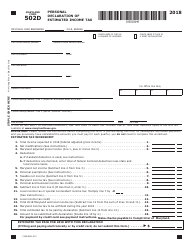

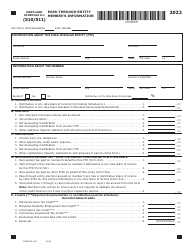

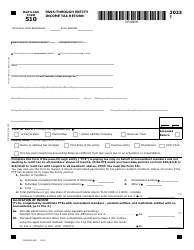

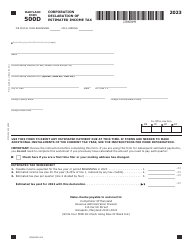

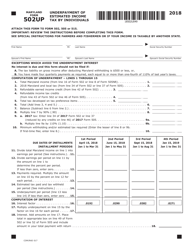

Maryland Form 510D (COM / RAD-073) Pass-Through Entity Declaration of Estimated Income Tax - Maryland

What Is Maryland Form 510D (COM/RAD-073)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

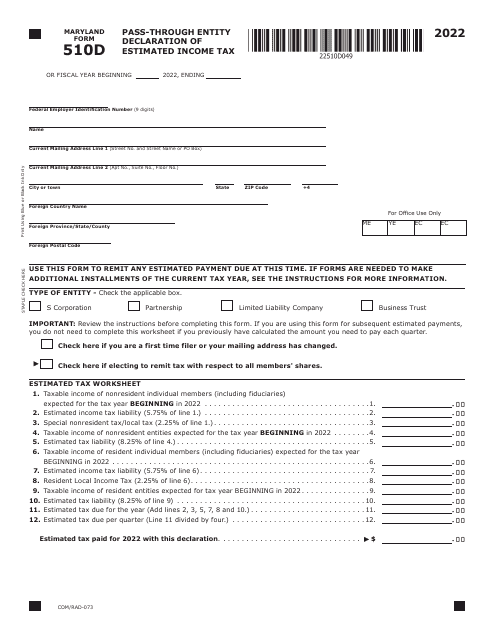

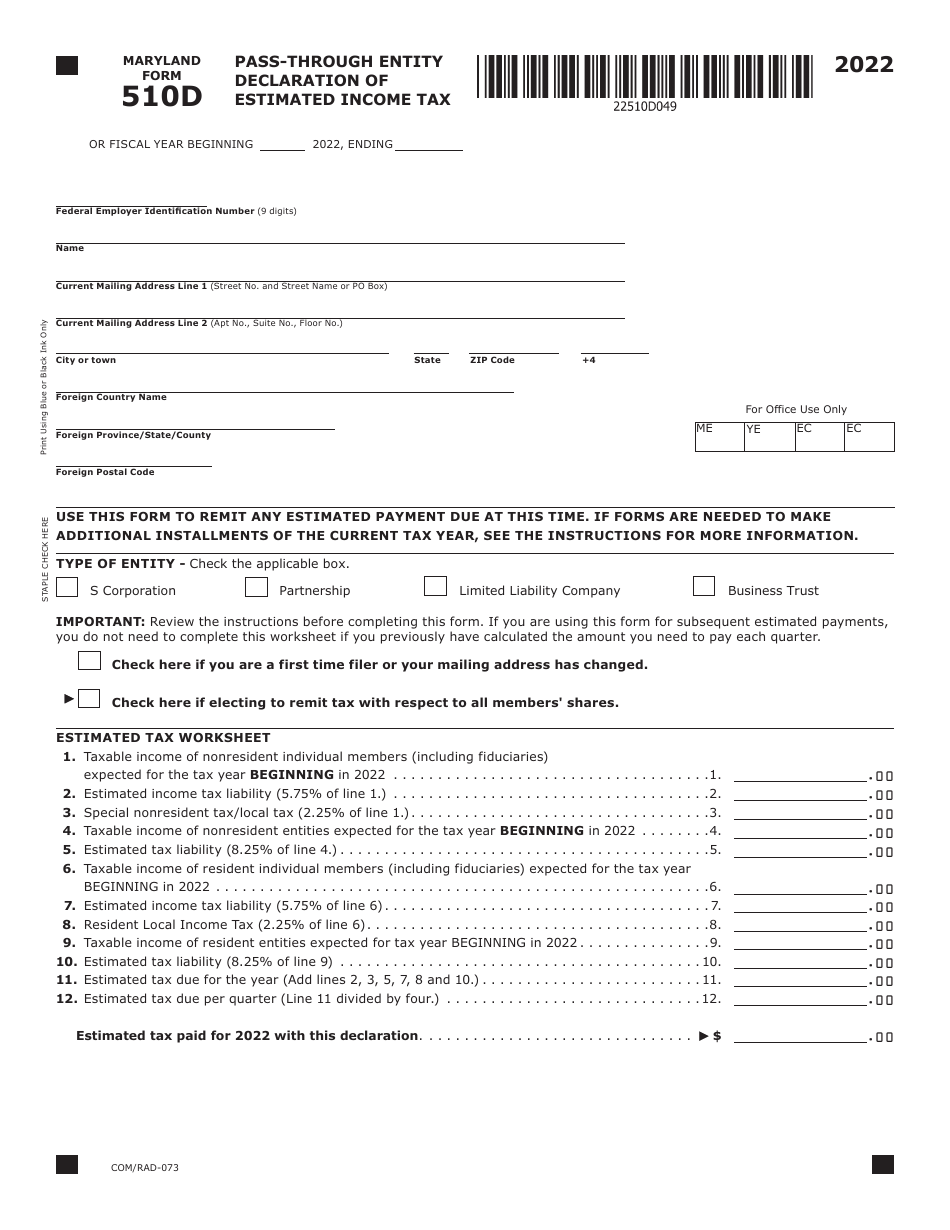

Q: What is Maryland Form 510D?

A: Maryland Form 510D is the Pass-Through Entity Declaration of Estimated Income Tax form for Maryland.

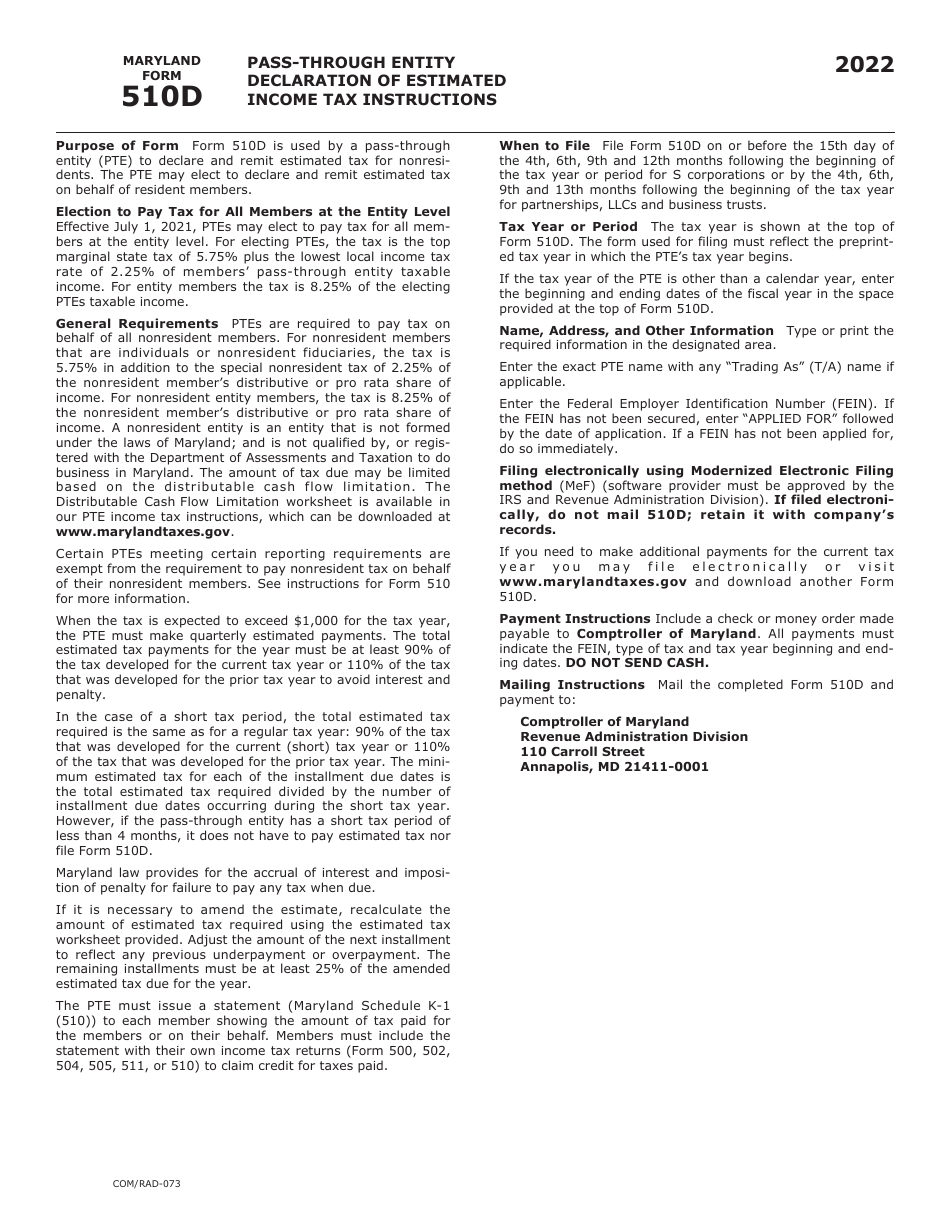

Q: Who should file Maryland Form 510D?

A: Pass-through entities in Maryland, such as partnerships and S corporations, should file Maryland Form 510D.

Q: What is the purpose of Maryland Form 510D?

A: The purpose of Maryland Form 510D is to declare and pay estimated income tax for pass-through entities in Maryland.

Q: How often should Maryland Form 510D be filed?

A: Maryland Form 510D should be filed quarterly, with the due dates in April, June, September, and January of the following year.

Q: What information is required on Maryland Form 510D?

A: Maryland Form 510D requires information such as the entity's name, address, federal identification number, and estimated income.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form 510D (COM/RAD-073) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.