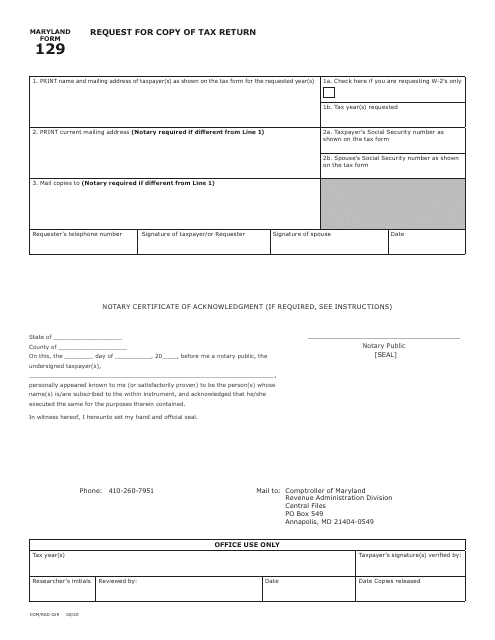

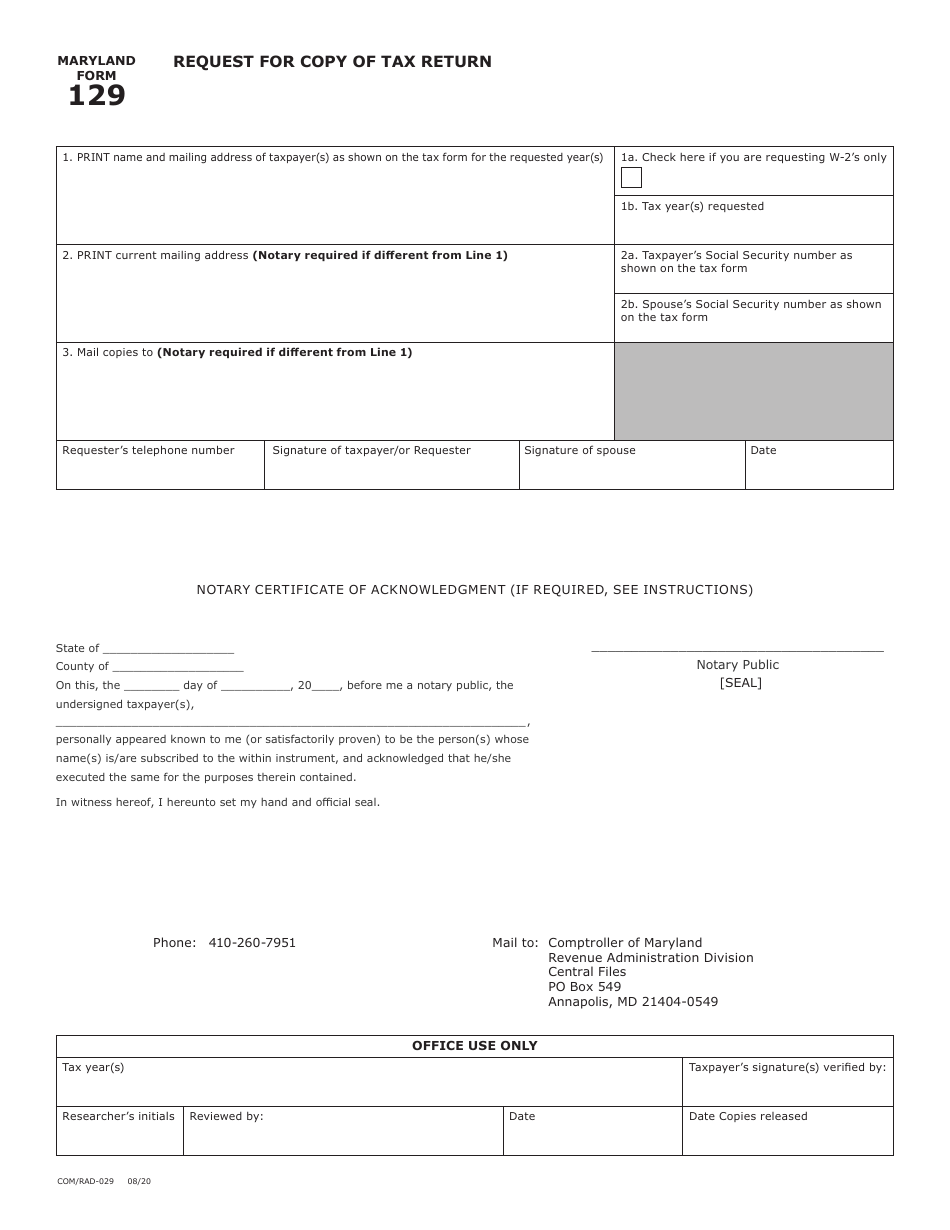

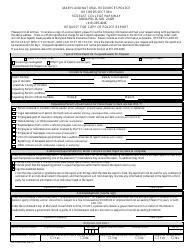

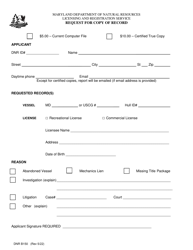

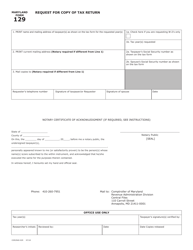

Maryland Form 129 (COM / RAD-029) Request for Copy of Tax Return - Maryland

What Is Maryland Form 129 (COM/RAD-029)?

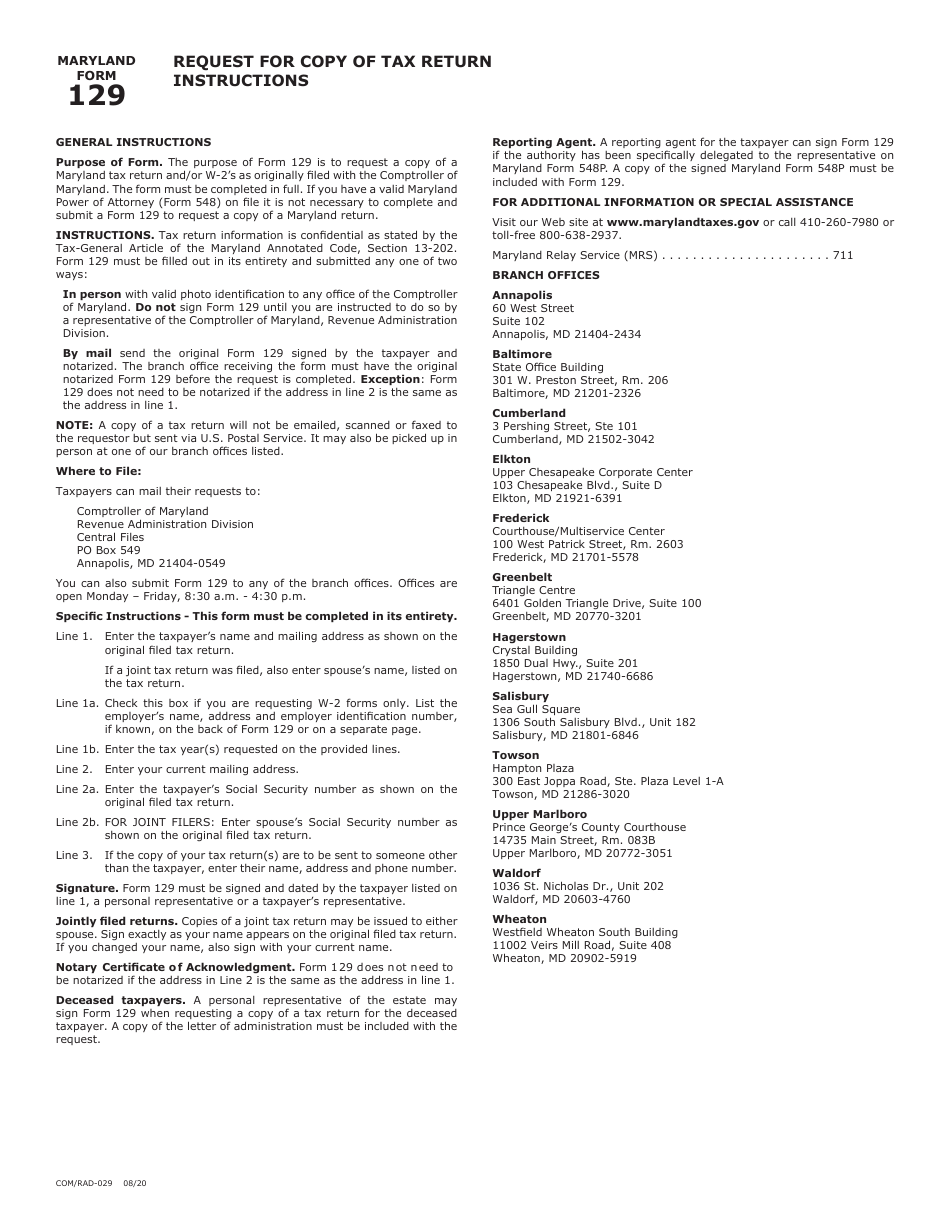

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

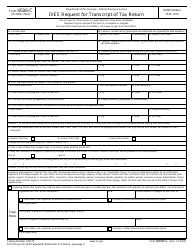

Q: What is Maryland Form 129?

A: Maryland Form 129 is a request form to obtain a copy of your tax return filed in Maryland.

Q: What is COM/RAD-029?

A: COM/RAD-029 is the form number assigned to Maryland Form 129.

Q: What is the purpose of Maryland Form 129?

A: The purpose of Maryland Form 129 is to request a copy of your previously filed tax return.

Q: Is there a fee for requesting a copy of my tax return using Maryland Form 129?

A: Yes, there is a fee associated with requesting a copy of your tax return using Maryland Form 129. The fee amount may vary.

Q: What information do I need to provide on Maryland Form 129?

A: On Maryland Form 129, you will need to provide your personal information, including your name, Social Security number, and the tax year for which you are requesting a copy of the tax return.

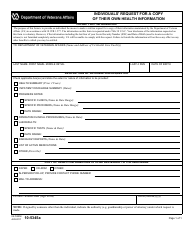

Q: How long does it take to receive a copy of my tax return requested through Maryland Form 129?

A: The processing time to receive a copy of your tax return requested through Maryland Form 129 can vary, but it generally takes a few weeks.

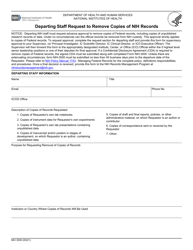

Q: Can I request a copy of someone else's tax return using Maryland Form 129?

A: No, Maryland Form 129 is only for requesting a copy of your own tax return. You cannot request a copy of someone else's tax return using this form.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form 129 (COM/RAD-029) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.