This version of the form is not currently in use and is provided for reference only. Download this version of

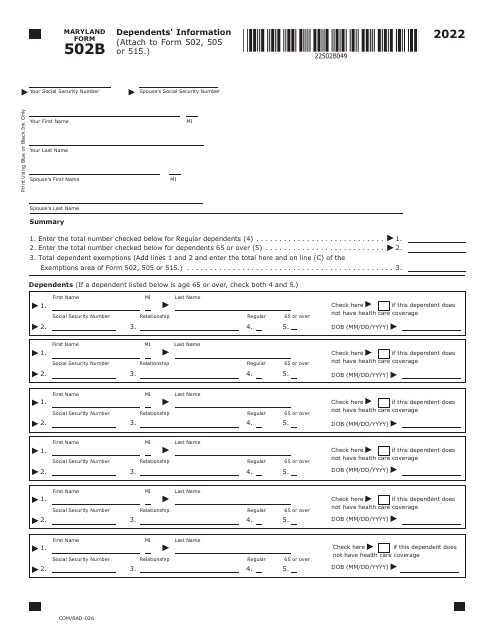

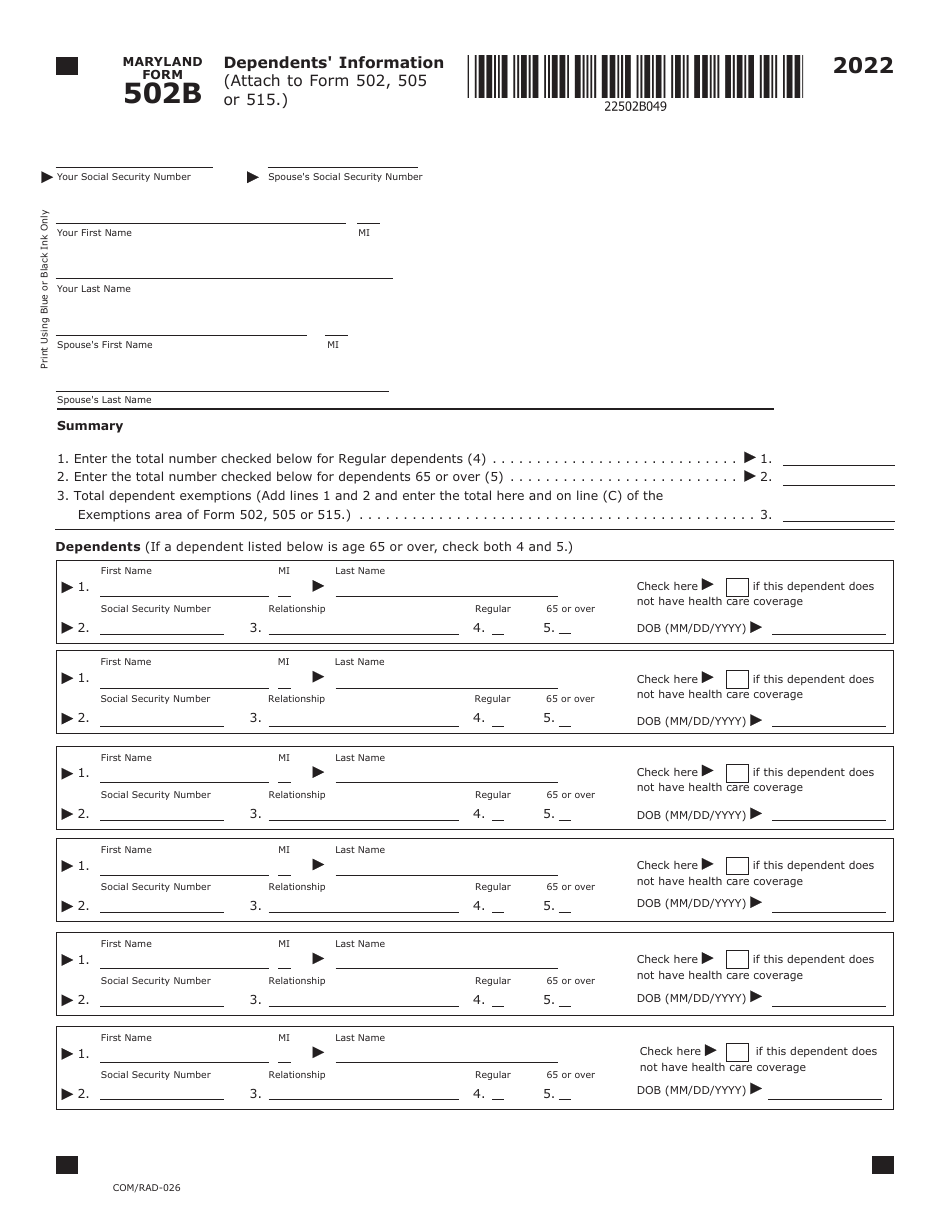

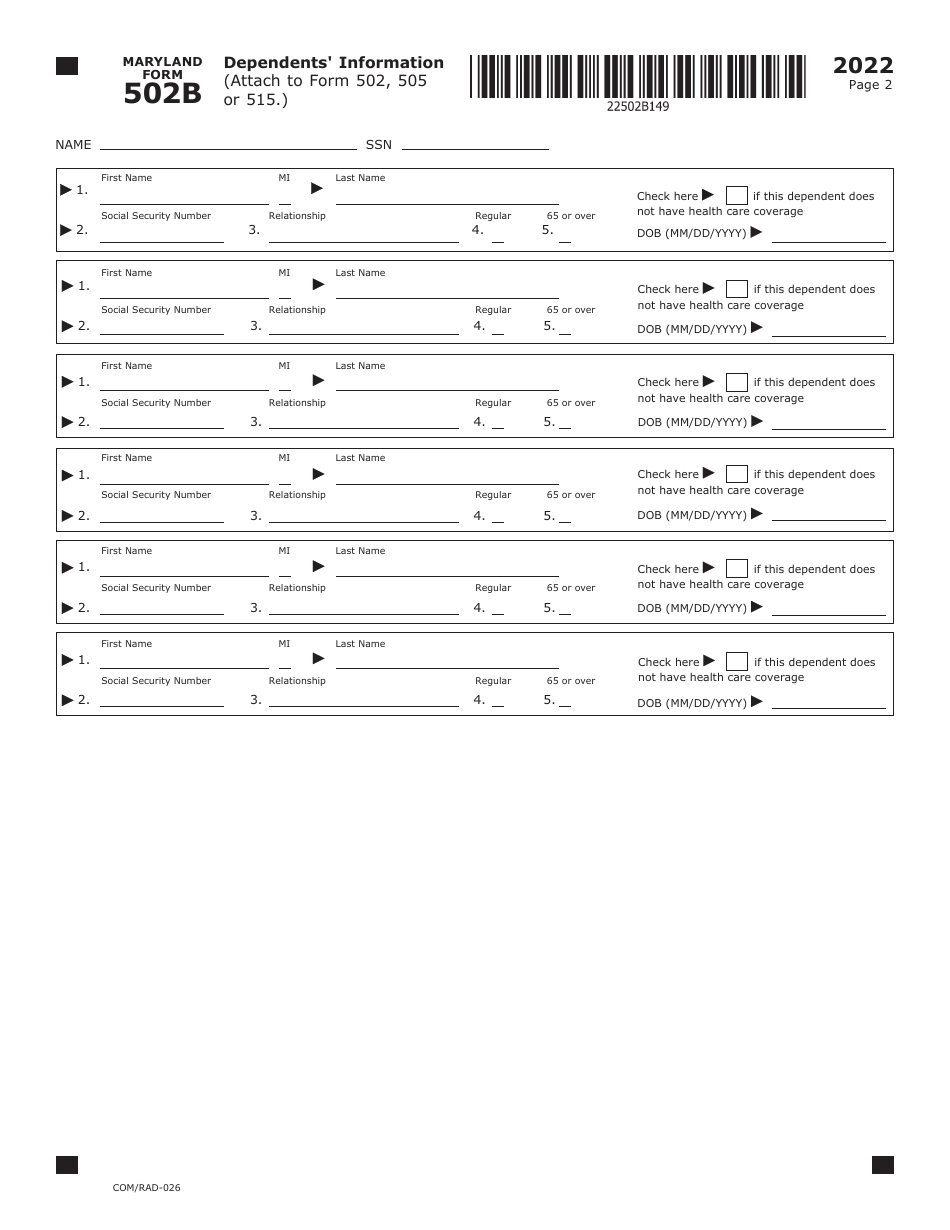

Maryland Form 502B (COM/RAD-026)

for the current year.

Maryland Form 502B (COM / RAD-026) Dependents' Information - Maryland

What Is Maryland Form 502B (COM/RAD-026)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Maryland Form 502B?

A: Maryland Form 502B is the form used to report dependents' information in Maryland.

Q: What is the purpose of Form 502B?

A: The purpose of Form 502B is to provide information about dependents for tax purposes in Maryland.

Q: Who needs to fill out Form 502B?

A: Form 502B needs to be filled out by Maryland residents who have dependents.

Q: What information is required on Form 502B?

A: Form 502B requires information about the dependent's name, social security number, relationship to the taxpayer, and other details.

Q: When is the deadline to file Form 502B?

A: The deadline to file Form 502B is usually the same as the deadline to file your Maryland income tax return.

Q: Are there any penalties for not filing Form 502B?

A: Yes, there may be penalties for not filing Form 502B or providing false information.

Q: Can Form 502B be e-filed?

A: Yes, Form 502B can be e-filed along with your Maryland income tax return.

Q: Can I claim my non-resident dependents on Form 502B?

A: No, Form 502B is for Maryland residents only. Non-resident dependents should be claimed on the appropriate state or federal tax forms.

Q: Is Form 502B the only form for reporting dependents in Maryland?

A: No, there may be other forms or schedules to report dependents' information depending on your specific tax situation.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form 502B (COM/RAD-026) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.