This version of the form is not currently in use and is provided for reference only. Download this version of

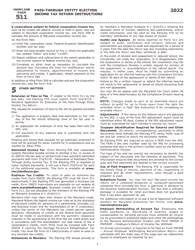

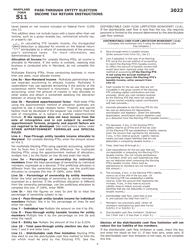

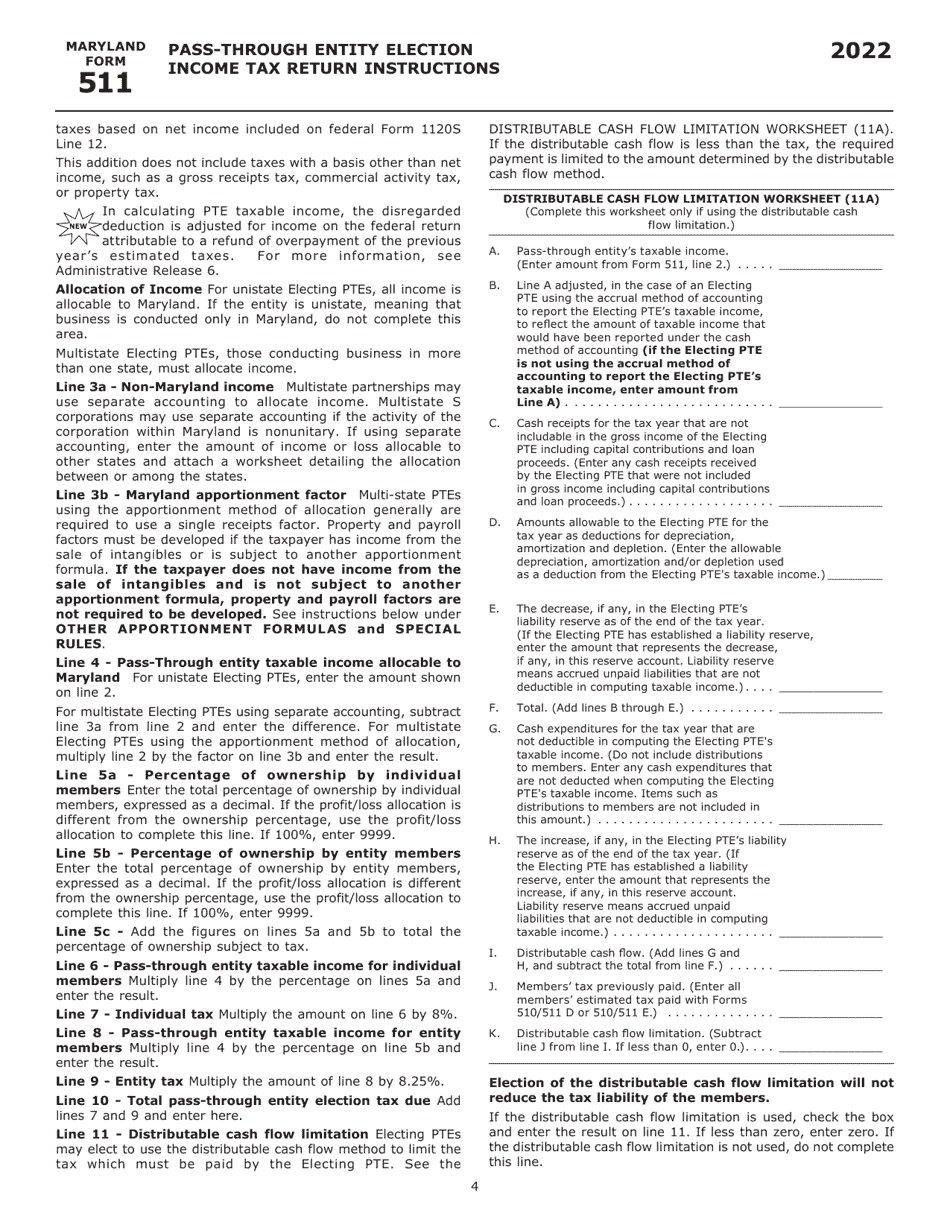

Instructions for Maryland Form 511, COM/RAD-069

for the current year.

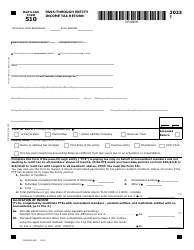

Instructions for Maryland Form 511, COM / RAD-069 Pass-Through Entity Election Income Tax Return - Maryland

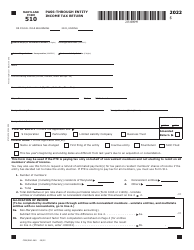

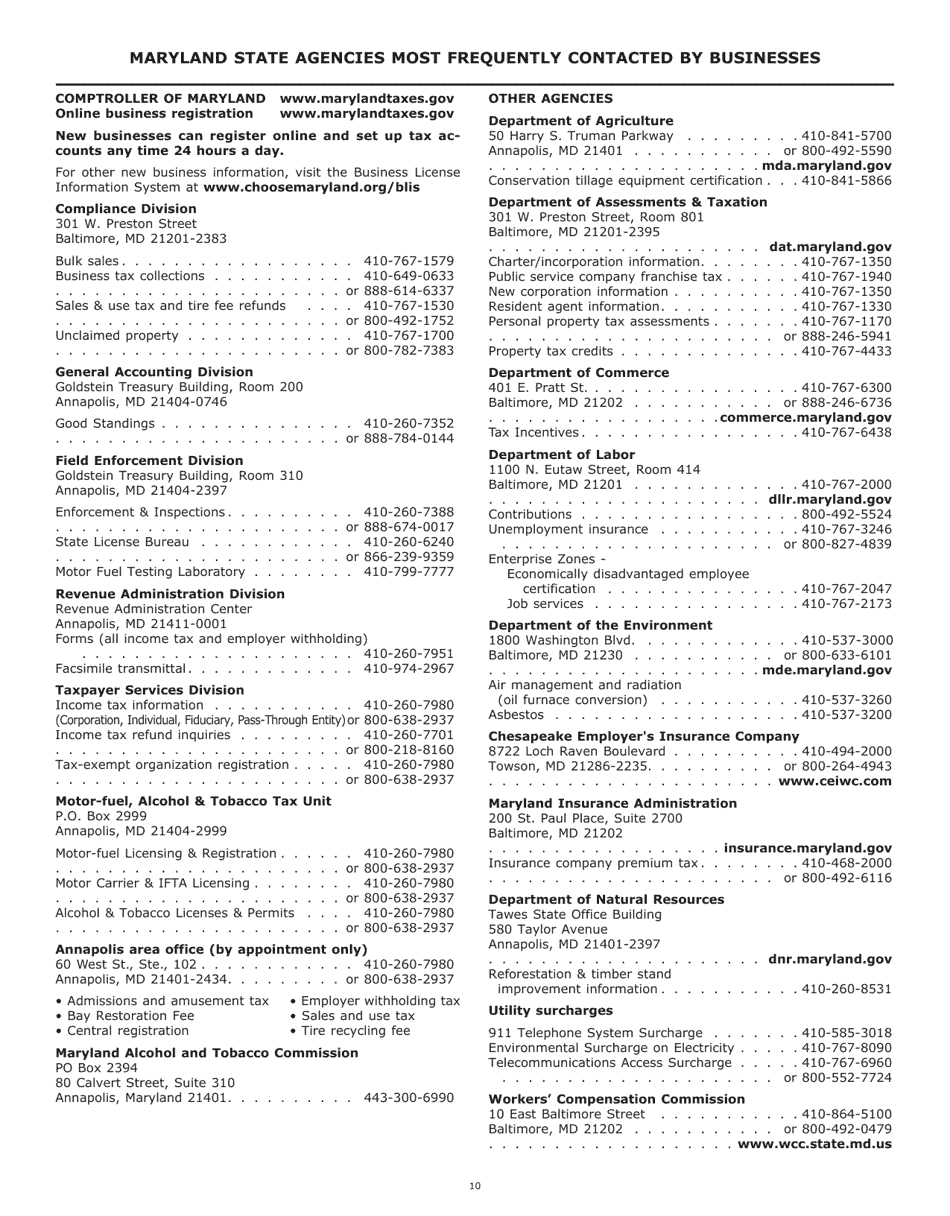

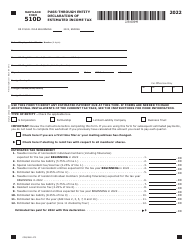

This document contains official instructions for Maryland Form 511 , and Form COM/RAD-069 . Both forms are released and collected by the Maryland Taxes. An up-to-date fillable Maryland Form 510 (COM/RAD-069) is available for download through this link.

FAQ

Q: What is Maryland Form 511?

A: Maryland Form 511 is the COM/RAD-069 Pass-Through Entity Election Income Tax Return for Maryland.

Q: Who needs to file Maryland Form 511?

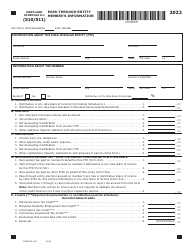

A: Pass-through entities in Maryland, such as partnerships and S corporations, need to file Form 511.

Q: What is the purpose of Maryland Form 511?

A: The purpose of Form 511 is to report income, deductions, credits, and taxes for pass-through entities in Maryland.

Q: When is the deadline for filing Maryland Form 511?

A: The deadline for filing Maryland Form 511 is on or before the 15th day of the fourth month following the close of the taxable year.

Q: What information do I need to complete Maryland Form 511?

A: You will need information about the pass-through entity's income, deductions, credits, and taxes paid or owed.

Instruction Details:

- This 12-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Maryland Taxes.