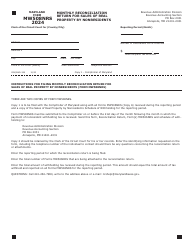

This version of the form is not currently in use and is provided for reference only. Download this version of

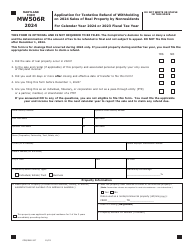

Maryland Form MW506NRS (COM/RAD-308)

for the current year.

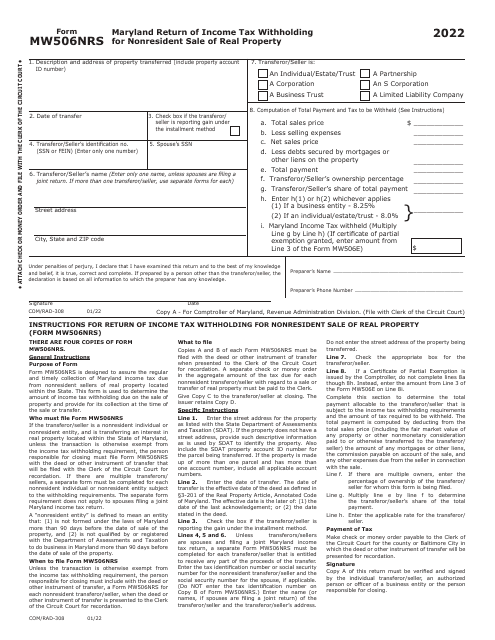

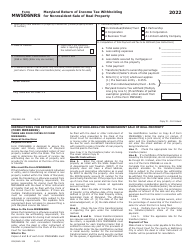

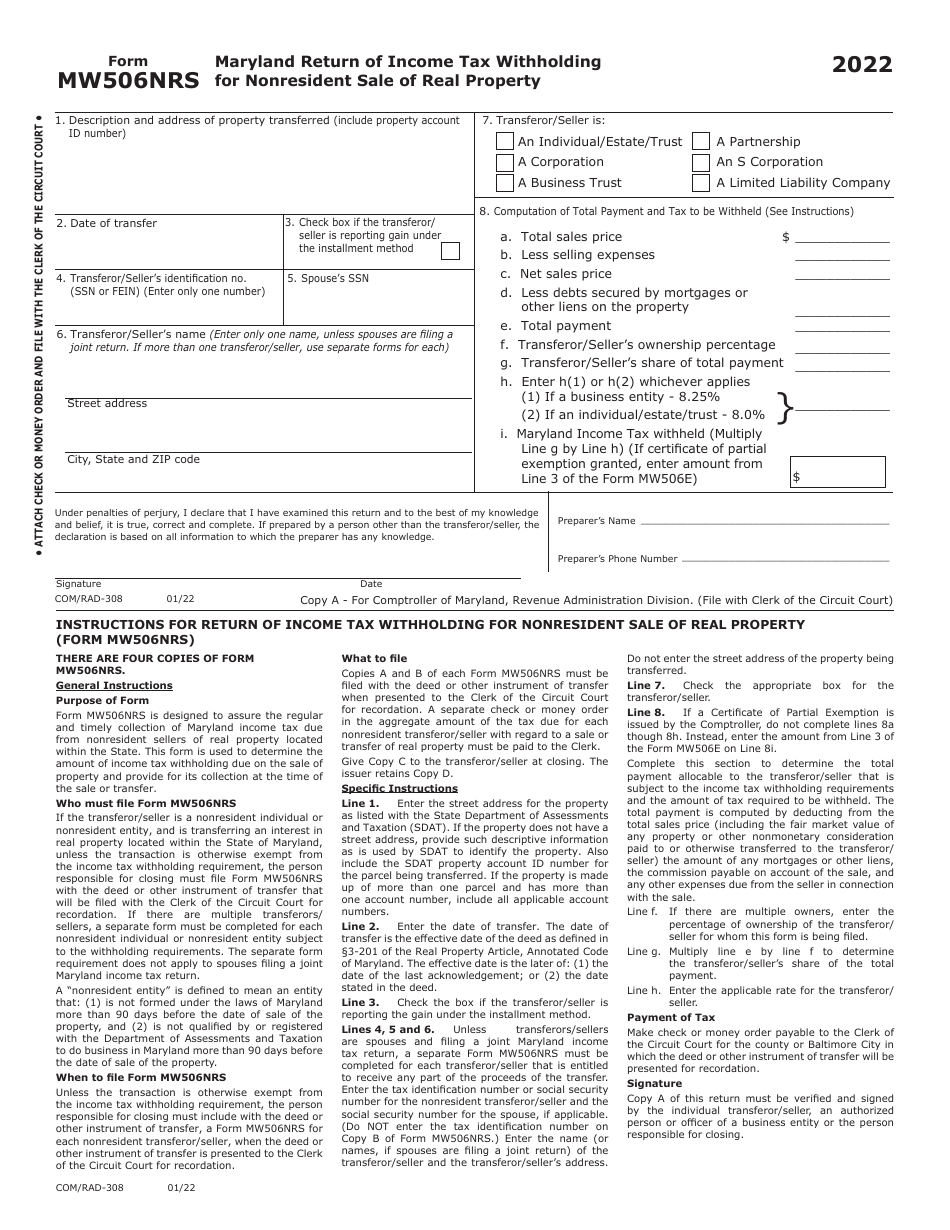

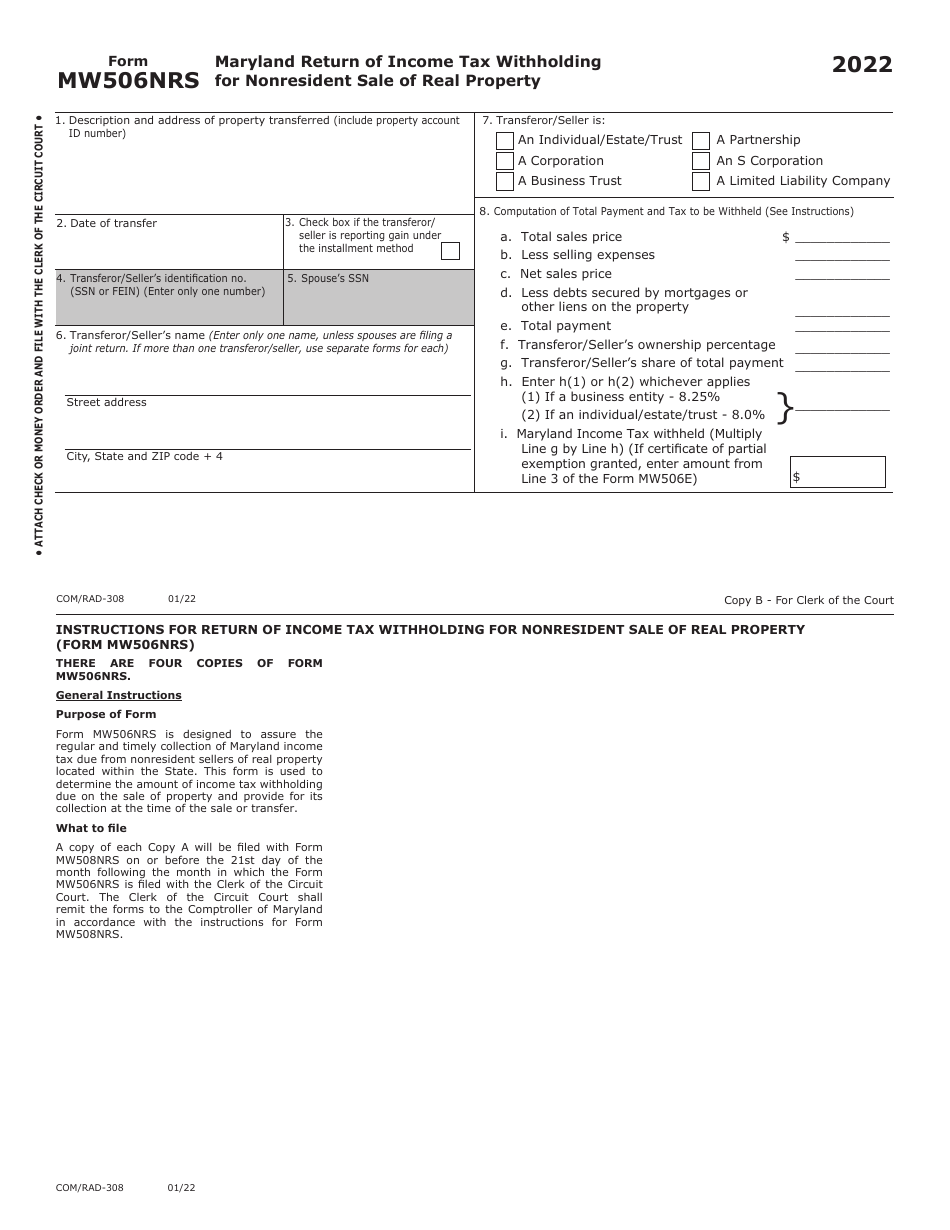

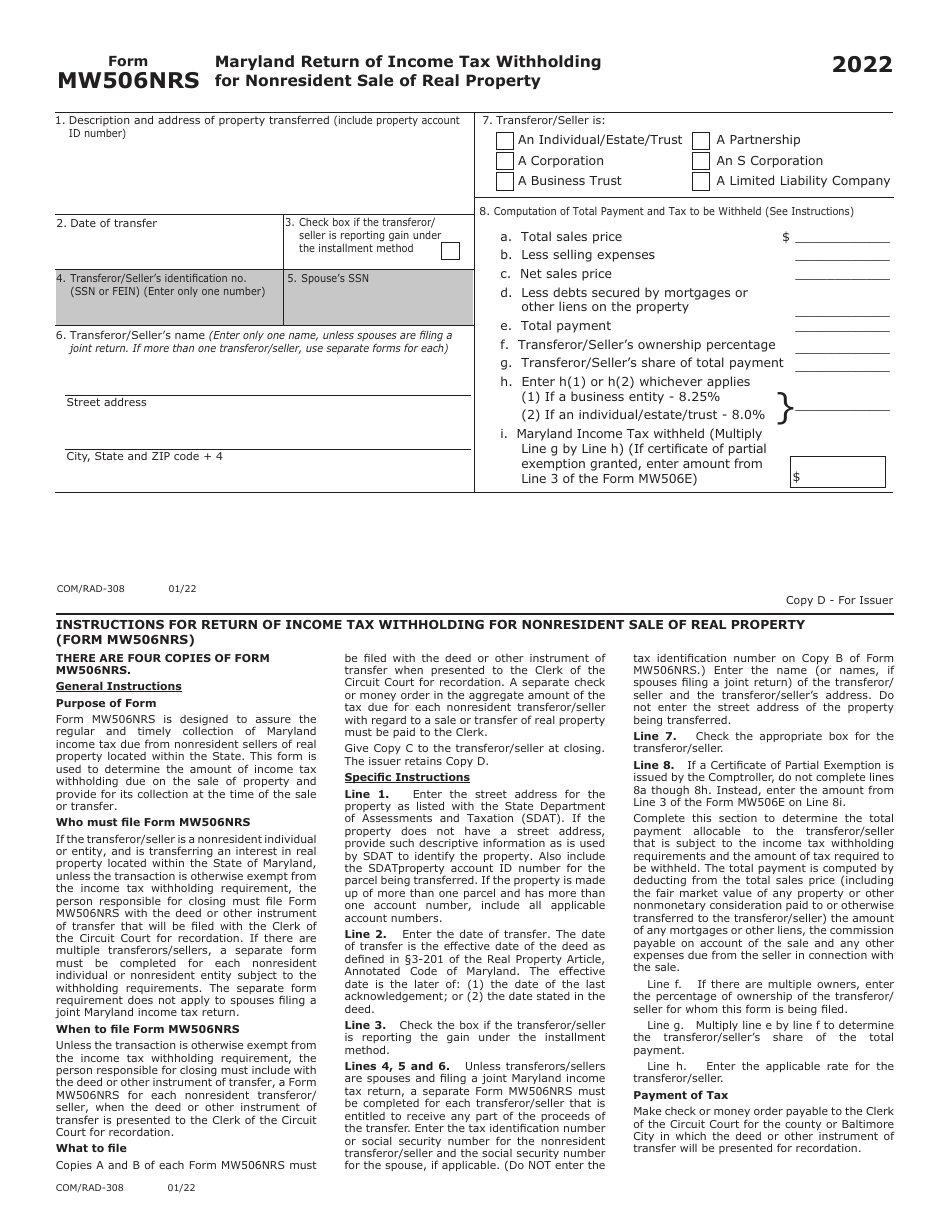

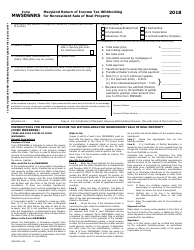

Maryland Form MW506NRS (COM / RAD-308) Maryland Return of Income Tax Withholding for Nonresident Sale of Real Property - Maryland

What Is Maryland Form MW506NRS (COM/RAD-308)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MW506NRS?

A: Form MW506NRS is the Maryland Return of Income Tax Withholding for Nonresident Sale of Real Property.

Q: Who is required to file Form MW506NRS?

A: Nonresident individuals or entities who have sold or transferred real property in Maryland are required to file Form MW506NRS.

Q: What is the purpose of Form MW506NRS?

A: Form MW506NRS is used to report and pay income tax withholding on the sale or transfer of real property in Maryland by nonresident sellers.

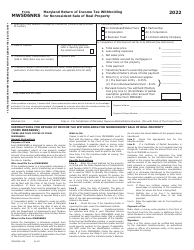

Q: How do I file Form MW506NRS?

A: Form MW506NRS can be filed electronically or by mail. Detailed instructions are provided on the form.

Q: When is Form MW506NRS due?

A: Form MW506NRS is due on or before the 15th day of the month following the date of settlement or transfer of the real property.

Q: What happens if I don't file Form MW506NRS?

A: Failure to file Form MW506NRS may result in penalties and interest.

Q: Do I need to include any supporting documents with Form MW506NRS?

A: Yes, you may need to include a copy of the settlement statement or other documentation to support the information reported on the form.

Q: Who should I contact for more information about Form MW506NRS?

A: For more information about Form MW506NRS, you can contact the Maryland Comptroller's Office.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form MW506NRS (COM/RAD-308) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.