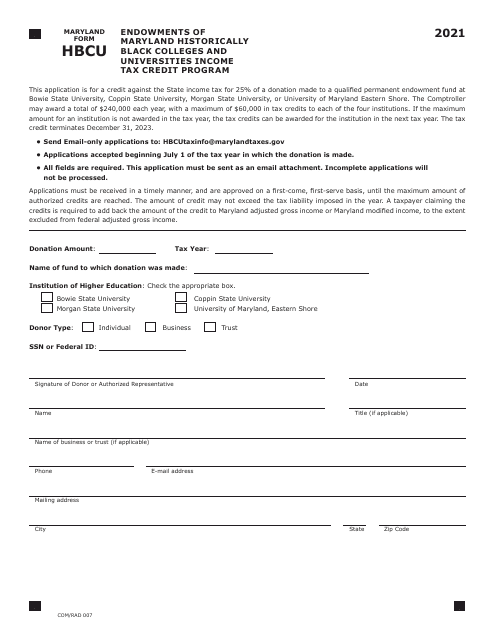

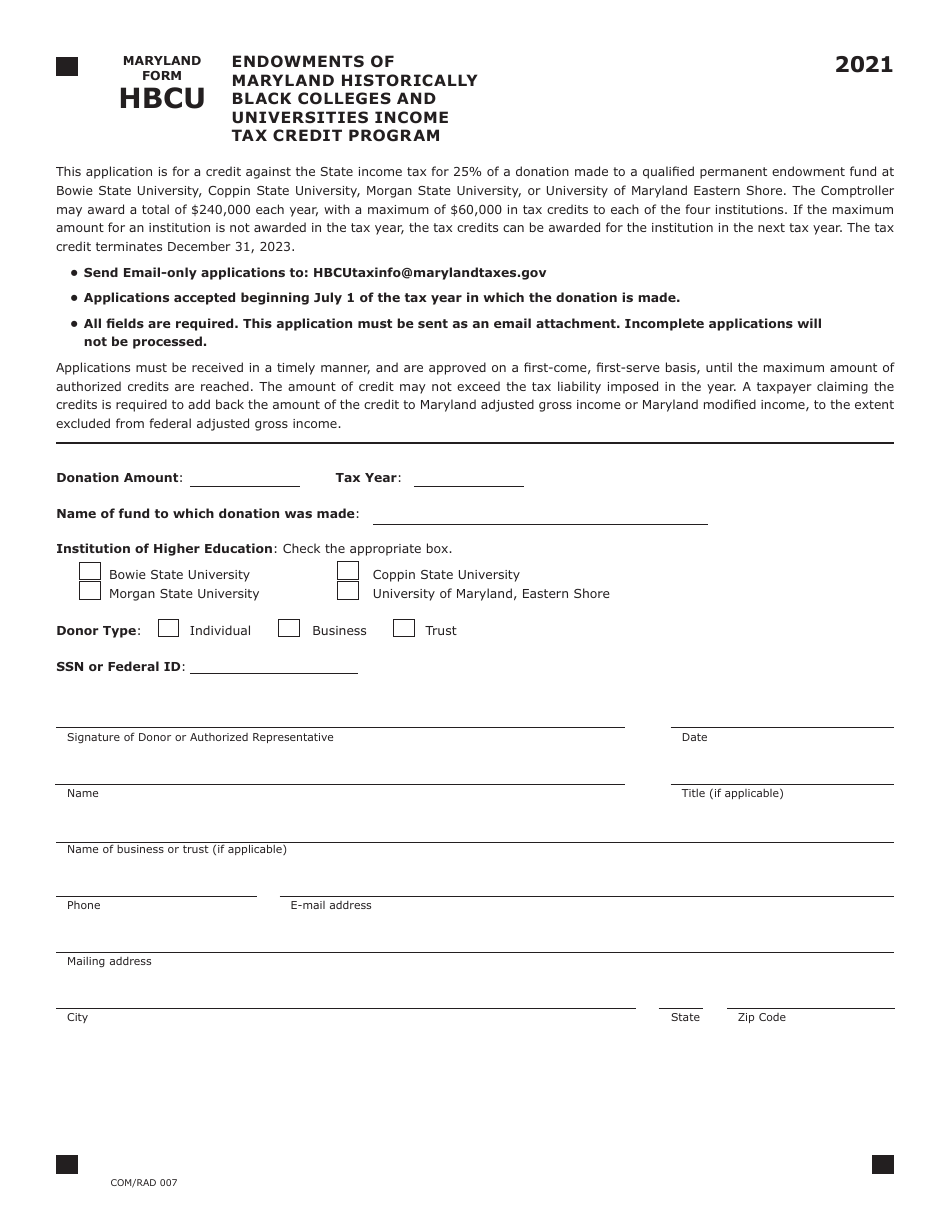

Maryland Form HBCU (COM / RAD007) Endowments of Maryland Historically Black Colleges and Universities Income Tax Credit Program - Maryland

What Is Maryland Form HBCU (COM/RAD007)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Maryland Form HBCU (COM/RAD007)?

A: The Maryland Form HBCU (COM/RAD007) is a form used for claiming the Endowments of Maryland Historically Black Colleges and Universities Income Tax Credit.

Q: What is the Endowments of Maryland Historically Black Colleges and Universities Income Tax Credit Program?

A: The Endowments of Maryland Historically Black Colleges and Universities Income Tax Credit Program is a program that provides tax credits to individuals and businesses that contribute to the endowments of Maryland's historically black colleges and universities.

Q: How can I claim the tax credit?

A: To claim the tax credit, you need to fill out the Maryland Form HBCU (COM/RAD007) and submit it to the Maryland State Department of Assessments and Taxation.

Q: Who is eligible for the tax credit?

A: Both individuals and businesses are eligible for the tax credit if they make qualifying contributions to the endowments of Maryland's historically black colleges and universities.

Q: What are the benefits of the tax credit?

A: The tax credit allows individuals and businesses to reduce their state income tax liability by a certain percentage of their qualifying contributions to the endowments of Maryland's historically black colleges and universities.

Q: Are there any limitations or restrictions on the tax credit?

A: Yes, there are limitations and restrictions on the tax credit. The maximum amount of the tax credit that can be claimed in a year is $200,000, and there is an overall limit of $5 million in tax credits that can be awarded each year.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form HBCU (COM/RAD007) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.