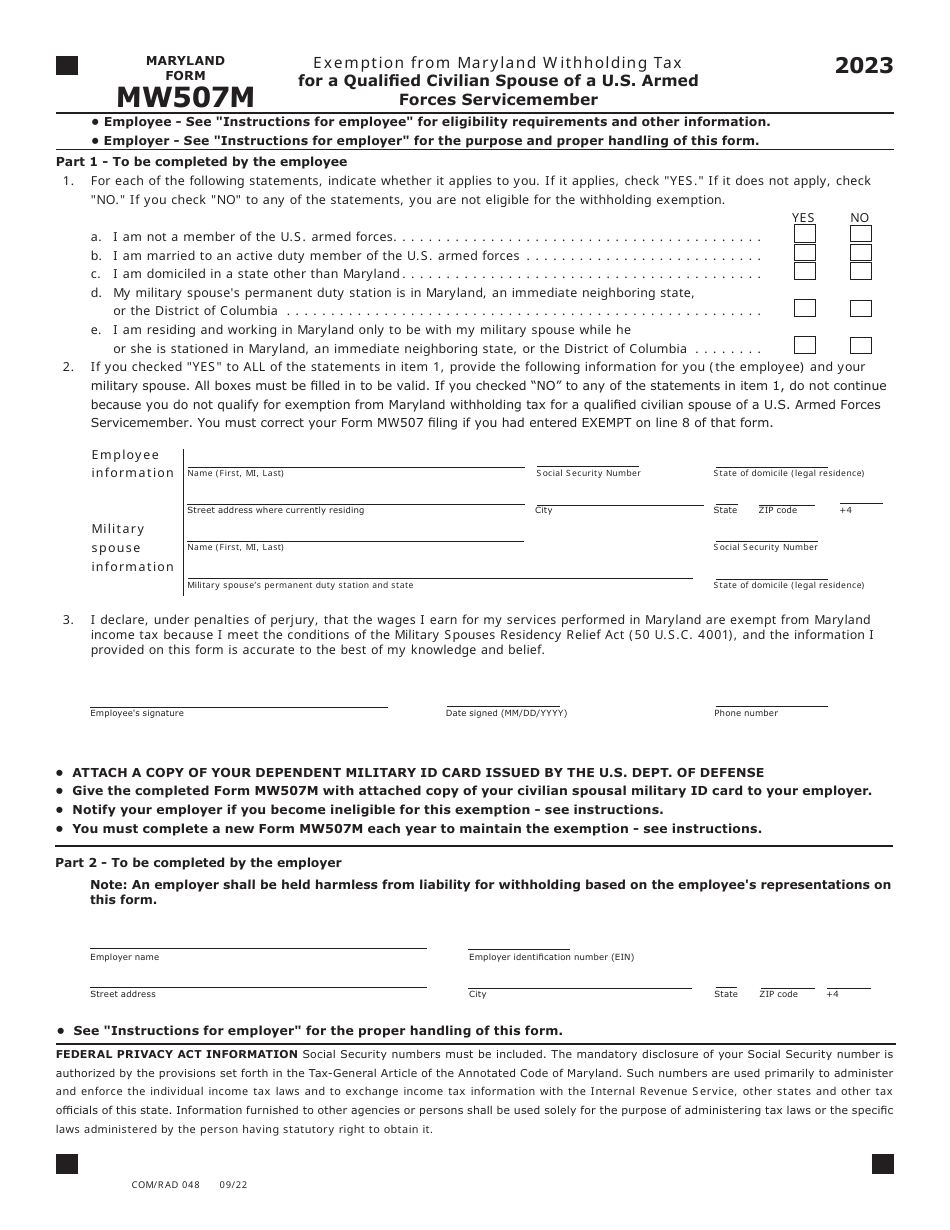

Q: Are there any specific requirements or documentation needed to use Maryland Form MW507M?

A: Yes, the qualified civilian spouse must provide documentation proving their eligibility, such as a copy of the servicemember's military orders.

Q: Is Maryland Form MW507M only applicable to Maryland residents?

A: Yes, only Maryland residents can use Maryland Form MW507M to claim exemption from Maryland withholding tax.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form MW507M (COM/RAD048) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.