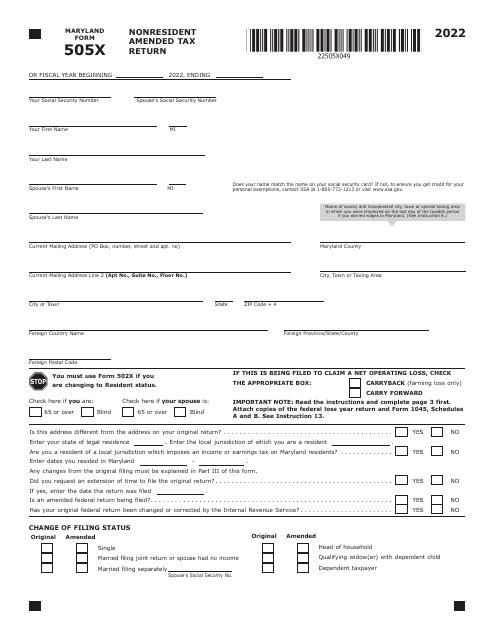

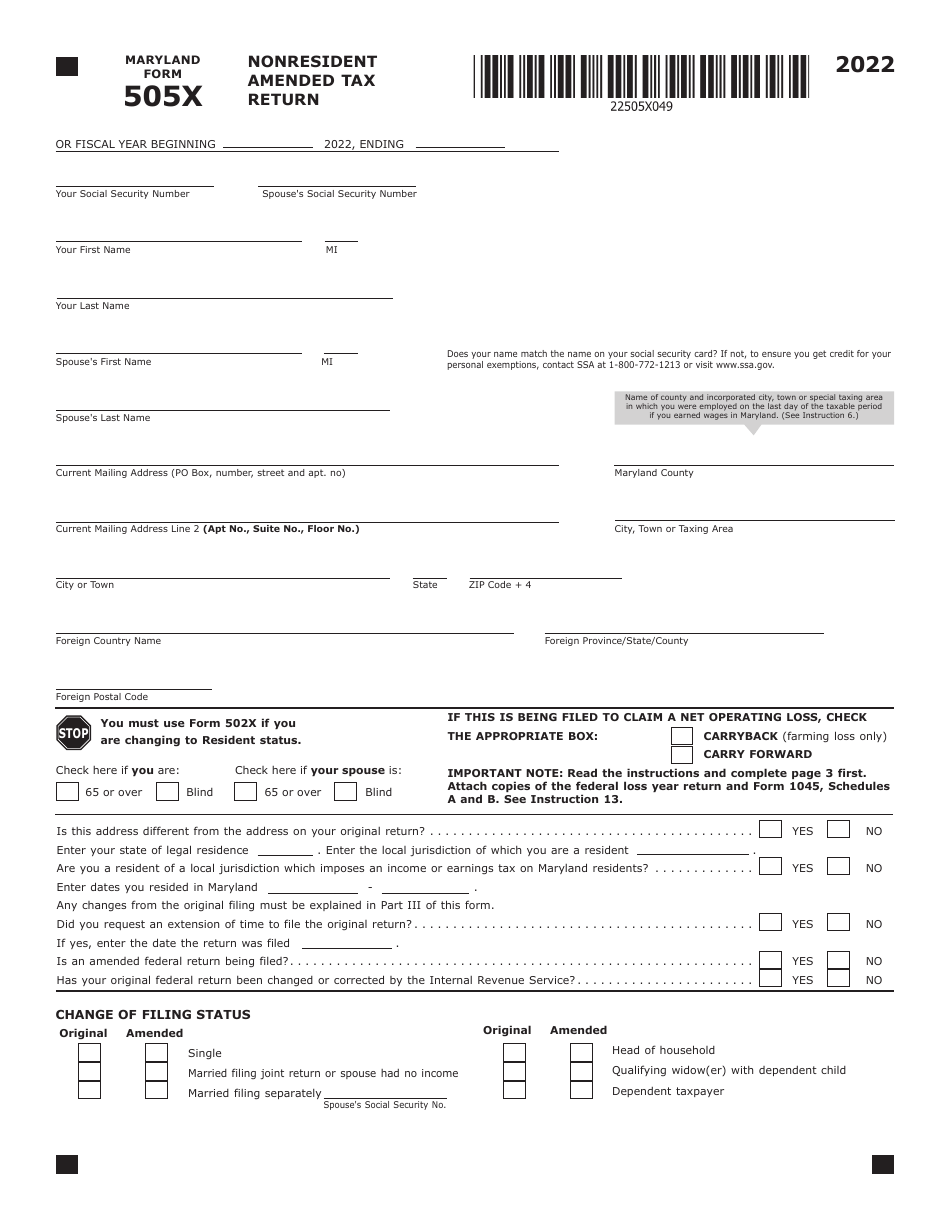

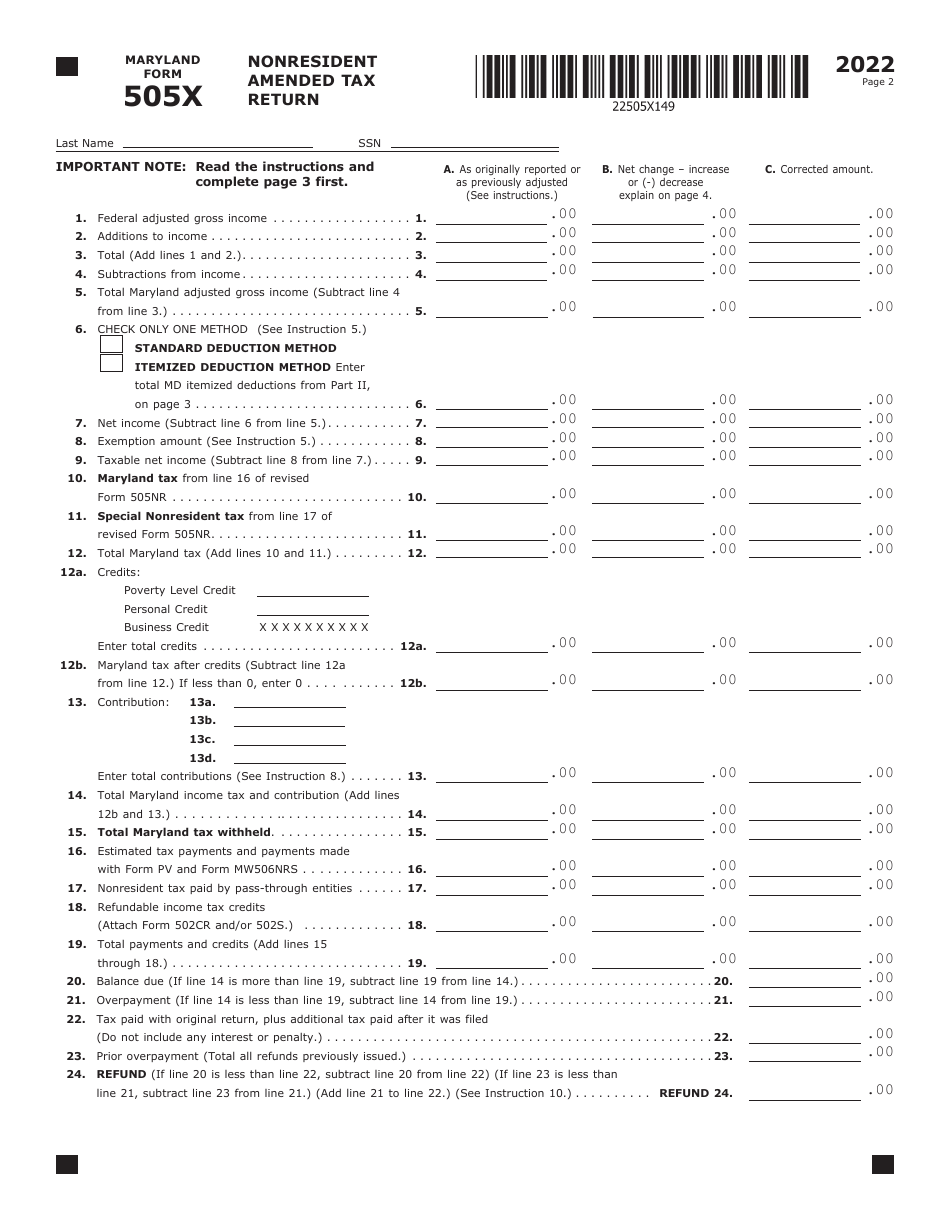

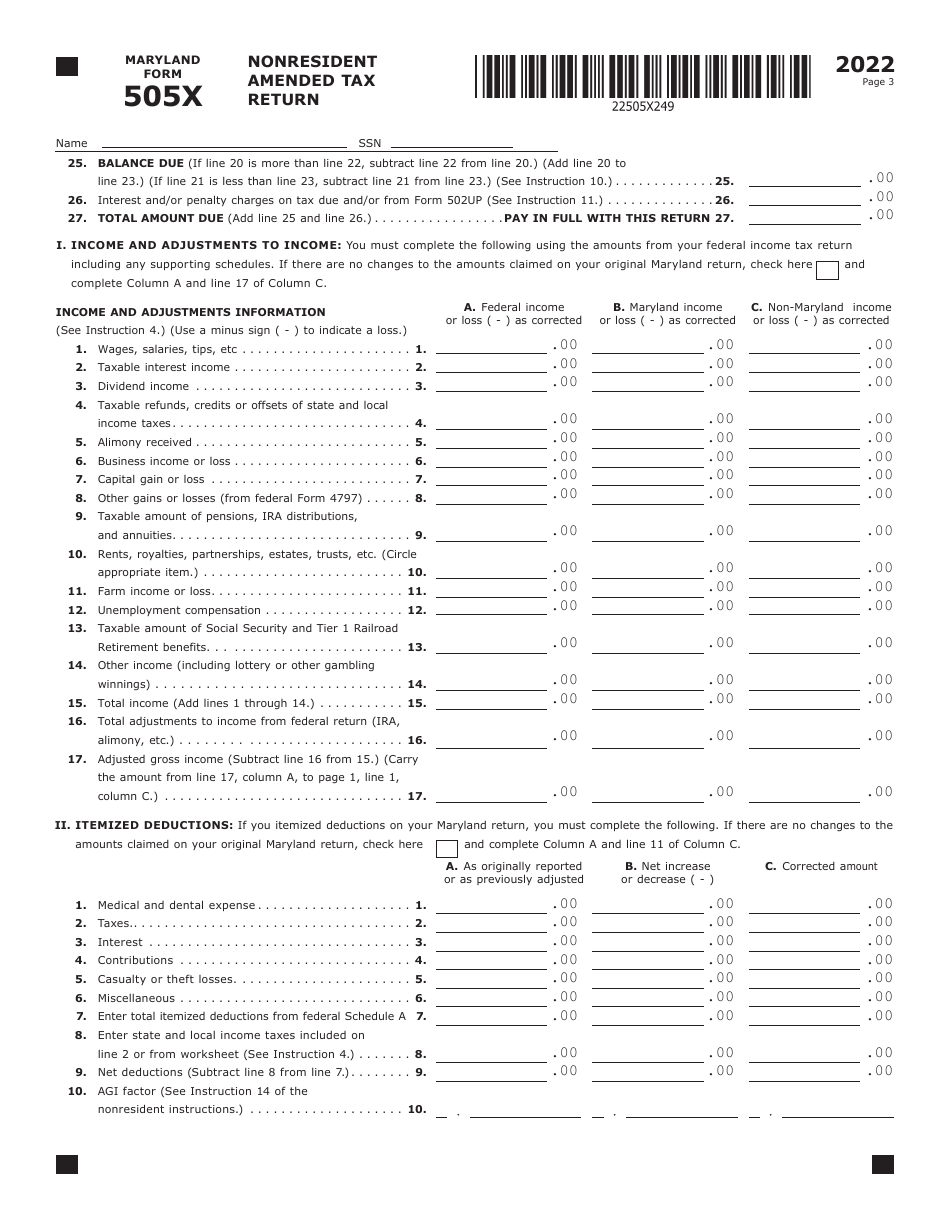

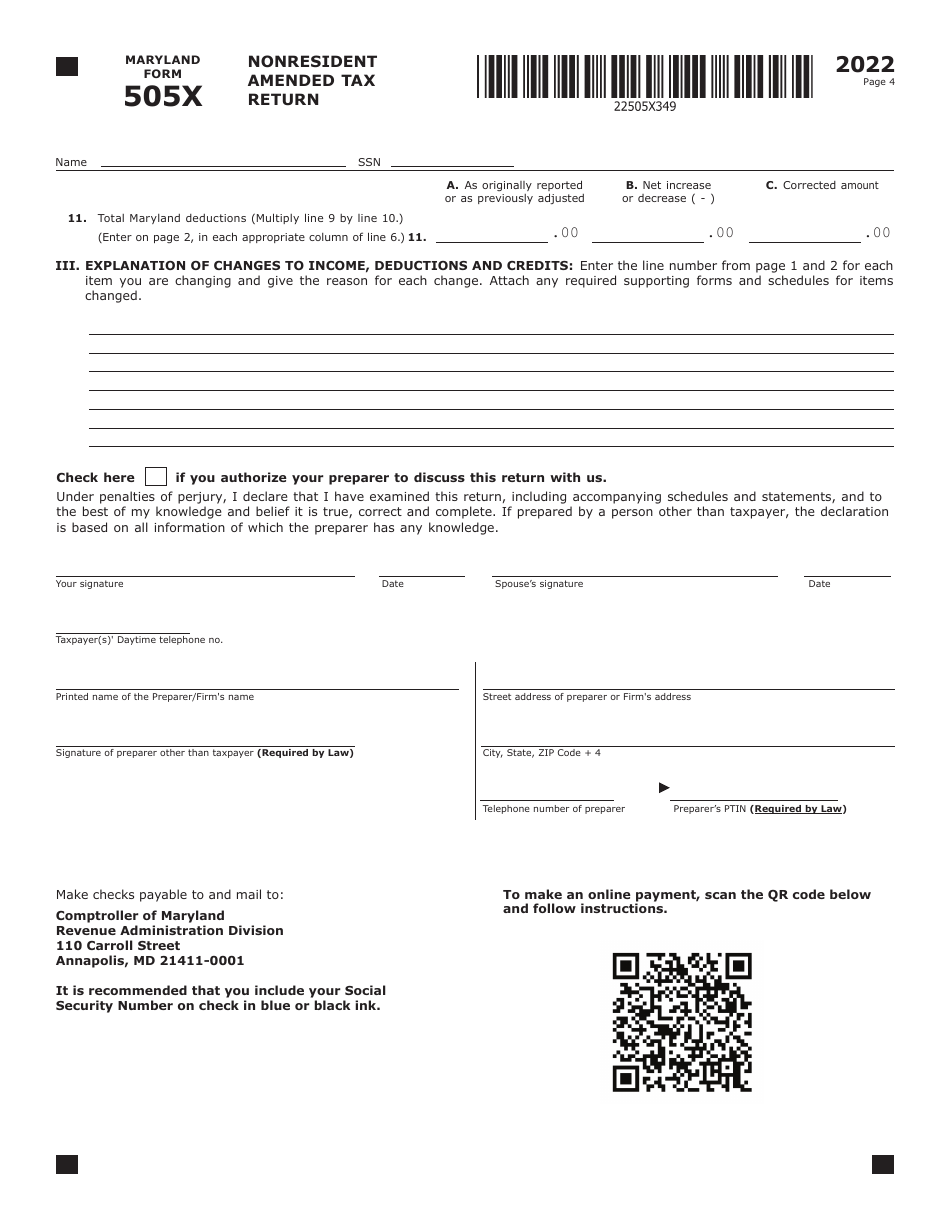

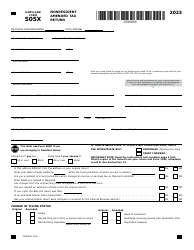

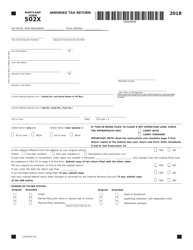

Maryland Form 505X Nonresident Amended Tax Return - Maryland

What Is Maryland Form 505X?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Maryland Form 505X?

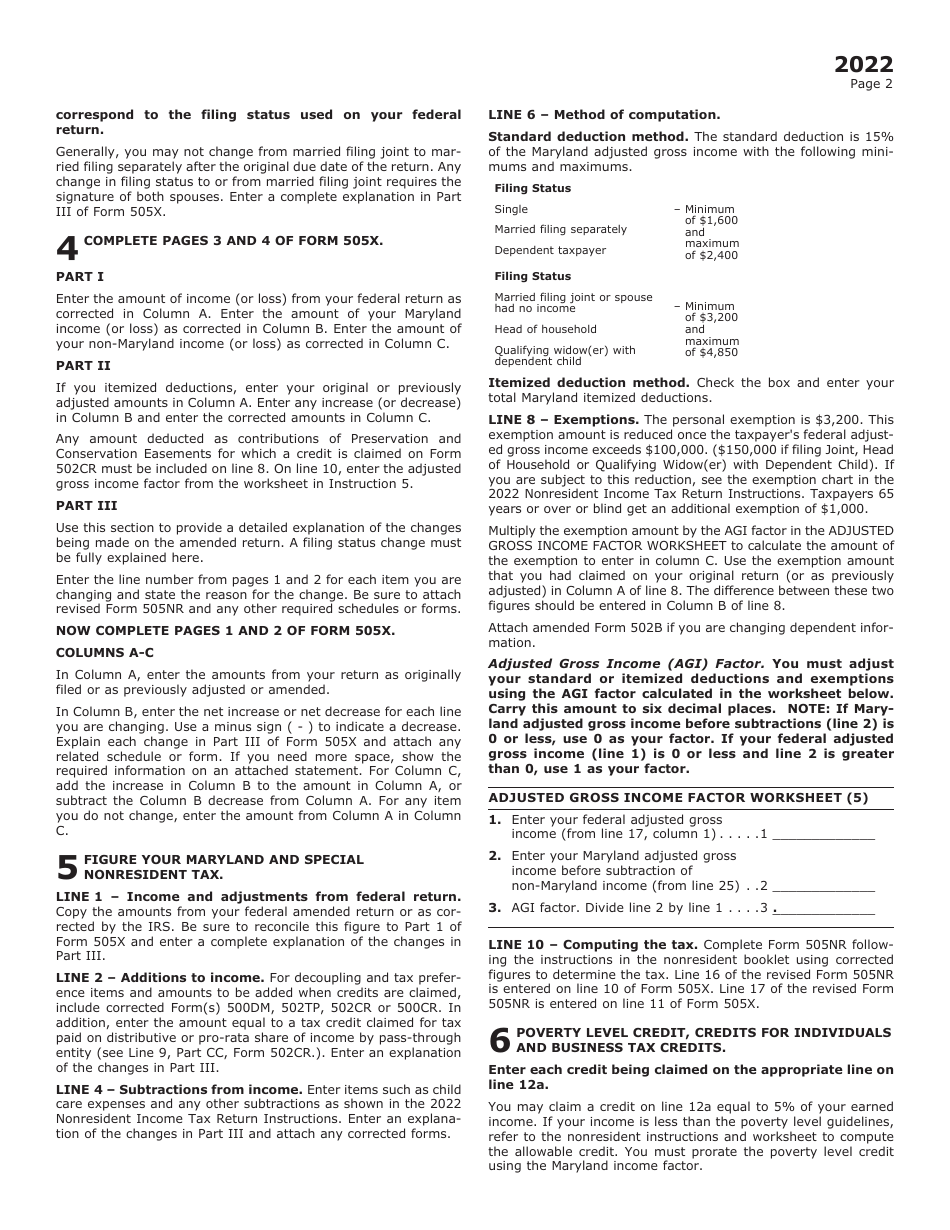

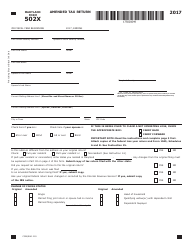

A: Maryland Form 505X is a tax form used to amend a previously filed Maryland Nonresident Tax Return.

Q: Who can use Maryland Form 505X?

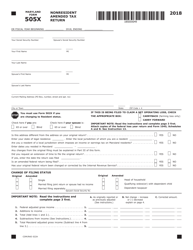

A: Maryland Form 505X can be used by nonresidents who need to make changes or corrections to their previously filed Maryland Nonresident Tax Return.

Q: What is the purpose of Maryland Form 505X?

A: The purpose of Maryland Form 505X is to allow nonresidents to amend their previously filed Maryland Nonresident Tax Return if there are any errors or changes that need to be made.

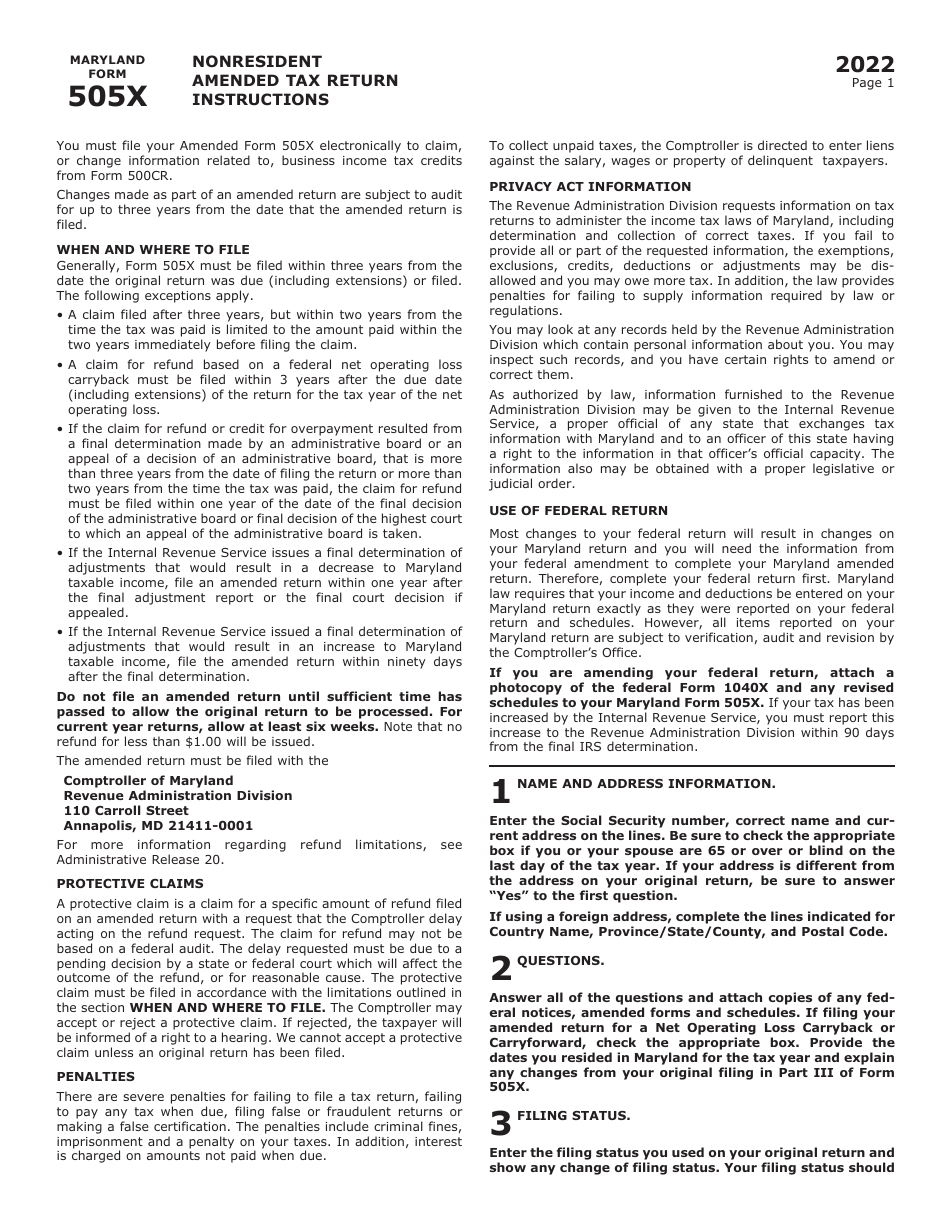

Q: What documentation is required to file Maryland Form 505X?

A: When filing Maryland Form 505X, you will generally need to attach any supporting documentation that is necessary to support the changes or corrections being made.

Q: When is the deadline to file Maryland Form 505X?

A: The deadline to file Maryland Form 505X is generally within three years from the original due date of the Maryland Nonresident Tax Return or within two years from the date the tax was paid, whichever is later.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form 505X by clicking the link below or browse more documents and templates provided by the Maryland Taxes.