This version of the form is not currently in use and is provided for reference only. Download this version of

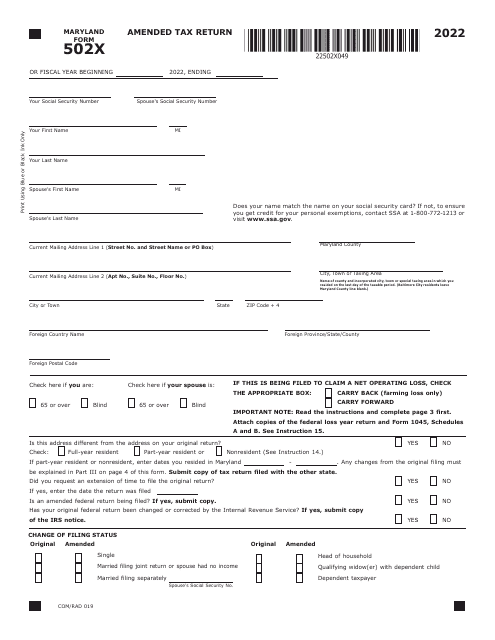

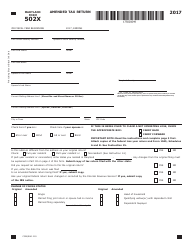

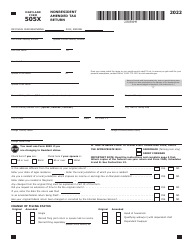

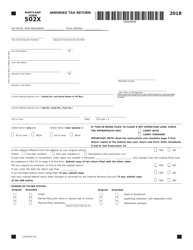

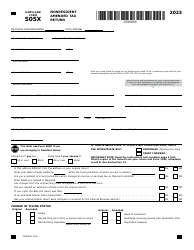

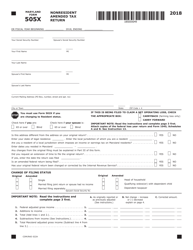

Maryland Form 502X (COM/RAD019)

for the current year.

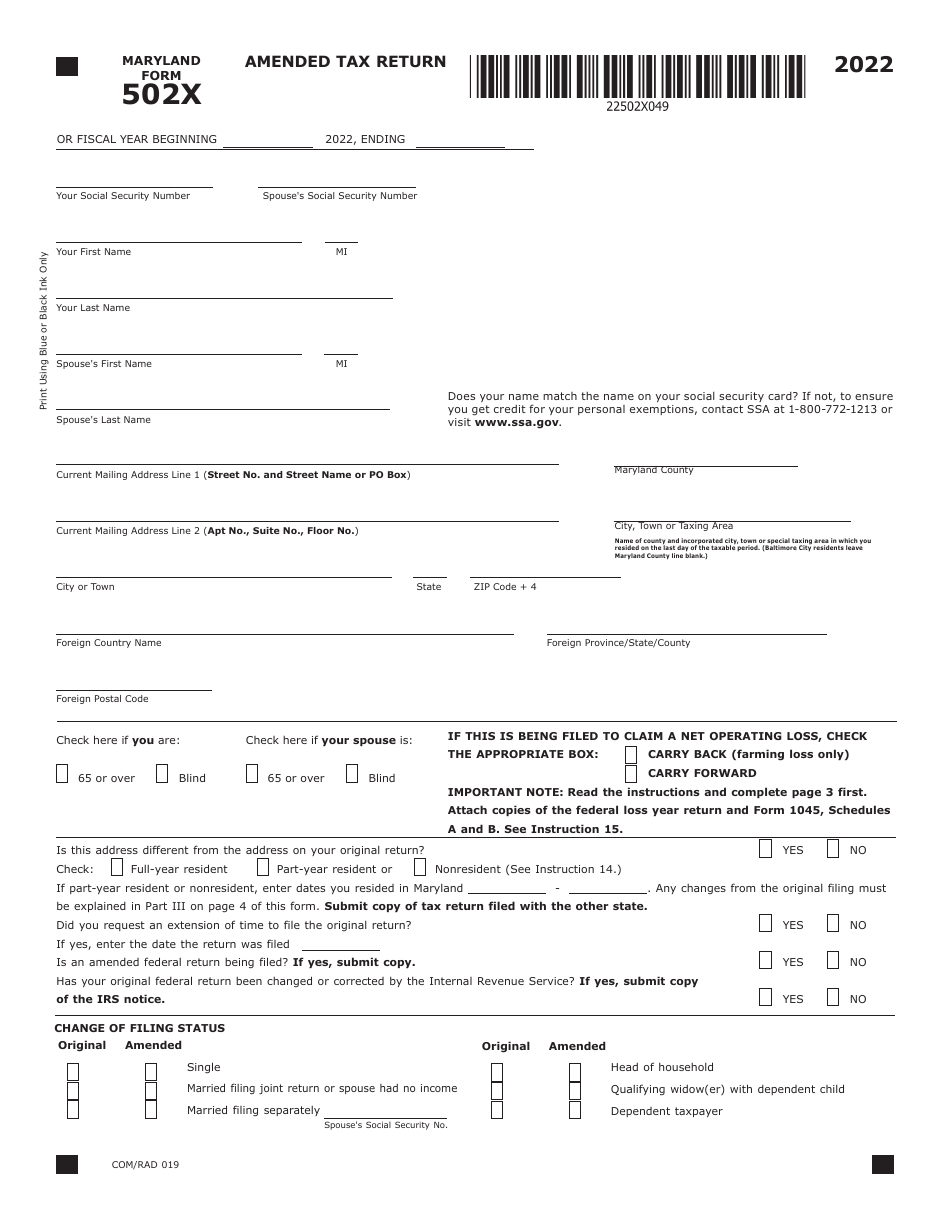

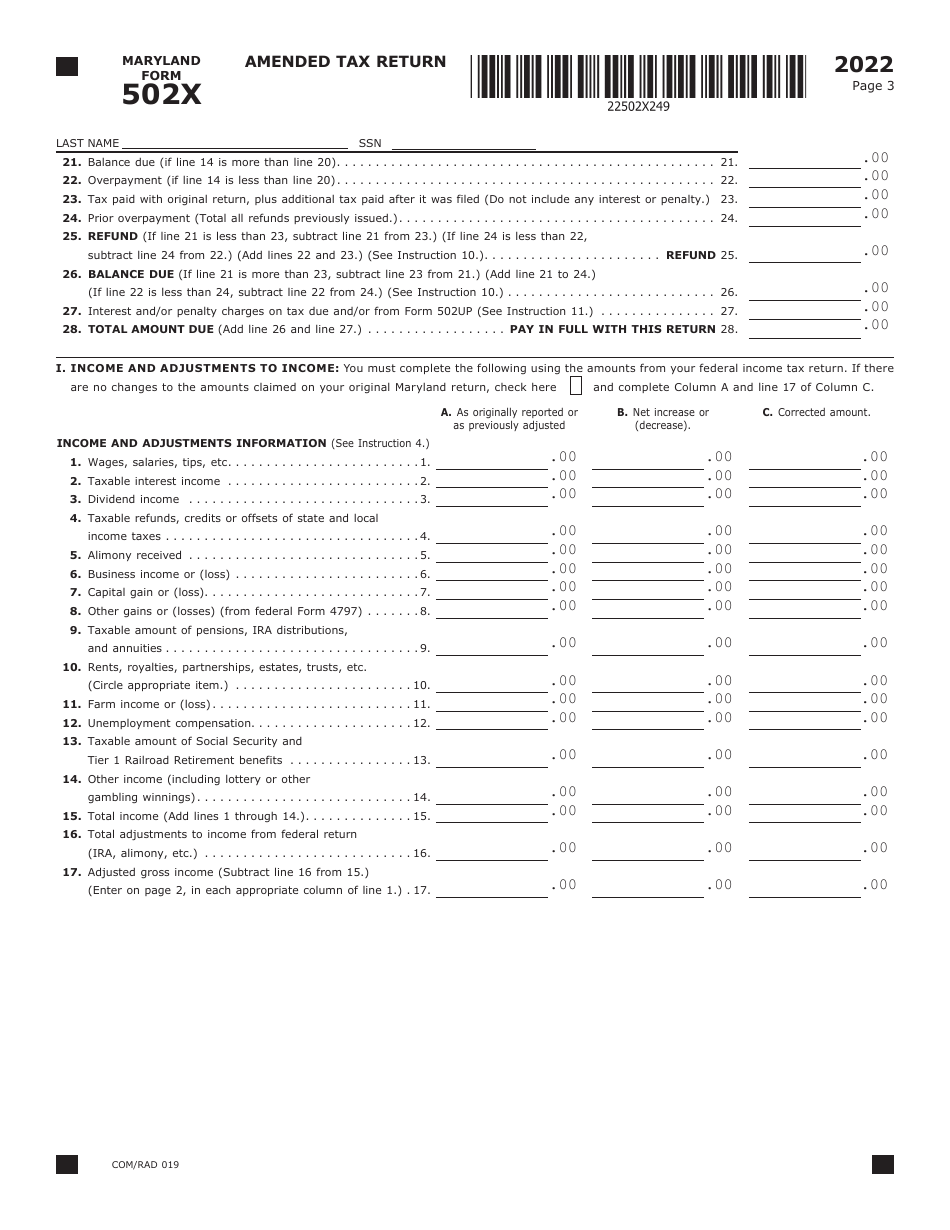

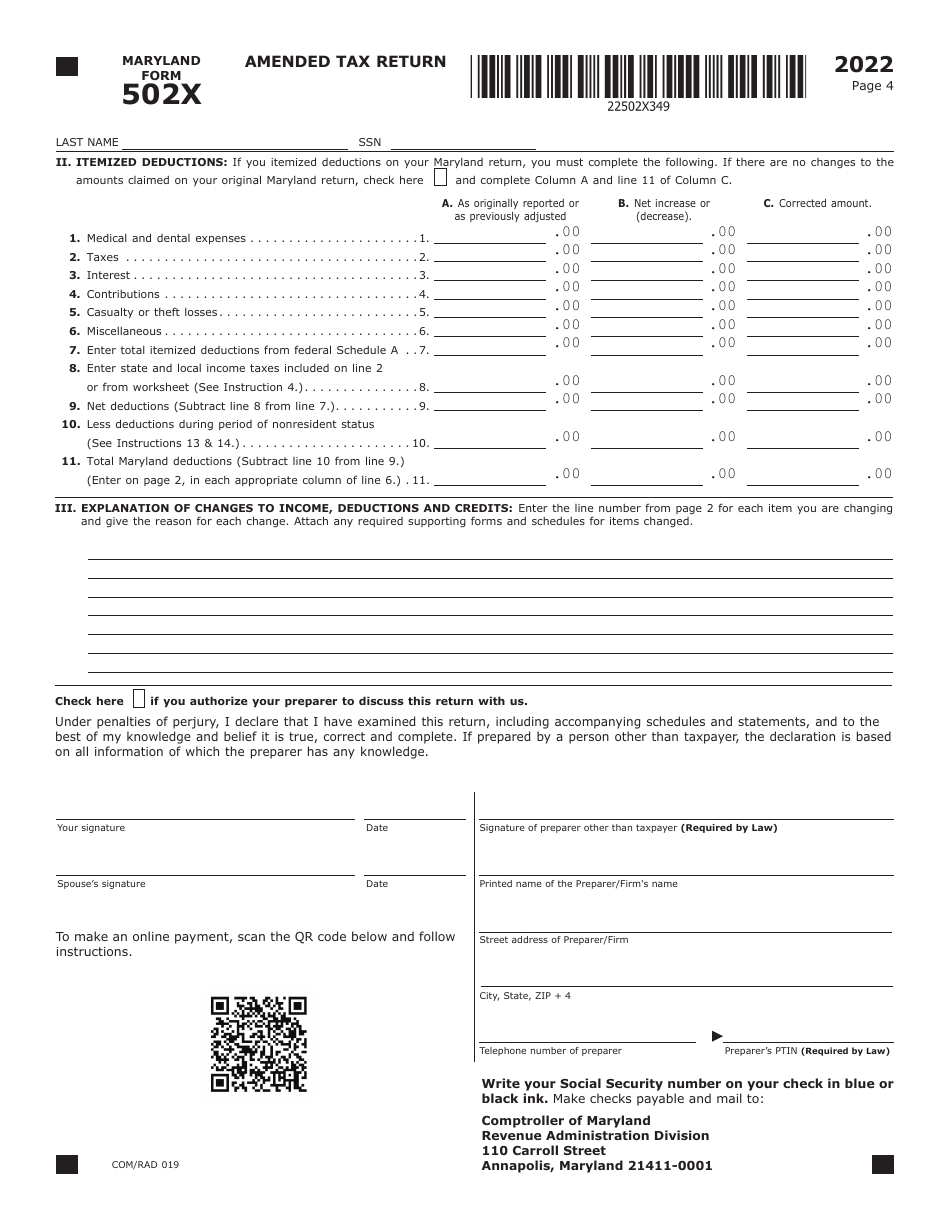

Maryland Form 502X (COM / RAD019) Amended Tax Return - Maryland

What Is Maryland Form 502X (COM/RAD019)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

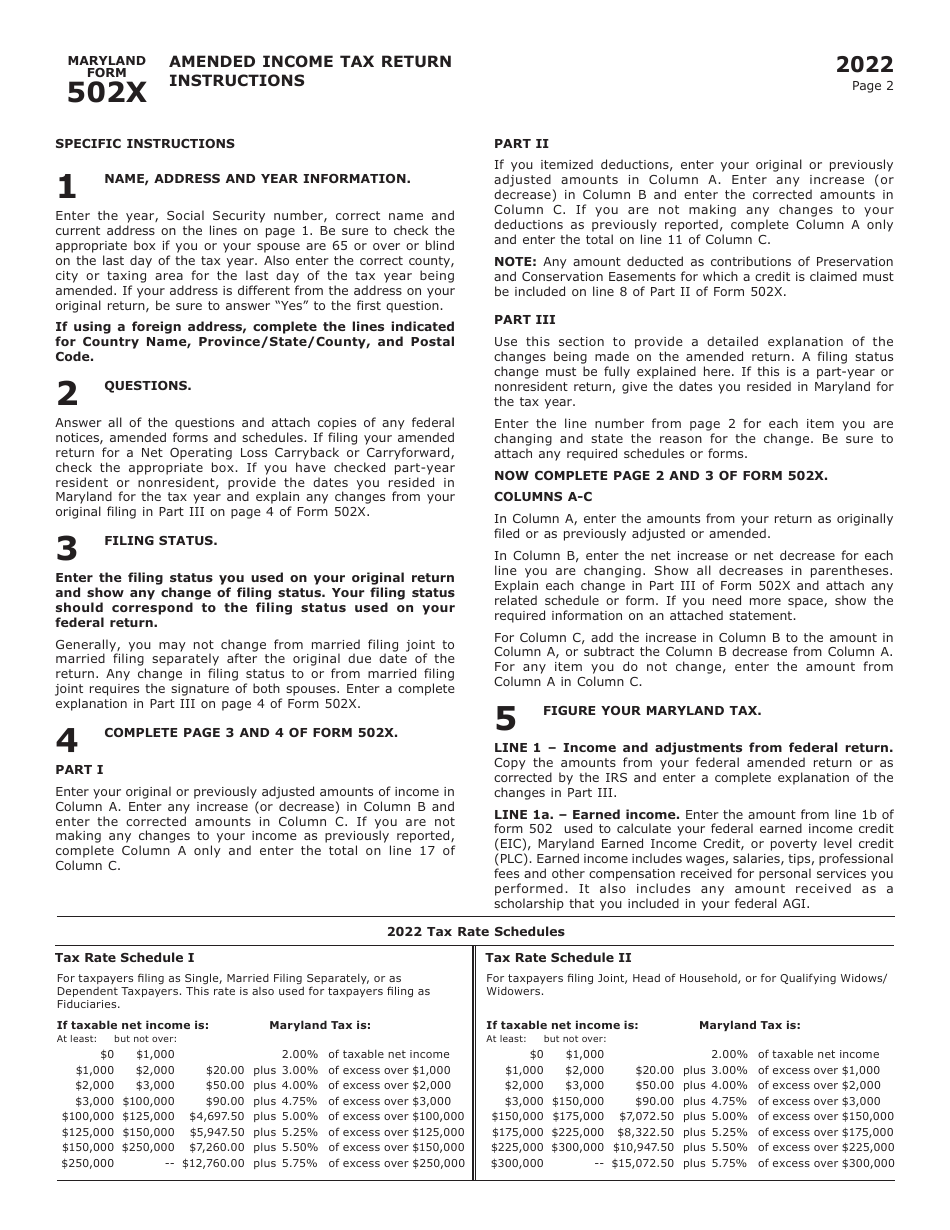

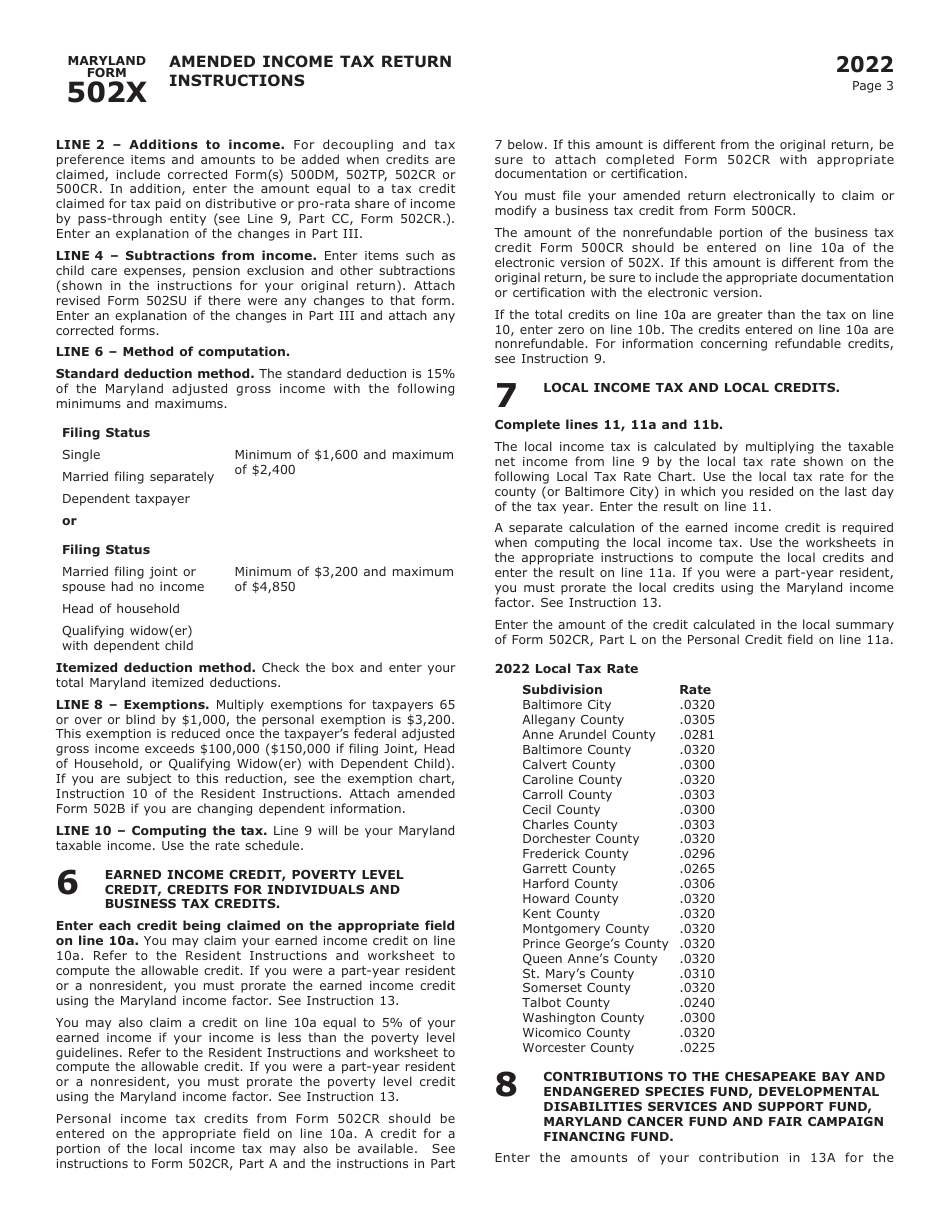

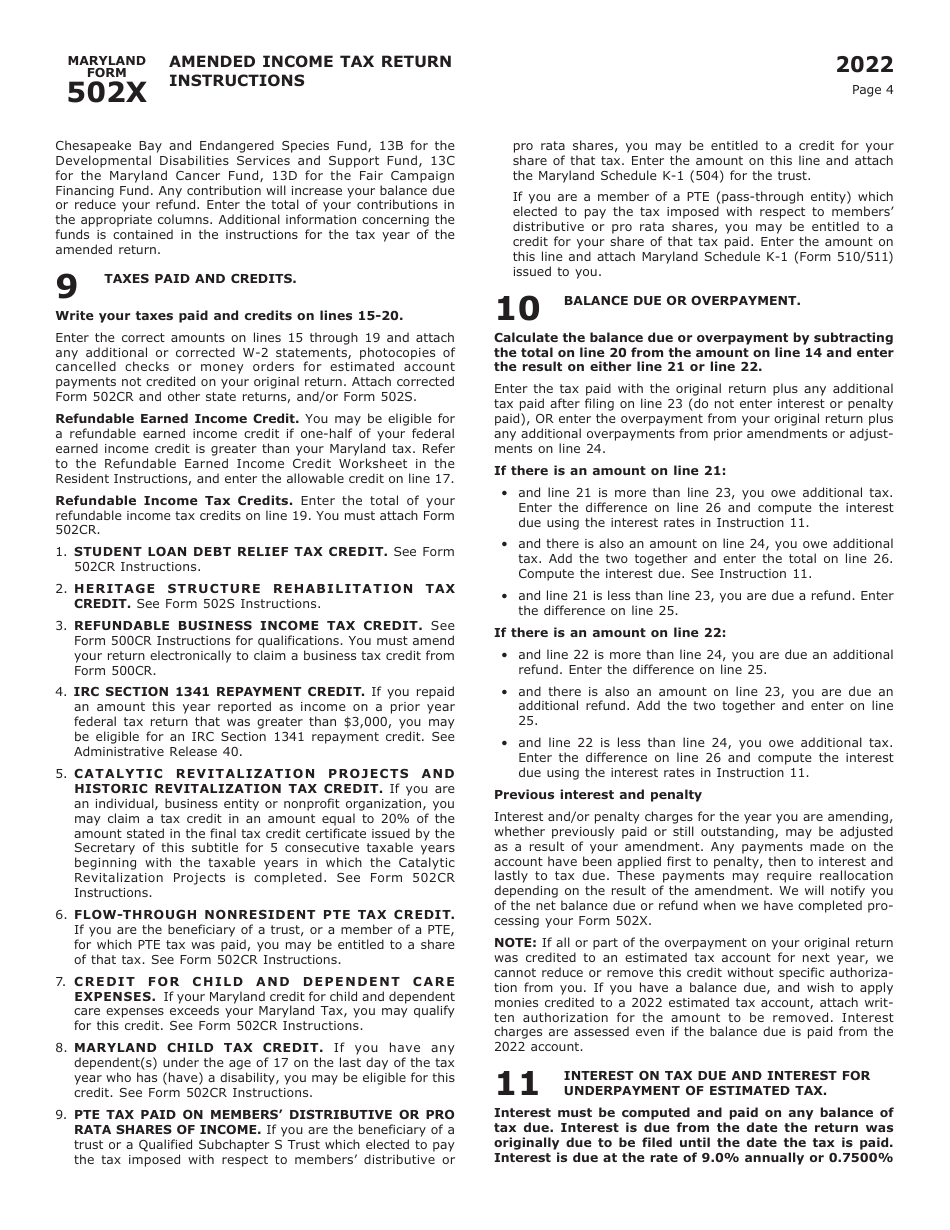

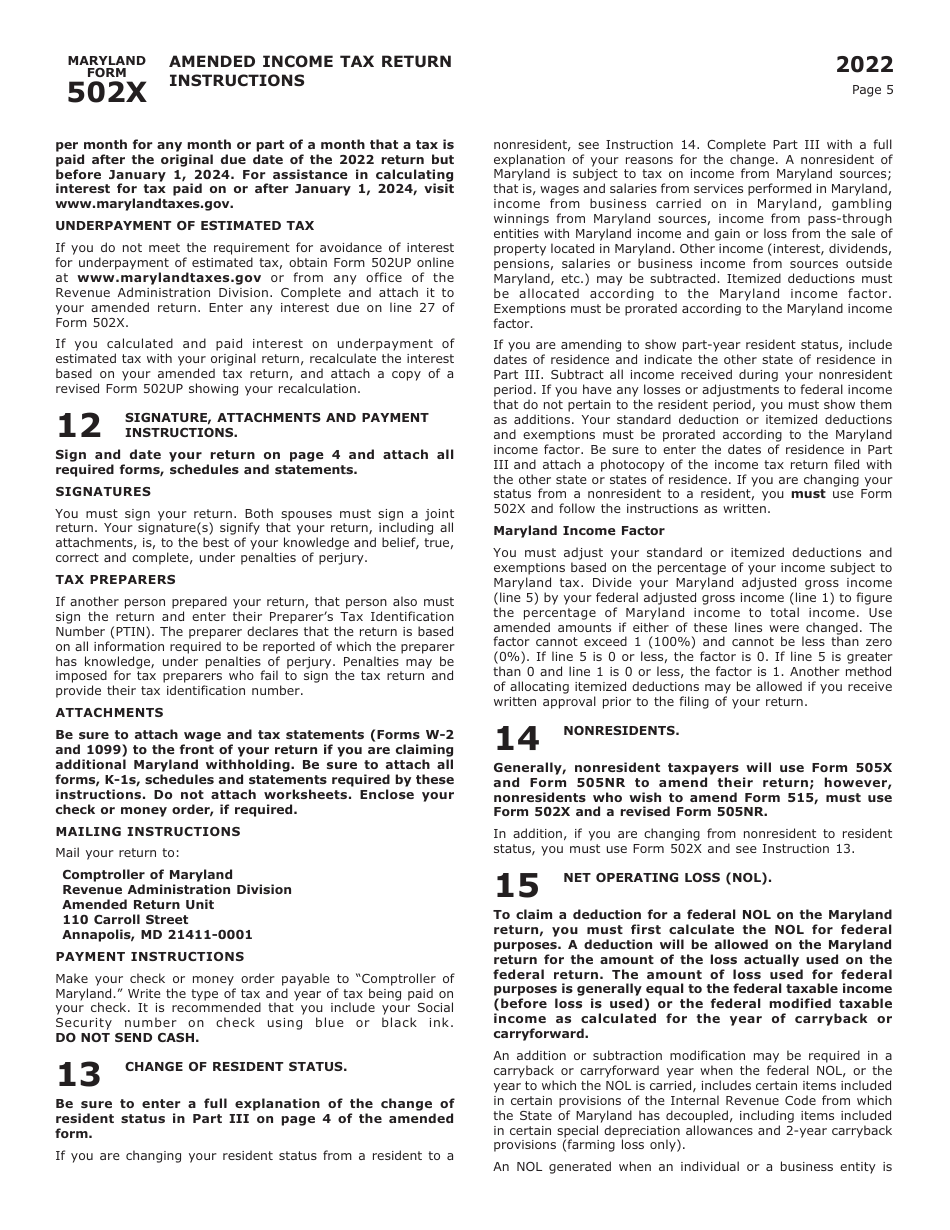

Q: What is Maryland Form 502X?

A: Maryland Form 502X is the Amended Tax Return form for the state of Maryland.

Q: What is the purpose of filing Form 502X?

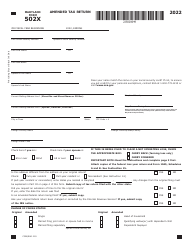

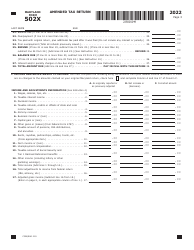

A: Form 502X is used to correct errors or make changes to a previously filed Maryland tax return.

Q: Who needs to file Maryland Form 502X?

A: Anyone who needs to correct errors or make changes to their previously filed Maryland tax return needs to file Form 502X.

Q: Do I need to include any additional documentation with Form 502X?

A: Depending on the changes you are making, you may need to include supporting documentation such as W-2s, 1099s, or other applicable forms.

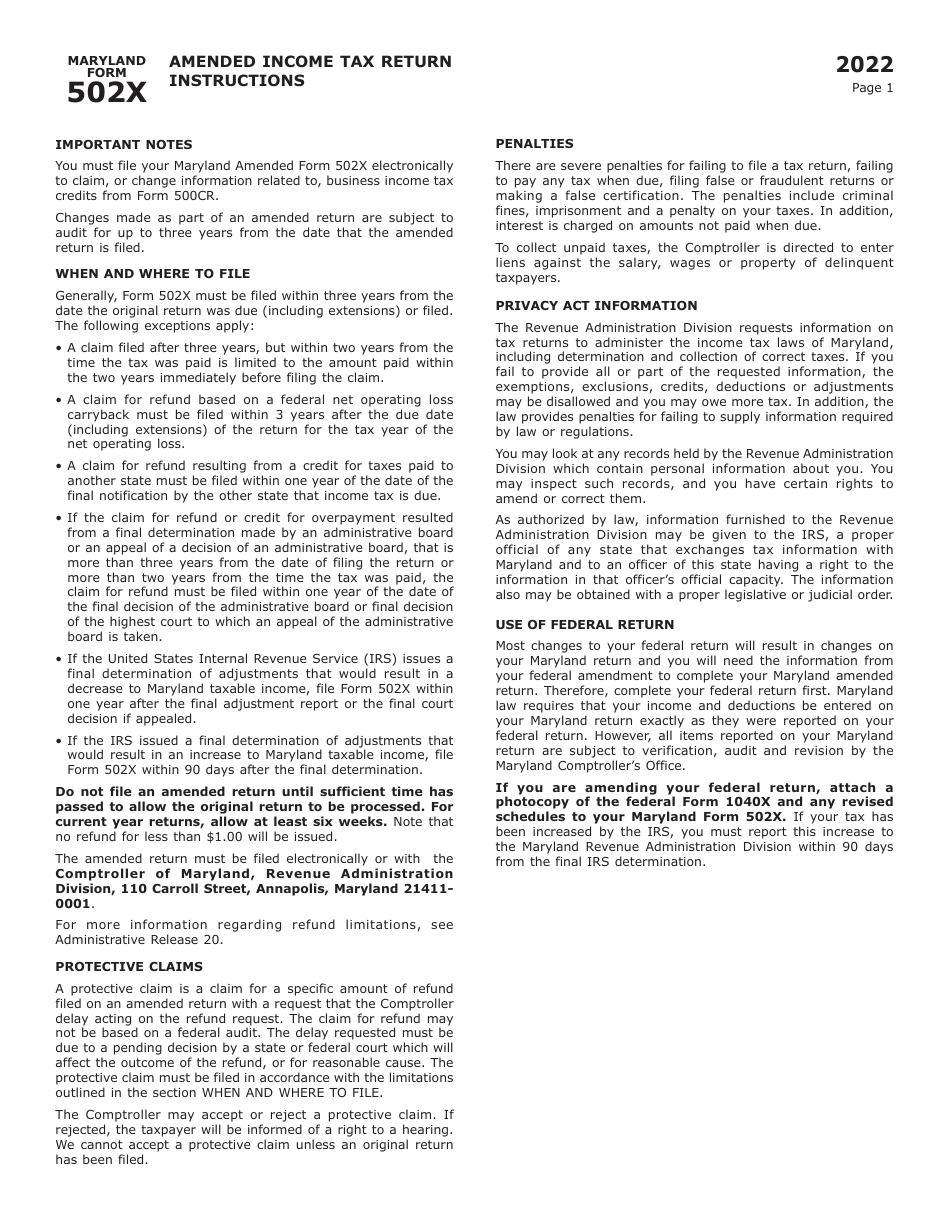

Q: What is the deadline for filing Form 502X?

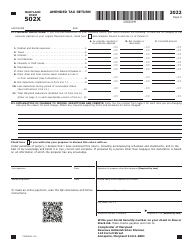

A: The deadline for filing Form 502X is 3 years from the original tax return due date or 2 years from the date of the last tax payment, whichever is later.

Q: Can I e-file my Maryland Form 502X?

A: No, Maryland Form 502X cannot be e-filed. It must be filed by mail.

Q: Is there a fee for filing Form 502X?

A: No, there is no fee for filing Maryland Form 502X.

Q: When can I expect to receive my refund for an amended return?

A: It can take up to 16 weeks for the Maryland Comptroller's Office to process an amended return and issue a refund.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form 502X (COM/RAD019) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.