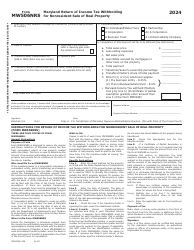

This version of the form is not currently in use and is provided for reference only. Download this version of

Maryland Form 505 (COM/RAD-022)

for the current year.

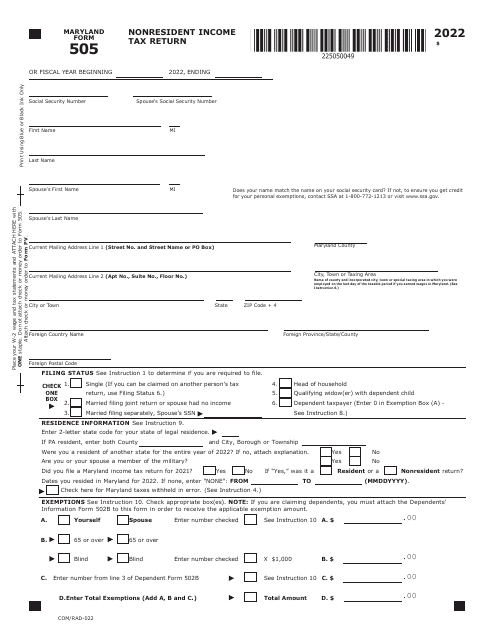

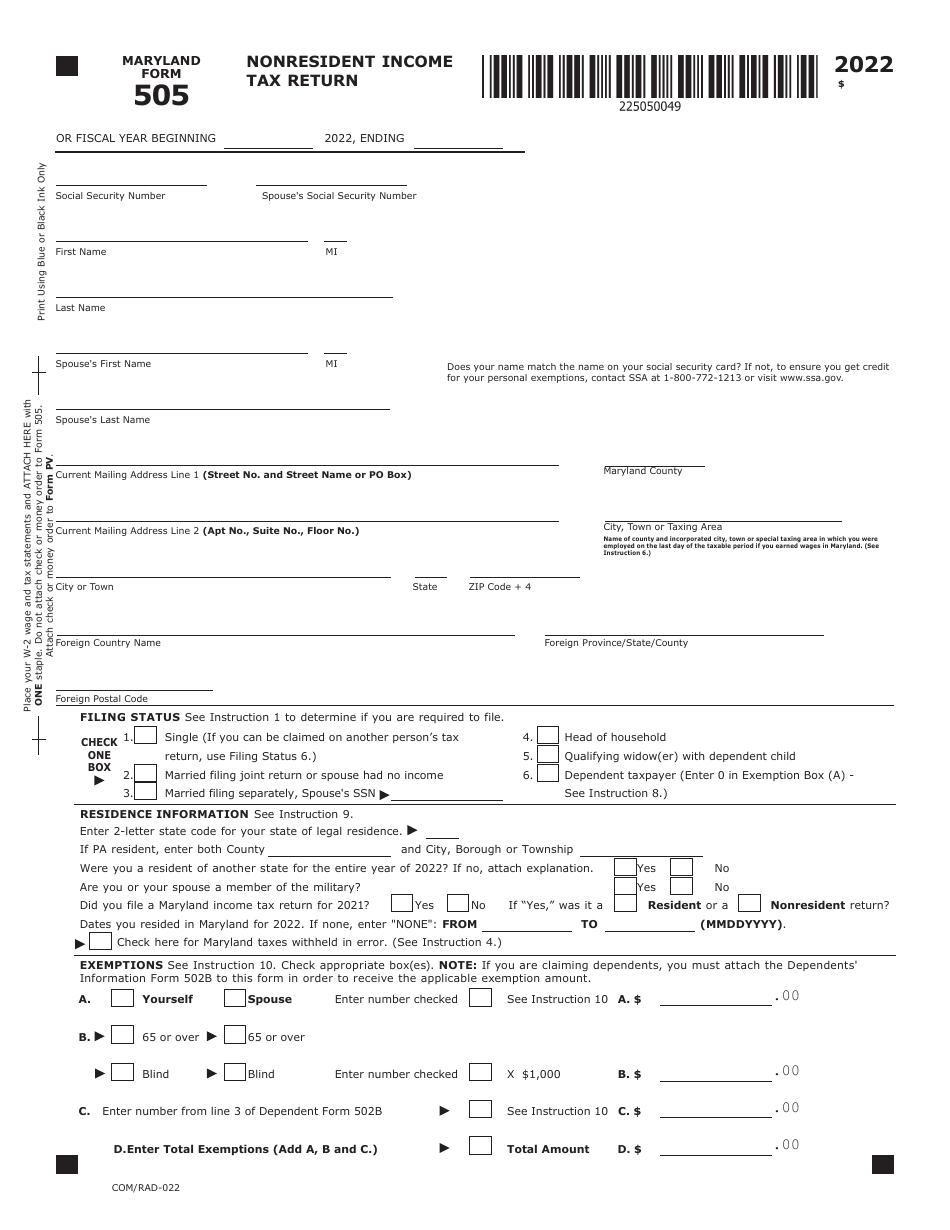

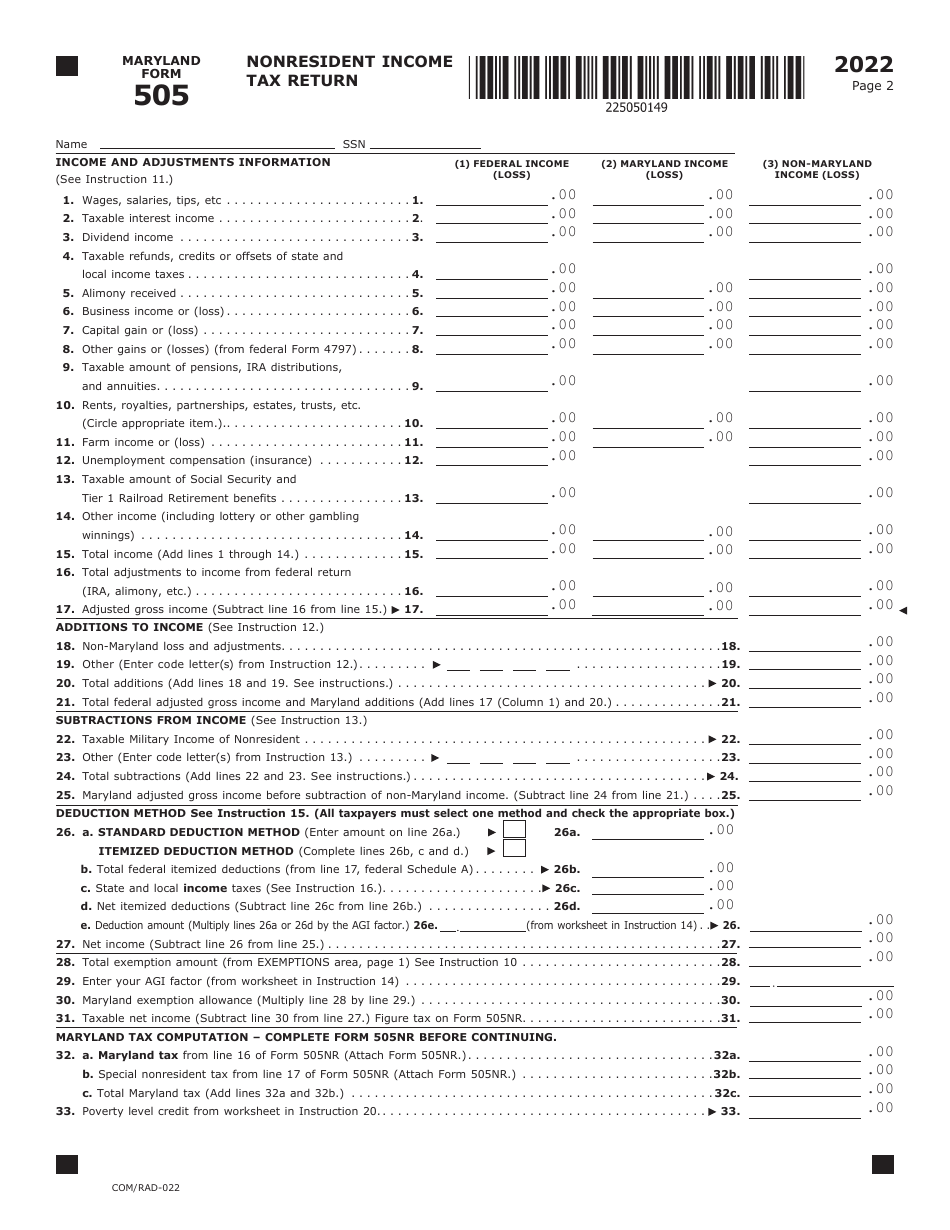

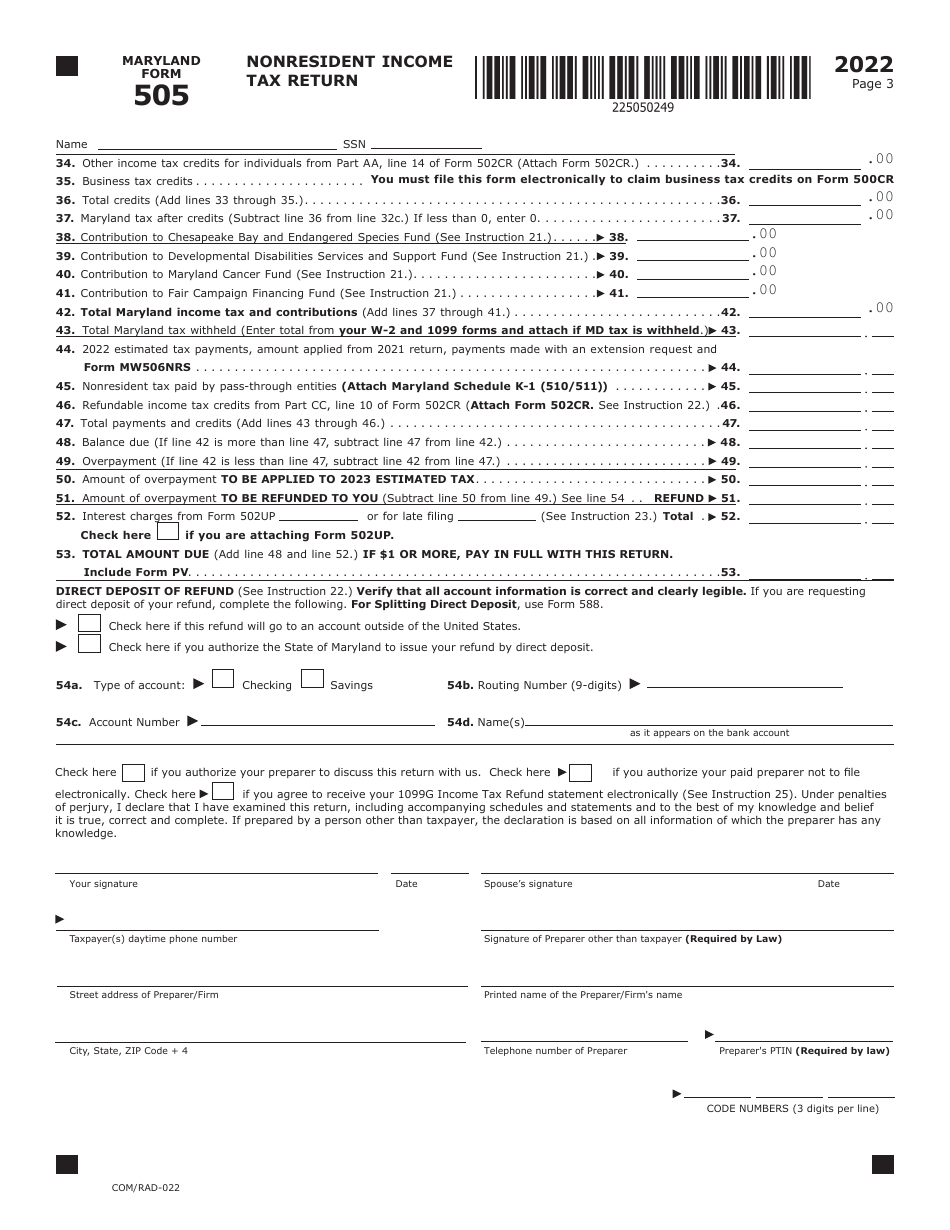

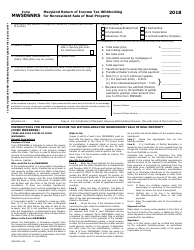

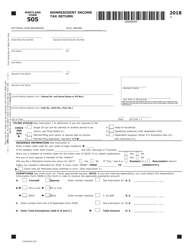

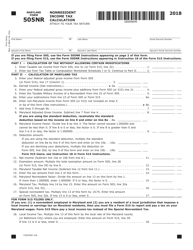

Maryland Form 505 (COM / RAD-022) Nonresident Income Tax Return - Maryland

What Is Maryland Form 505 (COM/RAD-022)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Maryland Form 505?

A: Maryland Form 505 is a nonresident income tax return for individuals who earned income in Maryland but are not residents of Maryland.

Q: Who should file Maryland Form 505?

A: Nonresidents who earned income in Maryland need to file Maryland Form 505.

Q: What is the purpose of filing Maryland Form 505?

A: The purpose of filing Maryland Form 505 is to report and pay taxes on income earned in Maryland as a nonresident.

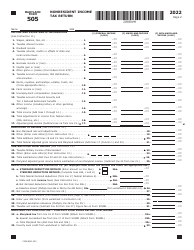

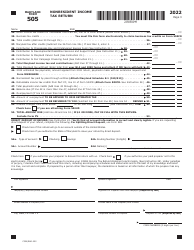

Q: What information is required to complete Maryland Form 505?

A: You will need to provide information about your income earned in Maryland, deductions, and any tax credits you may be eligible for.

Q: When is the deadline for filing Maryland Form 505?

A: The deadline for filing Maryland Form 505 is the same as the federal tax filing deadline, which is usually April 15th.

Q: Can I file Maryland Form 505 electronically?

A: Yes, you can file Maryland Form 505 electronically using the Maryland iFile system.

Q: Do I need to include a copy of my federal tax return with Maryland Form 505?

A: No, you do not need to include a copy of your federal tax return with Maryland Form 505.

Q: Are there any penalties for late filing of Maryland Form 505?

A: Yes, there can be penalties for late filing of Maryland Form 505. It is important to file your return on time to avoid penalties and interest charges.

Q: Can I file Maryland Form 505 if I am a resident of Maryland?

A: No, Maryland Form 505 is specifically for nonresidents who earned income in Maryland. Residents of Maryland should use the appropriate resident tax form.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form 505 (COM/RAD-022) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.