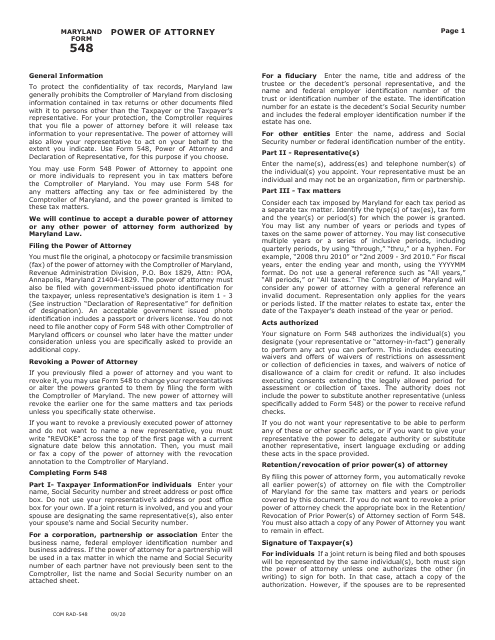

Instructions for Maryland Form 548, COM / RAD-548 Power of Attorney - Maryland

This document contains official instructions for Maryland Form 548 , and Form COM/RAD-548 . Both forms are released and collected by the Maryland Taxes. An up-to-date fillable Form COM/RAD-548 (Maryland Form 548) is available for download through this link.

FAQ

Q: What is Maryland Form 548?

A: Maryland Form 548 is the COM/RAD-548 Power of Attorney form used in Maryland.

Q: What is the purpose of Maryland Form 548?

A: The purpose of Maryland Form 548 is to grant someone else the legal authority to act on your behalf in matters related to your Maryland tax obligations.

Q: Who can use Maryland Form 548?

A: Any individual or entity that wants to grant someone else the power of attorney to handle their Maryland tax matters can use Maryland Form 548.

Q: Are there any fees associated with filing Maryland Form 548?

A: No, there are no fees associated with filing Maryland Form 548.

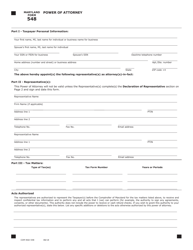

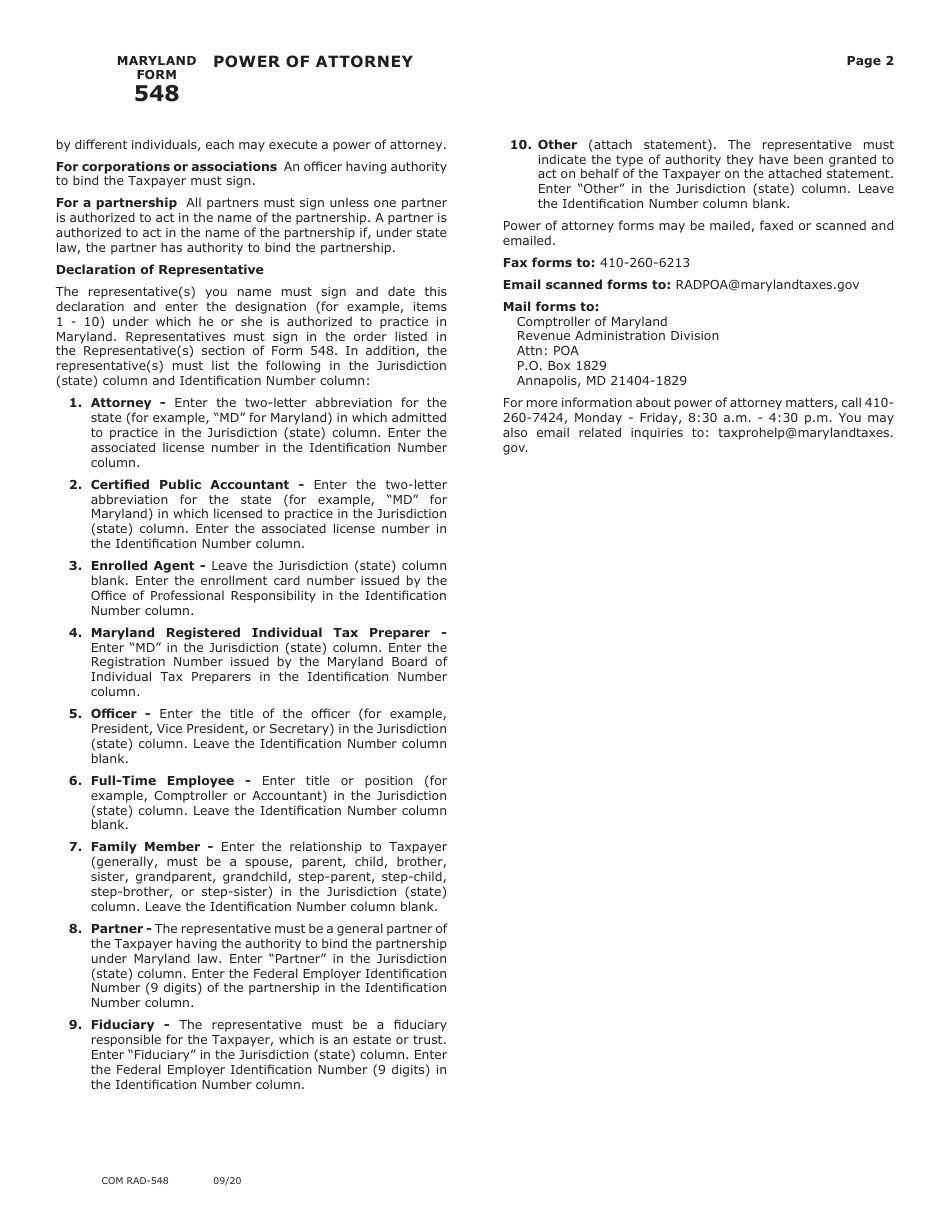

Q: What information is required on Maryland Form 548?

A: Maryland Form 548 requires information about the taxpayer, the appointed representative, and the scope of the power of attorney.

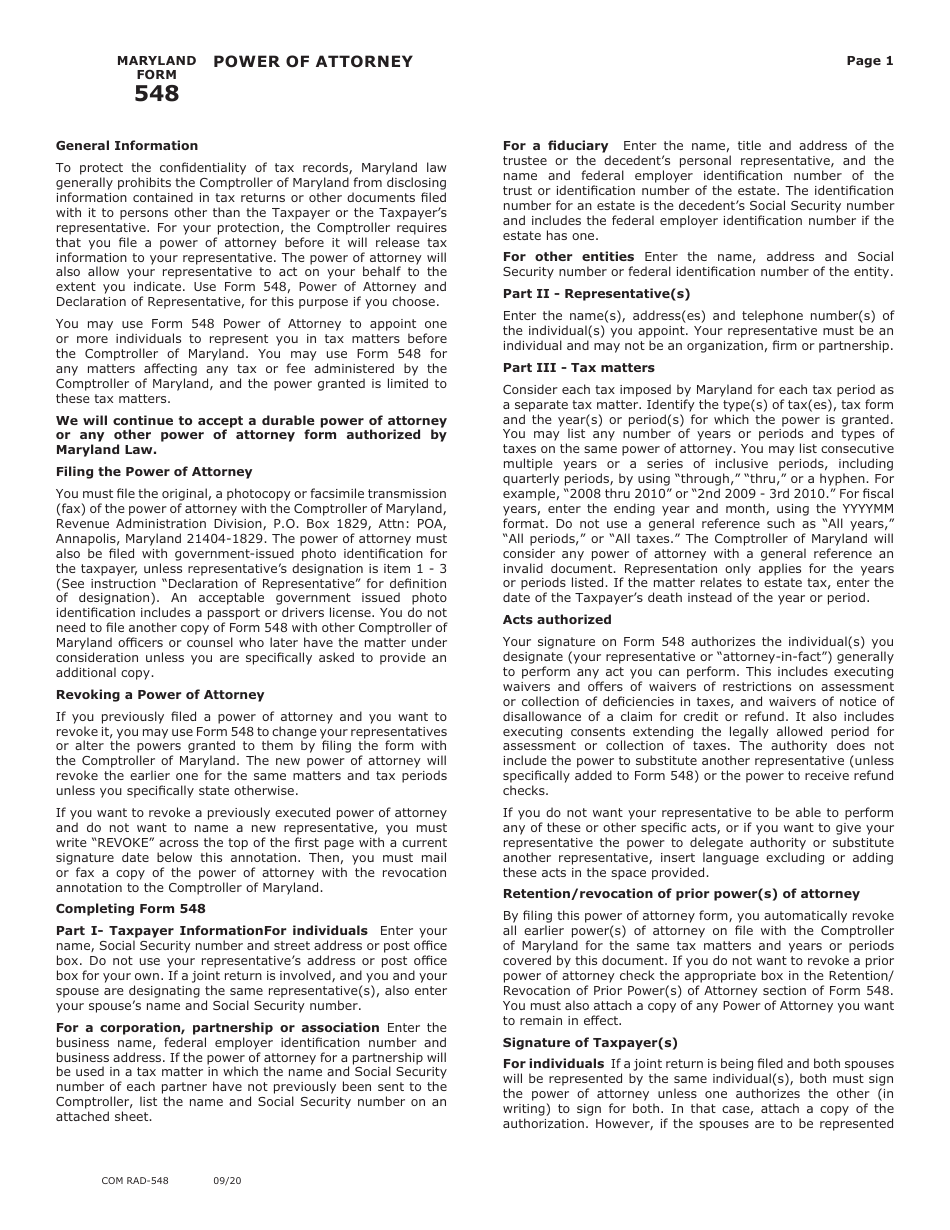

Q: How should I submit Maryland Form 548?

A: Maryland Form 548 should be mailed to the Maryland Comptroller's Office at the address provided on the form.

Q: Can I revoke a power of attorney granted using Maryland Form 548?

A: Yes, you can revoke a power of attorney granted using Maryland Form 548 by submitting a written revocation to the Maryland Comptroller's Office.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Maryland Taxes.