This version of the form is not currently in use and is provided for reference only. Download this version of

Maryland Form 505NR (COM/RAD-318)

for the current year.

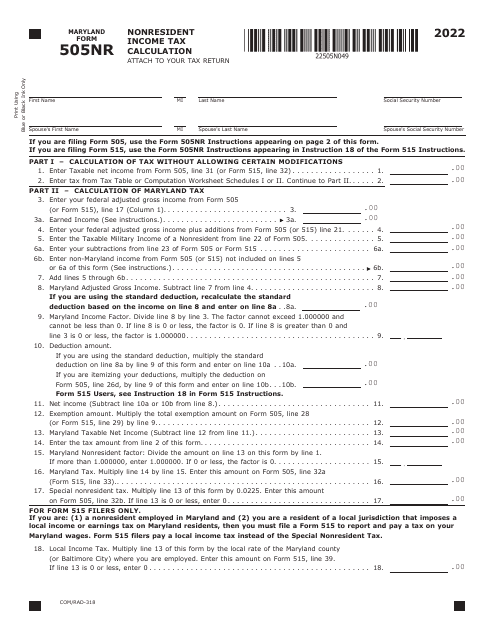

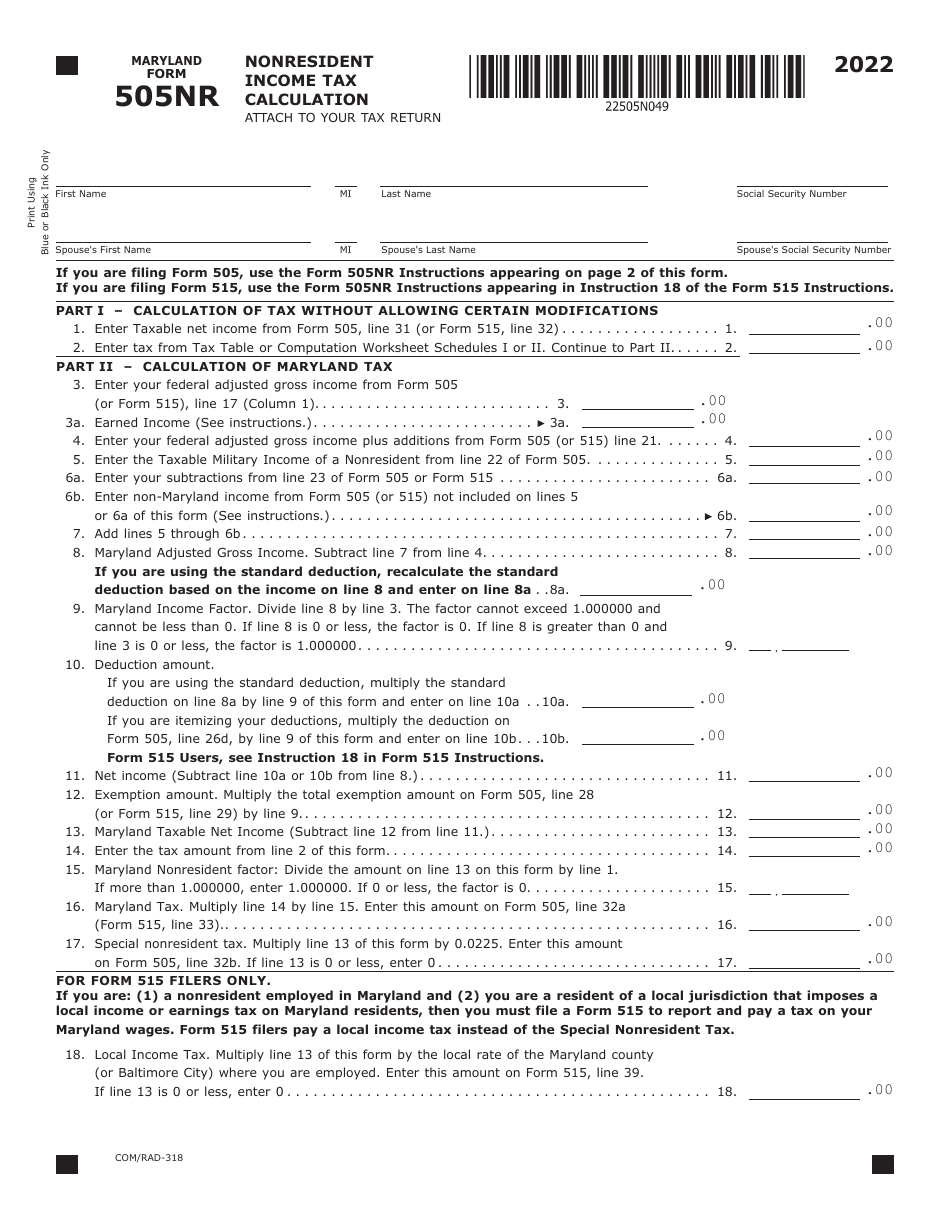

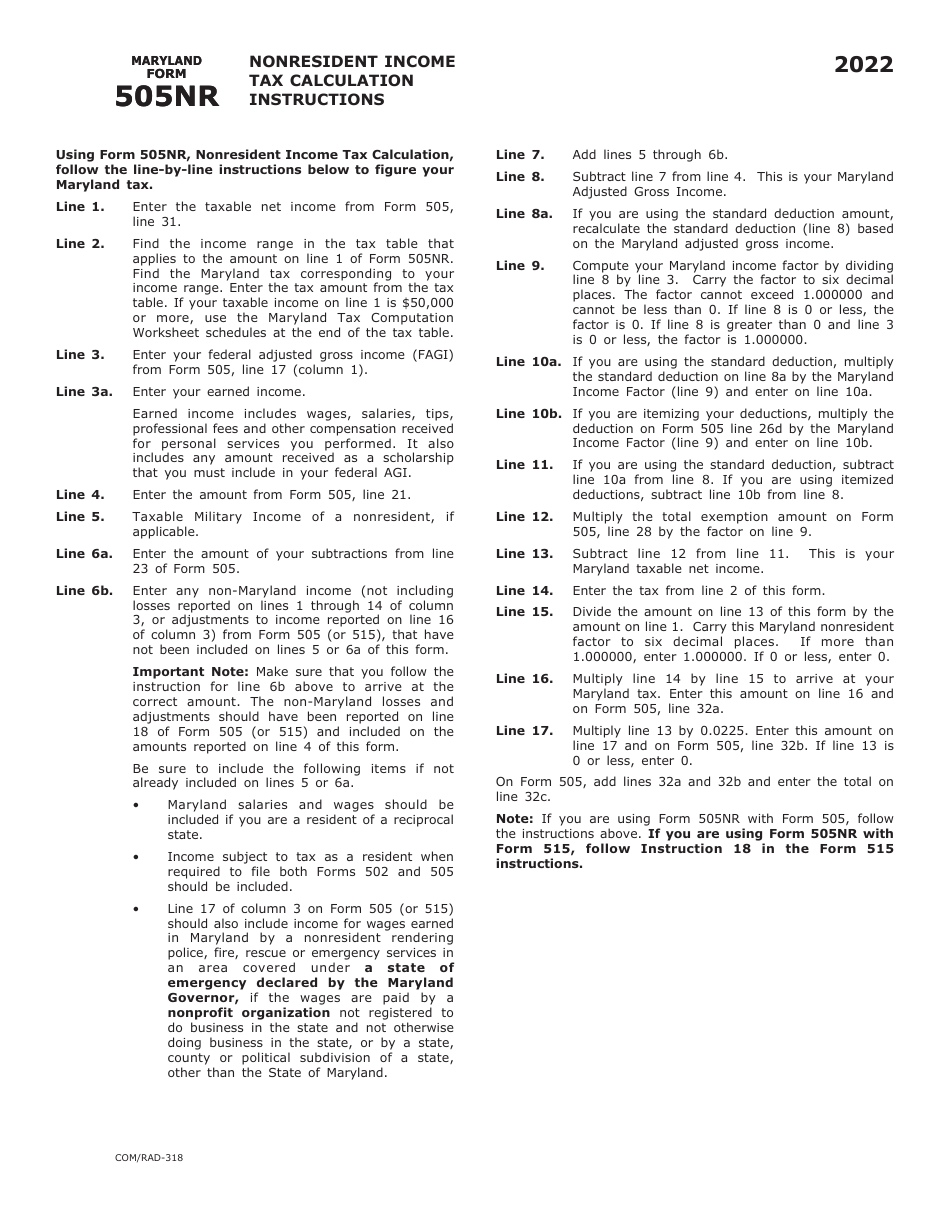

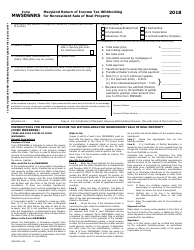

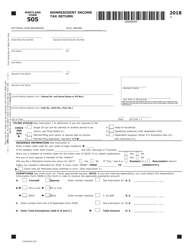

Maryland Form 505NR (COM / RAD-318) Nonresident Income Tax Calculation - Maryland

What Is Maryland Form 505NR (COM/RAD-318)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Maryland Form 505NR?

A: Maryland Form 505NR is a tax form used to calculate the nonresident income tax in the state of Maryland.

Q: Who needs to fill out Maryland Form 505NR?

A: Anyone who is a nonresident of Maryland and has income from Maryland sources needs to fill out Maryland Form 505NR.

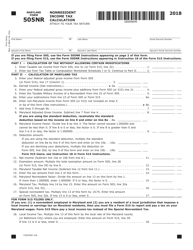

Q: What is the purpose of Maryland Form 505NR?

A: The purpose of Maryland Form 505NR is to determine the nonresident income tax owed to the state of Maryland.

Q: What information do I need to fill out Maryland Form 505NR?

A: You will need to provide information about your income from Maryland sources, as well as any deductions or exemptions that apply to you.

Q: When is the deadline to file Maryland Form 505NR?

A: The deadline to file Maryland Form 505NR is usually the same as the Federal income tax deadline, which is April 15th.

Q: Do I need to file Maryland Form 505NR if I have no income from Maryland sources?

A: If you have no income from Maryland sources, you generally do not need to file Maryland Form 505NR. However, you may still need to file a Maryland tax return if you have other types of income that are subject to Maryland income tax.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form 505NR (COM/RAD-318) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.